Chamber of commerce small business health insurance Idea

Home » Trending » Chamber of commerce small business health insurance IdeaYour Chamber of commerce small business health insurance images are ready in this website. Chamber of commerce small business health insurance are a topic that is being searched for and liked by netizens today. You can Get the Chamber of commerce small business health insurance files here. Download all free photos and vectors.

If you’re searching for chamber of commerce small business health insurance pictures information connected with to the chamber of commerce small business health insurance topic, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Chamber Of Commerce Small Business Health Insurance. Humana plans for small businesses. Guaranteed benefits for one and two person companies. Since its beginning in 2000, the south carolina small business chamber of commerce (scsbcc) has been the state’s leading business advocate for making health insurance more affordable. Humana health insurance plans suitable for small businesses are:

Small business chamber members can now offer group health From eparisextra.com

Small business chamber members can now offer group health From eparisextra.com

Chamber saver programtraditional aca plan. Telemedicine and mental health services are available in both english and spanish. For several years, the small business chamber has served on the health insurance policy advisory committee (hipac) to gather information on the. Having access to trusted health insurance benefits is a crucial piece to that success. More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. Ad compare top expat health insurance in indonesia.

For several years, the small business chamber has served on the health insurance policy advisory committee (hipac) to gather information on the.

The michigan chamber of commerce has been a trusted insurance solutions resource for michigan employers for over 20 years. Maintaining health insurance at a reasonable price for their family and employees has always been a challenge for small businesses. Small business insurance provides coverage for lawsuits, but it also has additional options for workers’ compensation and payment disputes (see here for an external glossary of insurance terms). Any small business that belongs to one of the more than 60 participating chambers of commerce and other business associations is eligible to join the chamber health coop. Chamber offers health insurance option for members. If your small business is a chamber member and has 50 or fewer employees, you may be eligible to participate in this program.

Source: springfieldchamber.com

Source: springfieldchamber.com

Since its beginning in 2000, the south carolina small business chamber of commerce (scsbcc) has been the state’s leading business advocate for making health insurance more affordable. During the 1990s, double digit increases in group health insurance premiums were recognized as unsustainable and had resulted in less than 40% of small. Health insurance coverage is one of the most important benefits businesses can offer when recruiting and retaining talent. The 29 chambers that can offer these insurance plans to its members are the franklin county regional chamber of commerce, jay peak area chamber of commerce, lamoille region chamber of commerce, northeast kingdom chamber of commerce, swanton chamber of commerce, heart of vermont chamber of commerce, lake champlain regional chamber of. The health insurance offered by the missouri benefit plan first rolled out to a limited number of small businesses in 2017.

Source: cullmanchamber.org

Source: cullmanchamber.org

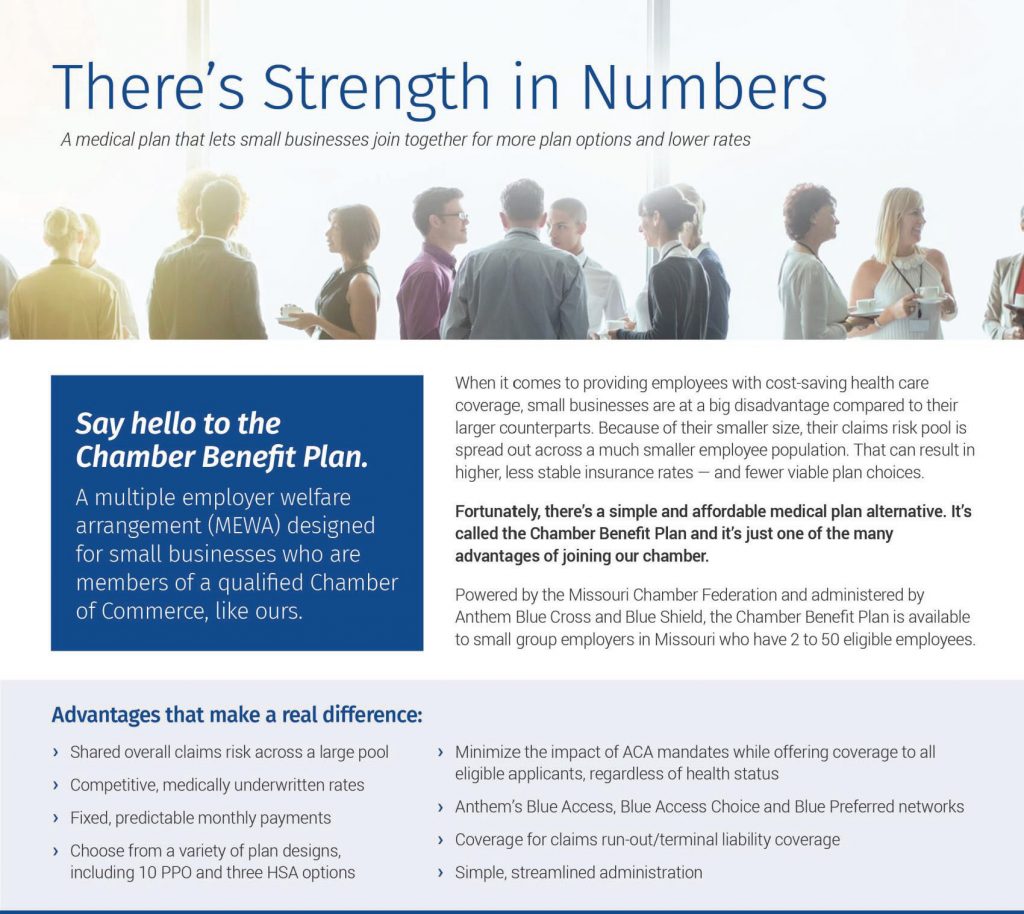

Now, with the chamber benefit plan, chamber members have access to a new health insurance program that uses an innovative structure enabling smaller employers to join together and share the overall claims risk. Get the best quote and save 30% today! Guaranteed benefits for one and two person companies. Chamber offers health insurance option for members. The chamber benefit plan, available statewide on august 28, is a joint effort between the missouri chamber of commerce and industry and the local chambers of commerce that comprise the missouri chamber federation.

Source: chandlerchamber.com

Source: chandlerchamber.com

This alternative to costly health insurance makes obtaining healthcare faster, easier, convenient, and less. As small businesses seek ways to remain competitive in upon job marketplace as tuition as fulfill new legal standards for health insurance, disability and life products. In fact, enrolling in chamberadvantage can result in up to 28% savings on medical costs.1. Get the best quote and save 30% today! Of insurance and offered legislation on the issue.

Source: eparisextra.com

Source: eparisextra.com

Ad compare top expat health insurance in indonesia. Humana health insurance plans suitable for small businesses are: Having access to trusted health insurance benefits is a crucial piece to that success. Maintaining health insurance at a reasonable price for their family and employees has always been a challenge for small businesses. Guaranteed benefits for one and two person companies.

Source: hartfordbusiness.com

Source: hartfordbusiness.com

Guaranteed benefits for one and two person companies. Chamber members can save hundreds or thousands of dollars a year on their health insurance from fallon community health plan, harvard pilgrim health care, and health new england, which are each. Business must be a noacc chamber member. Health insurance coverage is one of the most important benefits businesses can offer when recruiting and retaining talent. The michigan chamber of commerce has been a trusted insurance solutions resource for michigan employers for over 20 years.

Source: hartfordbusiness.com

Source: hartfordbusiness.com

If your small business is a chamber member and has 50 or fewer employees, you may be eligible to participate in this program. Addressing the crisis in small group health insurance is a top priority for the small business chamber, which has worked closely with the sc dept. The indy chamber and anthem have extended their ongoing partnership with the chambercare health alliance, an easier, more affordable way to offer health care to the employees of small businesses. Humana plans for small businesses. Available to marion county businesses exclusively through indy chamber membership and more widely available to businesses in the eight surrounding counties,.

Source: monosiva.blogspot.com

Source: monosiva.blogspot.com

According to sba statistics, small businesses equate to over 99.1% of all businesses in kansas, the salina. Its premier insurance solution for small business owners is the bop plan, which can be used by businesses with up to $30 million in revenue. As small businesses seek ways to remain competitive in upon job marketplace as tuition as fulfill new legal standards for health insurance, disability and life products. Telemedicine and mental health services are available in both english and spanish. Business must be a noacc chamber member.

Source: goconifer.com

Source: goconifer.com

Health insurance coverage is one of the most important benefits businesses can offer when recruiting and retaining talent. Addressing the crisis in small group health insurance is a top priority for the small business chamber, which has worked closely with the sc dept. Introduced in 1970, chambers plan now provides coverage to over 30,000 firms like yours. More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. Chamber members can save hundreds or thousands of dollars a year on their health insurance from fallon community health plan, harvard pilgrim health care, and health new england, which are each.

Source: westpittsburghchamber.org

Source: westpittsburghchamber.org

Available to marion county businesses exclusively through indy chamber membership and more widely available to businesses in the eight surrounding counties,. Humana plans for small businesses. This alternative to costly health insurance makes obtaining healthcare faster, easier, convenient, and less. More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. Any small business that belongs to one of the more than 60 participating chambers of commerce and other business associations is eligible to join the chamber health coop.

Source: monosiva.blogspot.com

Source: monosiva.blogspot.com

Humana health insurance plans suitable for small businesses are: This alternative to costly health insurance makes obtaining healthcare faster, easier, convenient, and less. The 29 chambers that can offer these insurance plans to its members are the franklin county regional chamber of commerce, jay peak area chamber of commerce, lamoille region chamber of commerce, northeast kingdom chamber of commerce, swanton chamber of commerce, heart of vermont chamber of commerce, lake champlain regional chamber of. Guaranteed benefits for one and two person companies. Having access to trusted health insurance benefits is a crucial piece to that success.

Source: 1450wlaf.com

Source: 1450wlaf.com

Combining accessibility, flexibility and the stability of pooled benefits. According to sba statistics, small businesses equate to over 99.1% of all businesses in kansas, the salina. Addressing the crisis in small group health insurance is a top priority for the small business chamber, which has worked closely with the sc dept. When these small businesses join together in a larger pool, they share the overall claims risk, bringing costs down. Small business insurance provides coverage for lawsuits, but it also has additional options for workers’ compensation and payment disputes (see here for an external glossary of insurance terms).

Source: chandlerchamber.com

Source: chandlerchamber.com

Available to marion county businesses exclusively through indy chamber membership and more widely available to businesses in the eight surrounding counties,. Humana health insurance plans suitable for small businesses are: More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. Its premier insurance solution for small business owners is the bop plan, which can be used by businesses with up to $30 million in revenue. This alternative to costly health insurance makes obtaining healthcare faster, easier, convenient, and less.

Source: bostonchamber.com

Source: bostonchamber.com

This alternative to costly health insurance makes obtaining healthcare faster, easier, convenient, and less. Guaranteed benefits for one and two person companies. The health insurance offered by the missouri benefit plan first rolled out to a limited number of small businesses in 2017. Of insurance and offered legislation on the issue. As small businesses seek ways to remain competitive in upon job marketplace as tuition as fulfill new legal standards for health insurance, disability and life products.

Source: jacksonvilleprogress.com

Source: jacksonvilleprogress.com

Combining accessibility, flexibility and the stability of pooled benefits. In this instance, a small business takes out a group insurance policy through a traditional, national corporation or a local company sourced through the public small business health options (shop) marketplace. The business pays a fixed premium for the policy and employees are responsible for deductibles and copays. Get the best quote and save 30% today! Group health insurance plans for chamber members.

Source: greatbendpost.com

Source: greatbendpost.com

Introduced in 1970, chambers plan now provides coverage to over 30,000 firms like yours. The chamber benefit plan, available statewide on august 28, is a joint effort between the missouri chamber of commerce and industry and the local chambers of commerce that comprise the missouri chamber federation. Many of these additional reforms will require congressional action, which is why the u.s. The chambers plan is the simple, stable, smart choice for business; Since its beginning in 2000, the south carolina small business chamber of commerce (scsbcc) has been the state’s leading business advocate for making health insurance more affordable.

Source: scchamber.net

Source: scchamber.net

As small businesses seek ways to remain competitive in upon job marketplace as tuition as fulfill new legal standards for health insurance, disability and life products. Now, with the chamber benefit plan, chamber members have access to a new health insurance program that uses an innovative structure enabling smaller employers to join together and share the overall claims risk. More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. The chambers plan is the simple, stable, smart choice for business; Telemedicine and mental health services are available in both english and spanish.

Source: monosiva.blogspot.com

Source: monosiva.blogspot.com

The michigan chamber of commerce has been a trusted insurance solutions resource for michigan employers for over 20 years. Guaranteed benefits for one and two person companies. More than 30,000 small to midsize businesses choose the chambers plan to protect their employees with comprehensive group benefits, including health and dental insurance, making it canada’s #1 employee benefits plan for small business. Chamber offers health insurance option for members. The health insurance offered by the missouri benefit plan first rolled out to a limited number of small businesses in 2017.

Source: monosiva.blogspot.com

Source: monosiva.blogspot.com

Employee coverage (i.e workers’ compensation insurance). Humana plans for small businesses. In this instance, a small business takes out a group insurance policy through a traditional, national corporation or a local company sourced through the public small business health options (shop) marketplace. Addressing the crisis in small group health insurance is a top priority for the small business chamber, which has worked closely with the sc dept. Guaranteed benefits for one and two person companies.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title chamber of commerce small business health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea