Changing life insurance policy Idea

Home » Trend » Changing life insurance policy IdeaYour Changing life insurance policy images are ready in this website. Changing life insurance policy are a topic that is being searched for and liked by netizens today. You can Download the Changing life insurance policy files here. Get all royalty-free images.

If you’re searching for changing life insurance policy images information connected with to the changing life insurance policy keyword, you have visit the right blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video content and images that match your interests.

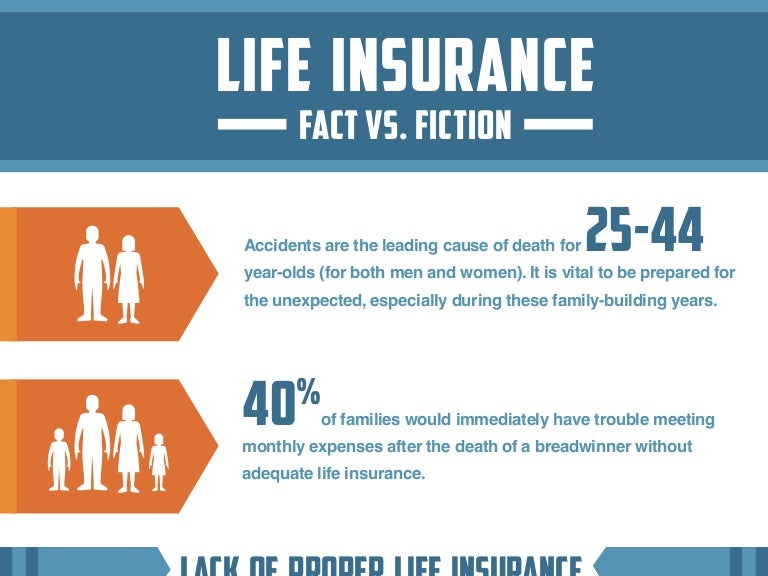

Changing Life Insurance Policy. These 7702 changes represents the first major change to life insurance funding parameters since 7702 was originally enacted in the 1980’s. How can i change the owner of my life insurance policy? This section of the tax code dictates the premium limits for life insurance policies before they are considered a mec (modified endowment contract) and receive adverse tax treatment by the irs. In the case of permanent cash value policies there two tax items:

Life Changes Causing Michigan To Evaluate Their Insurance From compass-insurance-agency.com

Life Changes Causing Michigan To Evaluate Their Insurance From compass-insurance-agency.com

But there are a few things to consider before you go ahead and change your insurance policy provider. Personal property has an owner. Contact the life insurance company and request a change of policyholder form. If your life insurance claim has been denied and you would like to discuss the. A life insurance claim denied due to lapse following change in ownership may be reversed with the help of an experienced life insurance attorney. Whenever the circumstances of your life change, your life insurance should change too.

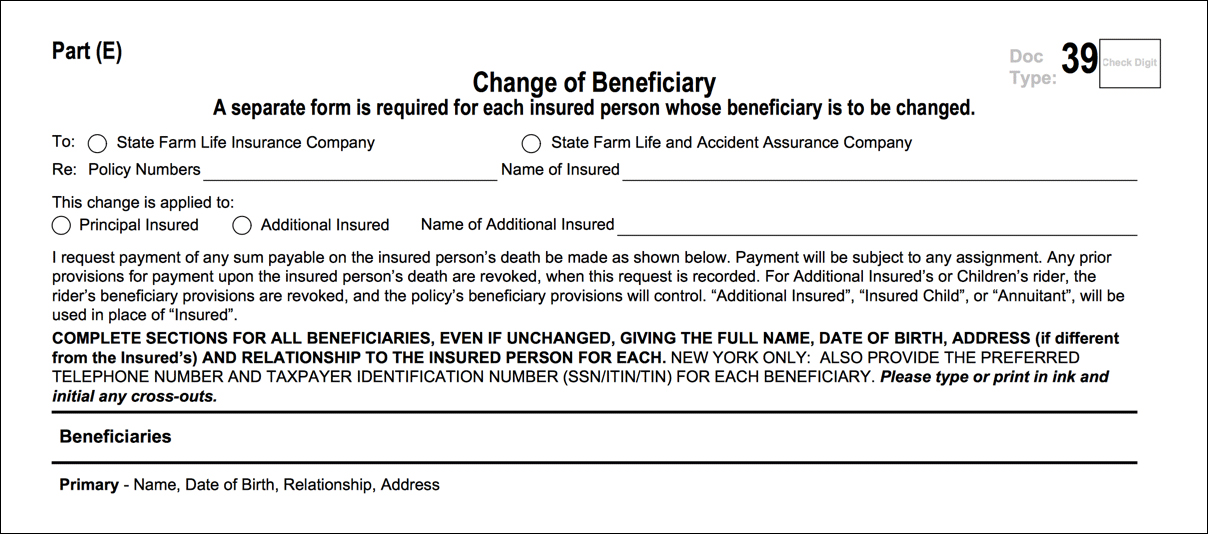

You’ll need to submit a change of beneficiary form online, on paper, or over the phone.

For example, you become a new parent or decide to move to a bigger house. You’ll need to submit a change of beneficiary form online, on paper, or over the phone. Whenever the circumstances of your life change, your life insurance should change too. When do i need to change my life insurance? How can i change the owner of my life insurance policy? How do i change the beneficiary of my life insurance policy?

Source: gandhiselimlaw.com

Source: gandhiselimlaw.com

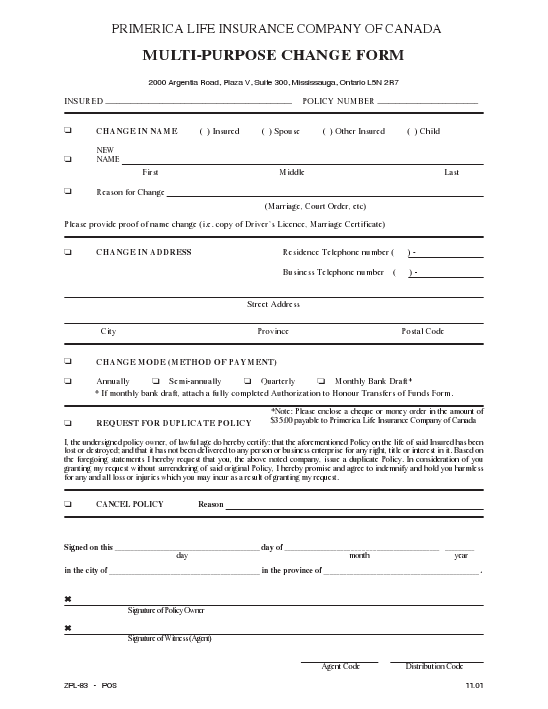

If you don’t keep your insurance up to date, the protection you. This section of the tax code dictates the premium limits for life insurance policies before they are considered a mec (modified endowment contract) and receive adverse tax treatment by the irs. The ownership of a life insurance policy can be changed and only by the owner of the policy. 6 reasons to change a life insurance policy checklist you find a cheaper life insurance policy you have a change in life circumstance you need to change or add a beneficiary you find out there might be a better type of policy for you like whole life or term insurance. However, it is illegal for a life insurance agent to steer a consumer into changing a policy that.

Source: pocketsense.com

Source: pocketsense.com

Some insurance companies may allow you to download a form from their website and fax the change of policyholder form to their home office. This might be a good time to talk with your agent about switching to a permanent life. Compare life insurance policies to check if yours is still the best for you, at. Contact the life insurance company and request a change of policyholder form. You can call the life insurance company directly and ask for this form.

Source: statefarm.com

Source: statefarm.com

These types of events usually mean that you need more protection. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by. At our firm, our life insurance lawyers focus on recovering denied life insurance claims and collecting lapsed policies. Any change in the ownership could trigger a taxable event or a carry forward of basis.

Source: fancypanther.blogspot.com

Source: fancypanther.blogspot.com

You can call the life insurance company directly and ask for this form. Contact the life insurance company and request a change of policyholder form. Changing your type of coverage. But there are a few things to consider before you go ahead and change your insurance policy provider. These types of events usually mean that you need more protection.

Source: slideshare.net

Source: slideshare.net

Some insurance companies may allow you to download a form from their website and fax the change of policyholder form to their home office. Provide your agent with their social security numbers to facilitate benefit payouts should you die. Personal property has an owner. Some insurance companies may allow you to download a form from their website and fax the change of policyholder form to their home office. There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by.

Source: funeralcoverfinder.co.za

Source: funeralcoverfinder.co.za

These types of events usually mean that you need more protection. Contact the life insurance company and request a change of policyholder form. These types of events usually mean that you need more protection. How do i change my life insurance policy? As such, you’ll want to ensure that changing your life insurance policy is right for you, and make sure you�ve got your new policy set up before cancelling your existing one.

Source: moneytothemasses.com

Source: moneytothemasses.com

This might be a good time to talk with your agent about switching to a permanent life. When do i need to change my life insurance? For example, you become a new parent or decide to move to a bigger house. These 7702 changes represents the first major change to life insurance funding parameters since 7702 was originally enacted in the 1980’s. Contestable period a new policy may have a contestable period.

Source: pocketsense.com

Source: pocketsense.com

When do i need to change my life insurance? However, it is illegal for a life insurance agent to steer a consumer into changing a policy that. 6 reasons to change a life insurance policy checklist you find a cheaper life insurance policy you have a change in life circumstance you need to change or add a beneficiary you find out there might be a better type of policy for you like whole life or term insurance. You can change the beneficiaries of your life insurance by contacting your insurance company. There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by.

Source: coreygrant.com

Source: coreygrant.com

When do i need to change my life insurance? This section of the tax code dictates the premium limits for life insurance policies before they are considered a mec (modified endowment contract) and receive adverse tax treatment by the irs. Contestable period a new policy may have a contestable period. You may want to consult your tax advisor prior to requesting a change in ownership. Simply put, this is a standard clause with most life insurance policies.

Source: insurance.ohio.gov

Source: insurance.ohio.gov

Some insurance companies may allow you to download a form from their website and fax the change of policyholder form to their home office. There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by. Provide your agent with their social security numbers to facilitate benefit payouts should you die. How do i change the beneficiary of my life insurance policy? But there are a few things to consider before you go ahead and change your insurance policy provider.

Source: youtube.com

Source: youtube.com

How can i change the owner of my life insurance policy? Simply put, this is a standard clause with most life insurance policies. How do i name or change a life insurance beneficiary on my insurance policy? Yes, you can change life insurance companies and take out a policy with another provider. How can i change the owner of my life insurance policy?

Source: bankonyourself.com

Source: bankonyourself.com

There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by other family members who will be the beneficiaries. Some insurance companies may allow you to download a form from their website and fax the change of policyholder form to their home office. This might be a good time to talk with your agent about switching to a permanent life. You can call the life insurance company directly and ask for this form. All you need to do is fill out a simple form and send it to the life insurance company.

Source: chandlerknowlescpa.com

Source: chandlerknowlescpa.com

If you don’t keep your insurance up to date, the protection you. Changing your type of coverage. Review your cover and calculate if it’s still enough for your needs and if not, how much life insurance cover you really. For example, you become a new parent or decide to move to a bigger house. If you don’t keep your insurance up to date, the protection you.

Source: paulasmithinsurance.com

Source: paulasmithinsurance.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You’ll need to submit a change of beneficiary form online, on paper, or over the phone. Changing your type of coverage. Changing your policy at certain key points of your life, you may need to increase the amount of cover you have. For example, you become a new parent or decide to move to a bigger house.

Source: blog.higginbotham.net

Contact the life insurance company and request a change of policyholder form. Contact the life insurance company and request a change of policyholder form. A life insurance claim denied due to lapse following change in ownership may be reversed with the help of an experienced life insurance attorney. Life insurance is personal property. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: primericafile.blogspot.com

Source: primericafile.blogspot.com

Contestable period a new policy may have a contestable period. However, other insurers will only accept an original signature. You can change the beneficiaries of your life insurance by contacting your insurance company. No, changing your life insurance provider is not illegal. All you need to do is fill out a simple form and send it to the life insurance company.

Source: sentinel-financial.com

Source: sentinel-financial.com

If your life insurance claim has been denied and you would like to discuss the. The ownership of a life insurance policy can be changed and only by the owner of the policy. Contestable period a new policy may have a contestable period. If you are the owner of your policy, you can transfer ownership. All you need to do is fill out a simple form and send it to the life insurance company.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

These types of events usually mean that you need more protection. Yes, you can change life insurance companies and take out a policy with another provider. There may also be tax consequences to having your life insurance policies or annuities owned by a trust, or by. Contact the life insurance company and request a change of policyholder form. If you transfer a cash value life insurance policy to someone and it’s worth more than the exclusion limit, it’s considered a taxable gift.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title changing life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information