Changing the beneficiary on a life insurance policy information

Home » Trending » Changing the beneficiary on a life insurance policy informationYour Changing the beneficiary on a life insurance policy images are ready in this website. Changing the beneficiary on a life insurance policy are a topic that is being searched for and liked by netizens now. You can Find and Download the Changing the beneficiary on a life insurance policy files here. Download all free photos.

If you’re searching for changing the beneficiary on a life insurance policy images information linked to the changing the beneficiary on a life insurance policy keyword, you have come to the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

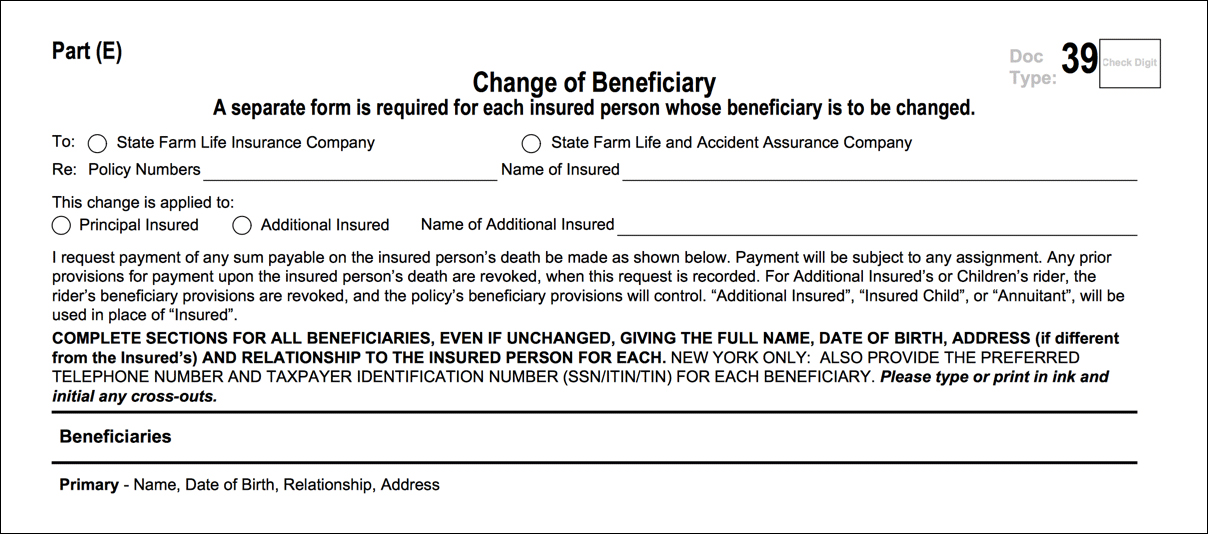

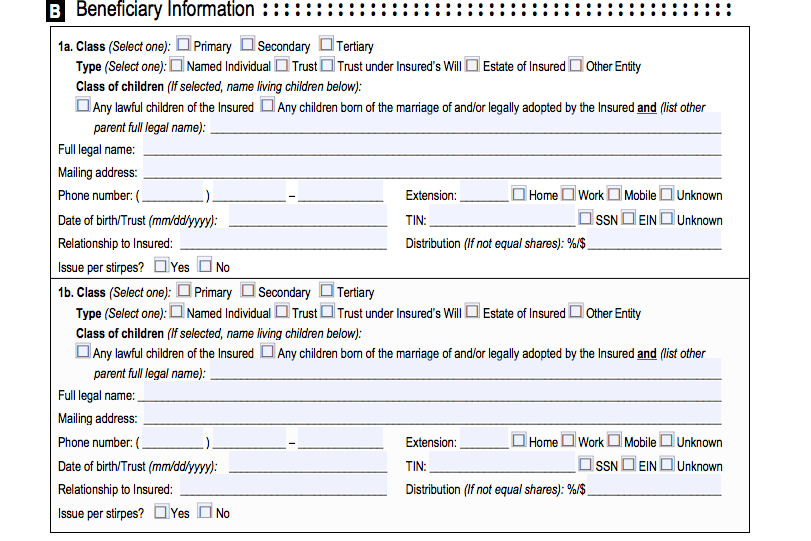

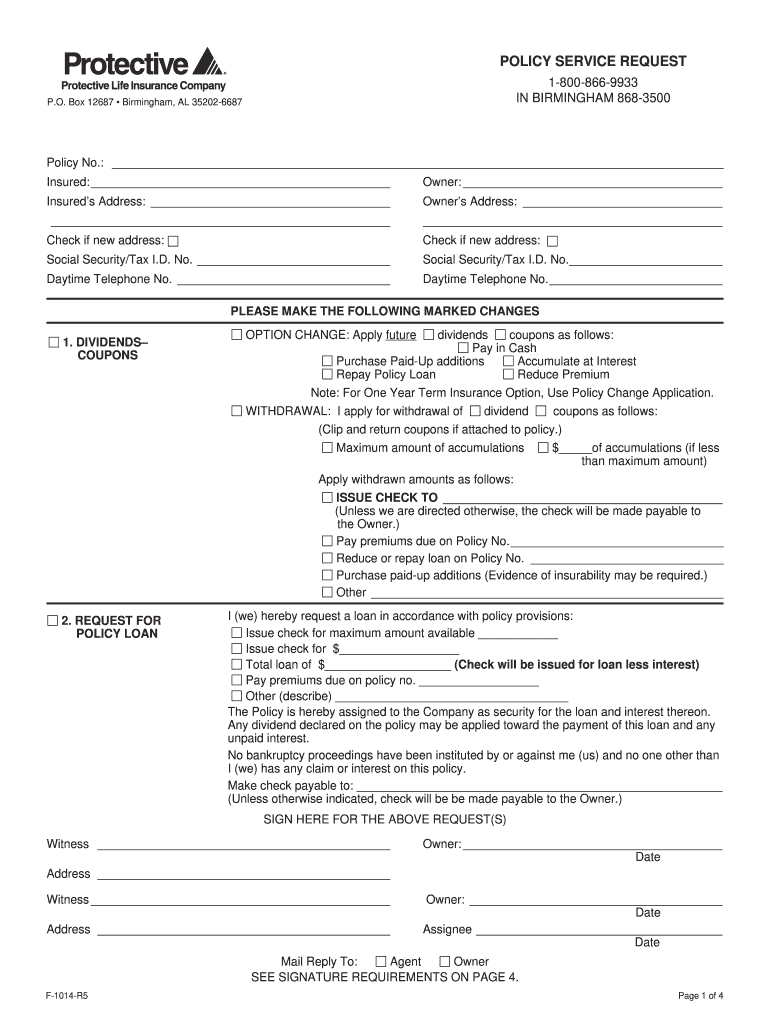

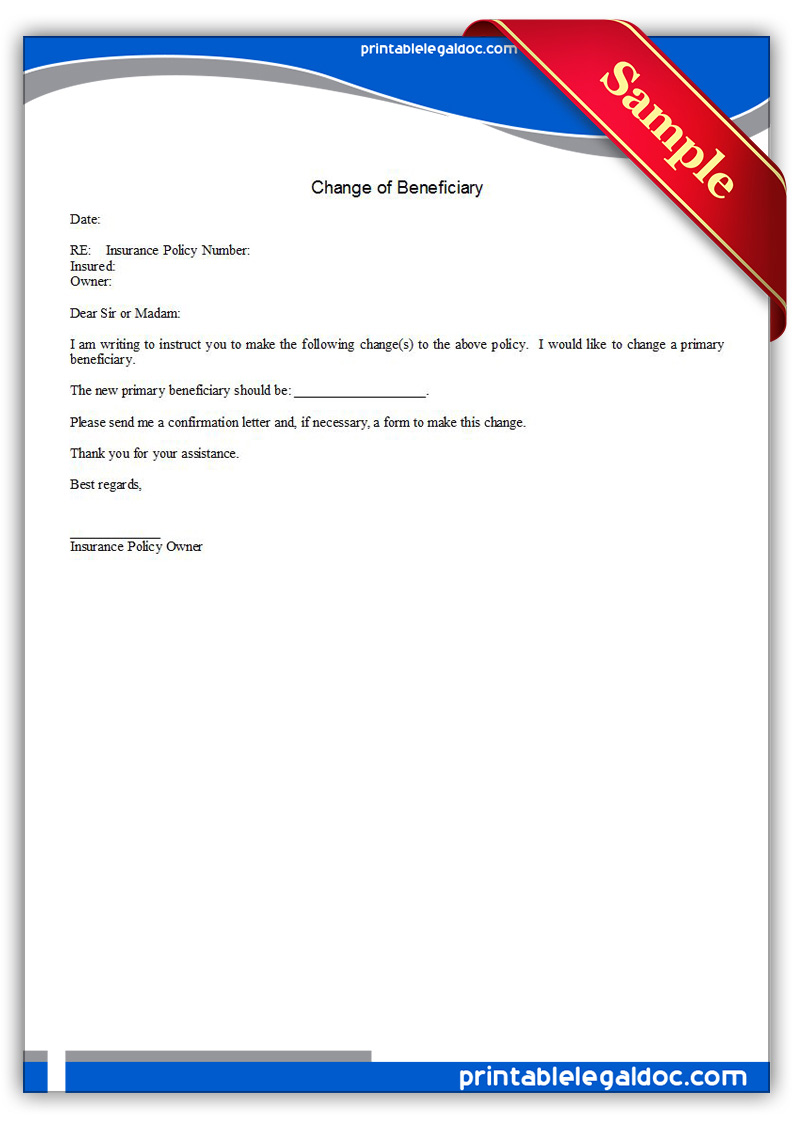

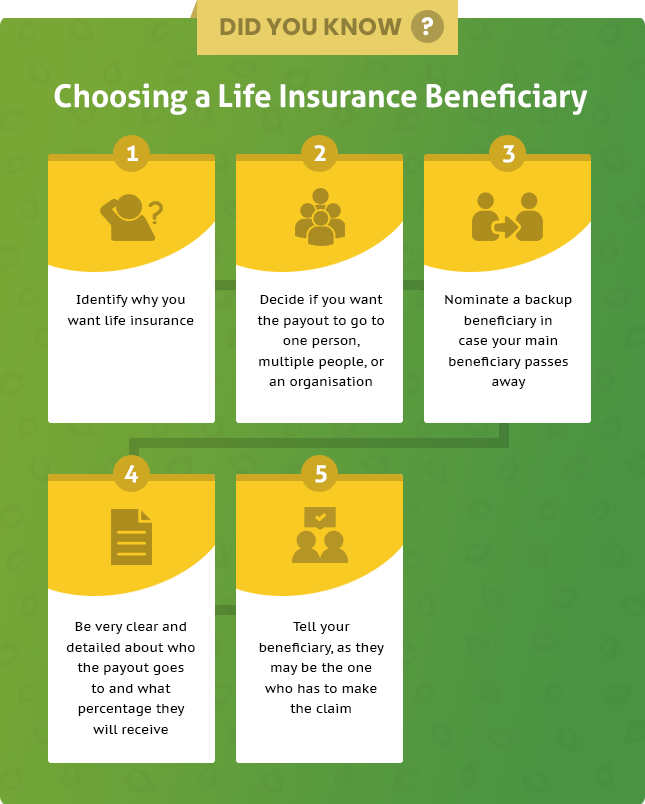

Changing The Beneficiary On A Life Insurance Policy. You can change the beneficiaries of your life insurance by contacting your insurance company. The form will ask for personal information about your beneficiary, such as: You simply need to contact your insurer and request a change of beneficiary form and fill out the form accurately and completely. If you are the owner of your life insurance policy, you have the option of adding, dropping or changing beneficiaries at your discretion.

Change Life Beneficiary From statefarm.com

Change Life Beneficiary From statefarm.com

These stipulations apply to both term life insurance and whole life insurance policies. The beneficiary of a life insurance policy can still meet their daily needs after passing on. Therefore, you cannot make changes to your policy in your will or in any document other than that which is approved by your insurance company. You’ll choose your beneficiaries when you first purchase a policy; While the precise procedure for policy owners to add or change life insurance beneficiaries varies by insurer, the basic process is the same. This allows you to name the people you’d like the money to go to in the event of your death, and it also protects the life insurance payout from inheritance tax.

In most cases, it is a simple matter to change the beneficiary on a life insurance policy.

For years life insurance has been sold in person by an insurance sales agent or a financial advisor who has some personal connection to you. You’ll need to submit a change of beneficiary form online, on paper, or over the phone. You can discuss your life insurance beneficiaries with your estate lawyer. The policyholder is generally the only person who can change the beneficiaries of a life insurance policy. The people you name are called your beneficiaries. In most cases, it is a simple matter to change the beneficiary on a life insurance policy.

Source: topwholelife.com

Source: topwholelife.com

How do i change the beneficiary of my life insurance policy? It is basically a simple matter that won’t alter any other aspects of your coverage policy. All you need is to contact the insurer and submit a request to change a beneficiary. The beneficiaries you named on your life insurance policy while you were an active crew member will remain your beneficiaries on your retiree (4). You can often change these, and might need to if your personal or financial situation changes.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

The form will ask for personal information about your beneficiary, such as: The insured’s daughter was originally the beneficiary of his life insurance policy, but they became estranged during that time, and he filled out and submitted a change of beneficiary form changing the beneficiary to his wife, our client. Changing a beneficiary of a life insurance policy has always been a simple process. You can discuss your life insurance beneficiaries with your estate lawyer. You can change the beneficiaries of your life insurance by contacting your insurance company.

Source: usaa.com

Source: usaa.com

Contesting a life insurance beneficiary is hard, and it�s almost always a long and expensive process. If you are the owner of your life insurance policy, you have the option of adding, dropping or changing beneficiaries at your discretion. Changing a beneficiary of a life insurance policy has always been a simple process. The form will ask for personal information about your beneficiary, such as: Because washington is a community property state, ruth would claim 50% of the death benefit because she was married to peter half of the time he had the life insurance policy, and the premiums were paid with community money.

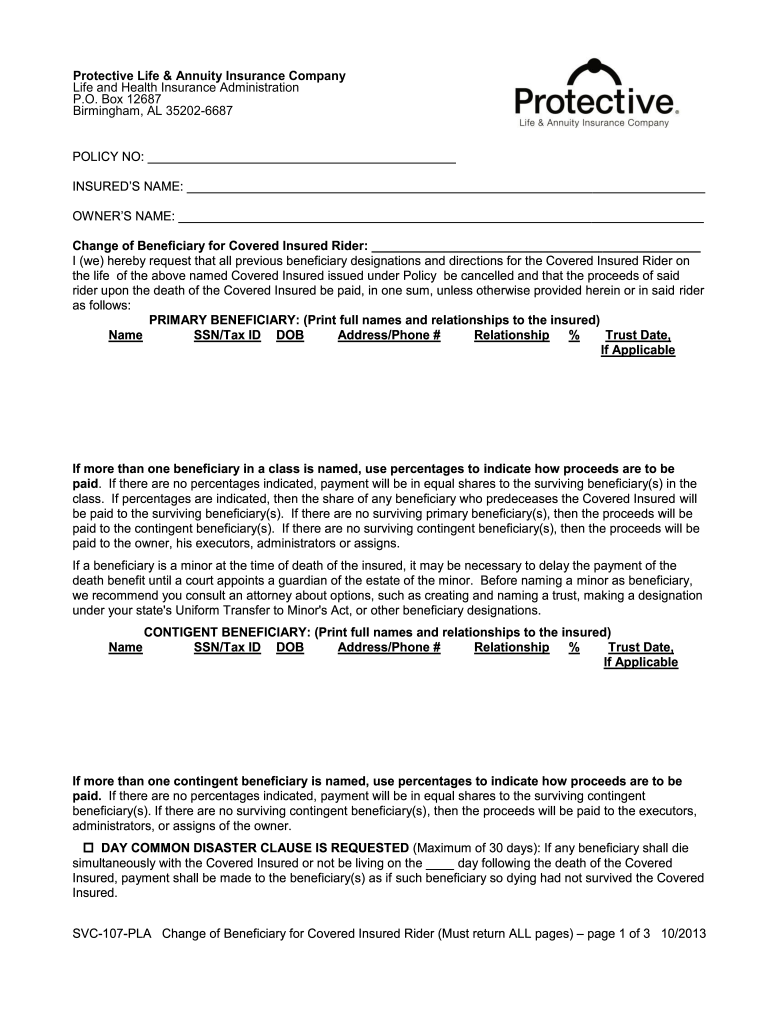

Source: pdffiller.com

Source: pdffiller.com

The insurance company may reject the change and ask the insured to make the designation on the form and in the manner required by the company. A spouse or former spouse may have an interest in life insurance proceeds if the policy premiums were paid with community funds. The policyholder is generally the only person who can change the beneficiaries of a life insurance policy. You can discuss your life insurance beneficiaries with your estate lawyer. How do i name or change a life insurance beneficiary on my insurance policy?

Source: everquote.com

Source: everquote.com

If you are the owner of your life insurance policy, you have the option of adding, dropping or changing beneficiaries at your discretion. Changing a beneficiary of a life insurance policy has always been a simple process. The policyholder is generally the only person who can change the beneficiaries of a life insurance policy. You can change the beneficiaries of your life insurance by contacting your insurance company. You must change your beneficiary according to the requirements set forth by your insurance company.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

The form will ask for personal information about your beneficiary, such as: You simply need to contact your insurer and request a change of beneficiary form and fill out the form accurately and completely. If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable. The beneficiary of a life insurance policy can still meet their daily needs after passing on. People often designate their spouse or adult children.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

What is the process for changing beneficiaries on a life insurance policy? While the precise procedure for policy owners to add or change life insurance beneficiaries varies by insurer, the basic process is the same. Therefore, you cannot make changes to your policy in your will or in any document other than that which is approved by your insurance company. You can discuss your life insurance beneficiaries with your estate lawyer. In most cases, it is a simple matter to change the beneficiary on a life insurance policy.

Source: rbo.org

Source: rbo.org

Provide your agent with their social security numbers to facilitate benefit payouts should you die. Contesting a life insurance beneficiary is hard, and it�s almost always a long and expensive process. People often designate their spouse or adult children. While the policy is redeemable when you die, it is not part of your estate. The beneficiaries you named on your life insurance policy while you were an active crew member will remain your beneficiaries on your retiree (4).

Source: pdffiller.com

Source: pdffiller.com

How to change the beneficiary on your life insurance? Adding and changing life insurance beneficiaries. In most cases, it is a simple matter to change the beneficiary on a life insurance policy. To change your beneficiary, simply contact your insurer. While the policy is redeemable when you die, it is not part of your estate.

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

Peter changed his policy beneficiary to paula when they got married. To change your beneficiary, simply contact your insurer. How do i change the beneficiary of my life insurance policy? The policyholder is generally the only person who can change the beneficiaries of a life insurance policy. Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary is contingent and becomes vested only upon the death of the insured.� thus, when a change is made, the original beneficiary

Source: signnow.com

Source: signnow.com

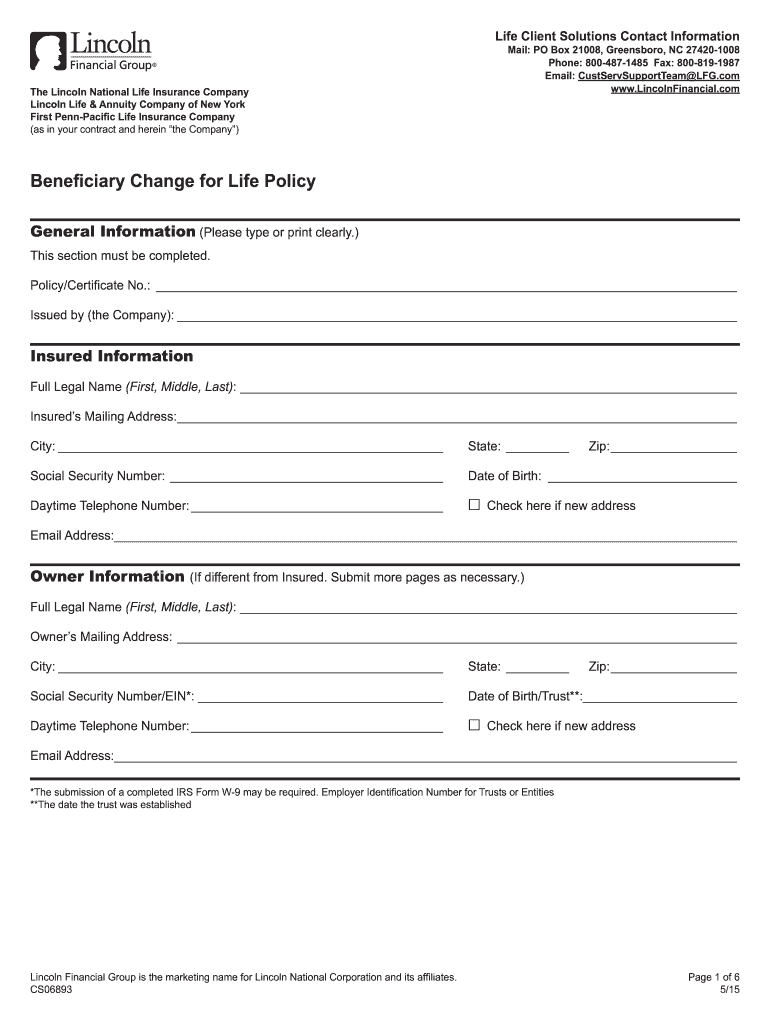

You’ll need to submit a change of beneficiary form online, on paper, or over the phone. Because washington is a community property state, ruth would claim 50% of the death benefit because she was married to peter half of the time he had the life insurance policy, and the premiums were paid with community money. How do i change the beneficiary of my life insurance policy? Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary is contingent and becomes vested only upon the death of the insured.� thus, when a change is made, the original beneficiary A life insurance beneficiary is a party explicitly named as the intended recipient of the policy’s death benefit (the amount payable to the beneficiary (ies) when a policyholder passes away).

Source: takemycounsel.com

Source: takemycounsel.com

Adding and changing life insurance beneficiaries. This allows you to name the people you’d like the money to go to in the event of your death, and it also protects the life insurance payout from inheritance tax. You can often change these, and might need to if your personal or financial situation changes. How to change the beneficiary on your life insurance? The policyholder is generally the only person who can change the beneficiaries of a life insurance policy.

Source: printablelegaldoc.com

Source: printablelegaldoc.com

This allows you to name the people you’d like the money to go to in the event of your death, and it also protects the life insurance payout from inheritance tax. Peter changed his policy beneficiary to paula when they got married. In most cases, it is a simple matter to change the beneficiary on a life insurance policy. The insurance company may reject the change and ask the insured to make the designation on the form and in the manner required by the company. If you transfer a life insurance policy to the beneficiary and it�s worth more than $15,000 in 2018 and 2019, then it�s considered a reportable.

Source: lifeandaccidentaldeathclaimlawyers.com

Source: lifeandaccidentaldeathclaimlawyers.com

Therefore, you cannot make changes to your policy in your will or in any document other than that which is approved by your insurance company. For years life insurance has been sold in person by an insurance sales agent or a financial advisor who has some personal connection to you. The policyholder is generally the only person who can change the beneficiaries of a life insurance policy. While the policy is redeemable when you die, it is not part of your estate. Once a life insurance policy has been issued and is in force, the owner of the policy (who would often also be the insured) is free to change the beneficiary to anyone he or she chooses, unless the beneficiary has been designated as irrevocable.

Source: signnow.com

Source: signnow.com

Any person with a valid legal claim can contest a life insurance policy�s beneficiary after the death of the insured. The best way around this is by engaging an attorney throughout the. In most cases, it is a simple matter to change the beneficiary on a life insurance policy. Use the sglv 8286 to make sgli coverage and beneficiary changes and submit your completed form to your branch of service personnel office. Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary is contingent and becomes vested only upon the death of the insured.� thus, when a change is made, the original beneficiary

Source: everquote.com

Source: everquote.com

This allows you to name the people you’d like the money to go to in the event of your death, and it also protects the life insurance payout from inheritance tax. Important information about changing the beneficiary on an insurance policy special notice for residents of a community property state: What is the process for changing beneficiaries on a life insurance policy? How do i name or change a life insurance beneficiary on my insurance policy? While the policy is redeemable when you die, it is not part of your estate.

Source: insuranceneighbor.com

Source: insuranceneighbor.com

In most cases, it is a simple matter to change the beneficiary on a life insurance policy. This allows you to name the people you’d like the money to go to in the event of your death, and it also protects the life insurance payout from inheritance tax. Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary. For years life insurance has been sold in person by an insurance sales agent or a financial advisor who has some personal connection to you. Once a life insurance policy has been issued and is in force, the owner of the policy (who would often also be the insured) is free to change the beneficiary to anyone he or she chooses, unless the beneficiary has been designated as irrevocable.

Source: gandhiselimlaw.com

Source: gandhiselimlaw.com

It is your responsibility to consult your legal advisor Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary. Change of beneficiary in insurance policy it is well established that when the beneficiary in a life policy or benefit certificate can be changed at the will of the insured, the interest of the beneficiary is contingent and becomes vested only upon the death of the insured.� thus, when a change is made, the original beneficiary What is the process for changing beneficiaries on a life insurance policy? In most cases, it is a simple matter to change the beneficiary on a life insurance policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title changing the beneficiary on a life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea