Characteristics of insurance risk information

Home » Trend » Characteristics of insurance risk informationYour Characteristics of insurance risk images are ready. Characteristics of insurance risk are a topic that is being searched for and liked by netizens today. You can Get the Characteristics of insurance risk files here. Find and Download all royalty-free vectors.

If you’re searching for characteristics of insurance risk pictures information connected with to the characteristics of insurance risk keyword, you have come to the right blog. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

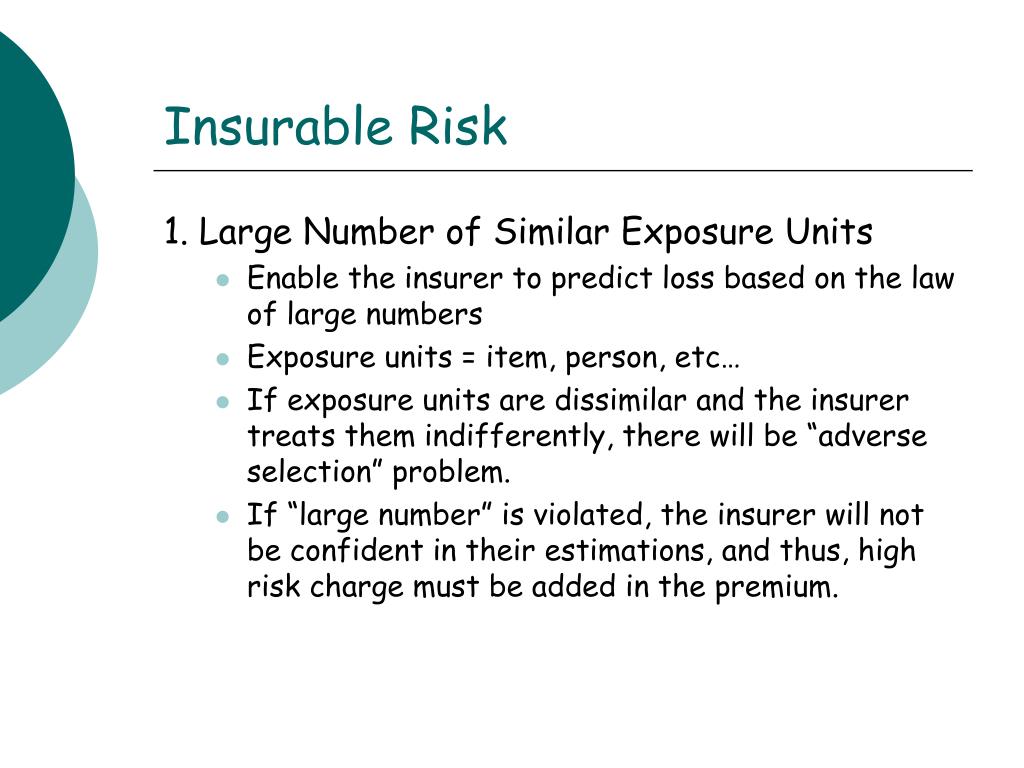

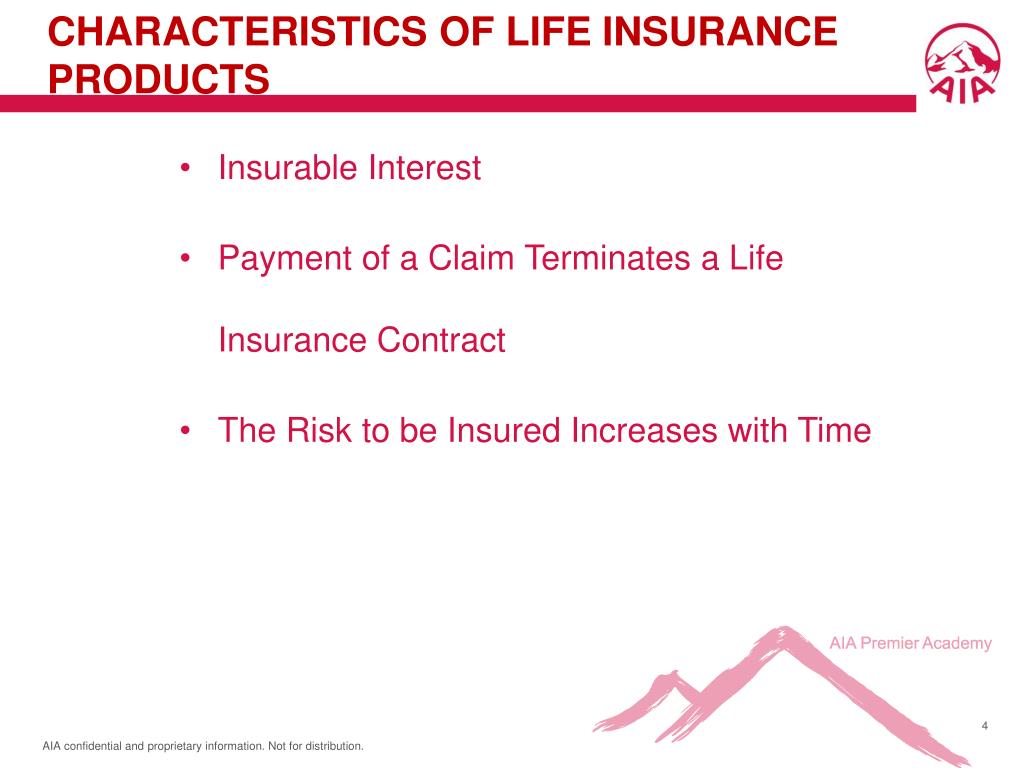

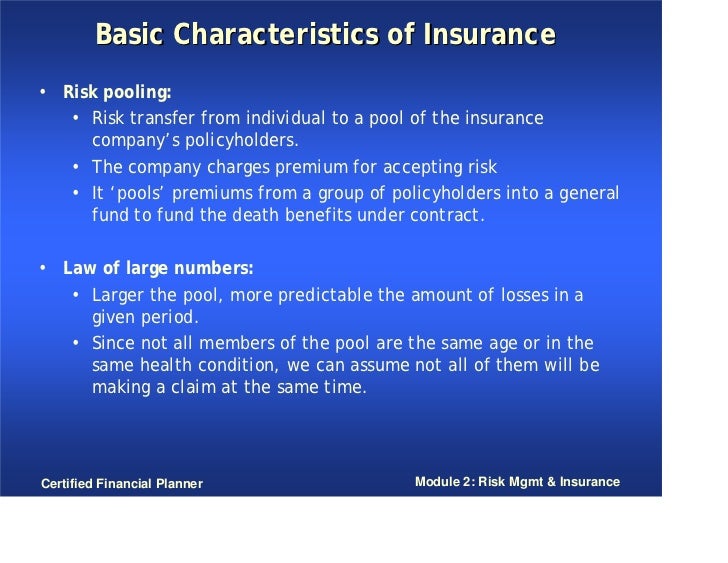

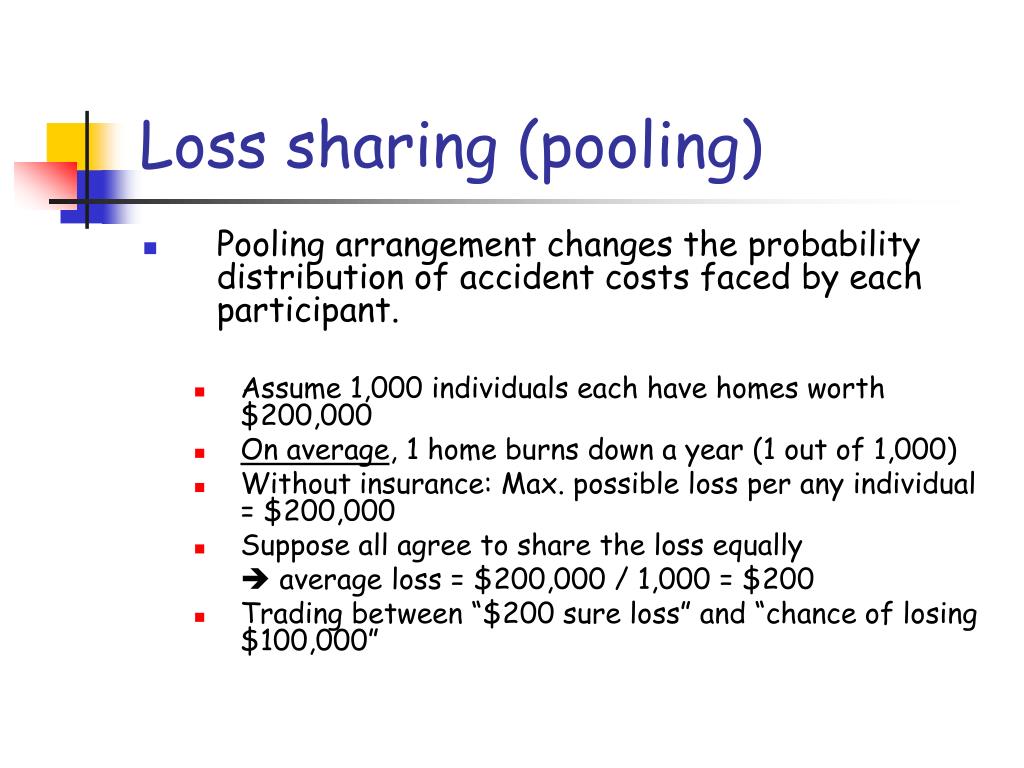

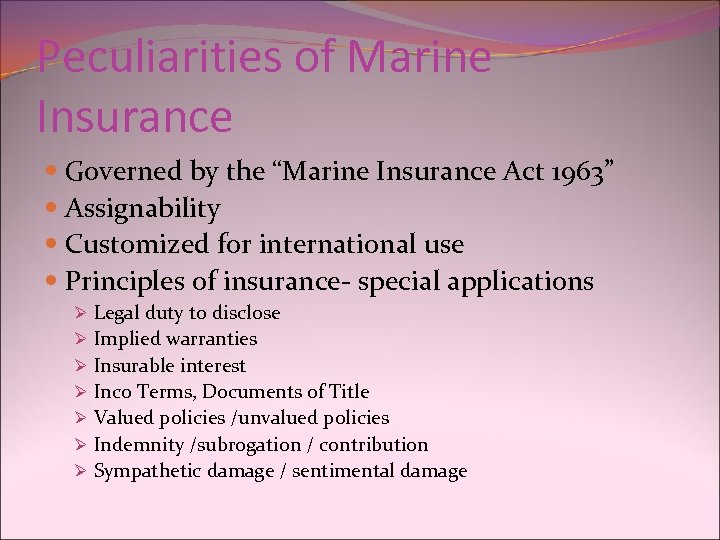

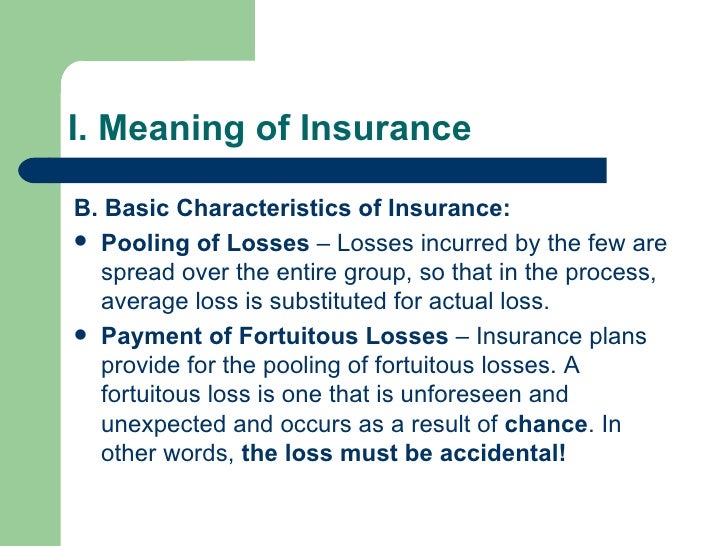

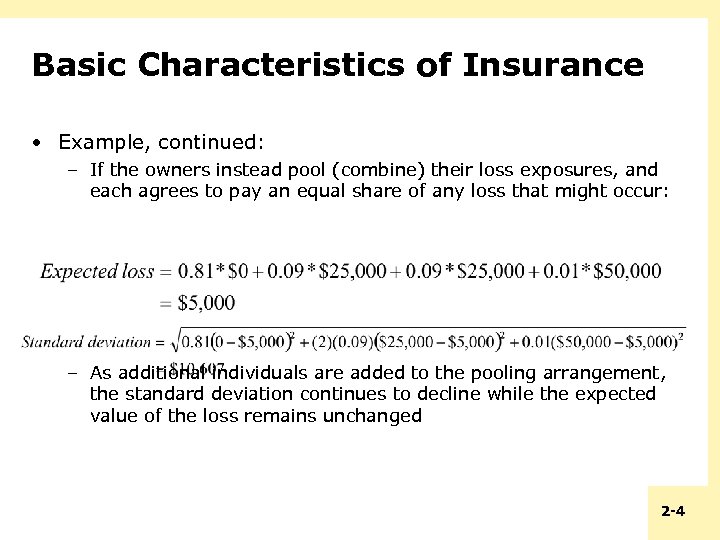

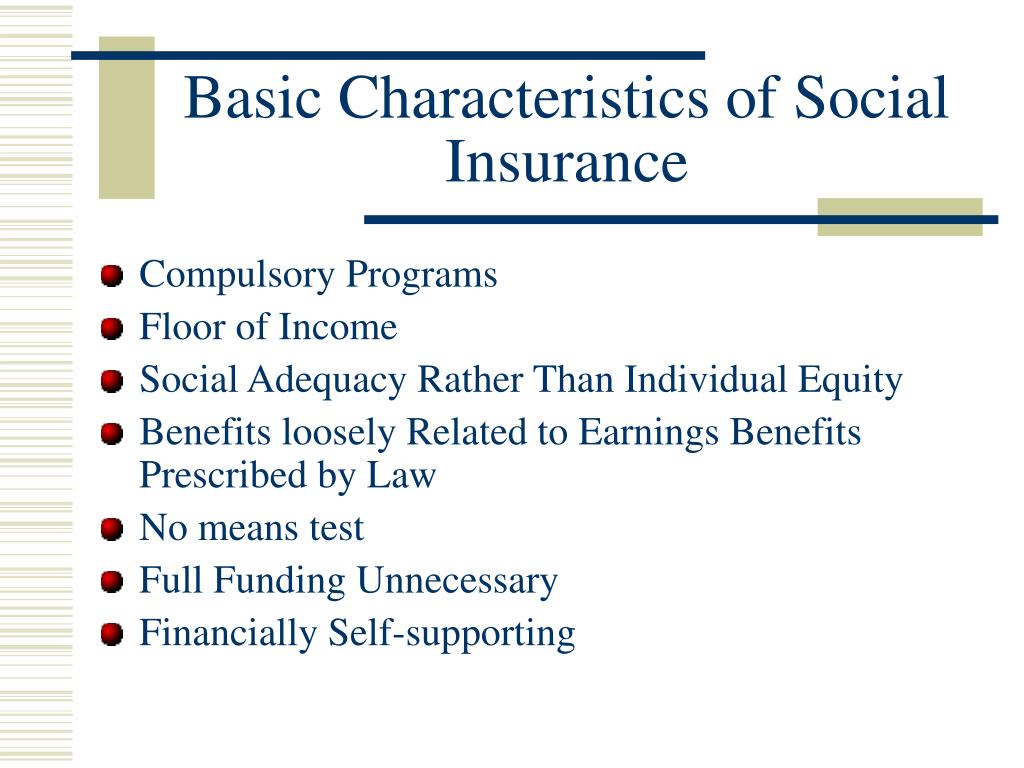

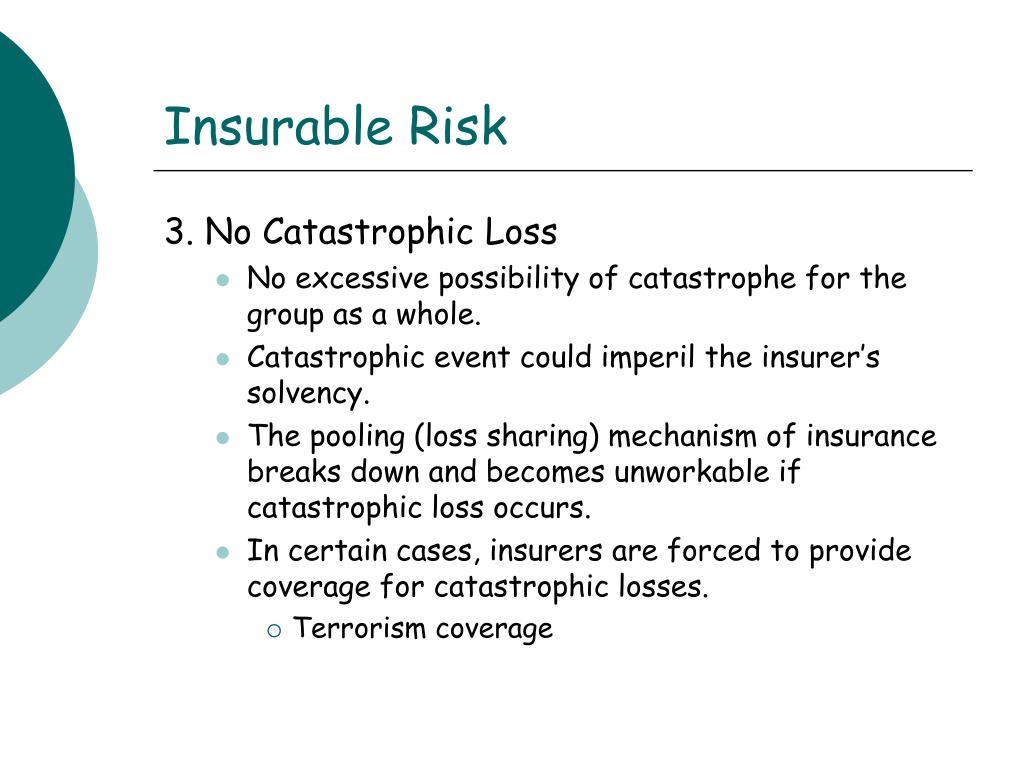

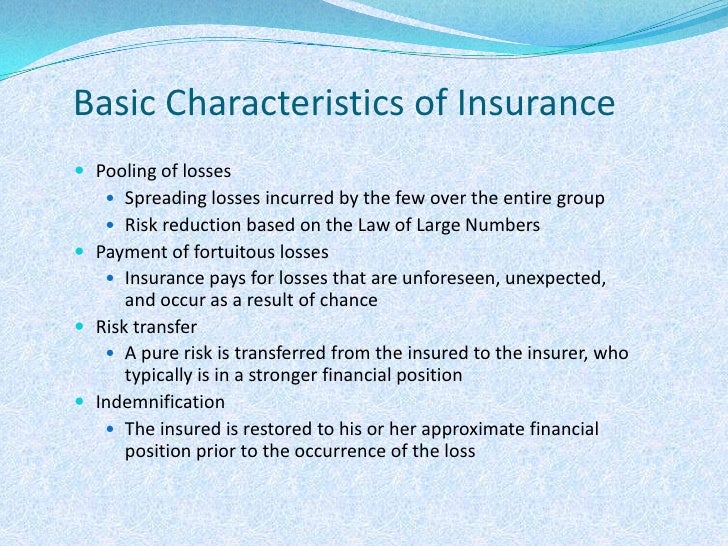

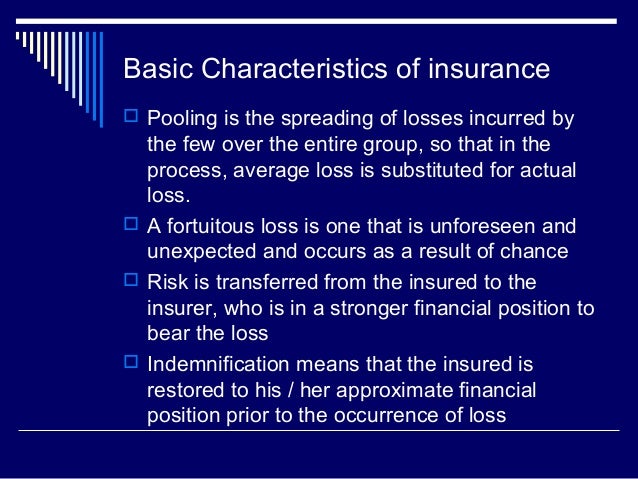

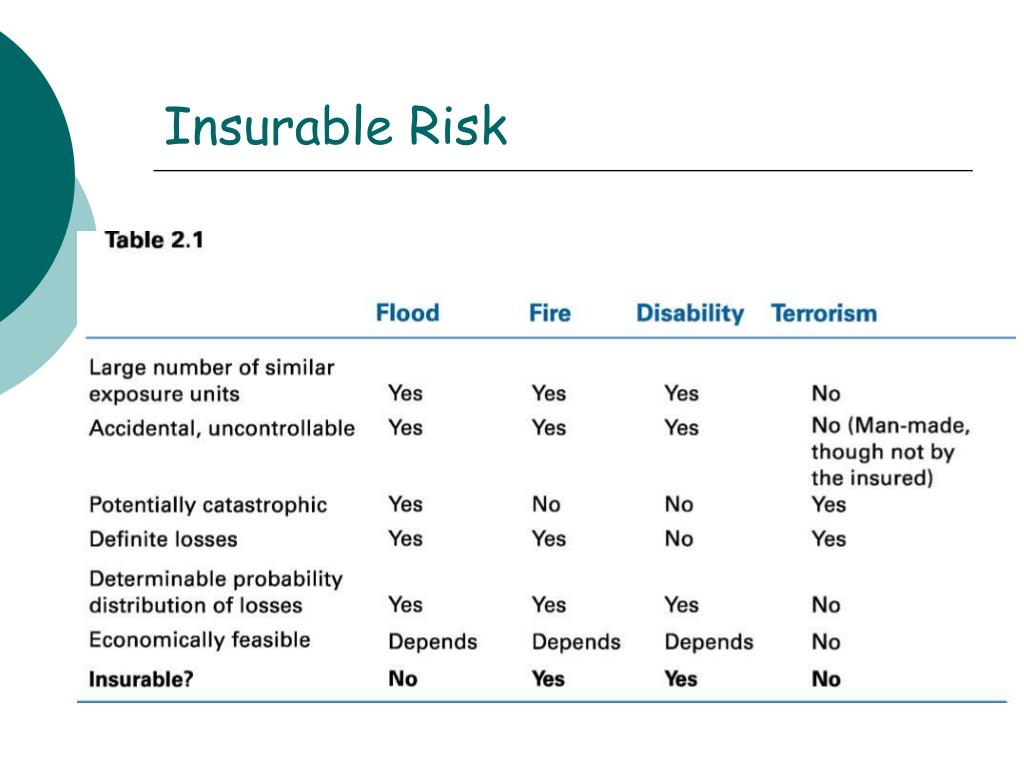

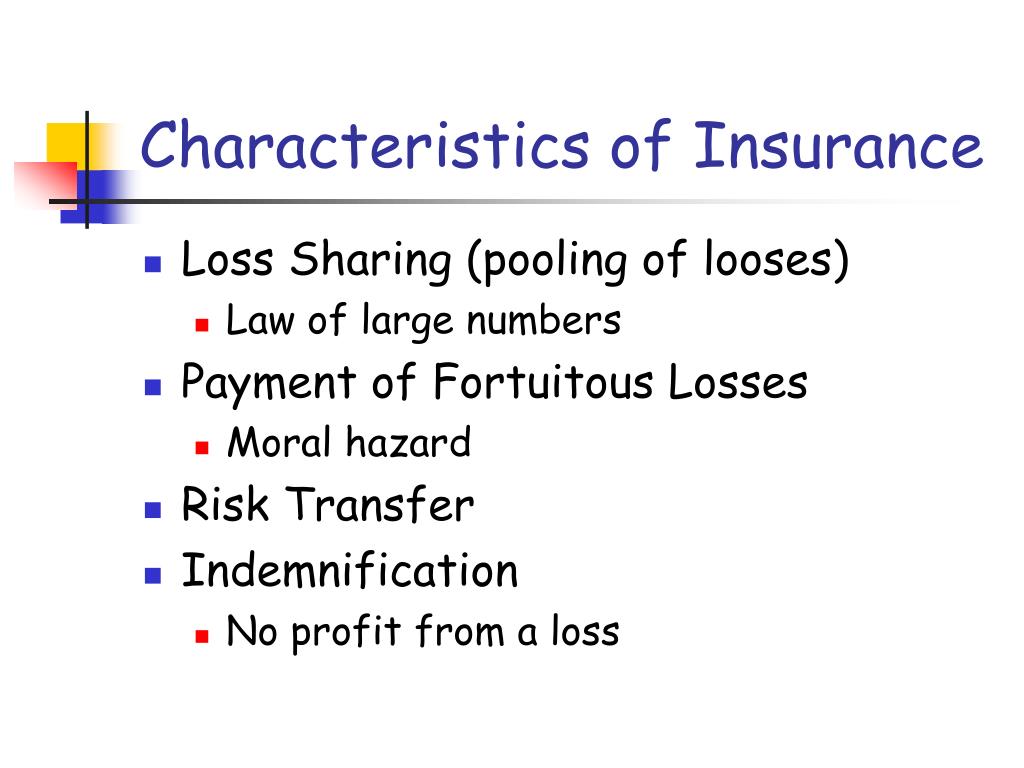

Characteristics Of Insurance Risk. Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. Basically there are seven characteristics of insurable risks as follows: The emotional and psychological loss can never be compensated, but at least the financial loss can be compensated with insurance. Pooling of losses payment of fortuitous losses risk transfer indemnification pooling.

Risk Management and Insurance From slideshare.net

Risk Management and Insurance From slideshare.net

For pure risks to be insurable, it should possess the following characteristics. The characteristics of insurable risk are as follows: Insurance is a device to share the financial losses which might befall on an individual or his family on the happening of a specified event. Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. With these principles in mind, what makes a risk insurable? The consequences (loss) must be assessable, definite or can be measured in terms of time or money/financially measurable.

Against this suffering insurance is a cover.

From the above explanation, we can find the following characteristics, which are generally observed in life, marine, fire, and general insurances. Here’s a look at some of the key characteristics that define an insurable risk: The risk is that we can not avoid in life, manage risks in order to reduce or transfer risk to others are things you can do. Download the ios download the android app there are 6 ideal characteristics of an insurable risk: University of ghana • finc 457. The characteristics of insurable risk are as follows:

Source: slideserve.com

Source: slideserve.com

Insurance is a means of protection from any unforeseen losses and contingencies. Basically there are seven characteristics of insurable risks as follows: Pooling of losses payment of fortuitous losses risk transfer indemnification pooling. Insurable risk is a risk that conforms to the insurance policy specifications in such a way that the criterion for insurance is fulfilled. L2_elements of risk and insurance.pdf.

Source: slideserve.com

Source: slideserve.com

We have stated previously that individuals see the purchase of insurance as economically advantageous. Planning for unknown events and market conditions that unfold before you as an entrepreneur is the purpose of risk management. The characteristics of insurance is discussed under the following heads: Defining insurable risks for businesses. Characteristics of an ideally insurable risk private insurers generally insure only pure risks.

Source: slideshare.net

Source: slideshare.net

5 crucial characteristics of risk management. Banking is intermediation for funds. In order for a risk to be insurable, it must have these key characteristics. Chapter 2 insurance and risk. Characteristics of an insurance risk.

Source: slideserve.com

Source: slideserve.com

In regards to insurance, it is important to understand that not everything is insurable. Evidently it is risk that leads to some profits. It is not possible to insure against an event which will definitely occur. The characteristics of insurable risk are as follows: Download the ios download the android app there are 6 ideal characteristics of an insurable risk:

Source: 1investing.in

Source: 1investing.in

The characteristics of insurable risk are as follows: The most important feature of insurance is that it is legal contract between the insurer and insured, under this insurer promises to compensate the insured for the loss which is mentioned in the policy and the insured promise to pay a fixed rate of premium which is. Insurance is also defined as a social device to accumulate funds to meet the uncertain losses arising through a certain risk to a person insured against the risk. With these principles in mind, what makes a risk insurable? But not all individual and commercial risks can be insured and given protection.

Source: slideshare.net

Source: slideshare.net

Banking is intermediation for funds. University of ghana • finc 457. But the insurance agrees to pay the compensation if the specified loss or damage results and the insured suffers. Risk of loss here may be avoided, or at least mitigated, with proper “controls” in place. How do insurers make the distinction when deciding which risks they are willing to assume and which they would rather avoid?

Source: present5.com

Source: present5.com

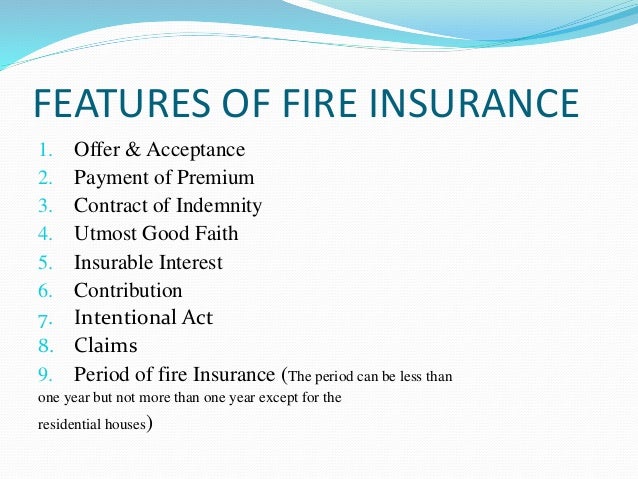

The insurance has the following characteristics which are, generally, observed in case of life, marine, fire and general insurances. A risk must have certain elements in it that make it insurable. In regards to insurance, it is important to understand that not everything is insurable. But not all individual and commercial risks can be insured and given protection. L2_elements of risk and insurance.pdf.

Source: slideserve.com

Source: slideserve.com

The risk against which the insurance has been taken may either arise or may not arise. The risk against which the insurance has been taken may either arise or may not arise. Characteristics of an insurance risk. The most important feature of insurance is that it is legal contract between the insurer and insured, under this insurer promises to compensate the insured for the loss which is mentioned in the policy and the insured promise to pay a fixed rate of premium which is. But, not all risks can be insured risk in the insured has the following specific characteristics:

Source: slideserve.com

Source: slideserve.com

But not all individual and commercial risks can be insured and given protection. Insurable risk is a risk that conforms to the insurance policy specifications in such a way that the criterion for insurance is fulfilled. Basic characteristics of insurance based on the preceding definition, an insurance plan or arrangement typically includes the following characteristics: As said earlier there is a close relationship between risk and reward. The risk against which the insurance has been taken may either arise or may not arise.

Source: slideshare.net

Source: slideshare.net

In order for a risk to be insurable, it must have these key characteristics. Evidently it is risk that leads to some profits. Losses due to an accident, such as critical illness late stage, hit by natural disasters. As said earlier there is a close relationship between risk and reward. The characteristics of insurance is discussed under the following heads:

Source: slideshare.net

Source: slideshare.net

Insurance that covers individuals that are not specifically named in an auto insurance policy. L2_elements of risk and insurance.pdf. Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. However, some pure risks are not privately insurable. The characteristics of insurance is discussed under the following heads:

Source: slideshare.net

Source: slideshare.net

Insurance is also defined as a social device to accumulate funds to meet the uncertain losses arising through a certain risk to a person insured against the risk. The most important feature of insurance is that it is legal contract between the insurer and insured, under this insurer promises to compensate the insured for the loss which is mentioned in the policy and the insured promise to pay a fixed rate of premium which is. Defining insurable risks for businesses. The risk is that we can not avoid in life, manage risks in order to reduce or transfer risk to others are things you can do. Life insurance provides financial benefits in the event a covered individual passes away.

Source: revisi.net

Source: revisi.net

In order to make profits and earn a spread banker takes a position in the investment market or in loan business. The beneficiaries of the policy are generally third parties rather than the insured or the insureds estate. How do insurers make the distinction when deciding which risks they are willing to assume and which they would rather avoid? Against this suffering insurance is a cover. The emotional and psychological loss can never be compensated, but at least the financial loss can be compensated with insurance.

Source: slideshare.net

Source: slideshare.net

Characteristics of an ideally insurable risk private insurers generally insure only pure risks. A risk must have certain elements in it that make it insurable. Life insurance provides financial benefits in the event a covered individual passes away. The most important feature of insurance is that it is legal contract between the insurer and insured, under this insurer promises to compensate the insured for the loss which is mentioned in the policy and the insured promise to pay a fixed rate of premium which is. Against this suffering insurance is a cover.

Source: slideserve.com

Source: slideserve.com

It is not possible to insure against an event which will definitely occur. Basically there are seven characteristics of insurable risks as follows: We have stated previously that individuals see the purchase of insurance as economically advantageous. Evidently it is risk that leads to some profits. Insurance is a device to share the financial losses which might befall on an individual or his family on the happening of a specified event.

Source: magne-ta.blogspot.com

Source: magne-ta.blogspot.com

The occurrence of the event must be entirely fortuitous as far as the insured is concerned (the ‘insured’ is the person, company or organisation insured by an insurance company). Insurance is a contractual agreement between two parties in which one party promise to protect another party from uncertainties and losses. The most important feature of insurance is that it is legal contract between the insurer and insured, under this insurer promises to compensate the insured for the loss which is mentioned in the policy and the insured promise to pay a fixed rate of premium which is. How do insurers make the distinction when deciding which risks they are willing to assume and which they would rather avoid? But not all individual and commercial risks can be insured and given protection.

Source: slideserve.com

Source: slideserve.com

The characteristics of insurance is discussed under the following heads: In order for a risk to be insurable, it must have these key characteristics. Planning for unknown events and market conditions that unfold before you as an entrepreneur is the purpose of risk management. Class 2 insurance, also written as class ii insurance, provides a narrower range. The characteristics of insurance is discussed under the following heads:

Source: iedunote.com

Source: iedunote.com

Basic characteristics of insurance based on the preceding definition, an insurance plan or arrangement typically includes the following characteristics: Evidently it is risk that leads to some profits. Pooling of losses payment of fortuitous losses risk transfer indemnification pooling. Basic characteristics of insurance based on the preceding definition, an insurance plan or arrangement typically includes the following characteristics: L2_elements of risk and insurance.pdf.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title characteristics of insurance risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information