Characteristics of insurance wikipedia information

Home » Trend » Characteristics of insurance wikipedia informationYour Characteristics of insurance wikipedia images are available in this site. Characteristics of insurance wikipedia are a topic that is being searched for and liked by netizens now. You can Find and Download the Characteristics of insurance wikipedia files here. Download all free photos.

If you’re looking for characteristics of insurance wikipedia images information linked to the characteristics of insurance wikipedia interest, you have visit the ideal blog. Our site frequently provides you with hints for viewing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

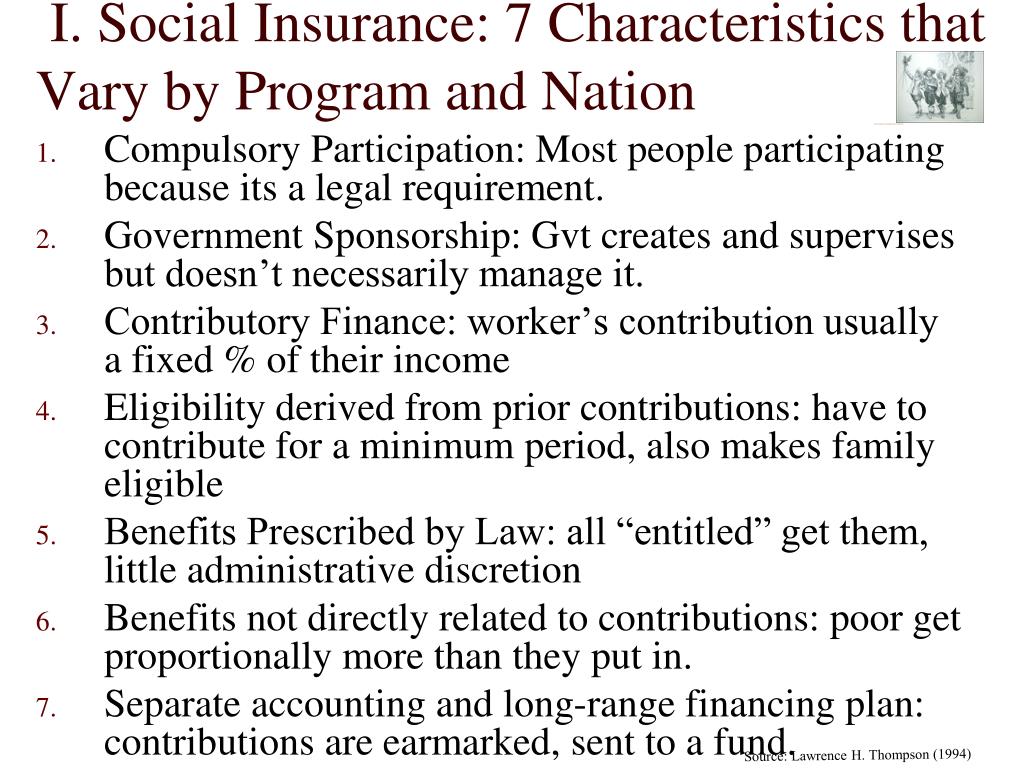

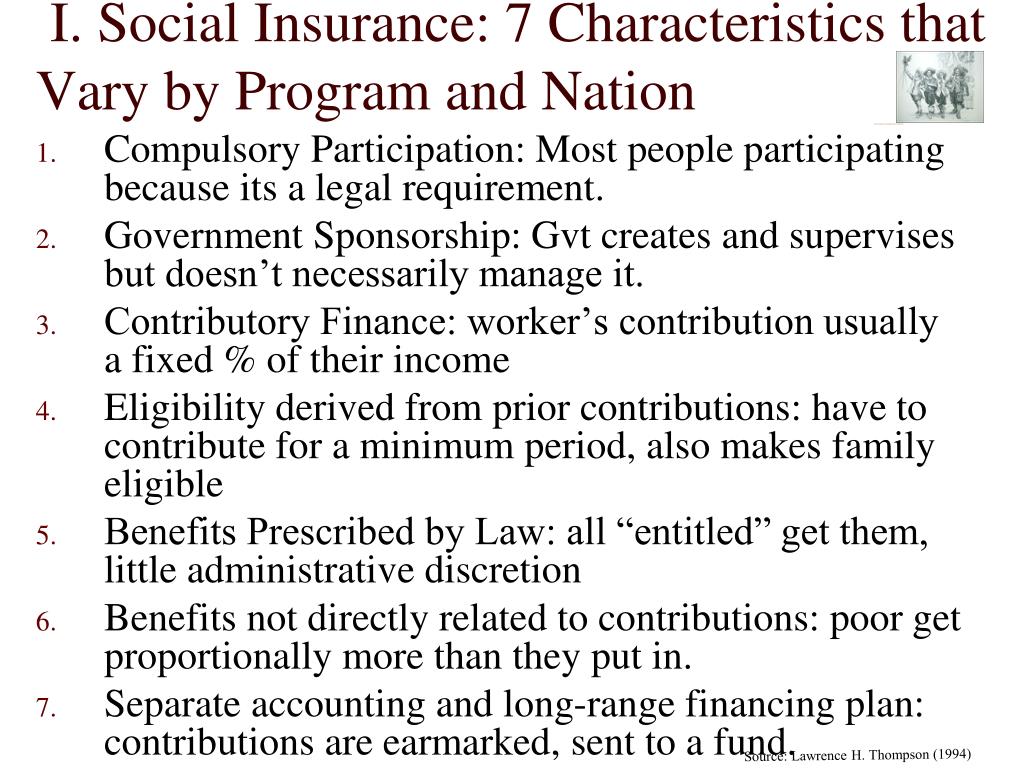

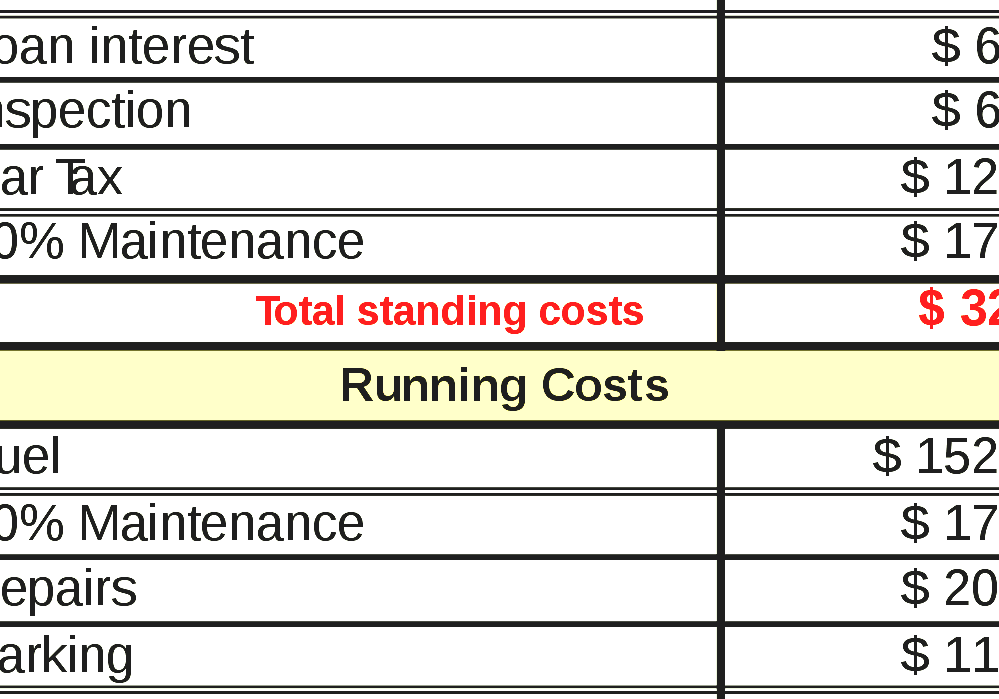

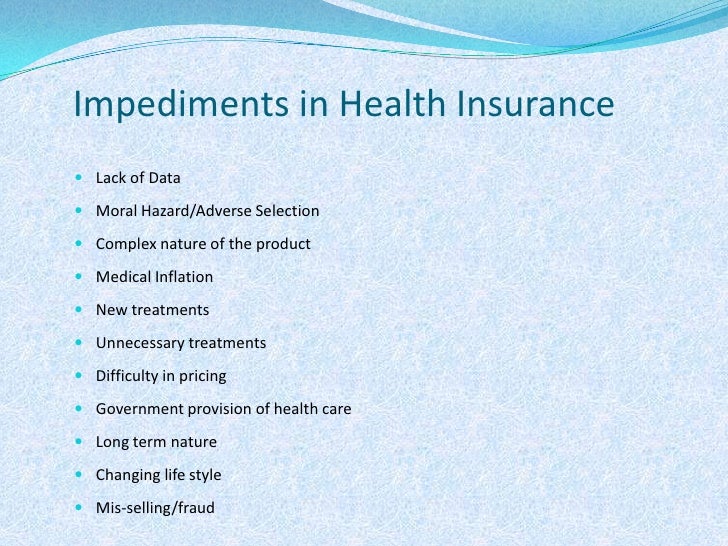

Characteristics Of Insurance Wikipedia. Cattle insurance policy is usually given for a period of 12 months or for a long term of 3 to 5 years as per term of loan. In most states, a person cannot purchase a policy on another person without their knowledge. Life insurance provides financial benefits in the event a covered individual passes away. Social insurance is a form of social welfare that provides insurance against economic risks.

PPT Approaches to Welfare PowerPoint Presentation, free From slideserve.com

PPT Approaches to Welfare PowerPoint Presentation, free From slideserve.com

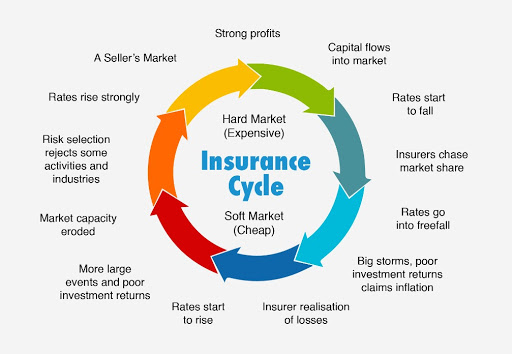

Jump to navigation jump to search. For technical reasons, life #9 redirects here. The loss should not be catastrophic. Primary functions of insurance 1. Social insurance is a form of social welfare that provides insurance against economic risks. By providing insurance coverage to employees, they increase their sense of loyalty, resulting in enhanced productivity.

The loss should not be catastrophic.

A person who is aging may require blood tests for diabetes, cholesterol or blood pressure checks. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. The rate at which patents have been issued has steadily risen from 15 in 2002 to 44 in 2006. The beneficiaries of the policy are generally third parties rather than the insured or the insureds estate. The chance of loss must be calculable. These services are designed and provided to the customers by financial institutions as per their needs.

Source: made2orderonline.com

Source: made2orderonline.com

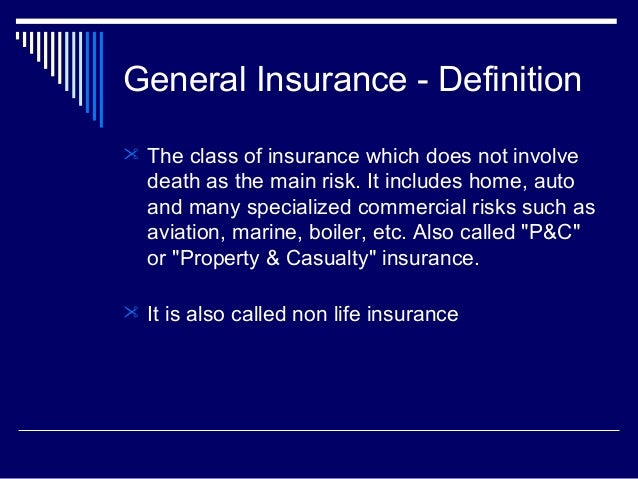

Insurance is a term in law and economics. The loss must be determinable and measurable. Association or labor organization) to its workers or members. It is something people buy to protect themselves from losing money. The insurance may be provided publicly or through the subsidizing of private insurance.

Source: slideshare.net

Source: slideshare.net

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. The chance of loss must be calculable. The loss must be determinable and measurable. The loss must be accidental and unintentional. The revised directive aims to improve regulation in the insurance market, to ensure a level playing field between all participants involved in the distribution of insurance products, and to strengthen policyholder protection.

Source: slideshare.net

Source: slideshare.net

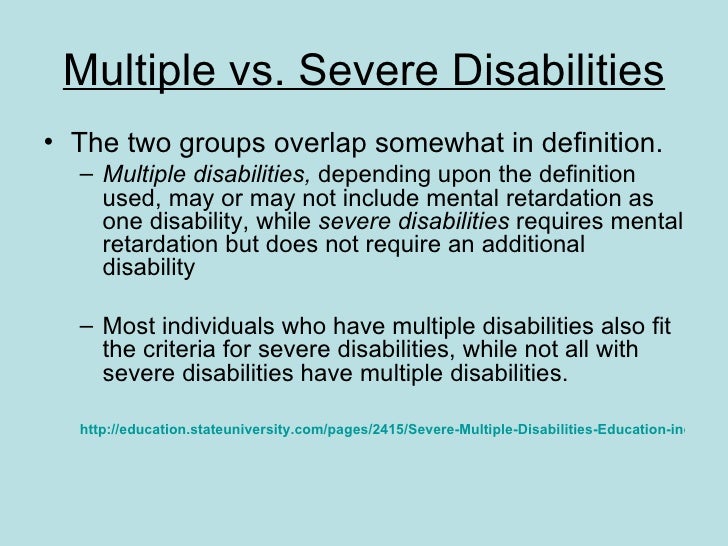

The important principle of insurance are as follows: From wikipedia, the free encyclopedia. There are ideally six characteristics of an insurable risk: Social insurance is a form of social welfare that provides insurance against economic risks. Here, we’ve summarised 10 key features of the idd to help you prepare for this huge change:

Source: slideserve.com

Source: slideserve.com

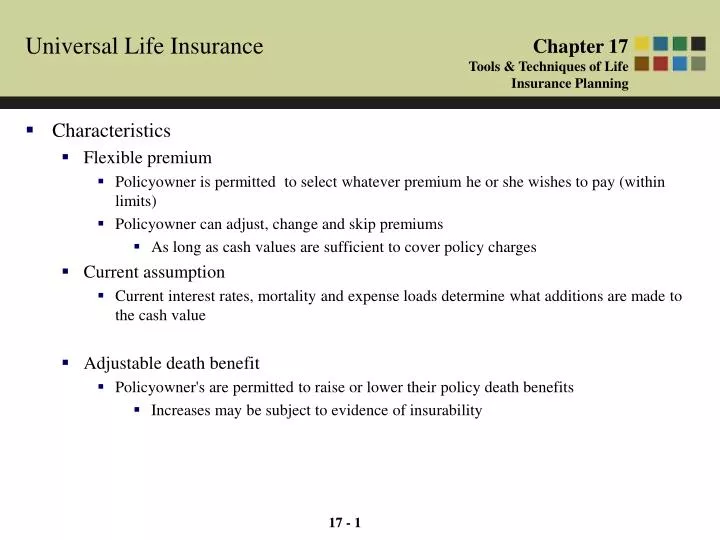

group life insurance is typically offered as a piece of a larger employer or membership benefit package. Life insurance provides financial benefits in the event a covered individual passes away. group life insurance is typically offered as a piece of a larger employer or membership benefit package. Are all covered under health insurance plans the premiums paid are allowed as a deduction. By providing insurance coverage to employees, they increase their sense of loyalty, resulting in enhanced productivity.

Source: slideserve.com

Source: slideserve.com

Auto insurance usually has several components. The insurance cover will be provided to a group of people under a single master life insurance policy. In contrast to other forms of social assistance, individuals� claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the. Characteristic that distinguishes physical entities having biological processes. Insurance premium increases with age an insurance company will often evaluate and review the profiles of patients which cost them more money.

Source: brocorights.blogspot.com

Source: brocorights.blogspot.com

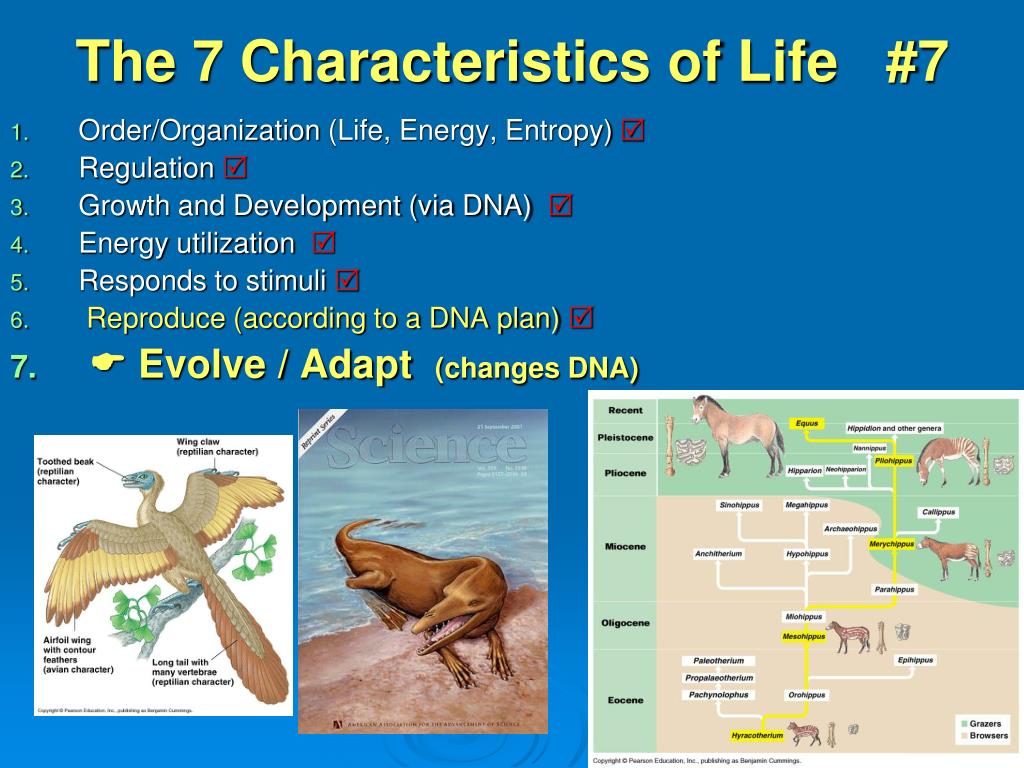

Insurance is the most effective risk management tool which can protect individuals and businesses from financial risks arising out of various contingencies. In a cattle insurance, the word cattle refers to cows & buffaloes, stud bulls, bullocks, he buffaloes, calves & heifers. For life in the personal sense, see personal life and everyday life. For other uses, see life (disambiguation). A person who is aging may require blood tests for diabetes, cholesterol or blood pressure checks.

Source: doctoraamill.blogspot.com

Source: doctoraamill.blogspot.com

Liability insurance provides coverage to. Here, we’ve summarised 10 key features of the idd to help you prepare for this huge change: In most states, a person cannot purchase a policy on another person without their knowledge. Employers are bound to provide an insurance plan to their employees and therefore often offer group insurance cover. Liability insurance provides coverage to.

Source: honeywelltruesteamhm509.blogspot.com

Source: honeywelltruesteamhm509.blogspot.com

Insurance provides certainty insurance provides certainty of payment at the uncertainty of loss. The beneficiaries of the policy are generally third parties rather than the insured or the insureds estate. The insurance may be provided publicly or through the subsidizing of private insurance. Insurance provides certainty insurance provides certainty of payment at the uncertainty of loss. Various elements like cost, liquidity and maturity periods of these services are decided in accordance with the suitability of customers.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

The loss should not be catastrophic. In most states, a person cannot purchase a policy on another person without their knowledge. They will pinpoint on those who require frequent medical care. Special features of cattle insurance. Once the insurer offers a health insurance plan, they are required to keep on renewing it until the policyholder’s lifetime.

Source: socialmeediaaa.blogspot.com

Source: socialmeediaaa.blogspot.com

In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. In case of hospitalisation, the total cost incurred is the sum of various factors such as room rent, surgery fees, cost of medicines, cost of equipments. Here, we’ve summarised 10 key features of the idd to help you prepare for this huge change: Not all coverages are purchased by every applicant, but the basic coverages are as follows: The emotional and psychological loss can never be compensated, but at least.

Source: insurancegully.blogspot.com

Source: insurancegully.blogspot.com

Nature of contract is a fundamental principle of insurance contract. For life in the personal sense, see personal life and everyday life. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium. In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. A person who is aging may require blood tests for diabetes, cholesterol or blood pressure checks.

Source: socialmeediaaa.blogspot.com

Source: socialmeediaaa.blogspot.com

Insurance is a term in law and economics. Association or labor organization) to its workers or members. By providing insurance coverage to employees, they increase their sense of loyalty, resulting in enhanced productivity. Insurance is a term in law and economics. In contrast to other forms of social assistance, individuals� claims are partly dependent on their contributions, which can be considered insurance premiums to create a common fund out of which the.

Source: slideshare.net

Source: slideshare.net

Primary functions of insurance 1. Characteristic that distinguishes physical entities having biological processes. In a cattle insurance, the word cattle refers to cows & buffaloes, stud bulls, bullocks, he buffaloes, calves & heifers. Liability insurance provides coverage to. Here, we’ve summarised 10 key features of the idd to help you prepare for this huge change:

Source: slideshare.net

Source: slideshare.net

The following are common categories of life insurance: There are ideally six characteristics of an insurable risk: In most states, a person cannot purchase a policy on another person without their knowledge. The loss must be determinable and measurable. A person who is aging may require blood tests for diabetes, cholesterol or blood pressure checks.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

In a cattle insurance, the word cattle refers to cows & buffaloes, stud bulls, bullocks, he buffaloes, calves & heifers. Characteristic that distinguishes physical entities having biological processes. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium. A recent example of a new insurance product that is patented. From wikipedia, the free encyclopedia.

Source: slideserve.com

Source: slideserve.com

group life insurance is typically offered as a piece of a larger employer or membership benefit package. Insurance is a term in law and economics. The beneficiaries of the policy are generally third parties rather than the insured or the insureds estate. Insurance is defined as the equitable transfer of risk of loss from one entity to another, in exchange for a premium. The loss must be determinable and measurable.

Source: hamiltonleigh.com

Source: hamiltonleigh.com

By providing insurance coverage to employees, they increase their sense of loyalty, resulting in enhanced productivity. Once the insurer offers a health insurance plan, they are required to keep on renewing it until the policyholder’s lifetime. The insurance may be provided publicly or through the subsidizing of private insurance. The rate at which patents have been issued has steadily risen from 15 in 2002 to 44 in 2006. Life insurance provides financial benefits in the event a covered individual passes away.

Source: thismybrightside.blogspot.com

Special features of cattle insurance. Are all covered under health insurance plans the premiums paid are allowed as a deduction. Not all coverages are purchased by every applicant, but the basic coverages are as follows: group life insurance is typically offered as a piece of a larger employer or membership benefit package. Employers are bound to provide an insurance plan to their employees and therefore often offer group insurance cover.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title characteristics of insurance wikipedia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information