Characteristics of non insurable risk Idea

Home » Trending » Characteristics of non insurable risk IdeaYour Characteristics of non insurable risk images are ready in this website. Characteristics of non insurable risk are a topic that is being searched for and liked by netizens now. You can Download the Characteristics of non insurable risk files here. Get all free photos and vectors.

If you’re looking for characteristics of non insurable risk images information connected with to the characteristics of non insurable risk topic, you have pay a visit to the ideal site. Our website always provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

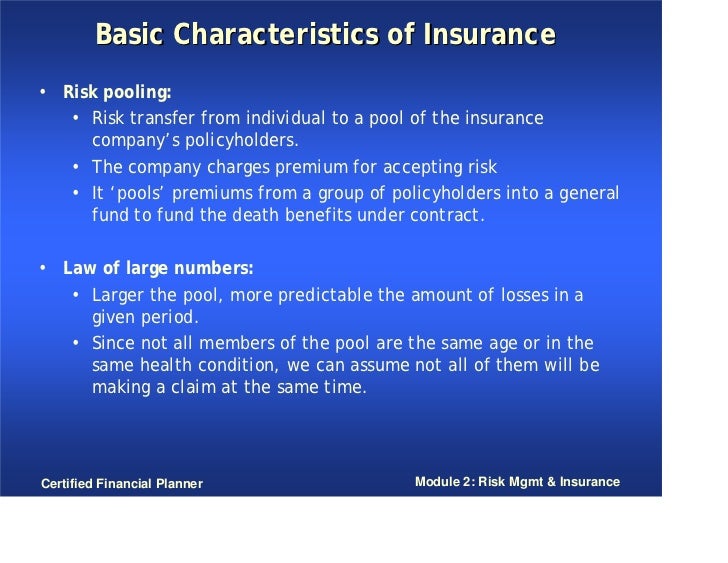

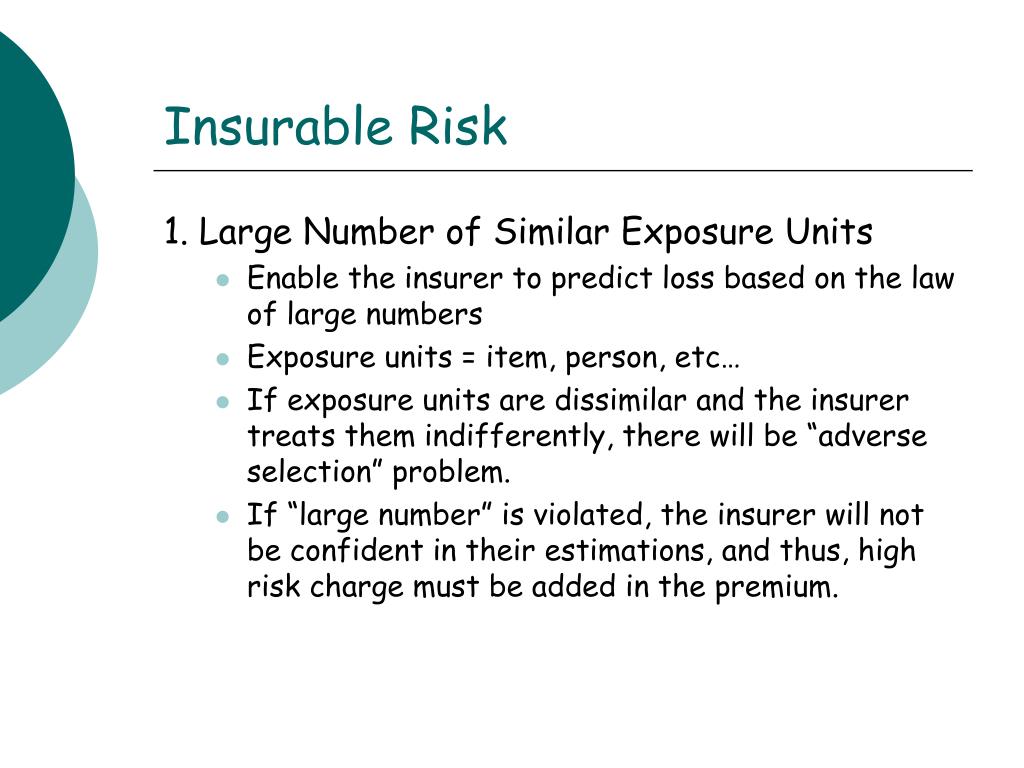

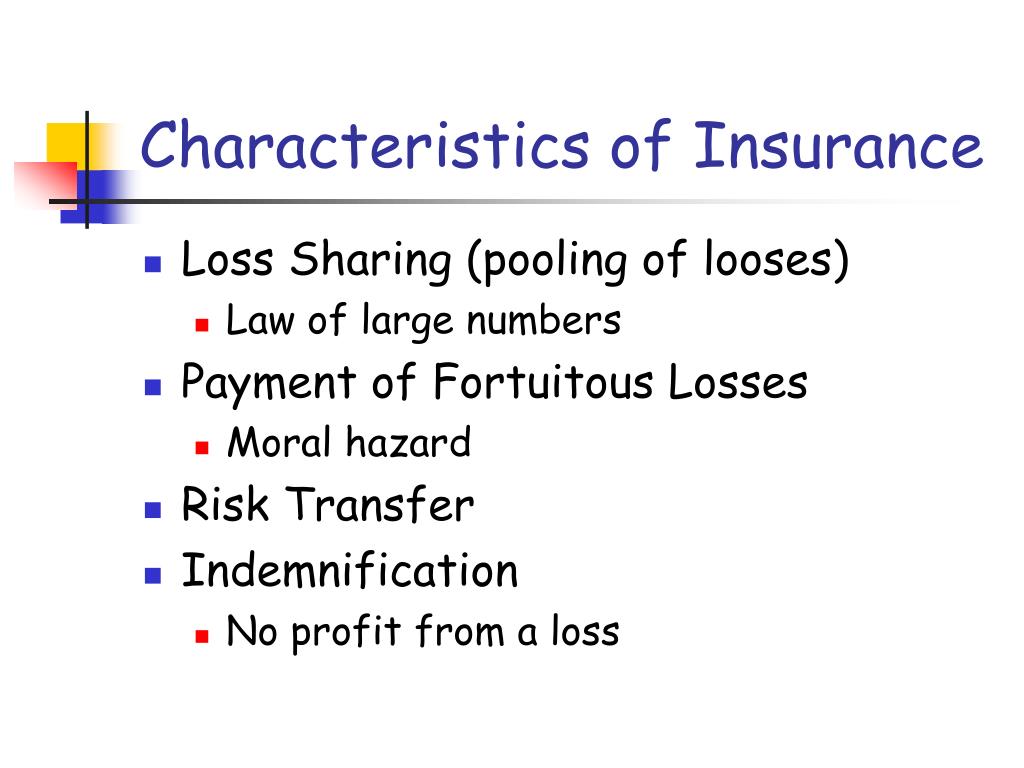

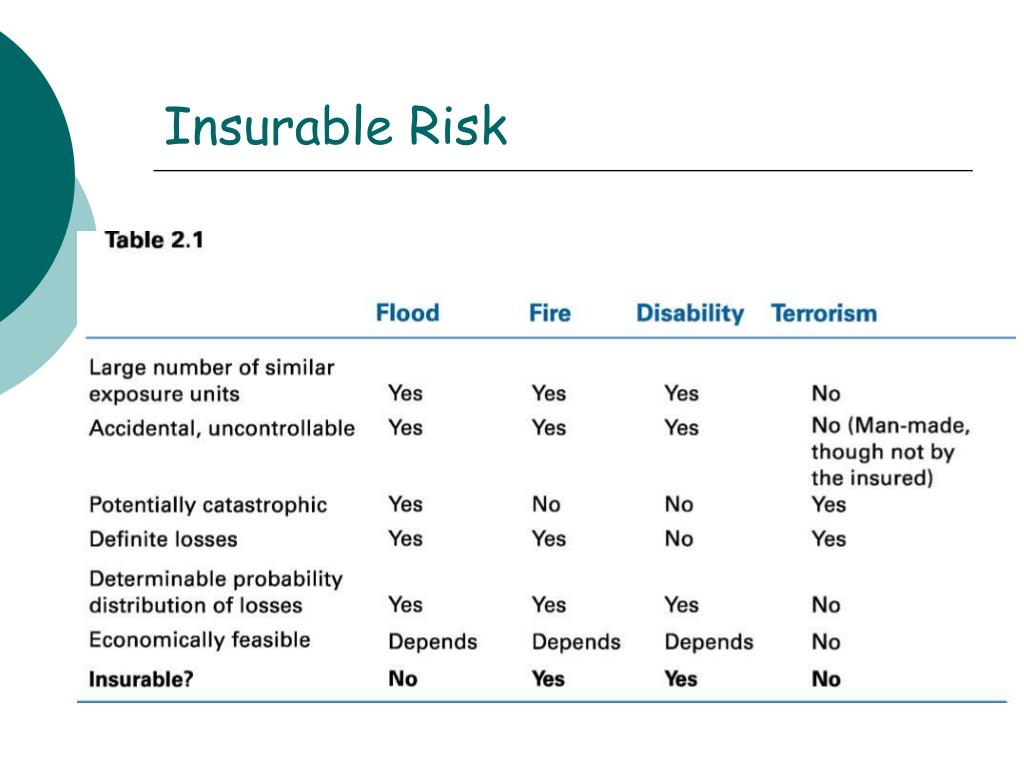

Characteristics Of Non Insurable Risk. The theory of insurance is based on the law of large numbers. It holds the prospect of gain as well as loss. Therefore the prime necessity for a risk to be insurable is that there must be a sufficiently large number of homogeneous exposures to combine reasonably predictable losses. There are ideally six characteristics of an insurable risk:

PPT Risk Management in the S.A. Public Sector PowerPoint From slideserve.com

PPT Risk Management in the S.A. Public Sector PowerPoint From slideserve.com

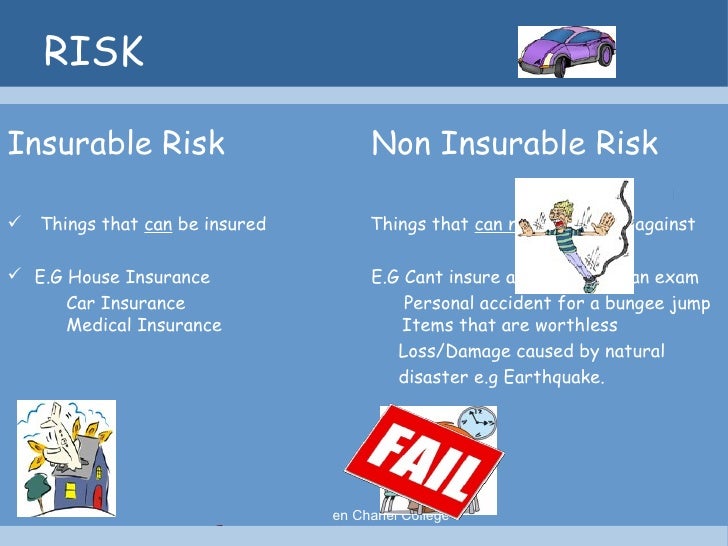

Due to chance, measurable and definite, predictability, noncatastrophic, random selection, and large loss exposure. When you buy commercial insurance, you pay premiums to your insurance company. The risk cannot be forecast and measured. The businessmen cannot get compensation for a change in demand or loss due to negligence or carelessness of employees. The prime need for a risk to be insurable is that there must be a sufficiently large number of homogeneous/similar exposures units (law of the large numbers). It is impossible to predict and measure the risk.

Example1 it will be hard to predict if the demand for a particular commodity will drop.

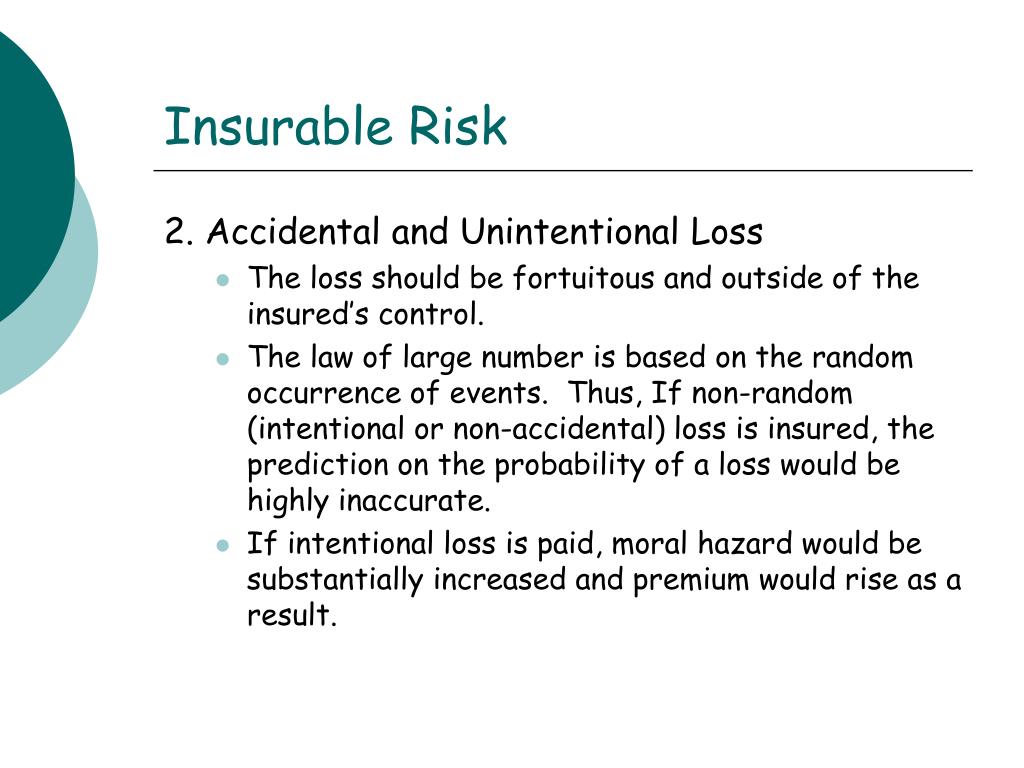

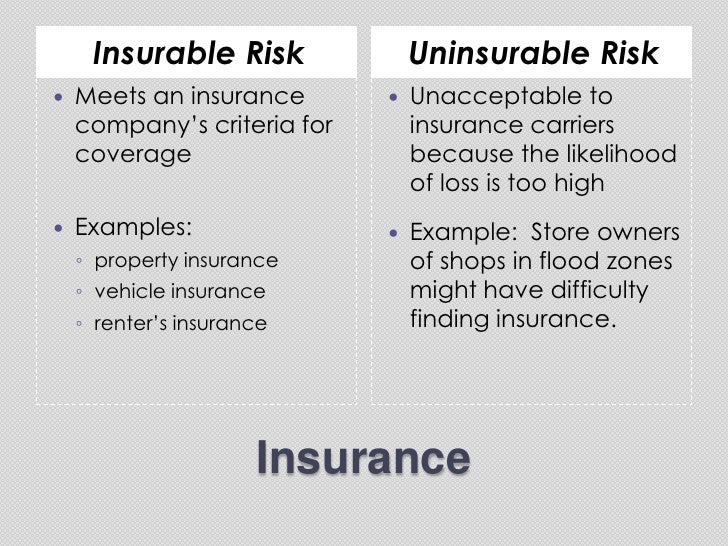

There must be a large number of exposure units. A prime example of a loss that isn’t insurable is flooding as flooding has become expected depending on the area you live in. The loss should not be catastrophic. These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss. In order for a risk to be insurable, losses must be random and unexpected. This means that the losses are unforeseeable, reasonably unpreventable and are overall completely random in nature.

Source: slideshare.net

Source: slideshare.net

The chance of loss must be calculable. These include a wide range of losses, including those from fire, theft, or lawsuits. When you buy commercial insurance, you pay premiums to your insurance company. There must be a large number of exposure units. An example for hoas is sinkholes.

Source: iedunote.com

Source: iedunote.com

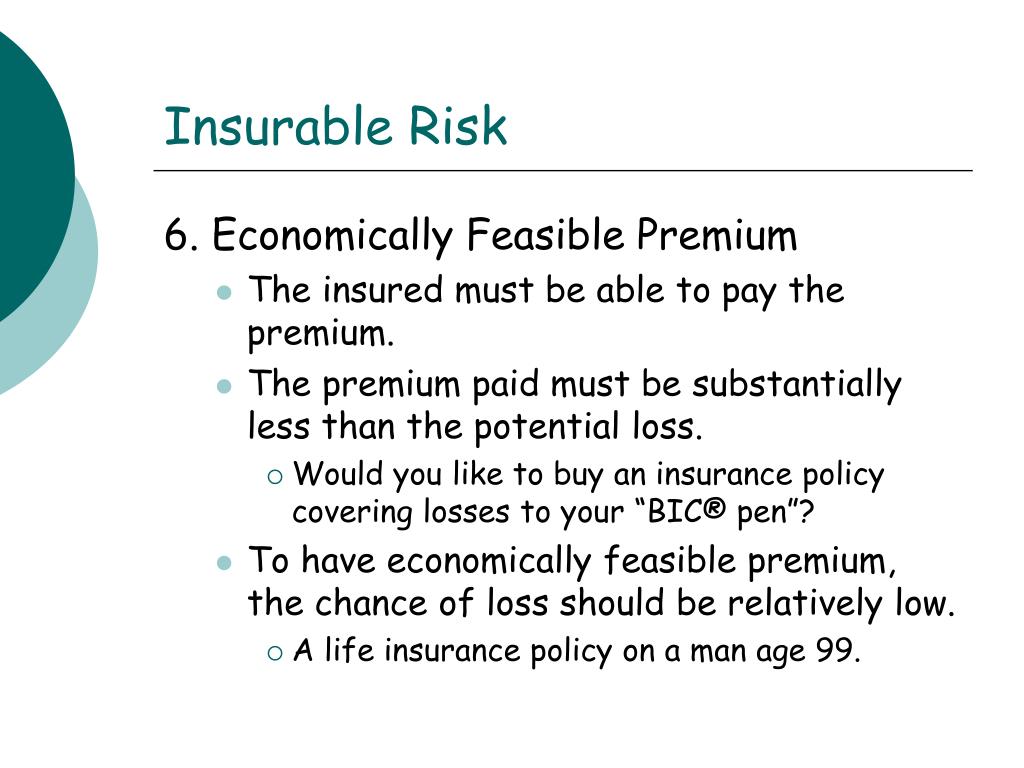

Therefore the prime necessity for a risk to be insurable is that there must be a sufficiently large number of homogeneous exposures to combine reasonably predictable losses. There are ideally six characteristics of an insurable risk: The premium must be economically feasible. In return, the company agrees to pay you in the event you suffer a covered loss. Therefore the prime necessity for a risk to be insurable is that there must be a sufficiently large number of homogeneous exposures to combine reasonably predictable losses.

Source: revisi.net

Source: revisi.net

Insurable types of risk there are generally 3 types of risk that can be covered by insurance: The loss must be determinable and measurable. It holds the prospect of gain as well as loss. These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss. The risk cannot be forecast and measured.

Source: slideshare.net

Source: slideshare.net

Therefore the prime necessity for a risk to be insurable is that there must be a sufficiently large number of homogeneous exposures to combine reasonably predictable losses. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. It can be both a source of loss and gain. There must be a large number of exposure units. The loss must be accidental and unintentional.

Source: slideserve.com

Source: slideserve.com

A principle of insurance holds that only a small portion of a given group will experience loss at any one time. Risk of loss here may be avoided, or at least mitigated, with proper “controls” in place. One of the criteria for an insurable risk is that it not be catastrophic. The loss must be determinable and measurable. The businessmen cannot get compensation for a change in demand or loss due to negligence or carelessness of employees.

Source: slideserve.com

Source: slideserve.com

What is an insurable risk? The risk cannot be forecast and measured. The chance of loss must be calculable. The loss must be accidental and unintentional. Due to chance, measurable and definite, predictability, noncatastrophic, random selection, and large loss exposure.

Source: revisi.net

Source: revisi.net

It is impossible to predict and measure the risk. The premium must be economically feasible. In return, the company agrees to pay you in the event you suffer a covered loss. The chance of loss must be calculable. This means that the losses are unforeseeable, reasonably unpreventable and are overall completely random in nature.

Source: ezraberdeen.blogspot.com

Source: ezraberdeen.blogspot.com

Thus, a potential loss cannot be calculated so a premium cannot be established. Insurable types of risk there are generally 3 types of risk that can be covered by insurance: Thought is a fundamental component for the arrangement of an agreement. The loss must be determinable and measurable. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: slideserve.com

Source: slideserve.com

The theory of insurance is based on the law of large numbers. Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. Characteristics of non insurable risk. The risk cannot be forecast and measured. Large numbers of exposure units.

Source: slideserve.com

Source: slideserve.com

This means that the losses are unforeseeable, reasonably unpreventable and are overall completely random in nature. It is caused by some unfavourable or undesirable event. Non insurable risk insurance farmland insurable and non from dcnewsupdate.blogspot.com There are ideally six characteristics of an insurable risk: Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness.

Source: slideserve.com

Source: slideserve.com

The risk cannot be forecast and measured. It is caused by some unfavourable or undesirable event. The prime need for a risk to be insurable is that there must be a sufficiently large number of homogeneous/similar exposures units (law of the large numbers). Due to chance, measurable and definite, predictability, noncatastrophic, random selection, and large loss exposure. Example1 it will be hard to predict if the demand for a particular commodity will drop.

Source: brainly.in

Source: brainly.in

Thought is a fundamental component for the arrangement of an agreement. It holds the prospect of gain as well as loss. The loss must be accidental and unintentional. The loss must be accidental and unintentional. These are typically risks that are commercially uninsurable, illegal for the insurance company to insure, or hold the potential for catastrophic loss.

Source: dcnewsupdate.blogspot.com

Source: dcnewsupdate.blogspot.com

Personal risk is any risk that can affect the health or safety of an individual, such as being injured by an accident or suffering from an illness. It is caused by some unfavourable or undesirable event. The loss must be accidental and unintentional. Personal risk, property risk, and liability risk. There are ideally six characteristics of an insurable risk:

Source: ezraberdeen.blogspot.com

Source: ezraberdeen.blogspot.com

The prime need for a risk to be insurable is that there must be a sufficiently large number of homogeneous/similar exposures units (law of the large numbers). Acceptance characteristics of non insurable risk insurability of any risk for a risk that meets the ideal criteria for efficient insurance same peril similar. The risks are related with certain factors like changes in consumer tastes and fashions, changes in methods of production, strike or lockout in the work place, increased competition in the market, fire, theft accidents, natural. One of the criteria for an insurable risk is that it not be catastrophic. The consequences (loss) must be assessable, definite or can be measured in terms of time or money/financially measurable.

Source: slideserve.com

Source: slideserve.com

The prime need for a risk to be insurable is that there must be a sufficiently large number of homogeneous/similar exposures units (law of the large numbers). Personal risk, property risk, and liability risk. An example for hoas is sinkholes. Acceptance characteristics of non insurable risk insurability of any risk for a risk that meets the ideal criteria for efficient insurance same peril similar. There must be a large number of exposure units.

Source: slideserve.com

Source: slideserve.com

The loss must be accidental and unintentional. It is caused by some unfavourable or undesirable event. The loss must be accidental and unintentional. Due to chance, measurable and definite, predictability, noncatastrophic, random selection, and large loss exposure. These include a wide range of losses, including those from fire, theft, or lawsuits.

Source: slideserve.com

Source: slideserve.com

Insurable risks are risks that insurance companies will cover. One of the criteria for an insurable risk is that it not be catastrophic. When you buy commercial insurance, you pay premiums to your insurance company. Due to chance, measurable and definite, predictability, noncatastrophic, random selection, and large loss exposure. Thus, a potential loss cannot be calculated so a premium cannot be established.

Source: slideshare.net

Source: slideshare.net

For example, deterioration of property caused by wear and tear (because a decision was made to not maintain the property in question) or income loss due to market changes are typically not insurable. A principle of insurance holds that only a small portion of a given group will experience loss at any one time. It is impossible to predict and measure the risk. The chance of loss must be calculable. The loss must be accidental and unintentional.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title characteristics of non insurable risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea