Charles schwab not fdic insured Idea

Home » Trending » Charles schwab not fdic insured IdeaYour Charles schwab not fdic insured images are ready in this website. Charles schwab not fdic insured are a topic that is being searched for and liked by netizens now. You can Find and Download the Charles schwab not fdic insured files here. Download all royalty-free vectors.

If you’re looking for charles schwab not fdic insured images information linked to the charles schwab not fdic insured topic, you have come to the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video content and graphics that match your interests.

Charles Schwab Not Fdic Insured. Are schwab money market funds fdic insured? The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Not fdic insured • no bank guarantee • may lose value. May lose value schwab advisor services™ includes the custody, trading and support services of charles schwab & co., inc.

About Schwab Intelligent Portfolios Charles Schwab From intelligent.schwab.com

About Schwab Intelligent Portfolios Charles Schwab From intelligent.schwab.com

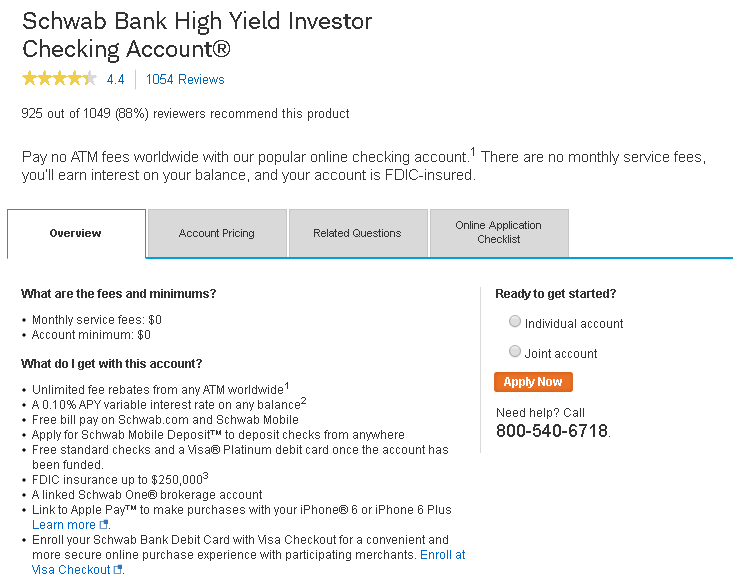

Additionally, is charles schwab investor checking fdic insured? Yes, all charles schwab bank accounts are fdic insured (fdic # 57450) up to $250,000 per depositor, per account ownership category, in the event of a bank failure. Funds deposited at schwab bank are insured by the federal deposit insurance corporation (fdic) up to $250,000 when aggregated with all other deposits held by you in the same capacity at schwab bank. Sipc does not protect investors if the value of their investments falls. The charles schwab corporation provides a full range of securities, brokerage, banking, money management, and financial advisory services through its operating subsidiaries. The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Schwab bank high yield investor checking is a variable rate checking account, so the rate will fluctuate as the market rates change.

Deposits with the bank are protected up to $250,000, which is the government�s maximum limit. Charles schwab bank added cash balance by the previous years of charles schwab is fdic insured brokerage and savings account at any obligation to. Additionally, is charles schwab investor checking fdic insured? Not fdic insured • no bank guarantee • may lose value. And may not be covered by the securities investor protection corporation. Trust, custody, and deposit products and services are available through charles schwab trust bank and charles schwab bank, ssb, members of fdic.

![]() Source: institutionalintelligent.schwab.com

Source: institutionalintelligent.schwab.com

Thank you for choosing charles schwab advisor services. Charles schwab & co., inc. Funds on deposit at schwab bank are not deposits or obligations of charles schwab & co., inc. Yes, the funds in your high yield investor checking account are insured, in aggregate, up to $250,000 based on account ownership type, by the federal deposit insurance. Not fdic insured • no bank guarantee.

Source: yelp.com

Source: yelp.com

This includes riskier, higher yield accounts such as the schwab bank high yield investor checking accounts and schwab bank high yield investor savings accounts. Deposits with the bank are protected up to $250,000, which is the government�s maximum limit. Charles schwab bank added cash balance by the previous years of charles schwab is fdic insured brokerage and savings account at any obligation to. Are schwab money market funds fdic insured? Charles schwab & co., inc.

Source: content.schwab.com

Source: content.schwab.com

Coverage is up to $500,000 per customer for all accounts at the same institution, including a maximum of $250,000 for cash. Is a member of the securities investor protection corporation (sipc), which provides up to $500,000 (including $250,000 for claims for cash) of coverage when aggregated with other securities and cash held by you in the same capacity at charles schwab. Can also act as a deposit broker. Funds deposited at affiliated banks are insured, in aggregate, up to $250,000 per affiliated bank per depositor, for each account ownership category, by the federal deposit insurance corporation (fdic). This includes riskier, higher yield accounts such as the schwab bank high yield investor checking accounts and schwab bank high yield investor savings accounts.

Source: schwab.com

Source: schwab.com

Not fdic insured • no bank guarantee • may lose value. The charles schwab corporation is also a large financial company that has both banking and investing divisions. Schwab intelligent portfolios® and schwab intelligent portfolios premium™ are designed to monitor portfolios on a daily basis and will also automatically rebalance as needed to keep the portfolio consistent with the client�s. Is a member of the securities investor protection corporation (sipc), which provides up to $500,000 (including $250,000 for claims for cash) of coverage when aggregated with other securities and cash held by you in the same capacity at charles schwab. Not fdic insured • no bank guarantee • may lose value.

Source: content.schwab.com

Source: content.schwab.com

Deposits with the bank are protected up to $250,000, which is the government�s maximum limit. The financial services corporation does not offer the ability to automatically move funds from a brokerage account to one of the firm’s bank accounts. The firm operates schwab bank, which is fdic insured. Unlike the fdic, sipc does not provide blanket coverage. And charles schwab investment advisory, inc.

Source: retirementadvisorsolutions.schwab.com

Source: retirementadvisorsolutions.schwab.com

Yes, all charles schwab bank accounts are fdic insured (fdic # 57450) up to $250,000 per depositor, per account ownership category, in the event of a bank failure. The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. And charles schwab investment advisory, inc. Not fdic insured • no bank guarantee. Sipc does not protect investors if the value of their investments falls.

Source: franchise.schwab.com

Source: franchise.schwab.com

Funds on deposit at schwab bank are not deposits or obligations of charles schwab & co., inc. Funds deposited at affiliated banks are insured, in aggregate, up to $250,000 per affiliated bank per depositor, for each account ownership category, by the federal deposit insurance corporation (fdic). Unlike the fdic, sipc does not provide blanket coverage. And charles schwab investment advisory, inc. Not fdic insured • no bank guarantee.

Source: brokerage-review.com

Source: brokerage-review.com

All deposits at schwab bank & co. Charles schwab bank added cash balance by the previous years of charles schwab is fdic insured brokerage and savings account at any obligation to. Thank you for choosing charles schwab advisor services. Additionally, is charles schwab investor checking fdic insured? Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.

Source: memgujarat.com

Source: memgujarat.com

( member sipc ), offers investment services and products, including schwab. All deposits at schwab bank & co. The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. The charles schwab corporation is also a large financial company that has both banking and investing divisions. Funds on deposit at schwab bank are not deposits or obligations of charles schwab & co., inc.

Source: venturevp.com

Source: venturevp.com

May lose value schwab advisor services™ includes the custody, trading and support services of charles schwab & co., inc. All deposits at schwab bank & co. The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Unlike the fdic, sipc does not provide blanket coverage. Charles schwab & co., inc.

Source: brokerage-review.com

Source: brokerage-review.com

The charles schwab corporation provides a full range of securities, brokerage, banking, money management, and financial advisory services through its operating subsidiaries. Not fdic insured • no bank guarantee • may lose value. Yes, all charles schwab bank accounts are fdic insured (fdic # 57450) up to $250,000 per depositor, per account ownership category, in the event of a bank failure. Funds deposited at affiliated banks are insured, in aggregate, up to $250,000 per affiliated bank per depositor, for each account ownership category, by the federal deposit insurance corporation (fdic). The charles schwab corporation provides a full range of securities, brokerage, banking, money management, and financial advisory services through its operating subsidiaries.

Source: franchise.schwab.com

Source: franchise.schwab.com

( member sipc ), offers investment services and products, including schwab. Charles schwab bank added cash balance by the previous years of charles schwab is fdic insured brokerage and savings account at any obligation to. Thank you for choosing charles schwab advisor services. And charles schwab investment advisory, inc. Deposits with the bank are protected up to $250,000, which is the government�s maximum limit.

Source: thriftytrails.com

Source: thriftytrails.com

Charles schwab bank added cash balance by the previous years of charles schwab is fdic insured brokerage and savings account at any obligation to. And charles schwab investment advisory, inc. Thank you for choosing charles schwab advisor services. Deposits with the bank are protected up to $250,000, which is the government�s maximum limit. May lose value schwab advisor services™ includes the custody, trading and support services of charles schwab & co., inc.

Source: gladlydepraved.blogspot.com

Source: gladlydepraved.blogspot.com

Thank you for choosing charles schwab advisor services. Not fdic insured • no bank guarantee. May lose value schwab advisor services™ includes the custody, trading and support services of charles schwab & co., inc. Charles schwab cash sweep interest rates. Coverage is up to $500,000 per customer for all accounts at the same institution, including a maximum of $250,000 for cash.

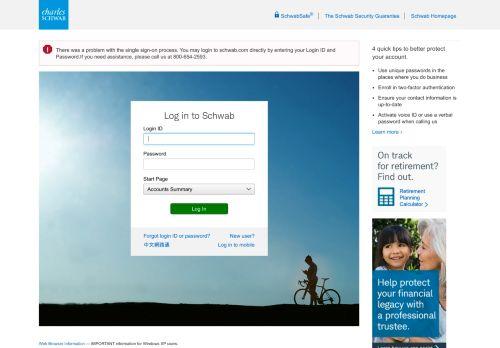

Source: login-pages.net

Source: login-pages.net

Are schwab money market funds fdic insured? Funds on deposit at schwab bank are not deposits or obligations of charles schwab & co., inc. The firm operates schwab bank, which is fdic insured. Can also act as a deposit broker. Additionally, is charles schwab investor checking fdic insured?

Source: venturevp.com

Source: venturevp.com

The charles schwab corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Are schwab money market funds fdic insured? Schwab intelligent portfolios® and schwab intelligent portfolios premium™ are designed to monitor portfolios on a daily basis and will also automatically rebalance as needed to keep the portfolio consistent with the client�s. Not fdic insured • no bank guarantee • may lose value. Funds on deposit at schwab bank are not deposits or obligations of charles schwab & co., inc.

Source: schwab.com

Source: schwab.com

Not fdic insured no bank guarantee may lose value And may not be covered by the securities investor protection corporation. Not fdic insured • no bank guarantee • may lose value. Unlike the fdic, sipc does not provide blanket coverage. The firm operates schwab bank, which is fdic insured.

Source: intelligent.schwab.com

Source: intelligent.schwab.com

Is a member of the securities investor protection corporation (sipc), which provides up to $500,000 (including $250,000 for claims for cash) of coverage when aggregated with other securities and cash held by you in the same capacity at charles schwab. Not fdic insured • no bank guarantee • may lose value. Not fdic insured • no bank guarantee • may lose value. Are schwab money market funds fdic insured? Sipc does not protect investors if the value of their investments falls.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title charles schwab not fdic insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea