Chart of accounts for insurance broker information

Home » Trend » Chart of accounts for insurance broker informationYour Chart of accounts for insurance broker images are ready. Chart of accounts for insurance broker are a topic that is being searched for and liked by netizens today. You can Find and Download the Chart of accounts for insurance broker files here. Find and Download all royalty-free images.

If you’re searching for chart of accounts for insurance broker images information connected with to the chart of accounts for insurance broker topic, you have visit the ideal site. Our website always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that fit your interests.

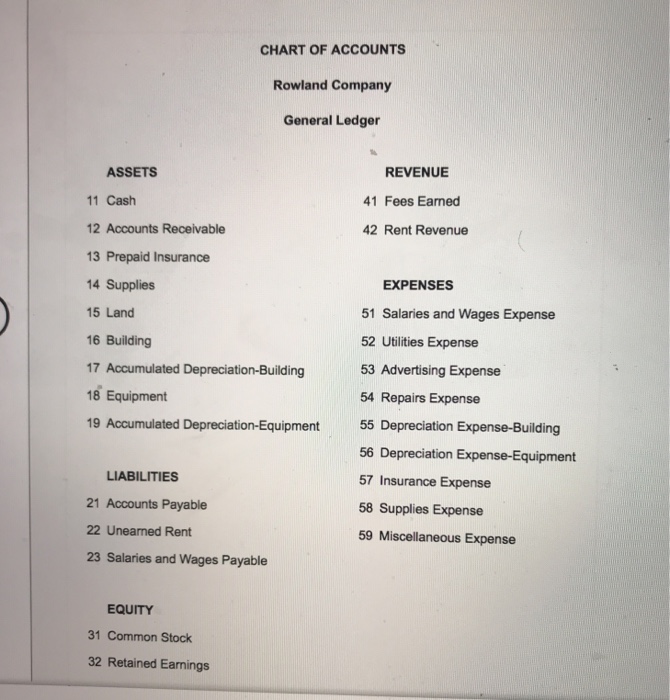

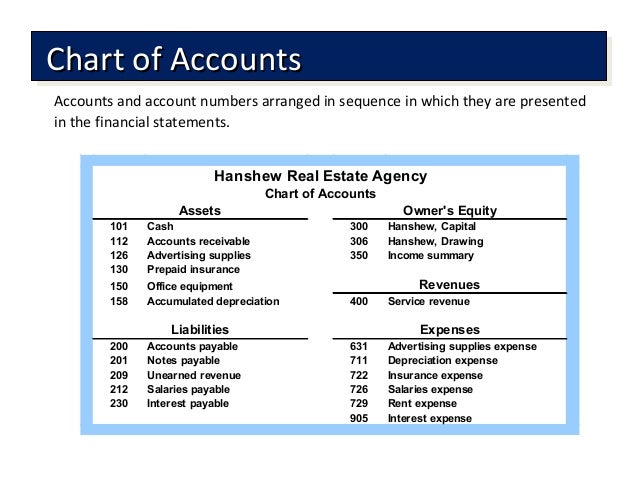

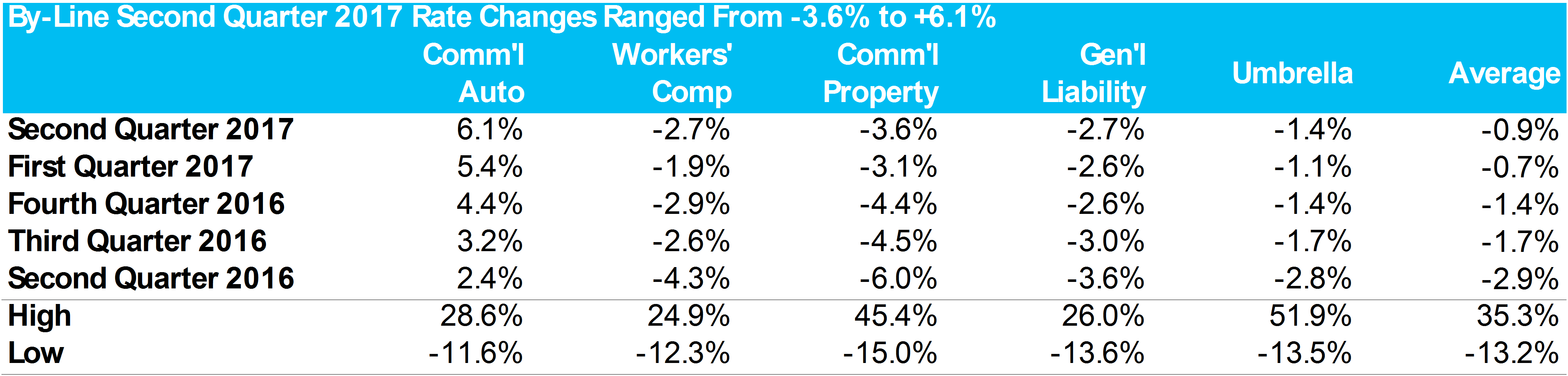

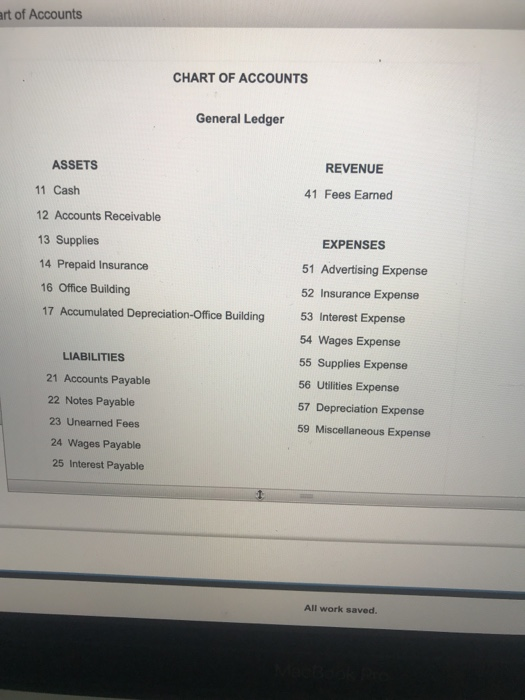

Chart Of Accounts For Insurance Broker. The standard chart of accounts list of categories may include the following: The accounting method you use for your insurance company will determine when you track expenses and income. There are two general accounting methods: 8040 finance & insurance compensation.

Chart Of Accounts Definition Gallery Of Chart 2019 From chartde.blogspot.com

Chart Of Accounts Definition Gallery Of Chart 2019 From chartde.blogspot.com

What is the chart of accounts? Create a service item called “premium” and map it, under the income account drop down to a “premium payable account (account type: Why is the chart of accounts important? It is used by all agency management software applications: Owners’ equity or shareholder’s equity; Learn to set up a chart of accounts to manage your insurance business properly insurance agencies and brokers can serve as guardian angels when dealing with hardships—but even guardian angels need to know how to make a quickbooks chart of accounts!

Under liabilities on the balance sheet, a separate entry should be made for the amounts due to the insurance companies from the trust account.

8020 salesperson compensation & incentives. What is the chart of accounts? Transactions are recorded when money changes hands. This is the actual income (brokerage) that will be displayed on your profit. 8020 salesperson compensation & incentives. It is used by all agency management software applications:

Source: insurancejournal.com

Source: insurancejournal.com

[deducible amount (colloquial 墊底費) of professional indemnity insurance] in general, must not be more than 50% of the company�s net assets as at. What is the chart of accounts? It is used by all agency management software applications: Other relevant accounts (see the following standard chart of accounts example below). Create a service item called “premium” and map it, under the income account drop down to a “premium payable account (account type:

Source: pinterest.com

Source: pinterest.com

8020 salesperson compensation & incentives. Under assets on the balance sheet, the accountant should include both the operating account balance and the trust account balance, and these should be kept separate bank accounts. The same can be said for real estate agents versus brokers, or reit versus bpo. 8020 salesperson compensation & incentives. There are two general accounting methods:

Source: insurancejournal.com

Source: insurancejournal.com

If all companies had the When it comes to managing your finances, the chart of accounts acts as the backbone for all your clients’ processes and procedures, no matter the industry—but how to set it up varies. [may recognizing revenue on a net basis] versus on a a gross basis (i.e., showing gross premiums), it is questionable recognizing revenue on a net basis is more appropriate; The standard chart of accounts is also called the uniform chart of accounts. The most reasonable approach to recording these proceeds is to wait until they have been received by the company.

Source: in.pinterest.com

Source: in.pinterest.com

As every accountant and bookkeeper knows, the financial success of every business starts with correctly setting up the chart of accounts in quickbooks ®. The most reasonable approach to recording these proceeds is to wait until they have been received by the company. No actual standard exists for a chart of accounts format. In this article, we address the best way to set up a chart of accounts for an organization that owns and manages real estate. Other relevant accounts (see the following standard chart of accounts example below).

Source: successfulportfolios.com

Source: successfulportfolios.com

Create another item type for “other charge” and enter the agreed percentage of premium you are entitled to and map it to the income account; Learn to set up a chart of accounts to manage your insurance business properly insurance agencies and brokers can serve as guardian angels when dealing with hardships—but even guardian angels need to know how to make a quickbooks chart of accounts! 12.2 central accounting bureaux 153 12.3 premiums 154 12.4 claims 156 12.5 reinsurance 157 12.6 facultative reinsurance 157 12.7 treaty reinsurance 157 12.8 basic accounting systems 158 12.9 accounting for brokerage 159 12.10 accounting for claims 164 12.11 accounting for reinsurance 165 12.12 balances with an insurer or an insured 166 Detailed organization chart mentioning roles and responsibilities. Guidelines in the imposition of fines for breach of tariff rates:

Source: chartde.blogspot.com

Source: chartde.blogspot.com

Chart of accounts an account is a tool that a company uses to record, group, and summarize similar type of business transactions which typically involve assets, liabilities, owner’s financial accounting in insurance companies equity, revenues and expenses. If all companies had the The accounting method you use for your insurance company will determine when you track expenses and income. We want to make it easy on you, though; Chart of accounts an account is a tool that a company uses to record, group, and summarize similar type of business transactions which typically involve assets, liabilities, owner’s financial accounting in insurance companies equity, revenues and expenses.

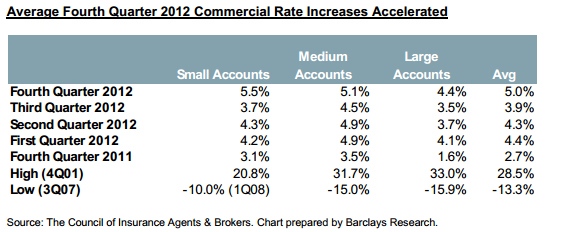

Source: ciab.com

Source: ciab.com

When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. In current practice insurance premium accounting is based on general ledger (gl) accounting. When it comes to managing your finances, the chart of accounts acts as the backbone for all your clients’ processes and procedures, no matter the industry—but how to set it up varies. As every accountant and bookkeeper knows, the financial success of every business starts with correctly setting up the chart of accounts in quickbooks ®. [may recognizing revenue on a net basis] versus on a a gross basis (i.e., showing gross premiums), it is questionable recognizing revenue on a net basis is more appropriate;

This is the actual income (brokerage) that will be displayed on your profit. The same can be said for real estate agents versus brokers, or reit versus bpo. At the highest level, the chart of accounts includes assets, liabilities, equity, revenues, and expenses. We want to make it easy on you, though; Think about the chart of accounts as the foundation of a building, in the chart of accounts you.

Source: slideshare.net

Source: slideshare.net

In current practice insurance premium accounting is based on general ledger (gl) accounting. We want to make it easy on you, though; Points need to know about insurance broker: Detailed organization chart mentioning roles and responsibilities. Owners’ equity or shareholder’s equity;

Source: personalfinanceplan.in

Source: personalfinanceplan.in

Think about the chart of accounts as the foundation of a building, in the chart of accounts you. However, there are lots of examples. Other relevant accounts (see the following standard chart of accounts example below). When it comes to managing your finances, the chart of accounts acts as the backbone for all your clients’ processes and procedures, no matter the industry—but how to set it up varies. I really don�t like the chart of accounts that comes with quickbooks.

Source: homeworklib.com

Source: homeworklib.com

Common agent revenue production (sales) job titles: 8020 salesperson compensation & incentives. The most reasonable approach to recording these proceeds is to wait until they have been received by the company. Transactions are recorded when money changes hands. At the highest level, the chart of accounts includes assets, liabilities, equity, revenues, and expenses.

Source: siskmorriscpa.com

Source: siskmorriscpa.com

It is used by all agency management software applications: The same can be said for real estate agents versus brokers, or reit versus bpo. The most reasonable approach to recording these proceeds is to wait until they have been received by the company. In this article, we address the best way to set up a chart of accounts for an organization that owns and manages real estate. Create a service item called “premium” and map it, under the income account drop down to a “premium payable account (account type:

Source: youtube.com

Source: youtube.com

As we discussed in our article: The same can be said for real estate agents versus brokers, or reit versus bpo. However, there are lots of examples. 8040 finance & insurance compensation. I believe the most useful p&l fits on one page.

Source: cbsnews.com

Source: cbsnews.com

Think about the chart of accounts as the foundation of a building, in the chart of accounts you. We want to make it easy on you, though; Insurance sales agent, insurance agent, insurance sales associate, insurance service representative, insurance sales producer The standard chart of accounts is also called the uniform chart of accounts. As we discussed in our article:

Source: ciab.com

Source: ciab.com

If all companies had the If all companies had the Insurance agents fall under two categories: Insurance sales agent, insurance agent, insurance sales associate, insurance service representative, insurance sales producer Common agent revenue production (sales) job titles:

Source: chegg.com

Source: chegg.com

If all companies had the The most reasonable approach to recording these proceeds is to wait until they have been received by the company. Under liabilities on the balance sheet, a separate entry should be made for the amounts due to the insurance companies from the trust account. Create another item type for “other charge” and enter the agreed percentage of premium you are entitled to and map it to the income account; 8040 finance & insurance compensation.

There are two general accounting methods: Insurance agents fall under two categories: Points need to know about insurance broker: [deducible amount (colloquial 墊底費) of professional indemnity insurance] in general, must not be more than 50% of the company�s net assets as at. The most reasonable approach to recording these proceeds is to wait until they have been received by the company.

8020 salesperson compensation & incentives. Captive agents (agents who work for one insurance company) and independent insurance agents (agents who work for insurance brokerages). 2100 · payroll liabilities:21006 · health insurance other current liability 2100 · payroll liabilities:21007 · life insurance other current liability 2100 · payroll liabilities:21008 · state other current liability sample quickbooks chart of accounts for use with service2000 page 1 That’s why we created a free pdf Owners’ equity or shareholder’s equity;

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chart of accounts for insurance broker by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information