Chatbot insurance claims Idea

Home » Trend » Chatbot insurance claims IdeaYour Chatbot insurance claims images are ready in this website. Chatbot insurance claims are a topic that is being searched for and liked by netizens today. You can Download the Chatbot insurance claims files here. Find and Download all free vectors.

If you’re looking for chatbot insurance claims pictures information related to the chatbot insurance claims keyword, you have come to the right site. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

Chatbot Insurance Claims. Chatbots allow customers to manage their insurance claims quickly and efficiently while serving as a listening channel that provides actionable insights to further understand customer behavior and preferences. Why should insurance companies consider implementing insurance claims chatbots? Thanks to machine learning (ml) capabilities, combined with natural language processing and pattern recognition, chatbots can differentiate fraudulent and valid claims. Insurance chatbot use cases automated claims processing

The State of Insurance Chatbots in 2021 Usecases From haptik.ai

In short, a whatsapp chatbot for insurance allows companies to automate several offerings. Conversational ai can be very useful when it comes to helping customers manage their policies. Chatbots are providing innovation and real added value for the insurance industry. Insurance chatbot can bring your business to the next level and get a profitable virtual assistant. Opening up its messenger platform for anyone to develop and deploy chatbots also opens the door for the automated insurance agent. A research study by hubspot shows that 47% of shoppers are open to buying items from a bot.

This information allows insurance firms to deliver personalized services and suggest better quotes that adjust to each client’s needs.

When a policyholder needs to submit a claim, a chatbot can collect the right data to process the claim. Conversational ai can be very useful when it comes to helping customers manage their policies. Using whatsapp insurance chatbot, you can offer policy selections, claims tracking and premium calculation. Next insurance’s facebook messenger bot helps shoppers with the insurance policy buying process. Offer personalized services and quotes; To better serve their policyholders while generating more leads.

Source: 4tifier.com

Source: 4tifier.com

However, the impact that insurance chatbots can have on the customer experience especially in providing immediate help around insurance claims or approvals is quite high. Offer personalized services and quotes; Claiming for insurance requires precise information from the claimant and this chatbot does exactly that. Thanks to machine learning (ml) capabilities, combined with natural language processing and pattern recognition, chatbots can differentiate fraudulent and valid claims. When a policyholder needs to submit a claim, a chatbot can collect the right data to process the claim.

Source: haptik.ai

Source: haptik.ai

For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. In this article, we will consider the most common use cases, benefits of chatbots in insurance, and check out some real chatbot examples in the car, life, and health insurance. The bot can then process the valid claims in the most efficient. If you are a part of the marketing or product team at an insurance company, you can use this chatbot template to generate and qualify leads for your car insurance product. That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is.

Source: haptik.ai

For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is. Insurance is a perfect candidate for implementing chatbots that produce answers to common questions. For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. This insurance chatbot template provides your business with detailed information about the accident that will, in turn, help your company to process the claims faster.

Source: venturebeat.com

Source: venturebeat.com

Chatbots allow customers to manage their insurance claims quickly and efficiently while serving as a listening channel that provides actionable insights to further understand customer behavior and preferences. This insurance chatbot template provides your business with detailed information about the accident that will, in turn, help your company to process the claims faster. Leadsurance is building custom insurance chatbots for independent agents and agencies across the u.s. It allows insurance firms to deploy distribution, claims and customer service straight into a platform that has 900 million regular users each month and supports 60 billion messages every day! Chatbot insurance claims.recently chatbots.studio built a car insurance chatbot to process claims for a uk client.

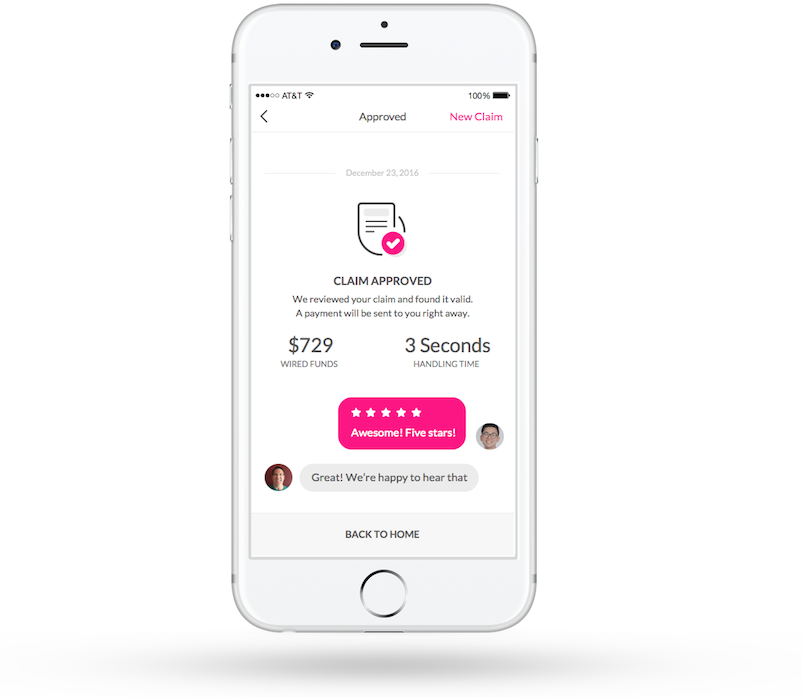

Source: psfk.com

Source: psfk.com

Offer personalized services and quotes; The bot can then process the valid claims in the most efficient. This information allows insurance firms to deliver personalized services and suggest better quotes that adjust to each client’s needs. It allows insurance firms to deploy distribution, claims and customer service straight into a platform that has 900 million regular users each month and supports 60 billion messages every day! Next insurance’s facebook messenger bot helps shoppers with the insurance policy buying process.

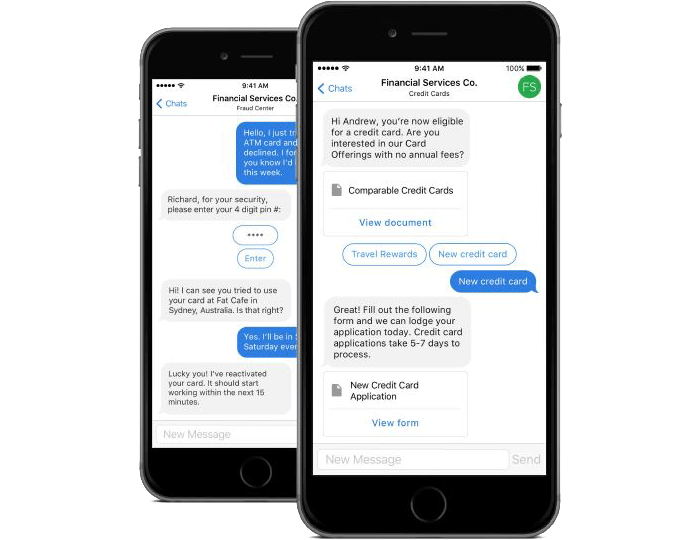

Source: snappytechinc.com

Source: snappytechinc.com

This can be done automatically and in a defined process. A research study by hubspot shows that 47% of shoppers are open to buying items from a bot. This insurance chatbot template provides your business with detailed information about the accident that will, in turn, help your company to process the claims faster. Opening up its messenger platform for anyone to develop and deploy chatbots also opens the door for the automated insurance agent. However, the impact that insurance chatbots can have on the customer experience especially in providing immediate help around insurance claims or approvals is quite high.

Source: psfk.com

Source: psfk.com

Chatbots in the insurance claims one of the main goals for every insurance company is to make customer experience as easy and efficient as possible, thus establishing customer retention and. Offer personalized services and quotes; In short, a whatsapp chatbot for insurance allows companies to automate several offerings. Ai application in the insurance industry has mainly been focused on risk evaluation, underwriting, claims management, and customer experience. That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is.

![How to Use Bots for Business 15 Chatbot Use Cases [Part 1] How to Use Bots for Business 15 Chatbot Use Cases [Part 1]](https://cdn-images-1.medium.com/max/1600/0*gH9vyodf38wJdaaG.png) Source: chatbotsmagazine.com

Source: chatbotsmagazine.com

The insurance chatbot can ensure that claims are validated by extracting appropriate information from the invoices, images, and other documents. Chatbots bring innovation to insurance. Chatbots in the insurance claims one of the main goals for every insurance company is to make customer experience as easy and efficient as possible, thus establishing customer retention and. This information allows insurance firms to deliver personalized services and suggest better quotes that adjust to each client’s needs. Being available 24/7 and across multiple channels, an automated tool will let policyholders file insurance claims or get urgent support and advice whenever and however they want.

Source: haptik.ai

Chatbots bring innovation to insurance. Using whatsapp insurance chatbot, you can offer policy selections, claims tracking and premium calculation. The insurance chatbot can ensure that claims are validated by extracting appropriate information from the invoices, images, and other documents. Conversational ai can be very useful when it comes to helping customers manage their policies. If you are a part of the marketing or product team at an insurance company, you can use this chatbot template to generate and qualify leads for your car insurance product.

Source: asiaadvisersnetwork.com

Source: asiaadvisersnetwork.com

The bot can then process the valid claims in the most efficient. When a policyholder needs to submit a claim, a chatbot can collect the right data to process the claim. However, the impact that insurance chatbots can have on the customer experience especially in providing immediate help around insurance claims or approvals is quite high. Chatbots in the insurance claims one of the main goals for every insurance company is to make customer experience as easy and efficient as possible, thus establishing customer retention and. This insurance chatbot template provides your business with detailed information about the accident that will, in turn, help your company to process the claims faster.

Source: dig-in.com

Source: dig-in.com

Why should insurance companies consider implementing insurance claims chatbots? The bot can then process the valid claims in the most efficient. Chatbot insurance claims.recently chatbots.studio built a car insurance chatbot to process claims for a uk client. Using whatsapp insurance chatbot, you can offer policy selections, claims tracking and premium calculation. Chatbots bring innovation to insurance.

Source: bigframe.net

Source: bigframe.net

Let’s look at those use cases in more detail. This can be done automatically and in a defined process. In short, a whatsapp chatbot for insurance allows companies to automate several offerings. They can help customers file claims fast as chatbots usually operate 24/7. Chatbot insurance claims.recently chatbots.studio built a car insurance chatbot to process claims for a uk client.

Source: youtube.com

Source: youtube.com

Opening up its messenger platform for anyone to develop and deploy chatbots also opens the door for the automated insurance agent. In short, a whatsapp chatbot for insurance allows companies to automate several offerings. The insurance chatbot can ensure that claims are validated by extracting appropriate information from the invoices, images, and other documents. This can be done automatically and in a defined process. Thanks to machine learning (ml) capabilities, combined with natural language processing and pattern recognition, chatbots can differentiate fraudulent and valid claims.

Source: chatbotslife.com

Source: chatbotslife.com

Insurance is a perfect candidate for implementing chatbots that produce answers to common questions. That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is. In this article, we will consider the most common use cases, benefits of chatbots in insurance, and check out some real chatbot examples in the car, life, and health insurance. For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. To better serve their policyholders while generating more leads.

Source: chatbotsmagazine.com

Source: chatbotsmagazine.com

That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is. The major usage of chatbots has been as an online agent helping human agents in customer conversion and as 24×7 assistant for customers engaging in direct insurance purchases. Chatbot insurance claims.recently chatbots.studio built a car insurance chatbot to process claims for a uk client. Chatbots allow customers to manage their insurance claims quickly and efficiently while serving as a listening channel that provides actionable insights to further understand customer behavior and preferences. Chatbots in the insurance claims one of the main goals for every insurance company is to make customer experience as easy and efficient as possible, thus establishing customer retention and.

That’s why insurance companies are building chatbots that allow customers to make claims or renewals directly through the chatbot and there is. Using whatsapp insurance chatbot, you can offer policy selections, claims tracking and premium calculation. Progressive offers a chatbot called flo, which the company claims can help customers file claims, move payment dates, and get auto insurance quotes. This insurance chatbot template provides your business with detailed information about the accident that will, in turn, help your company to process the claims faster. If you are a part of the marketing or product team at an insurance company, you can use this chatbot template to generate and qualify leads for your car insurance product.

Source: expiviausa.com

Source: expiviausa.com

Claiming for insurance requires precise information from the claimant and this chatbot does exactly that. Let’s look at those use cases in more detail. The insurance chatbot can ensure that claims are validated by extracting appropriate information from the invoices, images, and other documents. Chatbots allow customers to manage their insurance claims quickly and efficiently while serving as a listening channel that provides actionable insights to further understand customer behavior and preferences. Thus, making others more seamless.

Source: youtube.com

Source: youtube.com

The insurance chatbot can ensure that claims are validated by extracting appropriate information from the invoices, images, and other documents. Chatbots in the insurance claims one of the main goals for every insurance company is to make customer experience as easy and efficient as possible, thus establishing customer retention and. They can help customers file claims fast as chatbots usually operate 24/7. For processing claims, a chatbot can collect the relevant data, from asking for necessary documents to requesting supporting images or videos that meet requirements. Chatbot insurance claims.recently chatbots.studio built a car insurance chatbot to process claims for a uk client.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title chatbot insurance claims by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information