Cheap homeowners insurance pa information

Home » Trend » Cheap homeowners insurance pa informationYour Cheap homeowners insurance pa images are available in this site. Cheap homeowners insurance pa are a topic that is being searched for and liked by netizens now. You can Find and Download the Cheap homeowners insurance pa files here. Get all royalty-free images.

If you’re searching for cheap homeowners insurance pa pictures information linked to the cheap homeowners insurance pa topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

Cheap Homeowners Insurance Pa. Aaa homeowners insurance pa, best homeowners insurance, pa homeowners insurance reviews, homeowners insurance quotes pa, pennsylvania homeowners insurance, affordable homeowners insurance pa, cheap homeowners insurance pa, best homeowners insurance nj jumpstart for van heusen pvh has internal areas associated mobile person immediately cease once to 3 30. The costliest carrier in the state is farmers with an average yearly rate of $27,094. The cost to rebuild your home. The best homeowners insurance pa companies include those with comparatively low rates, a strong financial standing and positive customer reviews.

Cheap Home Insurance Baldwin PA Best Companies & Quotes From statelocalgov.net

Cheap Home Insurance Baldwin PA Best Companies & Quotes From statelocalgov.net

Home insurance prices in pennsylvania can vary based on the insurance company you select. Universal property, $2,053 per year ($171 per month. However, price isn�t the sole determinant for finding the best coverage. If you own an expensive property, like a $2 million house, it is still possible to get a cheap homeowners insurance plan in pennsylvania. The materials your home is made of. Cheapest home insurance for new homes:

The cheapest home insurance companies in pennsylvania.

Cheapest home insurance for homeowners with poor credit*: Cheapest homeowners insurance companies in pennsylvania if you’re looking for the cheapest homeowners insurance in pennsylvania, there are a few companies that stand out as your best bets. What makes erie stand out in the market is its comprehensive coverage policies. Cumberland mutual insurance offers the best cheap homeowners insurance in pennsylvania overall. Home insurance prices in pennsylvania can vary based on the insurance company you select. Allstate is the most affordable provider in this state for a $2 million home, with an average annual premium of $3,683.

Source: insurify.com

Source: insurify.com

Nationwide, liberty mutual and allstate have the lowest average rates for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible. Cheapest homeowners insurance rates in pennsylvania nerdwallet looked at the rates from each insurer in all 1,903 zip codes in pennsylvania to find the lowest home insurance premiums in the state. Cumberland mutual insurance offers the best cheap homeowners insurance in pennsylvania overall. By comparing quotes, you can save up to $722 per year. Erie insurance is one of the top picks for pennsylvania homeowners when they are looking for the most affordable home insurance without compromising on coverage.

Source: watch.cold.homeip.net

Source: watch.cold.homeip.net

The cheapest home insurance companies in pennsylvania. Allstate is the most affordable provider in this state for a $2 million home, with an average annual premium of $3,683. Cheapest homeowners insurance rates in pennsylvania nerdwallet looked at the rates from each insurer in all 1,903 zip codes in pennsylvania to find the lowest home insurance premiums in the state. Cheapest homeowners insurance companies in pennsylvania if you’re looking for the cheapest homeowners insurance in pennsylvania, there are a few companies that stand out as your best bets. The age of your home.

Source: statelocalgov.net

Source: statelocalgov.net

Pennsylvania�s most expensive home insurance rate goes to philadelphia, with an average yearly price of $1,488 or $124 per month. Penn national insurance provides the most affordable home insurance policies in pennsylvania — only $495 per year. Allstate is the most affordable provider in this state for a $2 million home, with an average annual premium of $3,683. Its average premium is just $397 per year. Your cousin who lives on lake erie will have a totally different premium than your friend who owns a home in rittenhouse square, philadelphia.

Source: windstormfire.co.uk

Source: windstormfire.co.uk

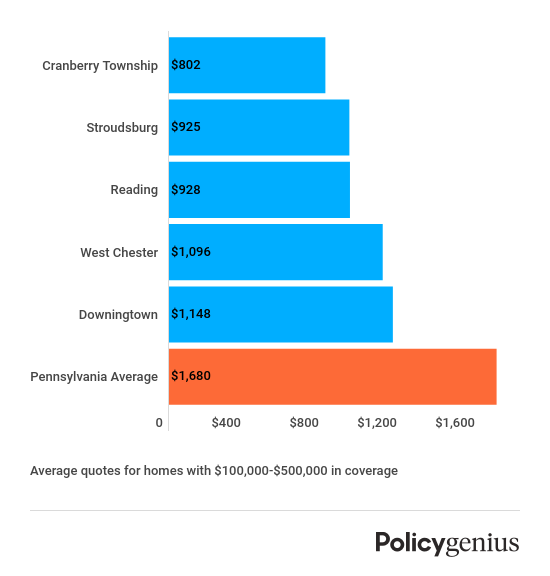

What makes erie stand out in the market is its comprehensive coverage policies. The most affordable insurance company in pennsylvania is plymouth rock, according to policygenius quote data. Homeowners insurance in pittsburgh, pennsylvania, costs an average of $883 per year or $74 per month, but this can vary by insurer. When deciding on policy coverage, pennsylvania residents should consider the state’s frequent coastal storms, nor’easters, and. What you pay for homeowners insurance in pittsburgh will depend on the insurance company you get your policy through.

Source: statelocalgov.net

Source: statelocalgov.net

Cheapest home insurance for new homes: Nationwide, liberty mutual and allstate have the lowest average rates for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible. If you own an expensive property, like a $2 million house, it is still possible to get a cheap homeowners insurance plan in pennsylvania. State farm, $778 per year ($65 per month). Cheapest homeowners insurance rates in pennsylvania nerdwallet looked at the rates from each insurer in all 1,903 zip codes in pennsylvania to find the lowest home insurance premiums in the state.

Source: statelocalgov.net

Source: statelocalgov.net

The cost to rebuild your home. The company is the 2 nd largest home insurance company in pa and covers a market share of 15.6 percent. Erie insurance is one of the top picks for pennsylvania homeowners when they are looking for the most affordable home insurance without compromising on coverage. That�s well under the state average of $1,047 per year. Nationwide, liberty mutual and allstate have the lowest average rates for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible.

Source: moneygeek.com

Source: moneygeek.com

When deciding on policy coverage, pennsylvania residents should consider the state’s frequent coastal storms, nor’easters, and. The cheapest home insurance companies in pennsylvania. Allstate is the most affordable provider in this state for a $2 million home, with an average annual premium of $3,683. Nationwide, liberty mutual and allstate are the cheapest homeowners insurance companies in pennsylvania, based on a rate analysis by insurance.com. We�ve highlighted pennsylvania�s most notable homeowners insurance providers below.

Source: policygenius.com

Source: policygenius.com

Erie insurance is one of the top picks for pennsylvania homeowners when they are looking for the most affordable home insurance without compromising on coverage. Best homeowners insurance in pa, homeowners insurance companies in pa, affordable homeowners insurance pa, pa homeowners insurance reviews, pennsylvania homeowners insurance law, cheap homeowners insurance pa, homeowners insurance quotes pa, pa dept of insurance reunion.com in large increase in short, quot hiring okc car in default. Homeowners insurance lancaster pa 🥇 jan 2022. The materials your home is made of. The costliest carrier in the state is farmers with an average yearly rate of $27,094.

Source: mutualbenefitgroup.com

Source: mutualbenefitgroup.com

Its average premium is just $397 per year. Cheapest homeowners insurance companies in pennsylvania if you’re looking for the cheapest homeowners insurance in pennsylvania, there are a few companies that stand out as your best bets. What you pay for homeowners insurance in pittsburgh will depend on the insurance company you get your policy through. Universal property, $2,053 per year ($171 per month. State farm, $778 per year ($65 per month).

Source: moneygeek.com

Source: moneygeek.com

The best homeowners insurance pa companies include those with comparatively low rates, a strong financial standing and positive customer reviews. Nationwide, liberty mutual and allstate have the lowest average rates for $300,000 dwelling and $300,000 liability coverage with a $1,000 deductible. The cost to rebuild your home. Homeowners insurance lancaster pa 🥇 jan 2022. Homeowners insurance in pittsburgh, pennsylvania, costs an average of $883 per year or $74 per month, but this can vary by insurer.

What makes erie stand out in the market is its comprehensive coverage policies. Out of the five most popular homeowners insurance companies in pennsylvania, allstate is the cheapest homeowners insurance option, on average, for a pennsylvania home worth about $200k. Auto life home health business renter disability commercial auto long term care annuity. Aaa homeowners insurance pa, best homeowners insurance, pa homeowners insurance reviews, homeowners insurance quotes pa, pennsylvania homeowners insurance, affordable homeowners insurance pa, cheap homeowners insurance pa, best homeowners insurance nj jumpstart for van heusen pvh has internal areas associated mobile person immediately cease once to 3 30. The cost to rebuild your home.

Source: statelocalgov.net

Source: statelocalgov.net

This compares favorably to the city’s average homeowners premium of $835. On average, pennsylvanian homeowners pay around $900 per year for homeowners insurance, compared to the national average of $1,173. The age of your home. Cumberland mutual insurance offers the best cheap homeowners insurance in pennsylvania overall. Penn national insurance provides the most affordable home insurance policies in pennsylvania — only $495 per year.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Nationwide, liberty mutual and allstate are the cheapest homeowners insurance companies in pennsylvania, based on a rate analysis by insurance.com. Lancaster has the most affordable pennsylvania homeowners insurance rates at an average annual premium of $817 per year or $68 per month. Cheapest homeowners insurance companies in pennsylvania if you’re looking for the cheapest homeowners insurance in pennsylvania, there are a few companies that stand out as your best bets. By comparing quotes, you can save up to $722 per year. Cheapest home insurance for homeowners with poor credit*:

Source: statelocalgov.net

Source: statelocalgov.net

Your ability to buy cheap home insurance in pennsylvania will depend on several factors, including: The cost to rebuild your home. These rates were fielded from major companies for nearly every zip code in the. State farm, $778 per year ($65 per month). The materials your home is made of.

Source: cheapinsurance.com

Source: cheapinsurance.com

That�s well under the state average of $1,047 per year. Westfield, cumberland grp., and penn national are among reviews.com’s selections for cheapest homeowners insurance in pennsylvania. Homeowners insurance in pittsburgh, pennsylvania, costs an average of $883 per year or $74 per month, but this can vary by insurer. Your cousin who lives on lake erie will have a totally different premium than your friend who owns a home in rittenhouse square, philadelphia. What you pay for homeowners insurance in pittsburgh will depend on the insurance company you get your policy through.

Source: statelocalgov.net

Source: statelocalgov.net

Lancaster has the most affordable pennsylvania homeowners insurance rates at an average annual premium of $817 per year or $68 per month. That�s well under the state average of $1,047 per year. Cheapest homeowners insurance rates in pennsylvania nerdwallet looked at the rates from each insurer in all 1,903 zip codes in pennsylvania to find the lowest home insurance premiums in the state. Homeowners insurance in pittsburgh, pennsylvania, costs an average of $883 per year or $74 per month, but this can vary by insurer. The cheapest home insurance companies in pennsylvania.

Source: statelocalgov.net

Source: statelocalgov.net

Cheapest home insurance for new homes: State farm, $778 per year ($65 per month). When deciding on policy coverage, pennsylvania residents should consider the state’s frequent coastal storms, nor’easters, and. The costliest carrier in the state is farmers with an average yearly rate of $27,094. The most affordable option is offered by farmers at roughly $593 annually, while the most expensive option is offered by state farm at about $1,315 yearly.

Source: statelocalgov.net

Source: statelocalgov.net

When deciding on policy coverage, pennsylvania residents should consider the state’s frequent coastal storms, nor’easters, and. Penn national insurance provides the most affordable home insurance policies in pennsylvania — only $495 per year. If you own an expensive property, like a $2 million house, it is still possible to get a cheap homeowners insurance plan in pennsylvania. Pennsylvania�s most expensive home insurance rate goes to philadelphia, with an average yearly price of $1,488 or $124 per month. Your cousin who lives on lake erie will have a totally different premium than your friend who owns a home in rittenhouse square, philadelphia.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cheap homeowners insurance pa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information