Cheap sr22 insurance wisconsin information

Home » Trending » Cheap sr22 insurance wisconsin informationYour Cheap sr22 insurance wisconsin images are available in this site. Cheap sr22 insurance wisconsin are a topic that is being searched for and liked by netizens today. You can Download the Cheap sr22 insurance wisconsin files here. Download all royalty-free photos.

If you’re searching for cheap sr22 insurance wisconsin pictures information linked to the cheap sr22 insurance wisconsin keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

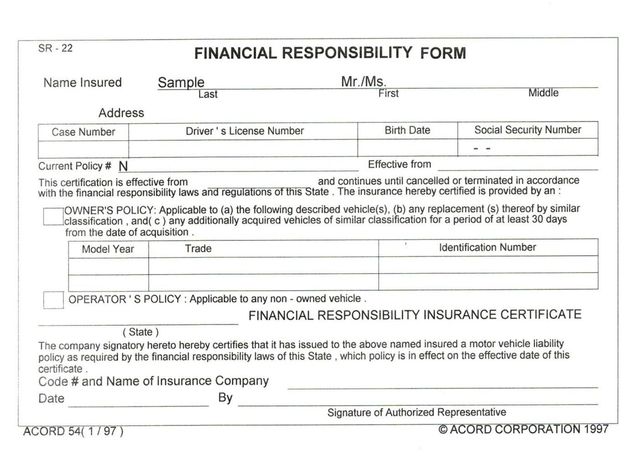

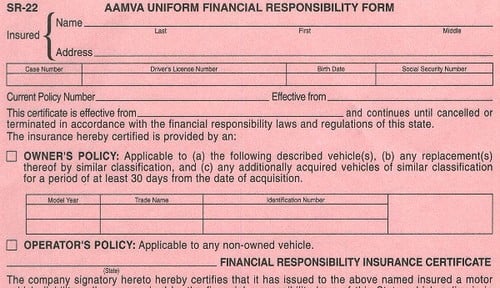

Cheap Sr22 Insurance Wisconsin. However, this is minimal coverage and can be higher, depending on your violation. Sr22 is often a relatively inexpensive certificate, priced at anywhere from around $17 to $45. Sr22 is actually a relatively inexpensive qualification, pricing anywhere from around $17 to $45. 7, integrity mutual, $1,023 ;

Wisconsin Sr22 Insurance Quotes. QuotesGram From quotesgram.com

Wisconsin Sr22 Insurance Quotes. QuotesGram From quotesgram.com

6, state farm, $982 ; The cost of car insurance in wisconsin per month for a 51 year old driver is around $1,200 a year for liability coverage and up to $3,200 a year for full coverage. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. Top 10 cheapest car insurance companies in wisconsin ; This allows the state of wisconsin to protect its insured drivers by issuing a sr22 insurance mandate to drivers who are uninsured or incur various traffic violations. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to.

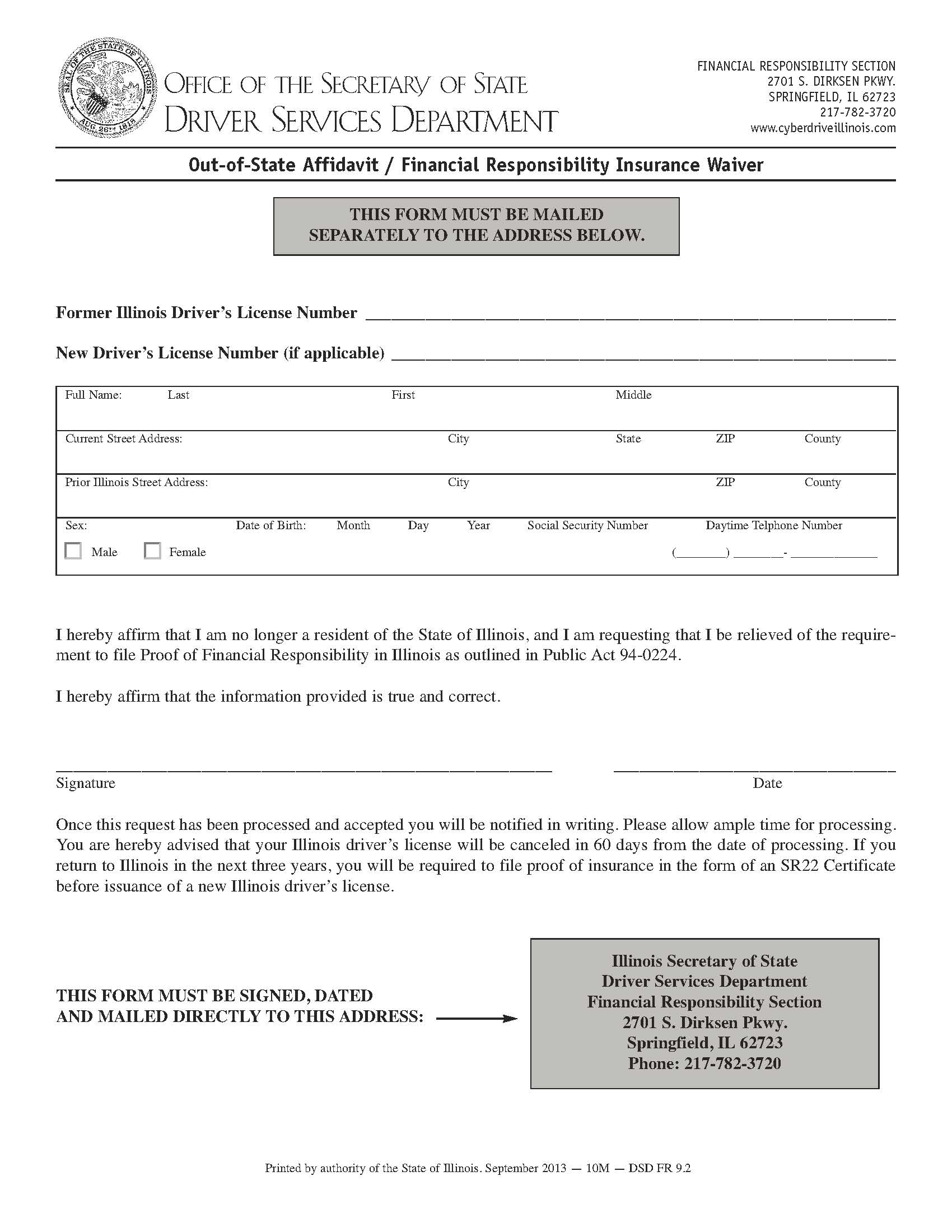

This allows the state of wisconsin to protect its insured drivers by issuing a sr22 insurance mandate to drivers who are uninsured or incur various traffic violations.

Also, if you can locate a company offering no money down insurance then that will bring the price down. Top 10 cheapest car insurance companies in wisconsin ; Therefore, your sr22 policy is monitored to ensure that it remains in force during that time. How much does sr22 insurance cost in wisconsin? Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. How much does a milwaukee non owner sr22 expense?

Source: quotesgram.com

Source: quotesgram.com

$25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. The cost of sr22 insurance is determined by your state’s minimum liability requirements. And we can obtain and file your sr22 certificate with the wisconsin. What amount of does an sr22 insurance milwaukee wi price tag? How much does a milwaukee non owner sr22 expense?

Source: cheapsr22insurance.us

Source: cheapsr22insurance.us

Proof of insurance is filed by providing a sr22 certificate to dmv. A non owners policy is usually a bit less expensive than a routine automobile insurance coverage. The cost of sr22 insurance is determined by your state’s minimum liability requirements. 7, integrity mutual, $1,023 ; Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to.

Source: diningroompedia.blogspot.com

Source: diningroompedia.blogspot.com

Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. If you want to know how much is sr22 insurance in wisconsin, some previous surveys show that state farm offers cheap sr22 wisconsin, costing around $302 per year. Wisconsin owi/dui laws & penalties This is dependent on how much the deductibles are and personal driving history. The cost of car insurance in wisconsin per month for a 51 year old driver is around $1,200 a year for liability coverage and up to $3,200 a year for full coverage.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

Top 10 cheapest car insurance companies in wisconsin ; On our list of insurers, the cheapest option is usaa with an average annual rate of $429. How much does sr22 insurance cost in wisconsin? In most state governments it will be exactly $25. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to.

Source: americanautoinsurance.com

Source: americanautoinsurance.com

The cost of sr22 insurance is determined by your state’s minimum liability requirements. In most state governments it will be exactly $25. Top 10 cheapest car insurance companies in wisconsin ; And we can obtain and file your sr22 certificate with the wisconsin. Therefore, your sr22 policy is monitored to ensure that it remains in force during that time.

Source: cheapinsurance.com

Source: cheapinsurance.com

Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. This is dependent on how much the deductibles are and personal driving history. Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. On our list of insurers, the cheapest option is usaa with an average annual rate of $429. How much does a milwaukee non owner sr22 expense?

Source: quotesgram.com

Source: quotesgram.com

7, integrity mutual, $1,023 ; Also, if you can locate a company offering no money down insurance then that will bring the price down. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. Top 10 cheapest car insurance companies in wisconsin ; Wisconsin owi/dui laws & penalties

Source: sr22savings.com

Source: sr22savings.com

Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. How much does a milwaukee non owner sr22 expense? A fee and the greater risk you represent. In most state governments it will be exactly $25.

Source: bestbuyinsurance.com

Source: bestbuyinsurance.com

Top 10 cheapest car insurance companies in wisconsin ; In most state governments it will be exactly $25. Sr22 is actually a relatively inexpensive qualification, pricing anywhere from around $17 to $45. Proof of insurance is filed by providing a sr22 certificate to dmv. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage.

Source: quotesgram.com

Source: quotesgram.com

7, integrity mutual, $1,023 ; Wisconsin sr22 insurance is usually required for a period of three to five years; The cost of sr22 insurance is determined by your state’s minimum liability requirements. What amount of does an sr22 insurance milwaukee wi price tag? This allows the state of wisconsin to protect its insured drivers by issuing a sr22 insurance mandate to drivers who are uninsured or incur various traffic violations.

Source: quotesgram.com

Source: quotesgram.com

Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. Sr22 is actually a relatively inexpensive qualification, pricing anywhere from around $17 to $45. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. How much does sr22 insurance cost in wisconsin? The cost of car insurance in wisconsin per month for a 51 year old driver is around $1,200 a year for liability coverage and up to $3,200 a year for full coverage.

Source: cheapinsurance.com

Source: cheapinsurance.com

On our list of insurers, the cheapest option is usaa with an average annual rate of $429. Also, if you can locate a company offering no money down insurance then that will bring the price down. $25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. Wisconsin sr22 insurance is usually required for a period of three to five years; How much does sr22 insurance cost in wisconsin?

Source: insuredasap.com

Source: insuredasap.com

Sr22 is actually a relatively inexpensive qualification, pricing anywhere from around $17 to $45. A non owners policy is usually a bit less expensive than a routine automobile insurance coverage. Wisconsin owi/dui laws & penalties The cost of sr22 insurance is determined by your state’s minimum liability requirements. If you want to know how much is sr22 insurance in wisconsin, some previous surveys show that state farm offers cheap sr22 wisconsin, costing around $302 per year.

Source: quotesgram.com

Source: quotesgram.com

$25,000 for injury to one person, $50,000 for injury to two or more people, and $10,000 for property damage. A non owners policy is usually a bit less expensive than a routine automobile insurance coverage. Most insurance companies that file sr22 certificates will electronically file or mail the information to dmv. In most says it is really accurately $25. A fee and the greater risk you represent.

Source: cheapinsurance.com

Source: cheapinsurance.com

How much does a milwaukee non owner sr22 expense? The cost will depend on a variety of different factors such as driving history, driving infractions, and the age of the driver. Proof of insurance is filed by providing a sr22 certificate to dmv. Sr22 is actually a relatively inexpensive qualification, pricing anywhere from around $17 to $45. This is dependent on how much the deductibles are and personal driving history.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

How much does a milwaukee non owner sr22 expense? How much does sr22 insurance cost in wisconsin? The cost of car insurance in wisconsin per month for a 51 year old driver is around $1,200 a year for liability coverage and up to $3,200 a year for full coverage. The cost of sr22 insurance is determined by your state’s minimum liability requirements. This allows the state of wisconsin to protect its insured drivers by issuing a sr22 insurance mandate to drivers who are uninsured or incur various traffic violations.

Source: allbikeprice.com

Source: allbikeprice.com

However, this is minimal coverage and can be higher, depending on your violation. How much does sr22 insurance cost in wisconsin? The cost of sr22 insurance is determined by your state’s minimum liability requirements. However, this is minimal coverage and can be higher, depending on your violation. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to.

Source: universalnetworkcable.com

Source: universalnetworkcable.com

In most state governments it will be exactly $25. Therefore, your sr22 policy is monitored to ensure that it remains in force during that time. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to. A non owners policy is usually a bit less expensive than a routine automobile insurance coverage. Most drivers want to know how much their auto insurance will increase due to an sr22 but it is not the sr22 that causes your rates to.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cheap sr22 insurance wisconsin by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea