Children s life insurance college savings information

Home » Trend » Children s life insurance college savings informationYour Children s life insurance college savings images are available. Children s life insurance college savings are a topic that is being searched for and liked by netizens today. You can Find and Download the Children s life insurance college savings files here. Download all royalty-free photos and vectors.

If you’re searching for children s life insurance college savings pictures information linked to the children s life insurance college savings keyword, you have pay a visit to the right site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Children S Life Insurance College Savings. A universal life insurance college savings plan can help parents and students pay for their college tuition. This provides a total net worth of $83,000. The earlier you start contributing, the more your savings will be. While permanent life insurance offers certain attractive features for paying college costs, when developing a plan to pay such costs, more traditional saving and investing vehicles such as 529 plans need to be considered.

Gerber Life College Savings Plan 529 Plan Alternative From annuityexpertadvice.com

Gerber Life College Savings Plan 529 Plan Alternative From annuityexpertadvice.com

The most popular vehicle parents use to save for their children’s college education is the 529 college savings fund.but lately, a newcomer has entered the fray: Plus, life insurance can offer more flexibility if you have other financial goals and obligations and if you have any doubt that your kids will go down the college path. Cash value life insurance based college savings plan. Both have pros and cons. (like iras or 529 college savings plans) the amount of. Even when life insurance policies are structured with the maximum client benefit in mind, they still tend to be much more costly.

529 plans and permanent life insurance are two ways to create college funds for kids;

Life insurance for college savings. The 529 plan may be viable for children up until 12 or 13 years old because of the stock market investment component. A universal life insurance college savings plan can help parents and students pay for their college tuition. College is expensive, and tuition continues to increase over the years. Children�s college and savings plan do you know life insurance offers so many tax benefits for savings plans? It provides a savings vehicle for my child’s education.

Source: pinterest.com

Source: pinterest.com

If you buy a policy for a newborn, it usually takes 15. The state farm family life insurance plan is great for the family who wants only death benefit coverage for their children and chooses to fund other life events like college, marriage, or housing. And with some types of life insurance, you can take loans against your policy without tax penalties. Life insurance for college savings. The earlier you start contributing, the more your savings will be.

Source: lukemusicfactory.blogspot.com

Source: lukemusicfactory.blogspot.com

This is what you’ll hear: When it comes to life insurance vs. Currently have $11,000 in the children’s college savings account. When funded properly, an iul policy can build up enough cash to help pay the cost of college for your children and grandchildren. A universal life insurance college savings plan can help parents and students pay for their college tuition.

Source: imoney.my

Source: imoney.my

Life insurance policies that build cash value could be a viable alternative for some people. 529 plans and permanent life insurance are two ways to create college funds for kids; Whole life insurance provides insurance for, you guessed it, your whole life. You’ve probably seen this as a feature of whole life insurance for children. The earlier you start contributing, the more your savings will be.

Source: pinterest.com

Source: pinterest.com

So life insurance for a child shouldn’t be a substitute for a 529 college savings plan, hoang says. 8 best whole life insurance companies for kids. Both have pros and cons. Whole life insurance provides insurance for, you guessed it, your whole life. Use whole life insurance for death benefit or cash value option.

Source: finstrat.com

Source: finstrat.com

Be sure to take into account these additional features when planning for your kids’ college funds, available with certain types of life insurance: Using life insurance to save for college. Let’s take a closer look at the specific myths people believe about life insurance for kids. If you buy a policy for a newborn, it usually takes 15. Use whole life insurance for death benefit or cash value option.

Source: youtube.com

Source: youtube.com

The 529 plan may be viable for children up until 12 or 13 years old because of the stock market investment component. 529 plans and permanent life insurance are two ways to create college funds for kids; This is what you’ll hear: The idea is that the monthly premium will build up savings for college. Plus, life insurance can offer more flexibility if you have other financial goals and obligations and if you have any doubt that your kids will go down the college path.

Source: pinterest.com

Source: pinterest.com

Even when life insurance policies are structured with the maximum client benefit in mind, they still tend to be much more costly. If you buy a policy for a newborn, it usually takes 15. Although the main purpose of a life insurance policy is to provide a death benefit to the beneficiaries, it can also be used to fund the child’s college education. The gerber life college plan is a life insurance policy that guarantees a set rate of return for your child’s college fund. The 529 plan may be viable for children up until 12 or 13 years old because of the stock market investment component.

Source: finance.yahoo.com

My personal opinion is that whole life insurance is not a good way to save for a child’s college expenses. 529 plans and permanent life insurance are two ways to create college funds for kids; The state farm family life insurance plan is great for the family who wants only death benefit coverage for their children and chooses to fund other life events like college, marriage, or housing. Unfortunately, parents are not always prepared to pay the expenses of their child’s tuition and room and board. My personal opinion is that whole life insurance is not a good way to save for a child’s college expenses.

Source: pinterest.com

Source: pinterest.com

When funded properly, an iul policy can build up enough cash to help pay the cost of college for your children and grandchildren. Both have pros and cons. While permanent life insurance offers certain attractive features for paying college costs, when developing a plan to pay such costs, more traditional saving and investing vehicles such as 529 plans need to be considered. Plus, life insurance can offer more flexibility if you have other financial goals and obligations and if you have any doubt that your kids will go down the college path. The idea is that the monthly premium will build up savings for college.

Source: largofinancialservices.com

Source: largofinancialservices.com

The gerber life college plan is a life insurance policy that guarantees a set rate of return for your child’s college fund. The idea is that the monthly premium will build up savings for college. We analyzed over 15 different companies to select the top 8. While permanent life insurance offers certain attractive features for paying college costs, when developing a plan to pay such costs, more traditional saving and investing vehicles such as 529 plans need to be considered. The most popular vehicle parents use to save for their children’s college education is the 529 college savings fund.but lately, a newcomer has entered the fray:

Source: pinterest.com

Source: pinterest.com

And with some types of life insurance, you can take loans against your policy without tax penalties. This option is available if you buy a permanent life insurance policy. We considered the financial strength of the company, cost of the insurance, ease of application, available riders, and complaint history. So life insurance for a child shouldn’t be a substitute for a 529 college savings plan, hoang says. Both have pros and cons.

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

We analyzed over 15 different companies to select the top 8. (like iras or 529 college savings plans) the amount of. This is what you’ll hear: Use whole life insurance for death benefit or cash value option. The state farm family life insurance plan is great for the family who wants only death benefit coverage for their children and chooses to fund other life events like college, marriage, or housing.

Source: es.slideshare.net

Source: es.slideshare.net

529 plans and permanent life insurance are two ways to create college funds for kids; It is a great way to set your child up for future financial stability. Using life insurance to save for college. You’ve probably seen this as a feature of whole life insurance for children. The state farm family life insurance plan is great for the family who wants only death benefit coverage for their children and chooses to fund other life events like college, marriage, or housing.

Source: pinterest.com

Source: pinterest.com

If you’re looking for a way to save for your child’s future college or nest egg, these alternatives to children�s life insurance give you more bang for your buck: This option is available if you buy a permanent life insurance policy. A universal life insurance college savings plan can help parents and students pay for their college tuition. College is expensive, and tuition continues to increase over the years. Both have pros and cons.

Source: pinterest.com

Source: pinterest.com

We analyzed over 15 different companies to select the top 8. It is the cash value accumulation feature of indexed universal life insurance that makes it a tool for funding your children’s college education. This option is available if you buy a permanent life insurance policy. Although the main purpose of a life insurance policy is to provide a death benefit to the beneficiaries, it can also be used to fund the child’s college education. The earlier you start contributing, the more your savings will be.

Source: pinterest.com

Source: pinterest.com

If you’re looking for a way to save for your child’s future college or nest egg, these alternatives to children�s life insurance give you more bang for your buck: Use term life insurance for a death benefit option. The most popular vehicle parents use to save for their children’s college education is the 529 college savings fund.but lately, a newcomer has entered the fray: Life insurance for college savings. A universal life insurance college savings plan can help parents and students pay for their college tuition.

Source: pinterest.com

Source: pinterest.com

Life insurance for college savings. My personal opinion is that whole life insurance is not a good way to save for a child’s college expenses. Use whole life insurance for death benefit or cash value option. Let’s take a closer look at the specific myths people believe about life insurance for kids. Guaranteed cash value, so you know a certain amount of money is available

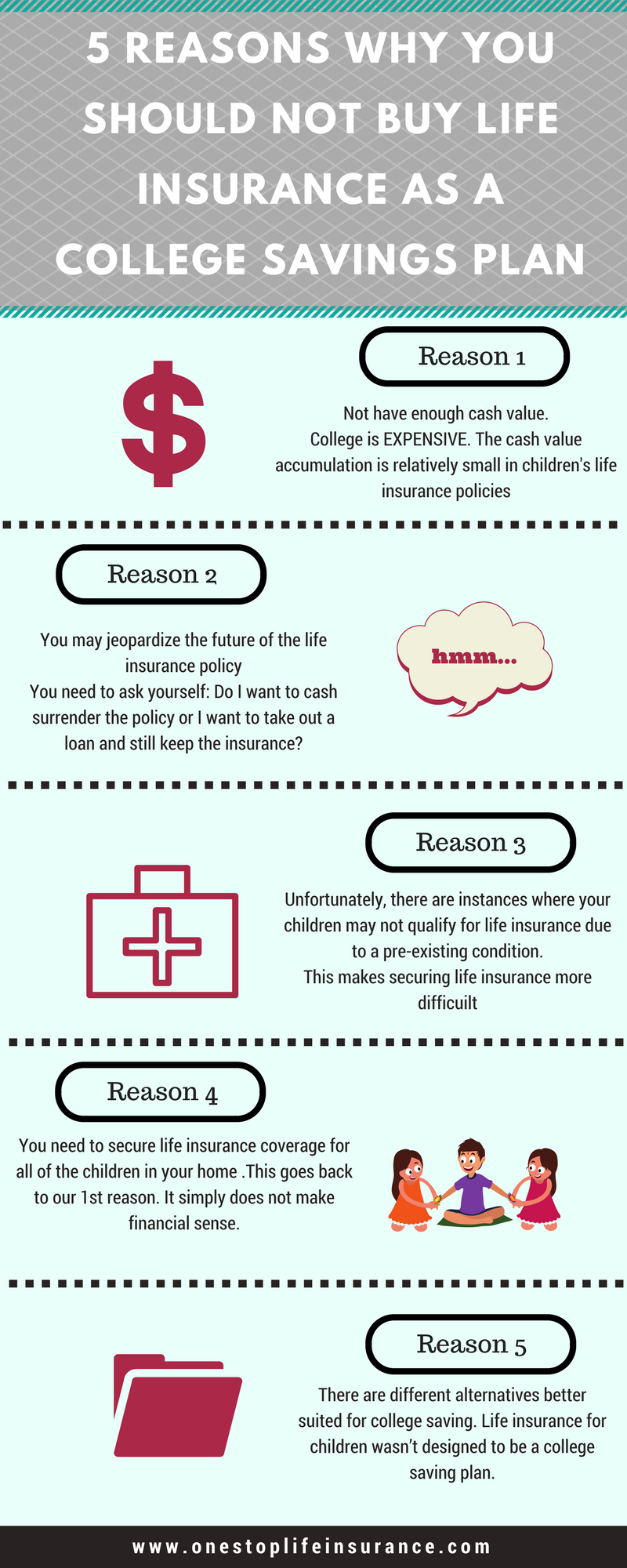

Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

Switching your savings strategy from a 529 plan to a whole life insurance plan can effectively improve your child�s chances of earning more. The most popular vehicle parents use to save for their children’s college education is the 529 college savings fund.but lately, a newcomer has entered the fray: When it comes to life insurance vs. Life insurance for college funding: My personal opinion is that whole life insurance is not a good way to save for a child’s college expenses.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title children s life insurance college savings by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information