Churning insurance Idea

Home » Trending » Churning insurance IdeaYour Churning insurance images are ready in this website. Churning insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Churning insurance files here. Get all free images.

If you’re searching for churning insurance pictures information connected with to the churning insurance keyword, you have pay a visit to the right site. Our site always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that fit your interests.

Churning Insurance. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. A vessel or device in which cream or milk is agitated to separate the oily globules from the caseous and serous parts, used to make butter. Churn can happen for a variety of reasons, natural and unnatural. Full list of insurance scams.

Churning Insurance Insurance Churning Center for From edufonsecacomvoce.blogspot.com

Churning Insurance Insurance Churning Center for From edufonsecacomvoce.blogspot.com

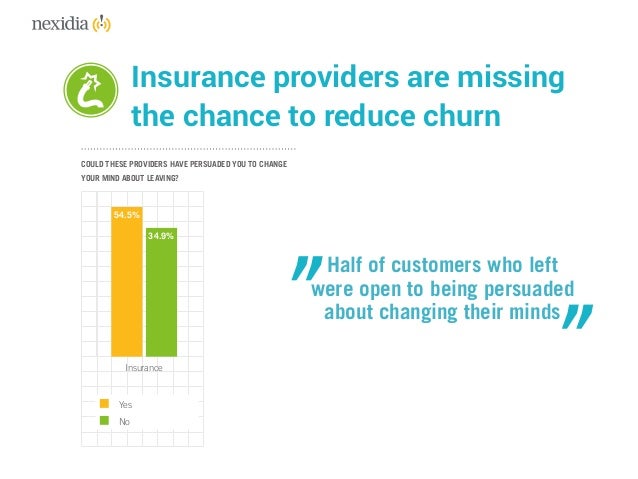

Agents may be paid more than the total amount of yearly premiums for selling a policy. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Individuals may avoid seeking health care when they need it during gaps in insurance coverage. To stay relevant in this tough market, insurers understand the need to work harder than ever to retain their customers. The insurance industry is particularly challenged by customer churn. Customer churn prediction for an insurance company author:

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Life insurance scams are also prevalent, as well as car insurance fraud. Full list of insurance scams. Brokers may often churn stocks and bonds, mutual funds, annuities, and life insurance policies. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Customer churn prediction for an insurance company author:

Source: chrt.org

Source: chrt.org

Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Even if consumers maintain continuous coverage while transitioning between different insurance plans, they may find that their regular health care providers do not accept their new. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Insurance churning can affect quality, cost, and continuity of care. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. The insurance scams go beyond typical policies. It is, however, a practice that can lead to ethical lapses. Churn can happen for a variety of reasons, natural and unnatural. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Insurance churning can affect quality, cost, and continuity of care. Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. Rui jorge de almeida e santos nogueira cz wouter wester msc a thesis submitted in ful lment of the requirements for the degree of master of science information systems ie&is april 2015 Twisting is a replacement contract with similar or worse benefits from a different carrier. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender (13).

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client�s account in order to generate commissions. Both churning and twisting assume scenarios where the coverage may be slightly different, but the overall. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Brokers may often churn stocks and bonds, mutual funds, annuities, and life insurance policies.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Insurance churning can affect quality, cost, and continuity of care. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. A vessel or device in which cream or milk is agitated to separate the oily globules from the caseous and serous parts, used to make butter. Churning would involve using the values in an existing life insurance policy or annuity to purchase another insurance policy or annuity contract with that (12).

Source: news.abs-cbn.com

Source: news.abs-cbn.com

It is, however, a practice that can lead to ethical lapses. Full list of insurance scams. Churning in the insurance industry is used in a variety of contexts. Churning is an illegal practice and it has no benefit for the insured. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client�s account in order to generate commissions.

Source: dollarsandsense.sg

Source: dollarsandsense.sg

Agents may be paid more than the total amount of yearly premiums for selling a policy. Individuals may avoid seeking health care when they need it during gaps in insurance coverage. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Full list of insurance scams. Churning would involve using the values in an existing life insurance policy or annuity to purchase another insurance policy or annuity contract with that (12).

Source: thecreditsolutionprogram.com

Source: thecreditsolutionprogram.com

Life insurance scams are also prevalent, as well as car insurance fraud. Brokers may often churn stocks and bonds, mutual funds, annuities, and life insurance policies. Replacement is defined as changes in existing coverage, usually with coverage from one insurer being replaced with coverage from another. Knowing what attributes are the most important enables the insurance company to take action to reduce churn. Individuals may avoid seeking health care when they need it during gaps in insurance coverage.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Life insurance scams are also prevalent, as well as car insurance fraud. If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. Insurance churning can affect quality, cost, and continuity of care. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent. Educated yourself with the articles below.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Customer churn prediction for an insurance company author: Full list of insurance scams. They also include churning, twisting, and other terms that you may not be familiar with. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent. Both churning and twisting assume scenarios where the coverage may be slightly different, but the overall.

Source: pixxviewwebdesign.blogspot.com

Source: pixxviewwebdesign.blogspot.com

Twisting is a replacement contract with similar or worse benefits from a different carrier. A vessel or device in which cream or milk is agitated to separate the oily globules from the caseous and serous parts, used to make butter. To stay relevant in this tough market, insurers understand the need to work harder than ever to retain their customers. Churning is illegal in most jurisdictions and may attract. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent.

Source: hackardlaw.com

Source: hackardlaw.com

Agents may be paid more than the total amount of yearly premiums for selling a policy. Both churning and twisting assume scenarios where the coverage may be slightly different, but the overall. To stay relevant in this tough market, insurers understand the need to work harder than ever to retain their customers. This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund. Customer churn prediction for an insurance company author:

Source: analyticsindiamag.com

Source: analyticsindiamag.com

Customer churn prediction for an insurance company author: Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account. Insurance churning is when an agent intentionally convinces you to switch to an allegedly better insurance policy within the same company, although the replacement would only benefit the agent. Both churning and twisting assume scenarios where the coverage may be slightly different, but the overall. Eindhoven university of technology dr.

Source: watoday.com.au

The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of. Twisting is a replacement contract with similar or worse benefits from a different carrier. If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. While there is no quantitative measure for churning. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Customer churn prediction for an insurance company author: Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Both churning and twisting assume scenarios where the coverage may be slightly different, but the overall. Churning can be defined as the practice of executing trades for a customer’s investment account by a broker or brokerage firm for the sole purpose of generating commissions from the account.

Source: abc.net.au

Source: abc.net.au

If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client�s account in order to generate commissions. Brokers may often churn stocks and bonds, mutual funds, annuities, and life insurance policies.

Source: youtube.com

Source: youtube.com

Full list of insurance scams. Churning is illegal in most jurisdictions and may attract. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Customer churn prediction for an insurance company author: Churning is the illegal and unethical practice by a broker of excessively trading assets in a client�s account in order to generate commissions.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Full list of insurance scams. Full list of insurance scams. Churning is an illegal practice and it has no benefit for the insured. Churning synonyms, churning pronunciation, churning translation, english dictionary definition of churning. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.churning is an illegal practice and it has no benefit for the insured.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title churning insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea