Churning insurance definition Idea

Home » Trend » Churning insurance definition IdeaYour Churning insurance definition images are available in this site. Churning insurance definition are a topic that is being searched for and liked by netizens now. You can Get the Churning insurance definition files here. Get all royalty-free photos and vectors.

If you’re searching for churning insurance definition images information linked to the churning insurance definition interest, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Churning Insurance Definition. Churning is in effect twisting of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of.

Making Your Customers Feel Amazing The Loyalty Programme From flexpricer.com

Making Your Customers Feel Amazing The Loyalty Programme From flexpricer.com

Churning is an illegal practice and it has no benefit for the insured. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. See further detail related to it here. Churning is illegal and unethical and. Churning is an illegal practice and it has no benefit for the insured. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value.

Thereof, what is the definition of churning in insurance?

Insurance churning is a scam designed to defraud people who try to purchase insurance. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. The term churn is often used because of the cyclical nature of moving between coverage sources or uninsurance. If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. While replacement of existing coverage is a perfectly legitimate practice, inducing changes in coverage based on misrepresentation or deception is unethical and illegal.

Source: pinterest.com

Source: pinterest.com

Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Insurance churning is a scam designed to defraud people who try to purchase insurance. Churning is illegal and unethical and. Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value.

Source: gojiberries.io

Source: gojiberries.io

Churning is an illegal practice and it has no benefit for the insured. Thereof, what is the definition of churning in insurance? Churning is an illegal practice and it has no benefit for the insured. The illegal practice by stockbrokers of buying and selling a client�s investments more often…. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: es.slideshare.net

Source: es.slideshare.net

Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. The term churn is often used because of the cyclical nature of moving between coverage sources or uninsurance. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Churning is an illegal practice and it has no benefit for the insured. If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning.

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

Run, don�t walk if an agent promises you a new. See further detail related to it here. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Dictionary, thesaurus, legal, financial, idioms, encyclopedia, wikipedia. Also known as “ twisting ,” this practice is illegal in most states and is also against most insurance company policies.

Source: process.st

Source: process.st

Run, don�t walk if an agent promises you a new. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client’s account in order to generate commissions. Also known as “ twisting ,” this practice is illegal in most states and is also against most insurance company policies. Churning is an illegal practice and it has no benefit for the insured. Dictionary, thesaurus, legal, financial, idioms, encyclopedia, wikipedia.

Source: samansiadati.blogspot.com

Source: samansiadati.blogspot.com

Churning is the illegal and unethical practice by a broker of excessively trading assets in a client’s account in order to generate commissions. Churn has nothing to do with milk and butter, but refers to a consumer’s transition between different types of coverage and/or becoming uninsured. The basics what is churn? See further detail related to it here. Churning is illegal and unethical and.

Source: airfocus.com

Source: airfocus.com

The term churn is often used because of the cyclical nature of moving between coverage sources or uninsurance. Churning is an illegal practice and it has no benefit for the insured. The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of. If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. Thereof, what is the definition of churning in insurance?

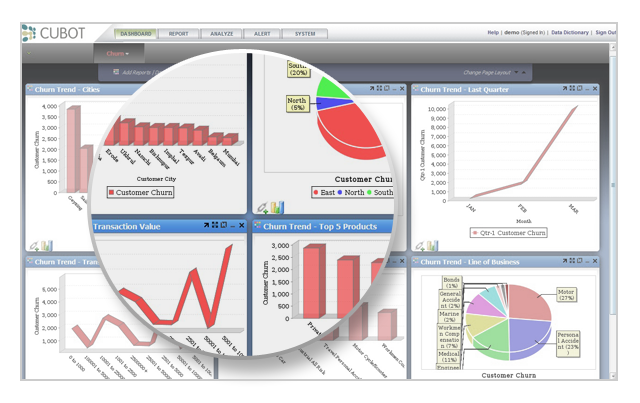

Source: tellius.com

Source: tellius.com

This is the most common type of churning exercised by brokers to make commissions. Some of the common types of churning are as explained below: Churn has nothing to do with milk and butter, but refers to a consumer’s transition between different types of coverage and/or becoming uninsured. Also known as “ twisting ,” this practice is illegal in most states and is also against most insurance company policies. While replacement of existing coverage is a perfectly legitimate practice, inducing changes in coverage based on misrepresentation or deception is unethical and illegal.

Source: flexpricer.com

Source: flexpricer.com

Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Some of the common types of churning are as explained below: The agitated mixture foamed and bubbled Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. While replacement of existing coverage is a perfectly legitimate practice, inducing changes in coverage based on misrepresentation or deception is unethical and illegal. Insurance churning is a scam designed to defraud people who try to purchase insurance. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client’s account in order to generate commissions. Churning is illegal and unethical and.

Source: pinterest.com

Source: pinterest.com

Churning is illegal and unethical and. Churning may exist in various types. This is where brokers inflate securities prices against the investors investment objectives to make a commission. Thereof, what is the definition of churning in insurance? Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer.

Source: retently.com

Source: retently.com

Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. Churning is an illegal practice and it has no benefit for the insured. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions.

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Knowing what attributes are the most important enables the insurance company to take action to reduce churn. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value. The broker might buy and sell securities at an excessive rate, or at a rate that�s inconsistent with your investment goals or the amount of.

Source: topmovielist1.blogspot.com

Source: topmovielist1.blogspot.com

Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Thereof, what is the definition of churning in insurance? Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. This is the most common type of churning exercised by brokers to make commissions. Also known as “ twisting ,” this practice is illegal in most states and is also against most insurance company policies.

Source: coloradohealthinstitute.org

Source: coloradohealthinstitute.org

This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund the purchase of the. The illegal practice by stockbrokers of buying and selling a client�s investments more often…. In a state of turbulence; The agitated mixture foamed and bubbled Churning is an illegal practice and it has no benefit for the insured.

Source: riskinfo.com.au

Source: riskinfo.com.au

Churning is illegal and unethical and. Dictionary, thesaurus, legal, financial, idioms, encyclopedia, wikipedia. If a broker intentionally mishandles buying and selling securities in your investment account, it�s known as churning. Churning is the illegal and unethical practice by a broker of excessively trading assets in a client’s account in order to generate commissions. Churn has nothing to do with milk and butter, but refers to a consumer’s transition between different types of coverage and/or becoming uninsured.

Source: slideshare.net

Source: slideshare.net

Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Knowing what attributes are the most important enables the insurance company to take action to reduce churn. See further detail related to it here. Churning may exist in various types.

Source: robustdesigns.com

Source: robustdesigns.com

Insurance churning is a scam designed to defraud people who try to purchase insurance. Dictionary, thesaurus, legal, financial, idioms, encyclopedia, wikipedia. Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Churning in insurance is when a producer replaces a client’s coverage with one from the same carrier that has similar or worse benefits. The agitated mixture foamed and bubbled

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title churning insurance definition by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information