Churning life insurance Idea

Home » Trending » Churning life insurance IdeaYour Churning life insurance images are available in this site. Churning life insurance are a topic that is being searched for and liked by netizens now. You can Download the Churning life insurance files here. Get all royalty-free photos.

If you’re looking for churning life insurance pictures information related to the churning life insurance interest, you have pay a visit to the ideal site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Churning Life Insurance. A recently published california case identifies the vulnerability of elders to financial abuse through life insurance schemes like churning. Why replace a life insurance or annuity contract? Chantine huigevoort april 2015 xii. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning.

5M Churning Penalty for AMP riskinfo » News From riskinfo.com.au

5M Churning Penalty for AMP riskinfo » News From riskinfo.com.au

Once a policyholder has been paying into a whole life insurance policy for some time, its. Both practices are illegal in florida. (a) misrepresentations and false advertising of insurance policies. Churning is in effect “twisting” of policies by an existing insurer. No hassles of a medical exam with certain term life insurance policies. Life insurance twisting occurs when an agent misrepresents the facts to replace a life policy the customer owns with a policy from another life insurance company.

Chantine huigevoort april 2015 xii.

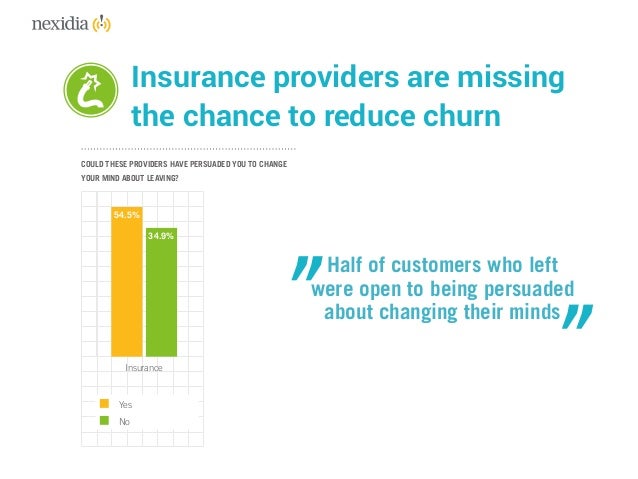

1 “most clicked” has been “underinsurance”. No hassles of a medical exam with certain term life insurance policies. The california insurance code provides in part that anyone “engaged in the transaction of insurance” with an elder owes that person “a duty of honesty, good faith, and fair dealing.” Churn in the life/risk space remains a contentious issue, but as col fullagar explains, responsibility not only resides with financial advisers but also with the insurers and how they monitor activity levels in the sector. Insurance salespeople work on a commission basis. Part of the difficulty in regulating contract churning or insurance twisting is because there are several truly valid reasons to replace a contract.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

No hassles of a medical exam with certain term life insurance policies. Churning also occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churn in the life/risk space remains a contentious issue, but as col fullagar explains, responsibility not only resides with financial advisers but also with the insurers and how they monitor activity levels in the sector. What does churning mean in insurance? November 1, 2015 hershelcise leave a comment.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. (a) misrepresentations and false advertising of insurance policies. Churning by an insurer or an agent is.

Source: riskinfo.com.au

Source: riskinfo.com.au

See further detail related to it here. Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. The benefits of a person relation management system (crm) and policy management system may help both life insurance agencies and agents take advantage of increased sales and client. In plain english, churning takes place when a broker trades a customer’s account for the purpose of generating commissions, not because the trades are suitable for the client. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: abc.net.au

Source: abc.net.au

Both practices are illegal in florida. Churn in the life/risk space remains a contentious issue, but as col fullagar explains, responsibility not only resides with financial advisers but also with the insurers and how they monitor activity levels in the sector. Life insurance twisting occurs when an agent misrepresents the facts to replace a life policy the customer owns with a policy from another life insurance company. Once a policyholder has been paying into a whole life insurance policy for some time, its. Life insurance churning and other types of.

Source: aquisotemmaluco.wordpress.com

Source: aquisotemmaluco.wordpress.com

1 “most clicked” has been “underinsurance”. Customer churn prediction for an insurance company author: Churning also occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. If they attempt to boost their own commissions by persuading their customers to switch insurance. Churning life insurance | elder financial abuse.

Source: hackardlaw.com

Source: hackardlaw.com

(a) misrepresentations and false advertising of insurance policies. Agents may be paid more than the total amount of yearly premiums for selling a policy. Once a policyholder has been paying into a whole life insurance policy for some time, its. Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. A recently published california case identifies the vulnerability of elders to financial abuse through life insurance schemes like churning.

Source: youtube.com

Source: youtube.com

Churning is the practice whereby policy values in an existing life insurance policy or annuity contract, including, but not limited to, cash, loan values, or dividend values, and in any riders to that policy or contract, are directly or indirectly used to purchase another insurance policy or annuity contract with that same insurer for the. Insurance salespeople work on a commission basis. The offending practices usually take one of two forms: November 1, 2015 hershelcise leave a comment. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself.

Source: smh.com.au

Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. Churning is the practice of an insurer replacing existing coverage with a new policy based on misrepresentations. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning also occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Part of the difficulty in regulating contract churning or insurance twisting is because there are several truly valid reasons to replace a contract.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Once a policyholder has been paying into a whole life insurance policy for some time, its. November 1, 2015 hershelcise leave a comment. Pro les which are comparable to the average of the population. Churning meaning in life insurance. The offending practices usually take one of two forms:

Source: iastl.com

Source: iastl.com

If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning. There is also the issue of churning by life insurance agents, which is the practice of persuading a policyholder to replace a policy. Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Once a policyholder has been paying into a whole life insurance policy for some time, its.

Source: actuaries.digital

Source: actuaries.digital

Life insurance churning and other types of. Churning by an insurer or an agent is. See further detail related to it here. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Once a policyholder has been paying into a whole life insurance policy for some time, its.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Churning is in effect “twisting” of policies by an existing insurer. No hassles of a medical exam with certain term life insurance policies. Churning (also known as twisting) or promises of vanishing premiums. churning and twisting. Also known as “ twisting,” this practice is illegal in most states and is also against most insurance company policies. November 1, 2015 hershelcise leave a comment.

Source: scam-detector.com

Source: scam-detector.com

Agents may be paid more than the total amount of yearly premiums for selling a policy. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company. Pro les which are comparable to the average of the population. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. 1 “most clicked” has been “underinsurance”.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Churning meaning in life insurance. Been an unforgettable period in my life. Customer churn prediction for an insurance company author: Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. The benefits of a person relation management system (crm) and policy management system may help both life insurance agencies and agents take advantage of increased sales and client.

Source: edufonsecacomvoce.blogspot.com

Source: edufonsecacomvoce.blogspot.com

Churn in the life/risk space remains a contentious issue, but as col fullagar explains, responsibility not only resides with financial advisers but also with the insurers and how they monitor activity levels in the sector. Churn in the life/risk space remains a contentious issue, but as col fullagar explains, responsibility not only resides with financial advisers but also with the insurers and how they monitor activity levels in the sector. Churning also occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning by an insurer or an agent is. Churning is very similar to insurance twisting with the only exception that in the former case, you’re tricked by the same company.

Source: watoday.com.au

Whereas churning tricks a policyholder to drain policy funds for a new policy with the same insurer, twisting is where a policy holder is tricked into draining funds from their life insurance policy for a policy with another insurer. Churning meaning in life insurance. Chantine huigevoort april 2015 xii. Once a policyholder has been paying into a whole life insurance policy for some time, its. Pro les which are comparable to the average of the population.

Source: news.abs-cbn.com

Source: news.abs-cbn.com

The offending practices usually take one of two forms: November 1, 2015 hershelcise leave a comment. Churning is an illegal practice and it has no benefit for the insured. 1 “most clicked” has been “underinsurance”. What does churning mean in insurance?

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Life insurance churning is especially common as a result of the high commissions paid for whole or universal life policies. Churning is an illegal practice and it has no benefit for the insured. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning is the practice of an insurer replacing existing coverage with a new policy based on misrepresentations. Churning customers and the last pro le indicates a churning pro le.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title churning life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea