Churning meaning in life insurance information

Home » Trending » Churning meaning in life insurance informationYour Churning meaning in life insurance images are ready. Churning meaning in life insurance are a topic that is being searched for and liked by netizens today. You can Download the Churning meaning in life insurance files here. Get all free photos.

If you’re searching for churning meaning in life insurance pictures information connected with to the churning meaning in life insurance interest, you have pay a visit to the ideal blog. Our website always provides you with hints for downloading the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

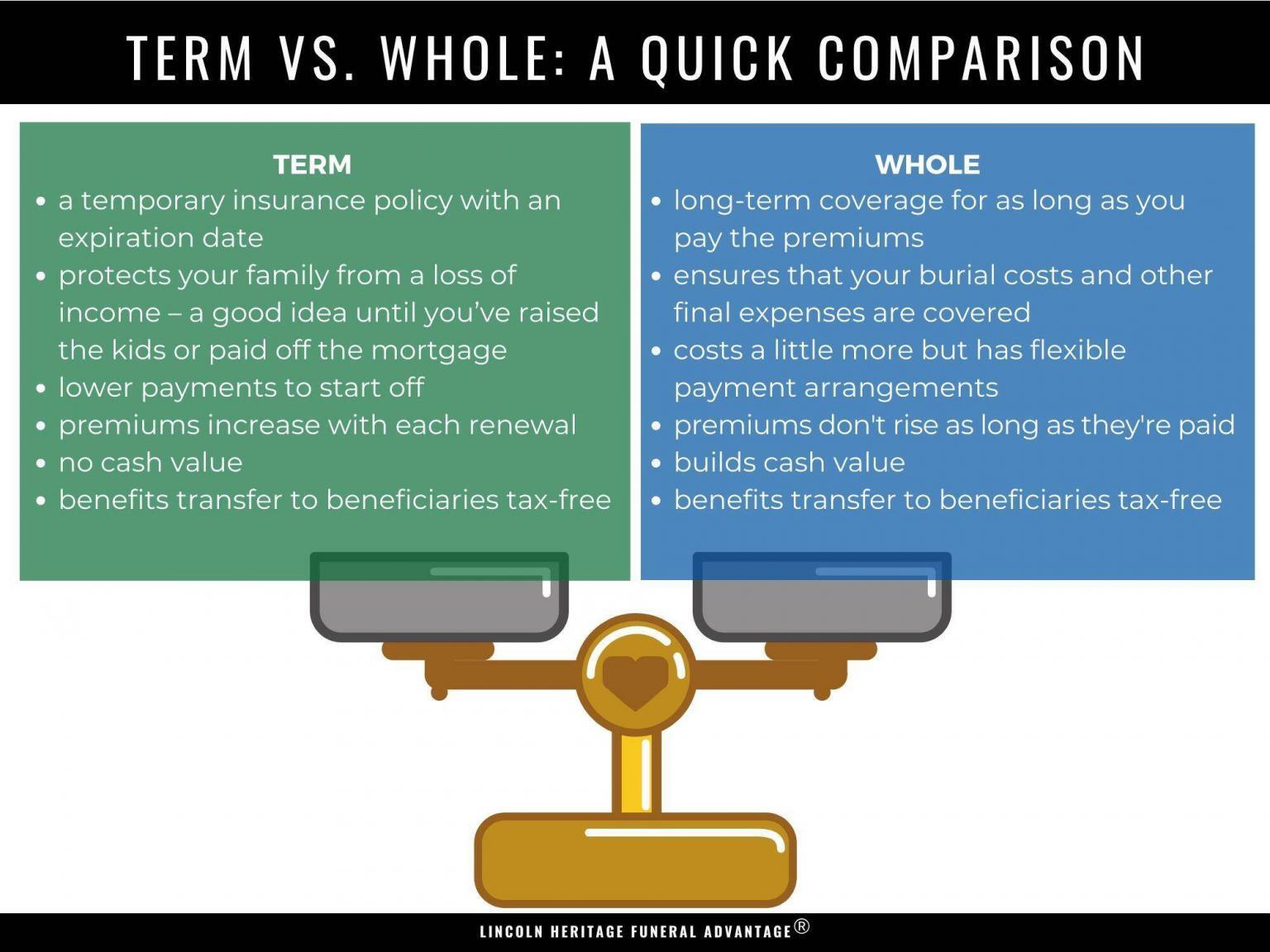

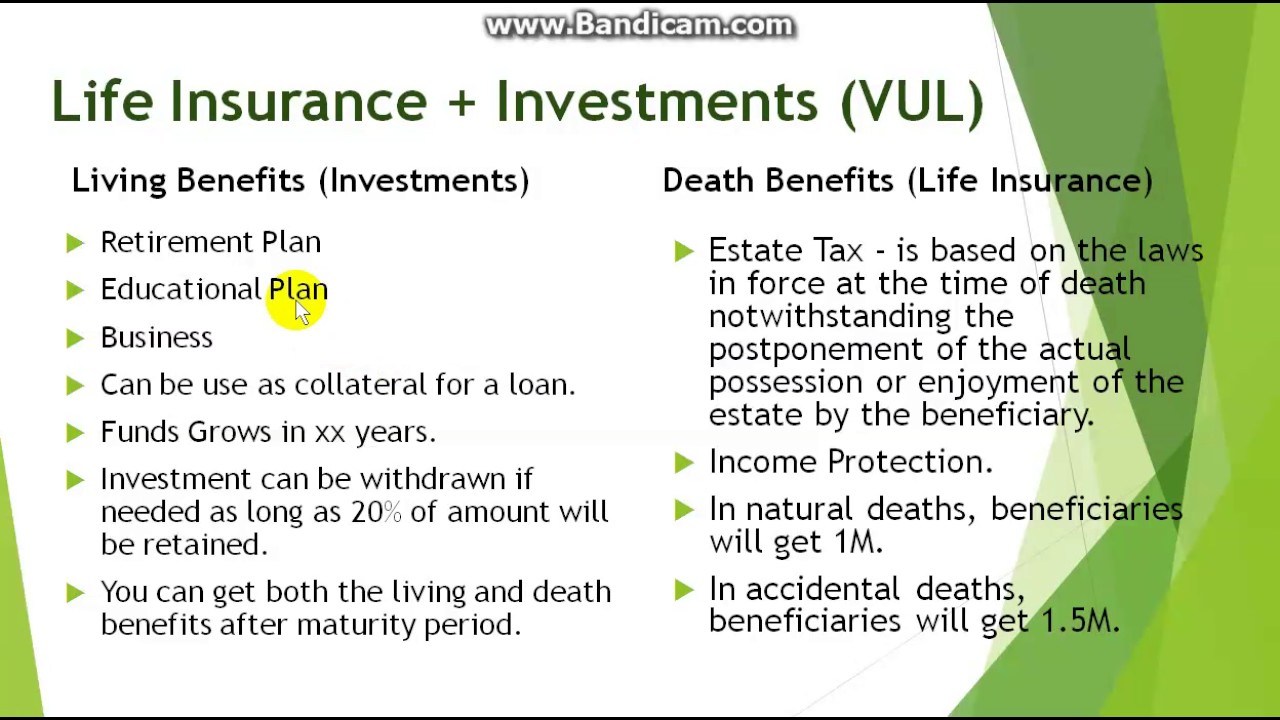

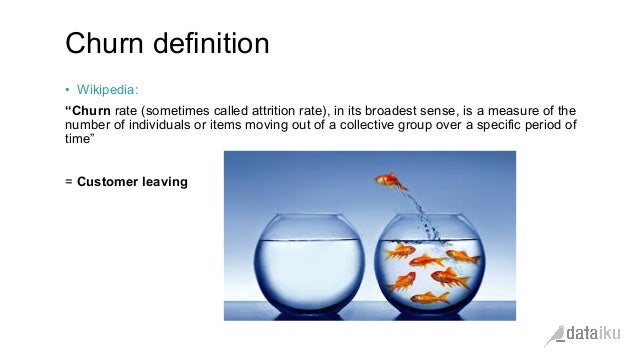

Churning Meaning In Life Insurance. This kind of behavior is known as churning when a life insurance agent is behaving questionably and creating repeat commissions for themselves on the same clients. The most important churning characteristics found in this research are age, the number of times a customer is insured at cz and health consumption. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Policy churn means replacing an existing life insurance policy with a new one within six months of discontinuing the old policy.

Life insurance �churning� widespread as reforms loom RN From abc.net.au

Life insurance �churning� widespread as reforms loom RN From abc.net.au

Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. The agitated mixture foamed and bubbled. Insurance churning is a scam designed to defraud people who try to purchase insurance. Churning in the insurance industry is used in a variety of contexts. If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning.

Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions.

Rising commission payments, soaring lapse rates and unnecessary product enhancements aimed at encouraging advisers to switch their clients are undermining life insurers� attempts to stop churning. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. A ny fraud lawyer explains insurance churning. In a state of turbulence; See further detail related to it here. While replacement of existing coverage is a perfectly legitimate.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

See further detail related to it here. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning. The most important churning characteristics found in this research are age, the number of times a customer is insured at cz and health consumption. Churning refers to an action where finance professionals do excessive buying and selling of products for the sole purpose of generating more commission for themselves, with no clear benefits for the clients they are supposed to represent.

Source: taylorimagecollection.blogspot.com

Churning is an illegal practice and it has no benefit for the insured. The illegal practice by stockbrokers of buying and selling a client�s investments more often…. Churning is illegal and unethical and. Churning in the insurance industry is used in a variety of contexts. The churning also keeps oxygen, nitrogen, phosphorus and other nutrients cycling through the atmosphere, oceans and rocks — and chemically transforms them into forms that living.

Source: lhlic.com

Source: lhlic.com

Churning in the insurance industry is used in a variety of contexts. Important information about the full consequence of their action is dishonestly withheld by the agent involved. Life assurance companies typically possess a wealth of data covering multiple systems and databases. Life insurance churning is especially common as a result of the high. There are times when the decision to make such a trade is prudent, but in many cases, the broker is the only one who comes out ahead when this type of transaction that takes place soon after a previous trade.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. Brokers churn mutual funds, annuities, and life insurance policies (though the last is commonly called “twisting”). If a customer is enticed into replacing an existing policy with a policy from the same company, the result is churning if the replacement was not to the customer�s benefit. This kind of behavior is known as churning when a life insurance agent is behaving questionably and creating repeat commissions for themselves on the same clients. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning.

Source: effectwiki.blogspot.com

Source: effectwiki.blogspot.com

A ny fraud lawyer explains insurance churning. Life insurance churning is especially common as a result of the high. This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund the purchase of the. The incontestability clause is standard with life insurance policies and basically means that in the first two years of a new policy, your death benefit may be denied or contested. Churning is an illegal practice and it has no benefit for the insured.

Source: insurance-companies.co

Source: insurance-companies.co

A ny fraud lawyer explains insurance churning. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. In a state of turbulence; A ny fraud lawyer explains insurance churning.

Source: abc.net.au

Source: abc.net.au

This is usually accomplished by convincing the insured to withdraw the cash accumulated from the existing policy in order to fund the purchase of the. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning is illegal and unethical and. Rising commission payments, soaring lapse rates and unnecessary product enhancements aimed at encouraging advisers to switch their clients are undermining life insurers� attempts to stop churning.

Source: lifeinsurancebenefits3.blogspot.com

Source: lifeinsurancebenefits3.blogspot.com

These reports describe a few major reasons for insurance churn, such as changes in income or hours worked, life circumstances like becoming pregnant or becoming an adult, frustration with the. There are times when the decision to make such a trade is prudent, but in many cases, the broker is the only one who comes out ahead when this type of transaction that takes place soon after a previous trade. Life assurance companies typically possess a wealth of data covering multiple systems and databases. Churning refers to an action where finance professionals do excessive buying and selling of products for the sole purpose of generating more commission for themselves, with no clear benefits for the clients they are supposed to represent. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b).

Source: thespiritualindian.com

Source: thespiritualindian.com

In a state of turbulence; The illegal practice by stockbrokers of buying and selling a client�s investments more often…. Churning is an illegal practice and it. Life insurance churning is especially common as a result of the high. Brokers churn mutual funds, annuities, and life insurance policies (though the last is commonly called “twisting”).

Source: aegonlife.com

Source: aegonlife.com

Churning is an illegal practice and it. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Life insurance churning is especially common as a result of the high. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning.

Source: pinterest.com

Source: pinterest.com

The churning also keeps oxygen, nitrogen, phosphorus and other nutrients cycling through the atmosphere, oceans and rocks — and chemically transforms them into forms that living. The churning also keeps oxygen, nitrogen, phosphorus and other nutrients cycling through the atmosphere, oceans and rocks — and chemically transforms them into forms that living. While replacement of existing coverage is a perfectly legitimate. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Churning occurs when agents sell policies not for the purpose of benefiting or protecting clients, but instead for the purpose of ear.

Source: slideshare.net

Source: slideshare.net

See further detail related to it here. The agitated mixture foamed and bubbled. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). The churning also keeps oxygen, nitrogen, phosphorus and other nutrients cycling through the atmosphere, oceans and rocks — and chemically transforms them into forms that living. A ny fraud lawyer explains insurance churning.

Source: buyyourproduct.com

Source: buyyourproduct.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value. The most important churning characteristics found in this research are age, the number of times a customer is insured at cz and health consumption. Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Churning occurs when agents sell policies not for the purpose of benefiting or protecting clients, but instead for the purpose of ear.

Source: expertinsurancereviews.com

Source: expertinsurancereviews.com

Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. While replacement of existing coverage is a perfectly legitimate. Churning, also known as twisting, is an attempt by an unscrupulous agent from an insurance company to cancel your existing policy and replace it with a new one, drawing down your cash value. The most important churning characteristics found in this research are age, the number of times a customer is insured at cz and health consumption. If an agent tricks a policyholder into draining his or her life insurance policy to fund a new one with the same insurer it is referred to as churning.

Source: slideshare.net

Source: slideshare.net

Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Insurance churning is a scam designed to defraud people who try to purchase insurance. Churning is excessive trading of assets in a client�s brokerage account in order to generate commissions. Life insurance churning is especially common as a result of the high. Policy churn means replacing an existing life insurance policy with a new one within six months of discontinuing the old policy.

Source: retroatos.blogspot.com

Source: retroatos.blogspot.com

Insurance companies use it to refer to the “customer churn” or attrition rate of customers who stop doing business with them. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Churning is in effect twisting of policies by the existing insurer (coverage with carrier a is replaced with coverage from carrier a). Life assurance companies typically possess a wealth of data covering multiple systems and databases. While replacement of existing coverage is a perfectly legitimate.

Source: hackardlaw.com

Source: hackardlaw.com

A ny fraud lawyer explains insurance churning. While replacement of existing coverage is a perfectly legitimate. Twisting is the act of replacing insurance coverage of one insurer with that of another based on misrepresentations (coverage with carrier a is replaced with coverage from carrier b). Churning occurs when an insurance producer deliberately uses misrepresentations or false statements in order to convince a customer to surrender a life insurance policy in favor of a new one from the same insurer. Churning is illegal and unethical and.

Source: policygenius.com

Source: policygenius.com

The agitated mixture foamed and bubbled. Churning occurs when agents sell policies not for the purpose of benefiting or protecting clients, but instead for the purpose of ear. Churning occurs when an insurance agent replaces a policyholder�s insurance policy for another insurance policy, usually without consulting the policyholder and often with no changes to the coverage itself. Policy churn means replacing an existing life insurance policy with a new one within six months of discontinuing the old policy. While replacement of existing coverage is a perfectly legitimate.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title churning meaning in life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea