Cif insurance policy Idea

Home » Trend » Cif insurance policy IdeaYour Cif insurance policy images are available in this site. Cif insurance policy are a topic that is being searched for and liked by netizens today. You can Get the Cif insurance policy files here. Find and Download all royalty-free photos and vectors.

If you’re looking for cif insurance policy pictures information connected with to the cif insurance policy interest, you have pay a visit to the ideal blog. Our site always gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

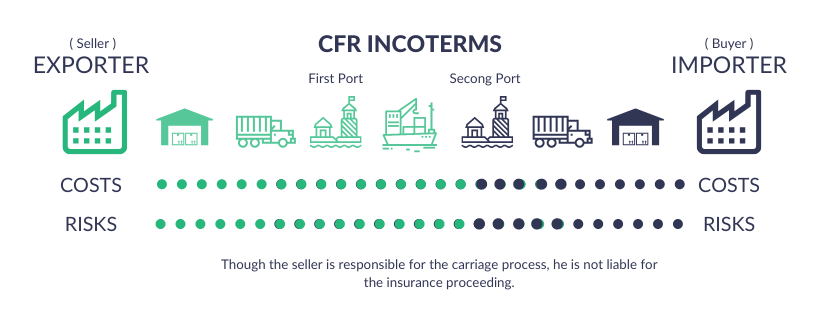

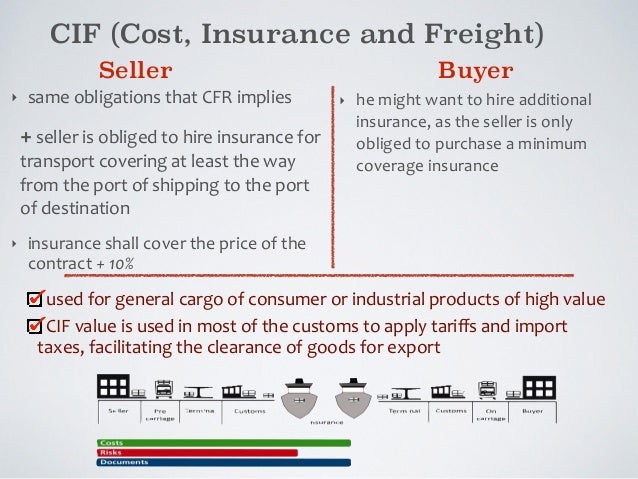

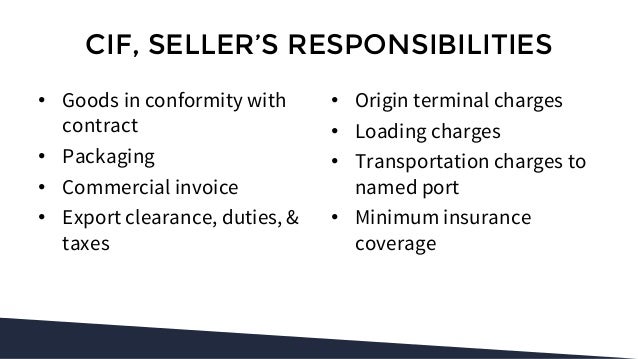

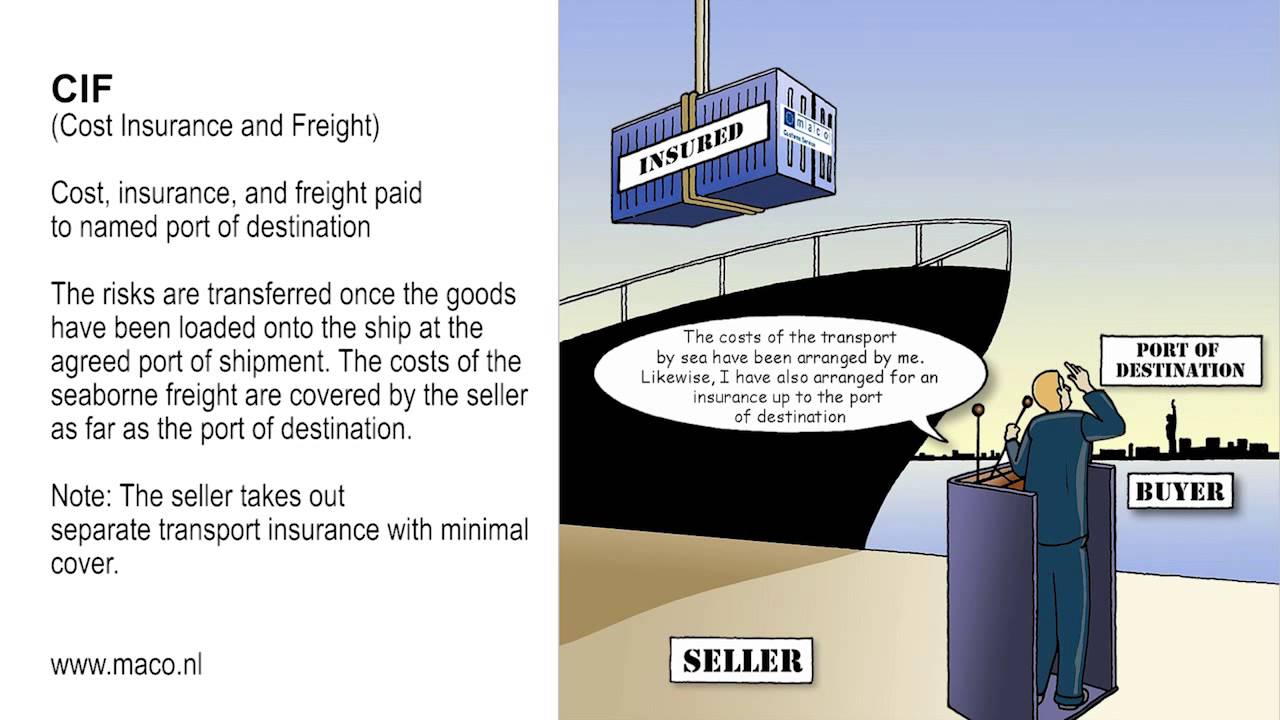

Cif Insurance Policy. The insurance shall be contracted with underwriters or an insurance company of good repute and, failing express agreement to the contrary, be in. Under the incoterms 2020 rules, cif means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point. Only two incoterms rules ( cif, cip) refer to freight insurance, which is to be arranged and paid for by the seller. Under cif, the seller is responsible for the cost and freight of bringing the goods to the port of destination specified by the buyer.

How to calculate minimum insurance cover under CIF From advancedontrade.com

How to calculate minimum insurance cover under CIF From advancedontrade.com

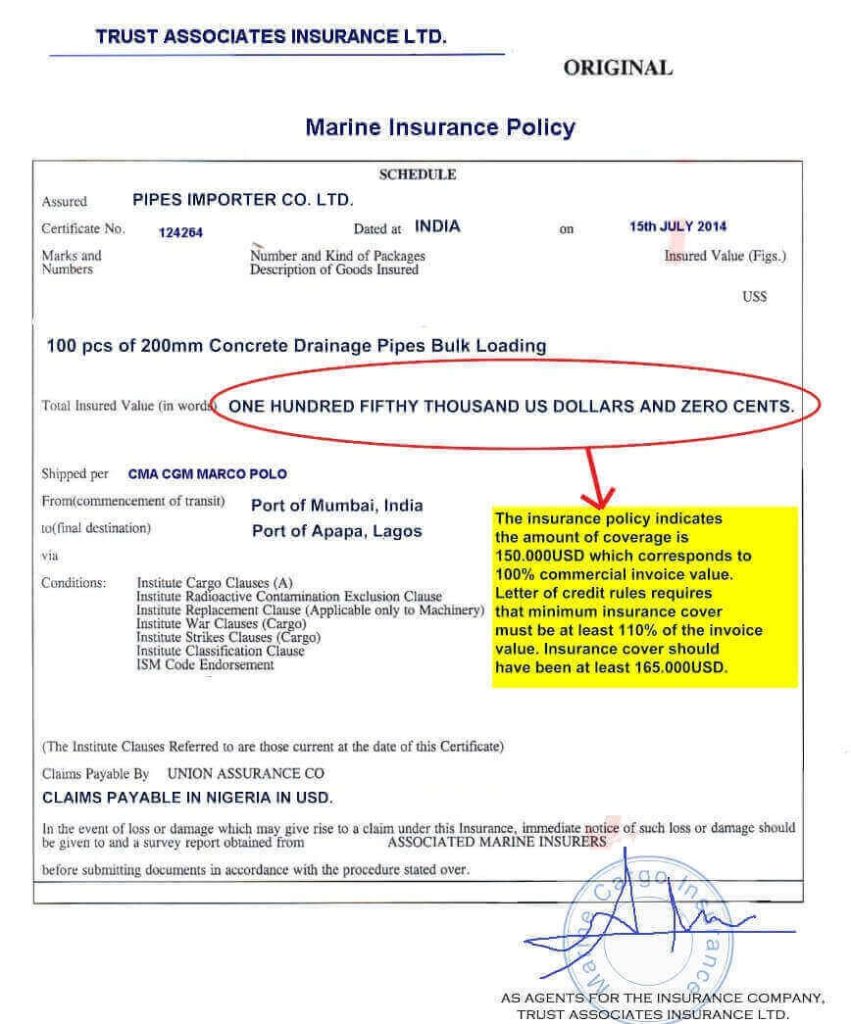

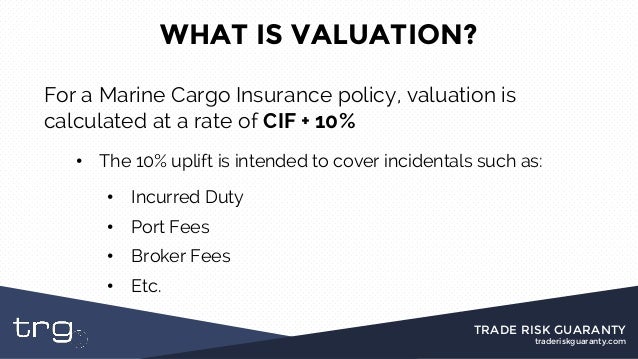

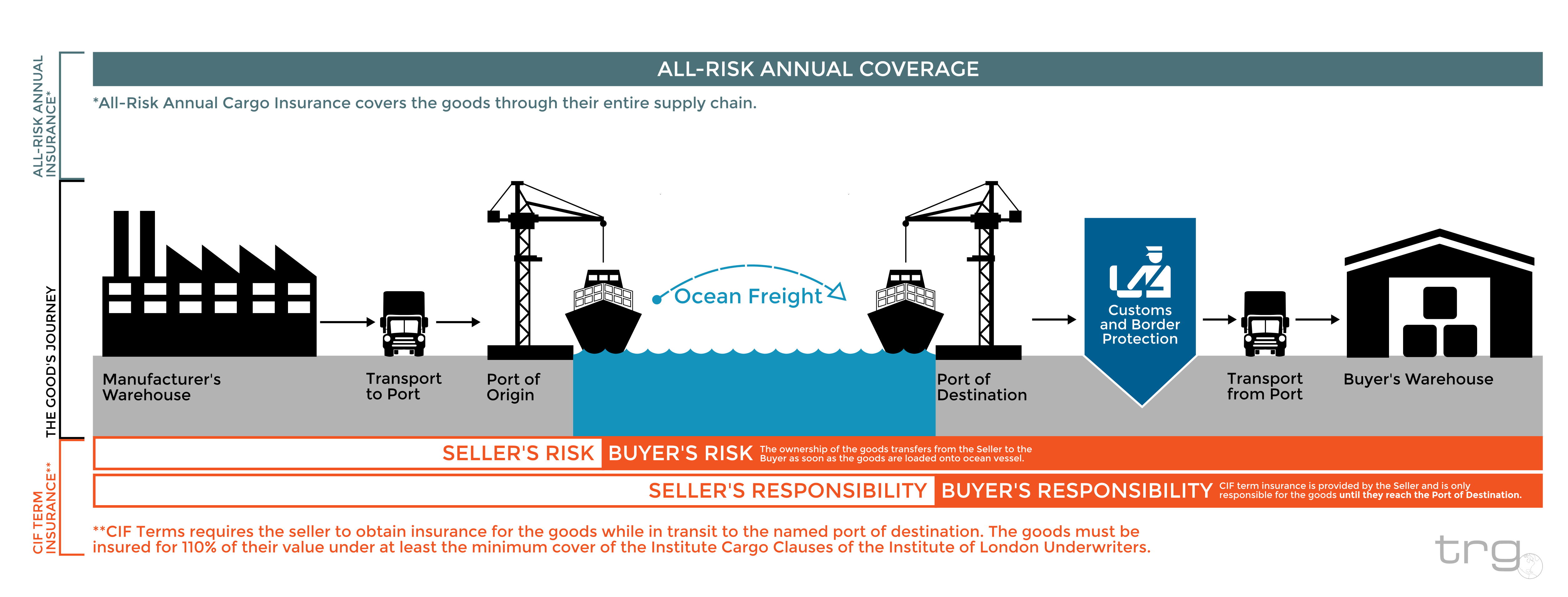

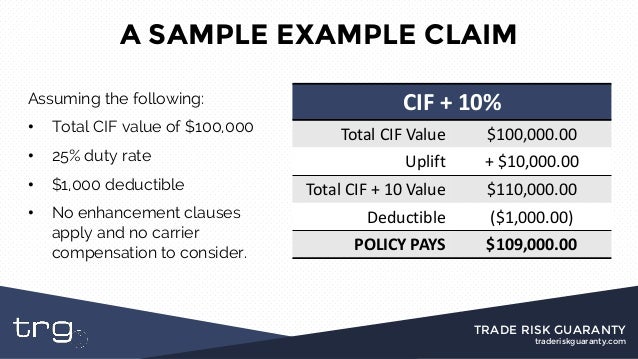

Once the goods arrive at the port of destination, the responsibility for the goods transfers over to the buyer and the cif term no longer applies. Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Normally, the insurance is taken for cif +10%. The risk of loss of or damage to the goods passes when the goods are on board the vessel. Even though the risk transfers to the seller upon loading the goods on board the vessel, in cif the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk. Cif risk transfer takes place when the merchandise.

For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”.

Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. The insurance policy in the c.i.f. The insurance shall be contracted with underwriters or an insurance company of good repute and, failing express agreement to the contrary, be in. Cif risk transfer takes place when the merchandise. Premium the insurance rate depends on a variety of factors such as the nature of the cargo, scope of cover, packing, mode of conveyance, distance and past claims experience. Under cif (short for “cost, insurance and freight”), the seller delivers the goods, cleared for export, onboard the vessel at the port of shipment, pays for the transport of the goods to the port of destination, and also obtains and pays for minimum insurance coverage on the goods through their journey to the named port of destination.

Source: traderiskguaranty.com

Source: traderiskguaranty.com

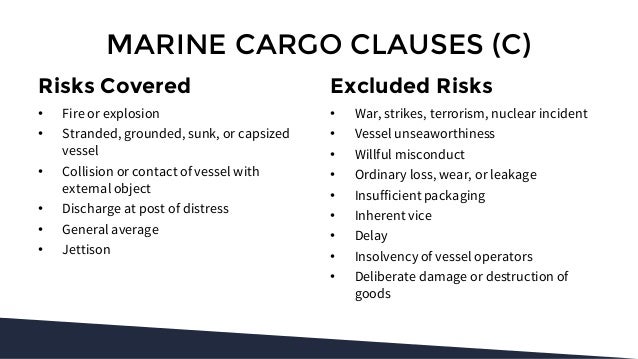

Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Cif incoterm cannot be used for air, rail and road transit. For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”. Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. This will be at institute cargo clauses (c) or similar.

Source: slideshare.net

Source: slideshare.net

In cif terms, the seller clears the goods at origin places the cargo on board and pays for insurance until the port of discharge at the minimum coverage. Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Even though the risk transfers to the seller upon loading the goods on board the vessel, in cif the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk. Cif cannot be used for air transport. The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any

Source: prezi.com

Source: prezi.com

It must always indicate the port of destination, ie cif shanghai. when a price is quoted cif, it means that the selling price includes the cost of the goods, the freight or transport costs and also the cost of marine. Once the goods arrive at the port of destination, the responsibility for the goods transfers over to the buyer and the cif term no longer applies. In cif terms, the seller clears the goods at origin places the cargo on board and pays for insurance until the port of discharge at the minimum coverage. Terkait dengan asuransi pada cif, seller harus membuat kontrak dengan perusahaan asuransi dengan biayanya sendiri. Under cif, the seller is responsible for the cost and freight of bringing the goods to the port of destination specified by the buyer.

Source: dripcapital.com

Source: dripcapital.com

Once the goods arrive at the port of destination, the responsibility for the goods transfers over to the buyer and the cif term no longer applies. What is cif shipping insurance? Penyerahan barang dengan cost, insurance and freight dilakukan di atas kapal, tetapi ongkos angkut dan premi asuransi sudah dibayar oleh penjual sampai ke pelabuhan tujuan, dengan begitu penjual wajib untuk mengurus formalitas ekspor. Policies are customisable to your needs, explore other various types of policies: The seller must give the buyer the insurance policy or a certificate under a policy — this document usually evidences the seller as the party being

Source: slideshare.net

Source: slideshare.net

Shall be entitled to claim directly form the insurer and provide the buyer with the insurance policy or other evidence of insurance cover. The seller must give the buyer the insurance policy or a certificate under a policy — this document usually evidences the seller as the party being Penyerahan barang dengan cost, insurance and freight dilakukan di atas kapal, tetapi ongkos angkut dan premi asuransi sudah dibayar oleh penjual sampai ke pelabuhan tujuan, dengan begitu penjual wajib untuk mengurus formalitas ekspor. Transaction completes the protection afforded to the buyer against loss or damage of the goods by providing cover in situations where the carrier would be excused from liability. Under the incoterms 2020 rules, cif means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point.

Source: politicalandcreditrisks.com

Source: politicalandcreditrisks.com

Cost, insurance and freight (cif) adalah bagian dari incoterms. Under the incoterms 2020 rules, cif means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point. The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any Because the buyer has usually made some form of financial commitment, this can result in massive delays and communication issues while the problems of compensation and replacement are. Under cif (short for “cost, insurance and freight”), the seller delivers the goods, cleared for export, onboard the vessel at the port of shipment, pays for the transport of the goods to the port of destination, and also obtains and pays for minimum insurance coverage on the goods through their journey to the named port of destination.

Source: advancedontrade.com

Source: advancedontrade.com

Cost, insurance and freight (cif) is a common term in a sales contract that may be encountered in international trading when ocean transport is used. Therefor the seller is the beneficiary of a payout should there be a claim. Policies are customisable to your needs, explore other various types of policies: Shall be entitled to claim directly form the insurer and provide the buyer with the insurance policy or other evidence of insurance cover. Loading the goods on board the vessel, in cif the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk.

Source: letterofcredit.biz

Source: letterofcredit.biz

The insurance policy in the c.i.f. Cost, insurance and freight (cif) is a common term in a sales contract that may be encountered in international trading when ocean transport is used. For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”. The insurance shall be contracted with underwriters or an insurance company of good repute and, failing express agreement to the contrary, be in. In cif terms, the seller clears the goods at origin places the cargo on board and pays for insurance until the port of discharge at the minimum coverage.

Source: famousmasahista.blogspot.com

Source: famousmasahista.blogspot.com

This is an agreed value policy. Cif incoterm cannot be used for air, rail and road transit. Under cif, the seller is responsible for the cost and freight of bringing the goods to the port of destination specified by the buyer. Loading the goods on board the vessel, in cif the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk. Under cif (short for “cost, insurance and freight”), the seller delivers the goods, cleared for export, onboard the vessel at the port of shipment, pays for the transport of the goods to the port of destination, and also obtains and pays for minimum insurance coverage on the goods through their journey to the named port of destination.

Source: famousmasahista.blogspot.com

Source: famousmasahista.blogspot.com

Under the incoterms 2020 rules, cif means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point. For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”. The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any Premium the insurance rate depends on a variety of factors such as the nature of the cargo, scope of cover, packing, mode of conveyance, distance and past claims experience. Penyerahan barang dengan cost, insurance and freight dilakukan di atas kapal, tetapi ongkos angkut dan premi asuransi sudah dibayar oleh penjual sampai ke pelabuhan tujuan, dengan begitu penjual wajib untuk mengurus formalitas ekspor.

Source: traderiskguaranty.com

Source: traderiskguaranty.com

Under cif, the seller is responsible for the cost and freight of bringing the goods to the port of destination specified by the buyer. For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”. It must always indicate the port of destination, ie cif shanghai. when a price is quoted cif, it means that the selling price includes the cost of the goods, the freight or transport costs and also the cost of marine. Cost, insurance and freight (cif) is a common term in a sales contract that may be encountered in international trading when ocean transport is used. Transaction completes the protection afforded to the buyer against loss or damage of the goods by providing cover in situations where the carrier would be excused from liability.

Source: emilyvega.blogspot.com

Source: emilyvega.blogspot.com

Under cif (short for “cost, insurance and freight”), the seller delivers the goods, cleared for export, onboard the vessel at the port of shipment, pays for the transport of the goods to the port of destination, and also obtains and pays for minimum insurance coverage on the goods through their journey to the named port of destination. Under a cif contract, the purchaser is obliged to pay against the tender of a clean bill of lading that covers the goods contracted to be sold, an insurance policy and a commercial invoice that shows the price. Cost, insurance and freight (cif) is a common term in a sales contract that may be encountered in international trading when ocean transport is used. The insurance shall be contracted with underwriters or an insurance company of good repute and, failing express agreement to the contrary, be in. What is cif shipping insurance?

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

Normally, the insurance is taken for cif +10%. Policies are customisable to your needs, explore other various types of policies: The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any Definition of cif (cost insurance and freight) incoterms 2020 dictates that the cif incoterm, or “cost, insurance and freight”, is exclusive to maritime shipping. The seller must give the buyer the insurance policy or a certificate under a policy — this document usually evidences the seller as the party being

Source: youtube.com

Source: youtube.com

With cif, sellers own the insurance policy covering the freight while in transit. Therefor the seller is the beneficiary of a payout should there be a claim. Because the buyer has usually made some form of financial commitment, this can result in massive delays and communication issues while the problems of compensation and replacement are. Under the incoterms 2020 rules, cif means the seller is responsible for loading properly packaged goods on board the vessel they’ve nominated, cost of carriage to the named port of destination on the buyer’s side, and insurance to that point. It must always indicate the port of destination, ie cif shanghai. when a price is quoted cif, it means that the selling price includes the cost of the goods, the freight or transport costs and also the cost of marine.

Source: farzanaselamat.blogspot.com

Source: farzanaselamat.blogspot.com

Under a cif contract, the purchaser is obliged to pay against the tender of a clean bill of lading that covers the goods contracted to be sold, an insurance policy and a commercial invoice that shows the price. Even though the risk transfers to the seller upon loading the goods on board the vessel, in cif the seller is obliged to take out the minimum level of insurance cover for the buyer’s risk. The risk of loss of or damage to the goods passes when the goods are on board the vessel. Therefor the seller is the beneficiary of a payout should there be a claim. The seller must give the buyer the insurance policy or a certificate under a policy — this document usually evidences the seller as the party being

Source: famousmasahista.blogspot.com

Source: famousmasahista.blogspot.com

Under a cif contract, the purchaser is obliged to pay against the tender of a clean bill of lading that covers the goods contracted to be sold, an insurance policy and a commercial invoice that shows the price. Policies are customisable to your needs, explore other various types of policies: Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Penyerahan barang dengan cost, insurance and freight dilakukan di atas kapal, tetapi ongkos angkut dan premi asuransi sudah dibayar oleh penjual sampai ke pelabuhan tujuan, dengan begitu penjual wajib untuk mengurus formalitas ekspor. Because the buyer has usually made some form of financial commitment, this can result in massive delays and communication issues while the problems of compensation and replacement are.

Source: youtube.com

Source: youtube.com

With cif, sellers own the insurance policy covering the freight while in transit. This will be at institute cargo clauses (c) or similar. Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Only two incoterms rules ( cif, cip) refer to freight insurance, which is to be arranged and paid for by the seller. Under cif, the seller is responsible for the cost and freight of bringing the goods to the port of destination specified by the buyer.

Source: advancedontrade.com

Source: advancedontrade.com

For the other rules, each party makes a commercial decision as to whether to insure for the part of the journey where they are “on risk”. Under a cif contract, the purchaser is obliged to pay against the tender of a clean bill of lading that covers the goods contracted to be sold, an insurance policy and a commercial invoice that shows the price. Even though the seller pays for insurance during the main carriage, the risk is transferred to the buyer at. Only two incoterms rules ( cif, cip) refer to freight insurance, which is to be arranged and paid for by the seller. In cif terms, the seller clears the goods at origin places the cargo on board and pays for insurance until the port of discharge at the minimum coverage.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cif insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information