Cii insurance exams information

Home » Trending » Cii insurance exams informationYour Cii insurance exams images are ready in this website. Cii insurance exams are a topic that is being searched for and liked by netizens now. You can Download the Cii insurance exams files here. Get all royalty-free photos.

If you’re searching for cii insurance exams images information related to the cii insurance exams interest, you have come to the ideal site. Our website always gives you hints for seeing the highest quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

Cii Insurance Exams. Group risk (gr1) provides an overview of the group risk market. +44 (0)20 8989 8464 email: The certificate develops core knowledge and confidence of the key disciplines needed before you focus your subsequent studies and specialise according to your ambitions and career requirements. You need to provide written evidence from an appropriately qualified professional to confirm your condition and how it would affect your performance during an exam, along with recommend solutions such as extra time, large font question papers and anything else to make sure you have an equal chance of passing your exam.

The Chartered Insurance Institute CII Certificate in Insurance From junior-broker.com

The Chartered Insurance Institute CII Certificate in Insurance From junior-broker.com

The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: The cii recommend between 50 and 100 hours of study, depending on the exam. By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. Motor, household, healthcare and packaged commercial insurances; Group risk (gr1) provides an overview of the group risk market.

It is essential that you familiarise yourself with this before commencing study.

The level 3 certificate in insurance is a core qualification for insurance staff working across all sectors of the profession. By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. If you are relatively new to the profession, you will need every minute of this. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: We are a professional body dedicated to building public trust.

Source: skillsedge.co.uk

Source: skillsedge.co.uk

Please contact customer.serv@cii.co.uk as soon as. Any questions which have been amended since the examination guide was first published will appear below. There is no prescribed order in which units must be taken, but it is strongly recommended that you sit the required core unit(s) first as these provide foundation knowledge upon which the others build. Cii examination questions undergo a rigorous writing and editing process before reaching an examination. The cii level 3 certificate in insurance is for all staff working in the insurance industry.

Source: stuffontoast.com

Source: stuffontoast.com

Cii examination questions undergo a rigorous writing and editing process before reaching an examination. +44 (0)20 8989 8464 email: This unit covers six essential topics, including the insurance market, legal principles, procedures and the major classes of insurance. The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. The cii level 3 certificate in insurance is for all staff working in the insurance industry.

Source: cii.co.uk

Source: cii.co.uk

Questions are very carefully worded to ensure that all the information Motor, household, healthcare and packaged commercial insurances; Group life insurance, group income protection and group critical illness. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: We are a professional body dedicated to building public trust.

Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: The cii level 3 certificate in insurance is for all staff working in the insurance industry. The level 3 certificate in insurance is a core qualification for insurance staff working across all sectors of the profession. You need to provide written evidence from an appropriately qualified professional to confirm your condition and how it would affect your performance during an exam, along with recommend solutions such as extra time, large font question papers and anything else to make sure you have an equal chance of passing your exam. There is no prescribed order in which units must be taken, but it is strongly recommended that you sit the required core unit(s) first as these provide foundation knowledge upon which the others build.

Source: blogs.city.ac.uk

Source: blogs.city.ac.uk

Know how to apply knowledge of principles of premium calculation of general insurance business to a given set of circumstances. Questions are very carefully worded to ensure that all the information Included in assessment only (if available for the unit): There is no prescribed order in which units must be taken, but it is strongly recommended that you sit the required core unit(s) first as these provide foundation knowledge upon which the others build. The questions are written to strict guidelines by practitioners with relevant technical knowledge and experience.

Source: cermpakistan.com

Source: cermpakistan.com

The cii recommend between 50 and 100 hours of study, depending on the exam. Please contact customer.serv@cii.co.uk as soon as. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: The cii level 3 certificate in insurance is for all staff working in the insurance industry. The following information is applicable to candidates wishing to sit cii examinations during 2018.

Questions are very carefully worded to ensure that all the information By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. Chartered insurance institute 3rd floor, 20 fenchurch street london ec3m 3by online webchat service mon to fri: Understand underwriting and policy wordings for general insurance business. Please contact customer.serv@cii.co.uk as soon as.

Source: acecerts.co.uk

Source: acecerts.co.uk

It is essential that you familiarise yourself with this before commencing study. Included in assessment only (if available for the unit): Understand underwriting and policy wordings for general insurance business. By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. Please contact customer.serv@cii.co.uk as soon as.

Source: slideserve.com

Source: slideserve.com

The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. Questions are very carefully worded to ensure that all the information The diploma in regulated financial planning is a ‘level 4’ qualification, made up of six ‘r0’ subjects. The ciigroup.org site is part of the chartered insurance institute. Study text, exam entry and additional revision aids.

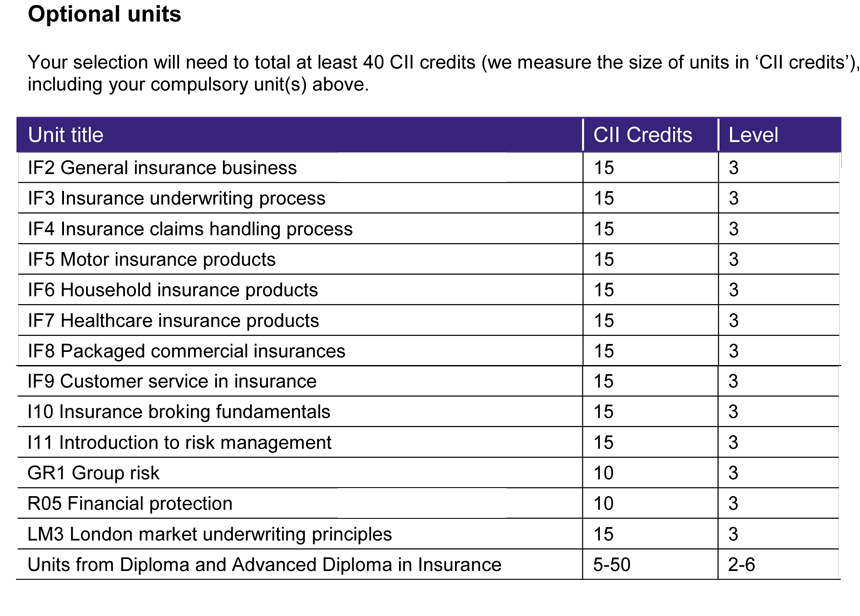

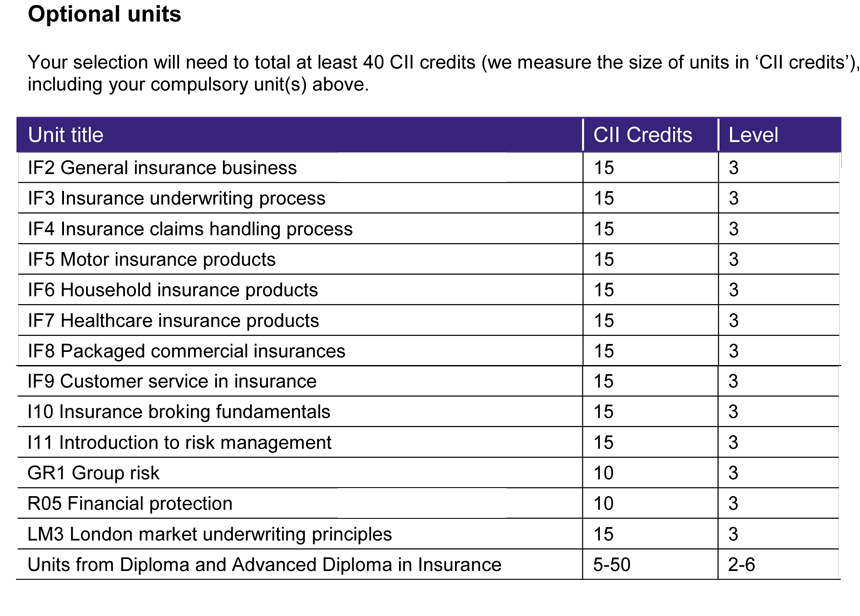

The certificate comprises one core unit and two option units from the cii insurance qualifications framework, providing a minimum total of 40 credits on successful completion. The m05 examination guide for exams from 1 may 2016 to 30 april 2017 was first published in february 2016. Study text, exam entry and additional revision aids. Cii examination questions undergo a rigorous writing and editing process before reaching an examination. If you are relatively new to the profession, you will need every minute of this.

![Home [www.localinstitutes.cii.co.uk] Home [www.localinstitutes.cii.co.uk]](http://www.localinstitutes.cii.co.uk/media/10524/act_one_insurance-qualification-training.jpg?autorotate=true&w=400&h=224&scale=both&mode=crop&anchor=middlecenter) Source: localinstitutes.cii.co.uk

Source: localinstitutes.cii.co.uk

Questions are very carefully worded to ensure that all the information Questions are very carefully worded to ensure that all the information The questions are written to strict guidelines by practitioners with relevant technical knowledge and experience. It is essential that you familiarise yourself with this before commencing study. Know insurance products and associated services for general insurance business.

Source: youracclaim.com

Source: youracclaim.com

Motor, household, healthcare and packaged commercial insurances; Study text, exam entry and additional revision aids. You need to provide written evidence from an appropriately qualified professional to confirm your condition and how it would affect your performance during an exam, along with recommend solutions such as extra time, large font question papers and anything else to make sure you have an equal chance of passing your exam. The questions are written to strict guidelines by practitioners with relevant technical knowledge and experience. Understand underwriting and policy wordings for general insurance business.

Source: garrattsinsurance.co.uk

Source: garrattsinsurance.co.uk

The level 3 certificate in insurance is a core qualification for insurance staff working across all sectors of the profession. There is no prescribed order in which units must be taken, but it is strongly recommended that you sit the required core unit(s) first as these provide foundation knowledge upon which the others build. Telephone service mon to fri: You need to provide written evidence from an appropriately qualified professional to confirm your condition and how it would affect your performance during an exam, along with recommend solutions such as extra time, large font question papers and anything else to make sure you have an equal chance of passing your exam. The certificate develops core knowledge and confidence of the key disciplines needed before you focus your subsequent studies and specialise according to your ambitions and career requirements.

Source: junior-broker.com

Source: junior-broker.com

By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. Group life insurance, group income protection and group critical illness. Questions are very carefully worded to ensure that all the information The ciigroup.org site is part of the chartered insurance institute. The diploma in regulated financial planning is a ‘level 4’ qualification, made up of six ‘r0’ subjects.

Source: iii.ie

Source: iii.ie

Included in enrolment plus (if available for the unit): Included in enrolment plus (if available for the unit): The diploma in regulated financial planning is a ‘level 4’ qualification, made up of six ‘r0’ subjects. Please contact customer.serv@cii.co.uk as soon as. We are a professional body dedicated to building public trust.

Source: financeprofessors.com

Source: financeprofessors.com

The certificate comprises one core unit and two option units from the cii insurance qualifications framework, providing a minimum total of 40 credits on successful completion. Telephone service mon to fri: By using and browsing the cii website, you consent to cookies being used in accordance with our policy.if you do not consent, you are always free to disable cookies if your browser permits, although doing so may interfere with. It covers fundamental risk and insurance principles and procedures, and. Please contact customer.serv@cii.co.uk as soon as.

Source: stuffontoast.com

Source: stuffontoast.com

Included in assessment only (if available for the unit): The cii level 3 certificate in insurance is for all staff working in the insurance industry. Know insurance products and associated services for general insurance business. Motor, household, healthcare and packaged commercial insurances; Included in assessment only (if available for the unit):

Source: reed.co.uk

Source: reed.co.uk

+44 (0)20 8989 8464 email: Group life insurance, group income protection and group critical illness. The following information is applicable to candidates wishing to sit cii examinations during 2018. Know insurance products and associated services for general insurance business. This unit covers six essential topics, including the insurance market, legal principles, procedures and the major classes of insurance.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title cii insurance exams by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea