Civil remedy notice of insurer violation information

Home » Trend » Civil remedy notice of insurer violation informationYour Civil remedy notice of insurer violation images are available in this site. Civil remedy notice of insurer violation are a topic that is being searched for and liked by netizens now. You can Get the Civil remedy notice of insurer violation files here. Find and Download all free vectors.

If you’re searching for civil remedy notice of insurer violation pictures information related to the civil remedy notice of insurer violation interest, you have come to the right site. Our site always gives you suggestions for viewing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

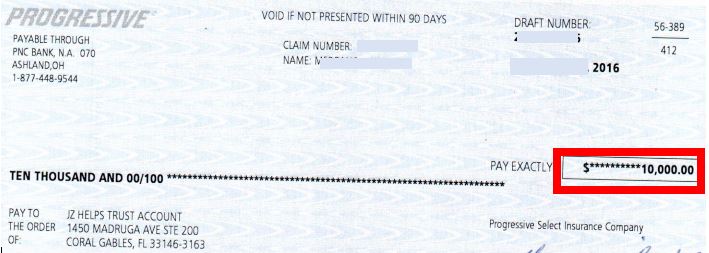

Civil Remedy Notice Of Insurer Violation. The department of financial services explains, The company responded outside of the statutory period citing outside factors claiming that the civil remedy notice (crn) was invalid. This form should be completed in its entirety and the applicable items checked. The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer.

Civil Remedy Notice Of Insurer Violation Florida at Insurance From revisi.net

Civil Remedy Notice Of Insurer Violation Florida at Insurance From revisi.net

One of your options is to file a civil remedy notice of insurer violation, or crn, with the department of financial services. Select the form you need in the collection of templates. Further, the insurer argued that the crn’s lack of requisite specificity precluded the insurer from an. The civil remedy notice is intended for use. The department of financial services explains, The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer.

This notice is commonly referred to as the civil remedy notice, or “crn.” the crn must contain the following specific information:

Further, the insurer argued that the crn’s lack of requisite specificity precluded the insurer from an. The department of financial services explains, The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. The insurer denied the assertions in the civil remedy notice. Further, the insurer argued that the crn’s lack of requisite specificity precluded the insurer from an. This form should be completed in its entirety and the applicable items checked.

Source: revisi.net

Source: revisi.net

The civil remedy notice is intended for use. As a condition precedent to filing a first party bad faith civil action under §624.155, the insured must give the florida department of financial services and the authorized insurer sixty (60) days written notice of the violation. A request for insurance assistance is different than filing a civil remedy notice (crn) of insurer violation. Log in to your registered account. Select the form you need in the collection of templates.

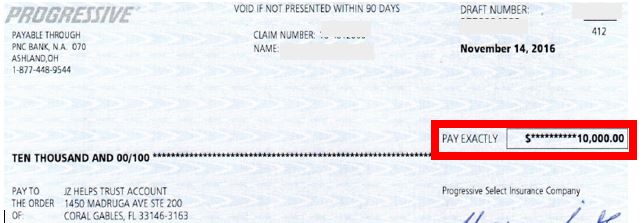

Source: justinziegler.net

Source: justinziegler.net

The carrier argued that the claimant could not prove they had actually sent a. The carrier argued that the claimant could not prove they had actually sent a. Follow these simple actions to get civil remedy notice of insurer violation instructions. Florida statute §624.155 mandates that any person may bring a civil action against an insurer when such person is damaged by the insurer’s violation of various statutory provisions. This system is intended for use by parties who are beginning the process of filing suit against an insurer when they feel they have been damaged by specific acts of.

Source: justinziegler.net

Source: justinziegler.net

This form should be completed in its entirety and the applicable items checked. Add statutory provision(s) which the insurer allegedly violated. Add statutory provision(s) which the insurer allegedly violated. If you are having issues with an insurance company and a florida insurance policy, you (or your lawyer) can file a crn against the insurance company. This form should be completed in its entirety and the applicable items checked.

Source: signnow.com

Source: signnow.com

No bad faith action shall lie “if, within 60 days after the insurer receives notice from the department in accordance with this subsection, the damages are paid or the circumstances. If you are having issues with an insurance company and a florida insurance policy, you (or your lawyer) can file a crn against the insurance company. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial. With the collaboration between signnow and chrome, easily find its extension in the web store and use it to esign florida civil remedy notice right in your browser. Florida’s civil remedy notice and bad faith claims adjusting june 24, 2020 under florida statute § 624.155, any person may bring a civil action against an insurer when such person is damaged by the insurer’s violation of statutory provisions.

Source: revisi.net

Source: revisi.net

Add statutory provision(s) which the insurer allegedly violated. In a recent decision, florida’s fourth district court of appeal addressed the mandatory requirement that a civil remedy notice of insurer violation is a condition precedent and must be sufficiently specific to comply with florida’s bad faith statute, section 624.155: The guidelines below will help you create an esignature for signing civil remedy notice in chrome: If you are a new user, please read the information below before you submit a civil remedy notice of insurer violation. Log in to your registered account.

Source: frauddocumentation.com

Source: frauddocumentation.com

Add statutory provision(s) which the insurer allegedly violated. The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. A request for insurance assistance is different than filing a civil remedy notice (crn) of insurer violation. Add statutory provision(s) which the insurer allegedly violated. Add statutory provision(s) which the insurer allegedly violated.

Source: npa1.org

Source: npa1.org

This civil remedy notice is a prerequisite to initiating such a bad faith claim; Procedures regarding the civil remedy notice (“crn”), which is required by florida law for prosecution of a statutory bad faith claim against an insurer. One of your options is to file a civil remedy notice of insurer violation, or crn, with the department of financial services. Add statutory provision(s) which the insurer allegedly violated. This form should be completed in its entirety and the applicable items checked.

Source: pdffiller.com

Source: pdffiller.com

The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial. Follow these simple actions to get civil remedy notice of insurer violation instructions. As a condition precedent to filing a first party bad faith civil action under §624.155, the insured must give the florida department of financial services and the authorized insurer sixty (60) days written notice of the violation. A request for insurance assistance is different than filing a civil remedy notice (crn) of insurer violation.

Source: reathr.reklamabil.com

Source: reathr.reklamabil.com

This system is intended for use by parties who are beginning the process of filing suit against an insurer when they feel they have been damaged by specific acts of. The carrier argued that the claimant could not prove they had actually sent a. A civil remedy notice is a prerequisite to filing a bad faith action after statutory violations have occurred. Log in to your registered account. The crn serves as notice to the insurance company that a bad faith claim is forthcoming.

Source: revisi.net

Source: revisi.net

One of your options is to file a civil remedy notice of insurer violation, or crn, with the department of financial services. The civil remedy notice is intended for use. This form should be completed in its entirety and the applicable items checked. The third requirement is for the insured to file a civil remedy notice (known as a “crn”) as a condition precedent to filing a statutory bad faith lawsuit giving the insurer 60 days’ notice of the bad faith violation and to cure the violation, i.e.,. Add statutory provision(s) which the insurer allegedly violated.

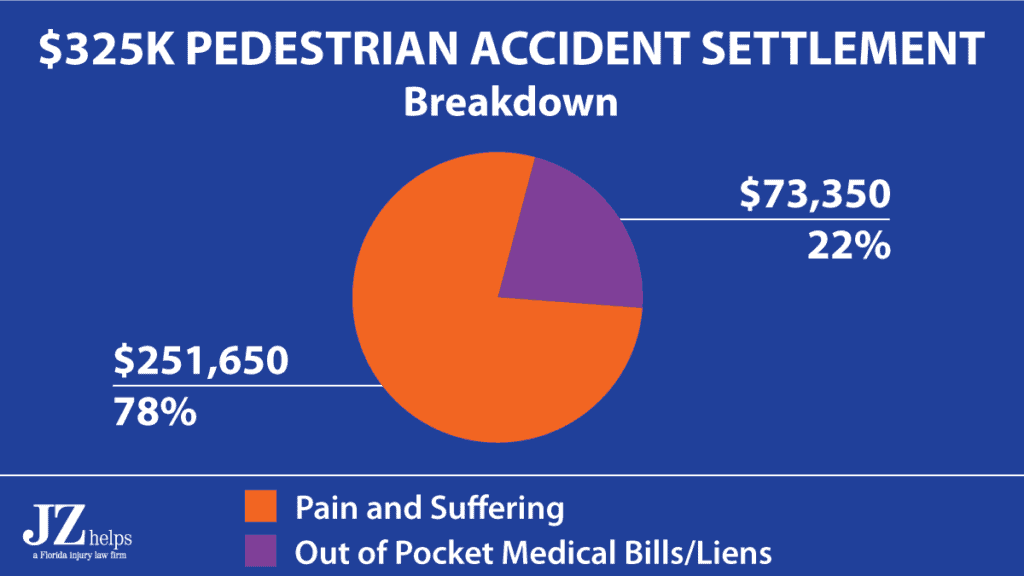

Source: justinziegler.net

Source: justinziegler.net

Is a consumer complaint different from a civil remedy notice (crn)? The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. Florida’s civil remedy notice and bad faith claims adjusting june 24, 2020 under florida statute § 624.155, any person may bring a civil action against an insurer when such person is damaged by the insurer’s violation of statutory provisions. The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. The company responded outside of the statutory period citing outside factors claiming that the civil remedy notice (crn) was invalid.

Source: frauddocumentation.com

Source: frauddocumentation.com

If you are having issues with an insurance company and a florida insurance policy, you (or your lawyer) can file a crn against the insurance company. One of your options is to file a civil remedy notice of insurer violation, or crn, with the department of financial services. A civil remedy notice of bad faith may have been sent to the wrong address for the insurer. The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. With the collaboration between signnow and chrome, easily find its extension in the web store and use it to esign florida civil remedy notice right in your browser.

Source: frauddocumentation.com

Source: frauddocumentation.com

Floridians who have suffered damages because of an insurer’s conduct have a right to civil remedies. A civil remedy notice is a prerequisite to filing a bad faith action after statutory violations have occurred. A request for insurance assistance is different than filing a civil remedy notice (crn) of insurer violation. Thereafter, the homeowners served a proposal for settlement / offer of judgment. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial.

Source: justinziegler.net

Source: justinziegler.net

Thereafter, the homeowners served a proposal for settlement / offer of judgment. This form should be completed in its entirety and the applicable items checked. The company responded outside of the statutory period citing outside factors claiming that the civil remedy notice (crn) was invalid. Is a consumer complaint different from a civil remedy notice (crn)? The notice specifies the statutory violations committed by the insurer and gives the insurer 60 days to cure the violation.

Source: itsaboutjustice.law

Source: itsaboutjustice.law

The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. This form should be completed in its entirety and the applicable items checked. The civil remedy notice is intended for use. Return this form to the florida department of insurance at. Select the form you need in the collection of templates.

Source: revisi.net

Source: revisi.net

Add statutory provision(s) which the insurer allegedly violated. Florida’s civil remedy notice and bad faith claims adjusting june 24, 2020 under florida statute § 624.155, any person may bring a civil action against an insurer when such person is damaged by the insurer’s violation of statutory provisions. Floridians who have suffered damages because of an insurer’s conduct have a right to civil remedies. Add statutory provision(s) which the insurer allegedly violated. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial.

Source: justinziegler.net

Source: justinziegler.net

The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer. Go through the instructions to learn which information you must include. Add statutory provision(s) which the insurer allegedly violated. The notice is intended to meet a portion of legal requirements set forth in section 624.155, florida statutes, which requires a party to file notice with the department of financial. The civil remedy notice is intended for use by parties who are beginning the process of filing suit against an insurer, when a party feels they have been damaged by specific acts of the insurer.

Source: offerincompromiseyoitsuma.blogspot.com

Source: offerincompromiseyoitsuma.blogspot.com

The insurer defended by stating that appraisal and the timely payment of the appraisal award cured the insureds’ civil remedy notice, thus obviating their right to a bad faith lawsuit pursuant to the civil remedy notice statute. The third requirement is for the insured to file a civil remedy notice (known as a “crn”) as a condition precedent to filing a statutory bad faith lawsuit giving the insurer 60 days’ notice of the bad faith violation and to cure the violation, i.e.,. Under florida statute section 624.155, insurers must act in good faith in settling their policyholders’ claims. Civil remedy notice of insurer violation. Find the extension in the web store and push add.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title civil remedy notice of insurer violation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information