Claim percentage insurance companies Idea

Home » Trending » Claim percentage insurance companies IdeaYour Claim percentage insurance companies images are ready. Claim percentage insurance companies are a topic that is being searched for and liked by netizens now. You can Find and Download the Claim percentage insurance companies files here. Get all royalty-free photos and vectors.

If you’re looking for claim percentage insurance companies pictures information related to the claim percentage insurance companies keyword, you have pay a visit to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

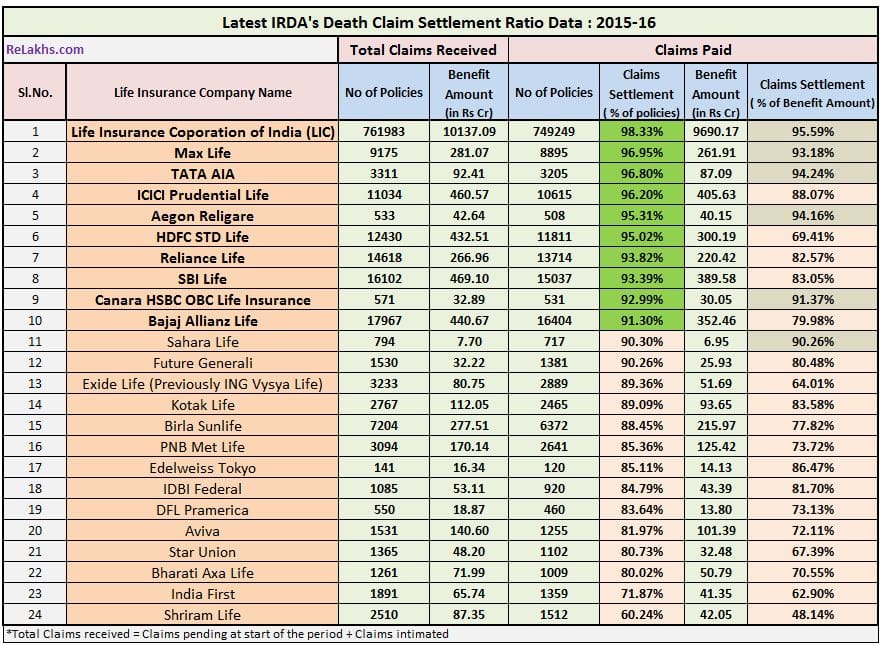

Claim Percentage Insurance Companies. The insurer evaluates your claim. One should immediately contact the insurance company and claim should be raised as soon as possible. Some contractors may ask you to sign a direction to pay form that allows your insurance company to pay the firm directly. This is followed by hdfc life insurance and tata aia life insurance with 99.07% and 99.06%, respectively.

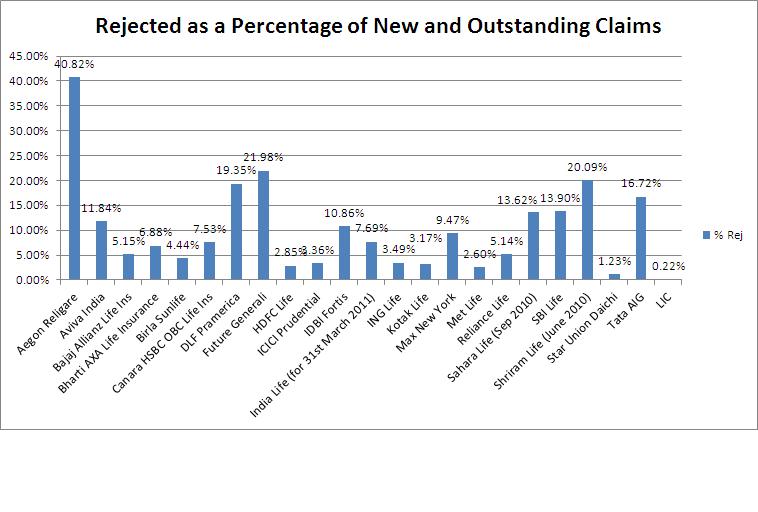

Star health and allied insurance co. Max life insurance has the highest claim settlement ratio in terms of number of claims with 99.22%. This is followed by hdfc life insurance and tata aia life insurance with 99.07% and 99.06%, respectively. As reported by the aarp1, estimates from us department of labor say that around 14% of all submitted medical claims are rejected. Car insurance claim statistics report that $166.7 billion was spent on car accidents in 2008, while another $99 billion went to weather and catastrophe claims. This form is a legal document, so you should read it carefully to be sure you are not also assigning your entire claim over to the contractor.

Claim settlement ratio is the percentage of claims that an insurance company has paid out in a financial year compared to the number of claims received.

So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%. Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. The legal aspect involving a company is significantly different than an insurance company’s claim culture. This means that the insurance policy is priced properly and has the right features. Star health and allied insurance co. That’s one claim in seven, which amounts to over 200 million denied claims a day.

Source: mintwise.com

Source: mintwise.com

Bharti axa has a wide network and trained insurance distributors who can provide perfect financial service to different customers. Such a scenario is better for the health insurance company and the policyholders as well. This insurance claims metric is defined as the division between the total number of claims processed over a certain period of time and the number of employees working within the claims department (e.g., claims adjusters, underwriters, etc.) of an insurance company. If you have a complex claim, then it could take weeks to evaluate damages. The legal aspect involving a company is significantly different than an insurance company’s claim culture.

Source: onemint.com

Source: onemint.com

Some contractors may ask you to sign a direction to pay form that allows your insurance company to pay the firm directly. Claim settlement ratio is calculated as claims settled in a year divided by the total claims received in a year multiplied by 100. Even if the payout for claims is 100% of the. The formula to calculate the claim settlement ratio is calculated by dividing the number of insurance claims settled by the number of insurance claims received by the insurance company. Star health and allied insurance co.

Source: basunivesh.com

Source: basunivesh.com

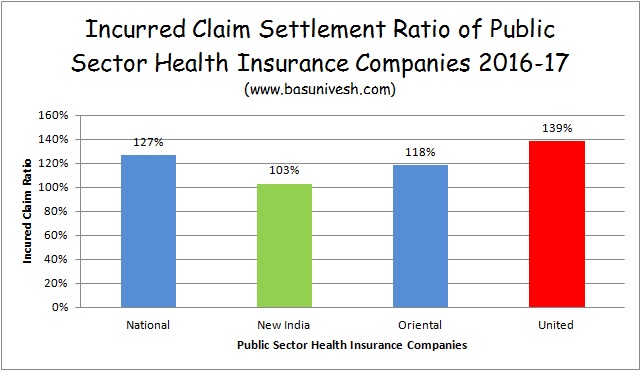

The higher the ratio, the lower the chances of claim rejection. The following methods are used by insurance corporations to calculate profits: Nationwide is ranked higher than most insurance companies based on claim customer satisfaction. Such a scenario is better for the health insurance company and the policyholders as well. What is claim settlement in car insurance?

Source: relakhs.com

Source: relakhs.com

It is best to go for an insurer who has a high. If 80 out of 100 claims are settled then the csr is 80%. This percentage is regarded to be a reliable metric for determining if an insurer comes to your rescue when the need arises. This form is a legal document, so you should read it carefully to be sure you are not also assigning your entire claim over to the contractor. The insurer will verify any documentation you provided.

Source: moneyexcel.com

Source: moneyexcel.com

Max bupa health insurance co. Claim settlement ratio is the percentage of claims that an insurance company has paid out in a financial year compared to the number of claims received. 3) incurred claim ratio of health insurance company is more than 50% and less than 100%: It is best to go for an insurer who has a high. Therefore basic formula to calculate profits for the insurance companies is :

Source: basunivesh.com

Source: basunivesh.com

The higher the ratio, the lower the chances of claim rejection. The insurance company starts your claim and gives you a claim number. Maintain the records of the accident with medical bills, car repair invoice, bills, fir copy, etc., to explain the event correctly, which can expedite the process. The insurer dispatches an adjuster to evaluate the damage. Nationwide is ranked higher than most insurance companies based on claim customer satisfaction.

Source: basunivesh.com

Source: basunivesh.com

Out of the top 10 life insurers, nine have a claim settlement ratio of more than 98%. Car insurance claim statistics report that $166.7 billion was spent on car accidents in 2008, while another $99 billion went to weather and catastrophe claims. What is claim settlement in car insurance? This form is a legal document, so you should read it carefully to be sure you are not also assigning your entire claim over to the contractor. Your insurance company may pay your contractor directly.

Source: basunivesh.com

Source: basunivesh.com

This is the most likely bracket to be in out of the three. What is claim settlement in car insurance? A loss ratio is a percentage based on how much they pay in claims. Manipal cigna health insurance co.ltd. Car insurance claim statistics report that $166.7 billion was spent on car accidents in 2008, while another $99 billion went to weather and catastrophe claims.

The following methods are used by insurance corporations to calculate profits: Your insurer evaluates the claim: Points to remember you must consider various other factors before selecting your insurer. A percentage is calculated based on the company’s performance. Manipal cigna health insurance co.ltd.

Source: moneyexcel.com

Source: moneyexcel.com

Claims for an accident cost so much more than just the actual costs of repairs. Manipal cigna health insurance co.ltd. Maintain the records of the accident with medical bills, car repair invoice, bills, fir copy, etc., to explain the event correctly, which can expedite the process. Bharti axa has a wide network and trained insurance distributors who can provide perfect financial service to different customers. This percentage is regarded to be a reliable metric for determining if an insurer comes to your rescue when the need arises.

Source: quora.com

Nationwide is ranked higher than most insurance companies based on claim customer satisfaction. One good parameter to compare different insurance policies is the car insurance claim settlement ratio (csr). The higher the ratio, the lower the chances of claim rejection. Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. Hence, in case the claim settlement ratio of a company stands at 90%, it means that 90 claims out of the 100 filed have been settled.

Source: basunivesh.com

Source: basunivesh.com

Hence, in case the claim settlement ratio of a company stands at 90%, it means that 90 claims out of the 100 filed have been settled. Claim settlement ratio is the percentage of claims settled by the insurance company against the total number of claims made against it. One good parameter to compare different insurance policies is the car insurance claim settlement ratio (csr). They have a huge number of satisfied customers. A claim settlement ratio is basically the ratio of settled claims to the total claims filed in a particular accounting period.

Source: relakhs.com

Source: relakhs.com

The legal aspect involving a company is significantly different than an insurance company’s claim culture. The higher the ratio, the lower the chances of claim rejection. 25 rows here is a table showing the claim settlement ratio of all life insurance. This is followed by hdfc life insurance and tata aia life insurance with 99.07% and 99.06%, respectively. Average value according to the national association of insurance commissioners , the average losses incurred across all lines of insurance is 55.2%.

Source: relakhs.com

Source: relakhs.com

Points to remember you must consider various other factors before selecting your insurer. Therefore basic formula to calculate profits for the insurance companies is : They have a huge number of satisfied customers. Claim settlement ratio is calculated as claims settled in a year divided by the total claims received in a year multiplied by 100. The following methods are used by insurance corporations to calculate profits:

Source: noclutter.cloud

Source: noclutter.cloud

Max life insurance has the highest claim settlement ratio in terms of number of claims with 99.22%. Your insurer evaluates the claim: Auto insurance claim settlements amount to several billion dollars every year. Even if the payout for claims is 100% of the. Max bupa health insurance co.

Source: insurancefunda.in

Source: insurancefunda.in

Such a scenario is better for the health insurance company and the policyholders as well. Your insurance company may pay your contractor directly. 25 rows here is a table showing the claim settlement ratio of all life insurance. Bharti axa has a wide network and trained insurance distributors who can provide perfect financial service to different customers. So, if an insurance company settles 95 out of 100 claims made on it in one financial year, its claim settlement ratio would be 95%.

Source: relakhs.com

Source: relakhs.com

Claims for an accident cost so much more than just the actual costs of repairs. The insurance company starts your claim and gives you a claim number. The insurer will verify any documentation you provided. Auto insurance claim settlements amount to several billion dollars every year. Hence, in case the claim settlement ratio of a company stands at 90%, it means that 90 claims out of the 100 filed have been settled.

Source: insurancefunda.in

Source: insurancefunda.in

Star health and allied insurance co. If 80 out of 100 claims are settled then the csr is 80%. What is claim settlement in car insurance? The higher the csr, the better it is. This is the most likely bracket to be in out of the three.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claim percentage insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea