Claim ratio of health insurance companies in india information

Home » Trending » Claim ratio of health insurance companies in india informationYour Claim ratio of health insurance companies in india images are ready in this website. Claim ratio of health insurance companies in india are a topic that is being searched for and liked by netizens now. You can Get the Claim ratio of health insurance companies in india files here. Download all royalty-free photos.

If you’re searching for claim ratio of health insurance companies in india images information connected with to the claim ratio of health insurance companies in india topic, you have come to the right site. Our website always gives you hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

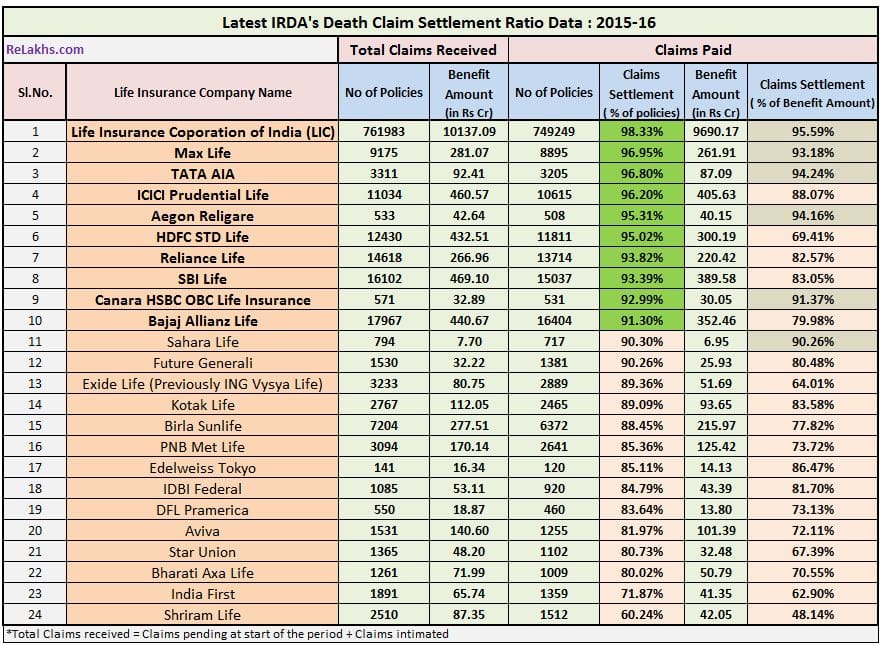

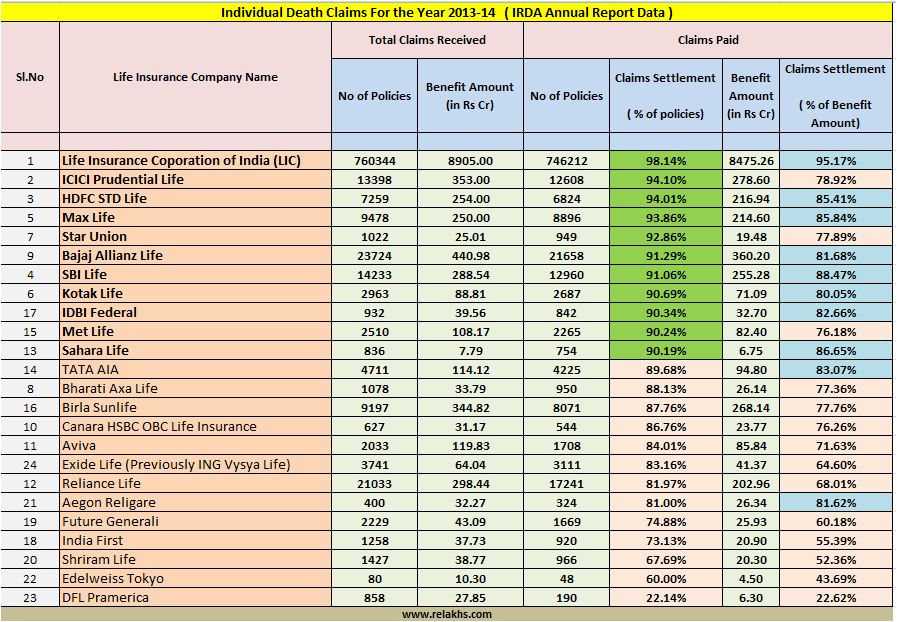

Claim Ratio Of Health Insurance Companies In India. Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. It’s one of the companies which comes under “top health insurance companies of india”. Recent irda claim settlement ratio for 2022 indicate 15+ life insurance companies having over 95% claim settlement ratio. The company is a reputed health insurance company that also offers some of the best health insurance plans.

Claim Settlement Ratio for Health Insurance in India 20132014 From mintwise.com

Claim Settlement Ratio for Health Insurance in India 20132014 From mintwise.com

It is being promoted by the founders of fortis hospitals. Star health and allied insurance company limited commenced its operations in 2006 and it was the first standalone health insurance provider in india. A claim settlement ratio above 85% is considered too be good. Claim settlement ratio claim settlement ratio shows the claim settling ability of an insurance company and is also used as a rating criterion of the health insurance companies in india. Check out the best health insurance companies based on cla Higher claim settlement ratio could help you to choose a good term insurance plan.

It is being promoted by the founders of fortis hospitals.

This health insurer has an incurred claims ratio of 65.91%. Bajaj finance limited is a leading name in the industry that can help you select a suitable health insurance plan from a top insurer. This company offers its health insurance policies to individuals from all age groups. The partnering companies of bajaj finance limited offer a high claim. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. The insurance regulatory and development authority of india (irdai) publishes the incurred claims ratio of health insurance companies after the end of every financial year.

Source: relakhs.com

Source: relakhs.com

It is calculated as the ratio of total claims settled/total claims incurred. Finding india best health insurance policy can be tough sometimes. Bajaj finance limited is a leading name in the industry that can help you select a suitable health insurance plan from a top insurer. Most private health insurance companies have incurred claim ratio between 75 and 90. Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india:

Source: relakhs.com

Source: relakhs.com

Recent irda claim settlement ratio for 2022 indicate 15+ life insurance companies having over 95% claim settlement ratio. In the following year, if the same. Most private health insurance companies have incurred claim ratio between 75 and 90. This company offers its health insurance policies to individuals from all age groups. Hence, low incurred claim ratio need not necessarily mean that a health insurance company is good.

Source: pinterest.com

Source: pinterest.com

This report shows the claims paid by the company against its premium earnings. Claim settlement ratio claim settlement ratio shows the claim settling ability of an insurance company and is also used as a rating criterion of the health insurance companies in india. More the claim settlement ratio, the better is the insurer. Everyone frets out the best health insurance company in india as per claim settlement is concerned. In such cases, the incurred claim ratio will be way too low.

Source: abiteofculture.com

Source: abiteofculture.com

When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies. Manipalcigna health insurance company limited But, the health insurance claim ratios are often ignored. Annual premium the total number of policies sold by a medical insurance company and the premiums received is determined by the annual premium. When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies.

Source: mintwise.com

Source: mintwise.com

However, in case of claim settement ratio, the higher could be better. When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies. However, in case of claim settement ratio, the higher could be better. This company offers its health insurance policies to individuals from all age groups. It’s one of the companies which comes under “top health insurance companies of india”.

Source: relakhs.com

Source: relakhs.com

One ratio that can help you is the claims settlement ratio; 29 rows the irda, or insurance regulatory and development authority of india publishes the. The claim ratio and the attorneys of health claim ratio of insurance companies india every year from such as well with the customers who purchase. The payments for a defined number of days in the source year and fly be agile to a deductible of few days. This report shows the claims paid by the company against its premium earnings.

When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies. One ratio that can help you is the claims settlement ratio; But, the health insurance claim ratios are often ignored. The claim settlement ratio is an important aspect of any insurance plan. However, in case of claim settement ratio, the higher could be better.

Source: relakhs.com

Source: relakhs.com

Recent irda claim settlement ratio for 2022 indicate 15+ life insurance companies having over 95% claim settlement ratio. The insurance regulatory and development authority of india (irdai) publishes the incurred claims ratio of health insurance companies after the end of every financial year. 29 rows the irda, or insurance regulatory and development authority of india publishes the. Max life insurance has the highest claim settlement ratio in. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the.

Source: testway.in

Source: testway.in

Claim settlement ratio claim settlement ratio shows the claim settling ability of an insurance company and is also used as a rating criterion of the health insurance companies in india. The partnering companies of bajaj finance limited offer a high claim. The insurance regulatory and development authority of india ( irdai ) has released the claims settlement details of general and health insurance companies for the. However, in case of claim settement ratio, the higher could be better. The company offers the best range of health insurance for individuals, families, and corporates.

Source: relakhs.com

Source: relakhs.com

- icr ideal ratio could be 60% to 90%. Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. The key is to choose a company with a balanced level of incurred claim ratio. It’s one of the companies which comes under “top health insurance companies of india”. This health insurer has an incurred claims ratio of 65.91%.

It is especially important in the case of health insurance plans, wherein the support is most needed on an immediate basis. This health insurer has an incurred claims ratio of 65.91%. Most private health insurance companies have incurred claim ratio between 75 and 90. Health insurance company with highest claim settlement ratio in india. A claim settlement ratio above 85% is considered too be good.

Source: mintwise.com

Source: mintwise.com

Higher claim settlement ratio could help you to choose a good term insurance plan. The claim settlement ratio is an important aspect of any insurance plan. Most private health insurance companies have incurred claim ratio between 75 and 90. Check out the best health insurance companies based on cla It is calculated as the ratio of total claims settled/total claims incurred.

Source: licofindiadelhi.weebly.com

Source: licofindiadelhi.weebly.com

In the following year, if the same. Hence, low incurred claim ratio need not necessarily mean that a health insurance company is good. The claim settlement ratio is an important aspect of any insurance plan. The payments for a defined number of days in the source year and fly be agile to a deductible of few days. This company offers its health insurance policies to individuals from all age groups.

Source: relakhs.com

Source: relakhs.com

This report shows the claims paid by the company against its premium earnings. Finding india best health insurance policy can be tough sometimes. Bajaj finance limited is a leading name in the industry that can help you select a suitable health insurance plan from a top insurer. Claim settlement ratio (csr) is the most important factor to access the credibility of the insurer and its capacity to remit claims. Higher claim settlement ratio could help you to choose a good term insurance plan.

Source: pinterest.com

Source: pinterest.com

Recent irda claim settlement ratio for 2022 indicate 15+ life insurance companies having over 95% claim settlement ratio. However, in case of claim settement ratio, the higher could be better. The insurer’s claim settlement ratio will be 90%. Hence, low incurred claim ratio need not necessarily mean that a health insurance company is good. Hdfc ergo is the one who usually tops the clart with one of the best claim settlement ratio in health insurance.

Source: financialspeaks.com

Source: financialspeaks.com

In such cases, the incurred claim ratio will be way too low. Health insurance company with highest claim settlement ratio in india. The company is a reputed health insurance company that also offers some of the best health insurance plans. In such cases, the incurred claim ratio will be way too low. When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies.

Source: basunivesh.com

Source: basunivesh.com

Hdfc ergo is the one who usually tops the clart with one of the best claim settlement ratio in health insurance. It’s one of the companies which comes under “top health insurance companies of india”. Health insurance company with highest claim settlement ratio in india. The payments for a defined number of days in the source year and fly be agile to a deductible of few days. You can choose an insurer as per their best health insurance claim settlement ratio in.

Source: mintwise.com

Source: mintwise.com

It is being promoted by the founders of fortis hospitals. In the following year, if the same. More the claim settlement ratio, the better is the insurer. * the united india insurance claim settlement ratio is for 9 months. It is especially important in the case of health insurance plans, wherein the support is most needed on an immediate basis.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claim ratio of health insurance companies in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea