Claim ratio of life insurance companies Idea

Home » Trending » Claim ratio of life insurance companies IdeaYour Claim ratio of life insurance companies images are ready in this website. Claim ratio of life insurance companies are a topic that is being searched for and liked by netizens now. You can Find and Download the Claim ratio of life insurance companies files here. Get all royalty-free photos and vectors.

If you’re looking for claim ratio of life insurance companies images information connected with to the claim ratio of life insurance companies topic, you have pay a visit to the ideal blog. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Claim Ratio Of Life Insurance Companies. Bajaj allianz life insurance company limited. Max life insurance company limited: Tata aia life insurance company. Csr is a good indicator of the claim settlement rate of an insurance company.

IRDA Claim Settlement Ratio 201617 Best Life Insurance From basunivesh.com

IRDA Claim Settlement Ratio 201617 Best Life Insurance From basunivesh.com

The claim pending ratio of the insurer is (30/1300)*100 = 2.3%. Icici prudential life insurance company limited: Following is the list of claim settlement ratio of the best life insurance companies in india: Irda report rank the best insurance company every year and this is how irda help customer for making best decision for them. An insurance company may be considered more consistent if its historic claim settlement ratio is in a narrower range. 25 rows hdfc life insurance company limited:

Following is the list of claim settlement ratio of the best life insurance companies in india:

When you are comparing life insurance policies do keep the claim settlement ratio of the insurance companies in mind. Icici prudential life insurance is promoted by icici bank and prudential corporation holdings. Aegon life insurance company limited. In this scenario, the claim settlement ratio of the company for its life insurance business is (1250/1300)*100 = 96.15%. Icici prudential life insurance company limited: Max life insurance company limited:

Source: mintwise.com

Source: mintwise.com

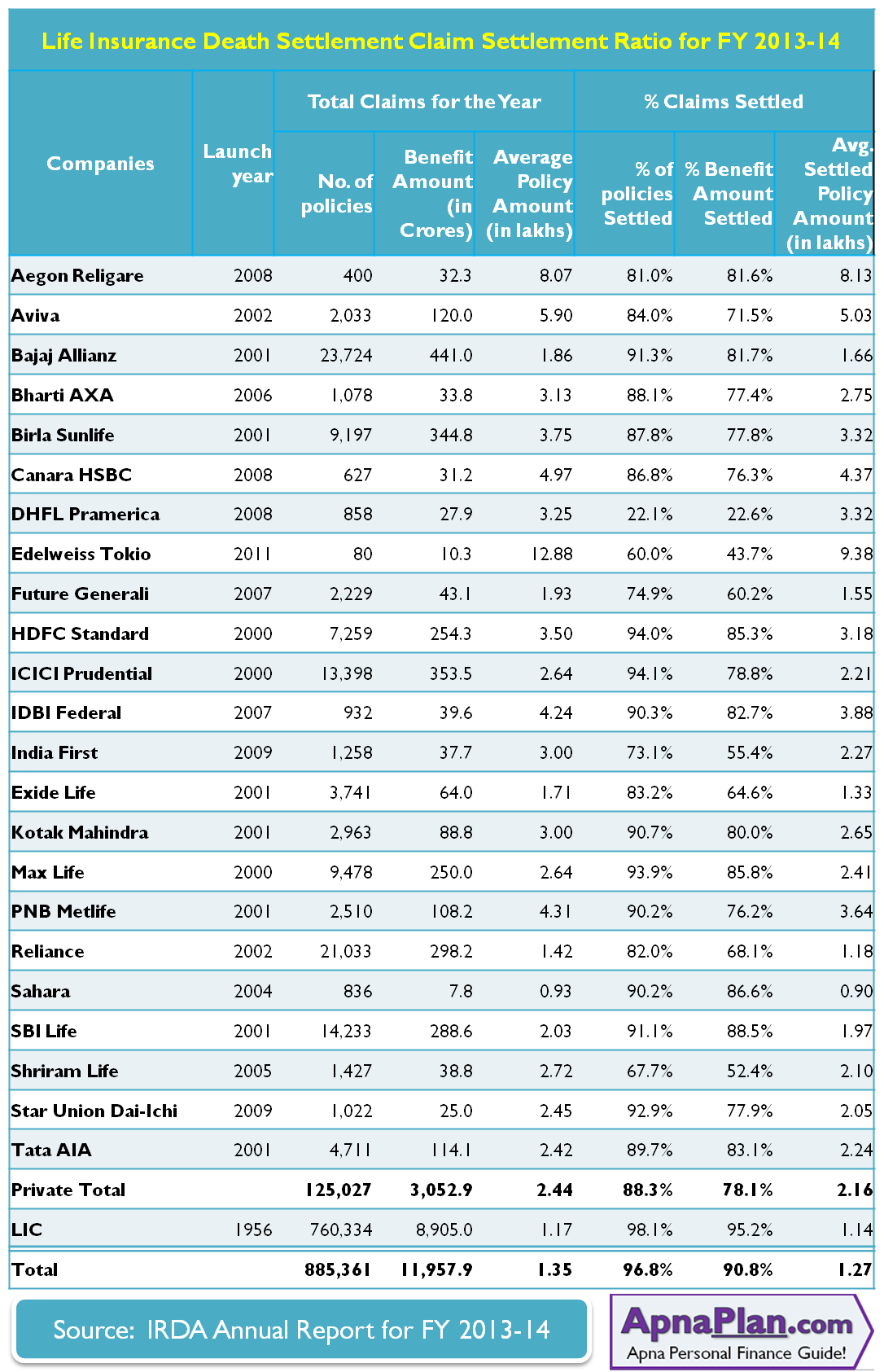

The claim settlement ratio by amount was 75.1%, 74.7% and 82.1% for fy2015, fy2016 and fy2017. Here are the top 5 life insurance companies in india that boast a claim settlement ratio of over 95%: So here is the table which give the claims ratio by amount rather than the number. Following close behind, tata aia boasts of a claim settlement ratio of 99.06%. Kotak mahindra life insurance company limited:

Source: basunivesh.com

Source: basunivesh.com

If a company has a claim settlement ratio of 99%. What is claim settlement ratio life cover insurance company life insurance claim settlement ratios of li Bajaj allianz life insurance company limited. If a company has a claim settlement ratio of 99%. Claim settlement ratio of life insurance companies in india.

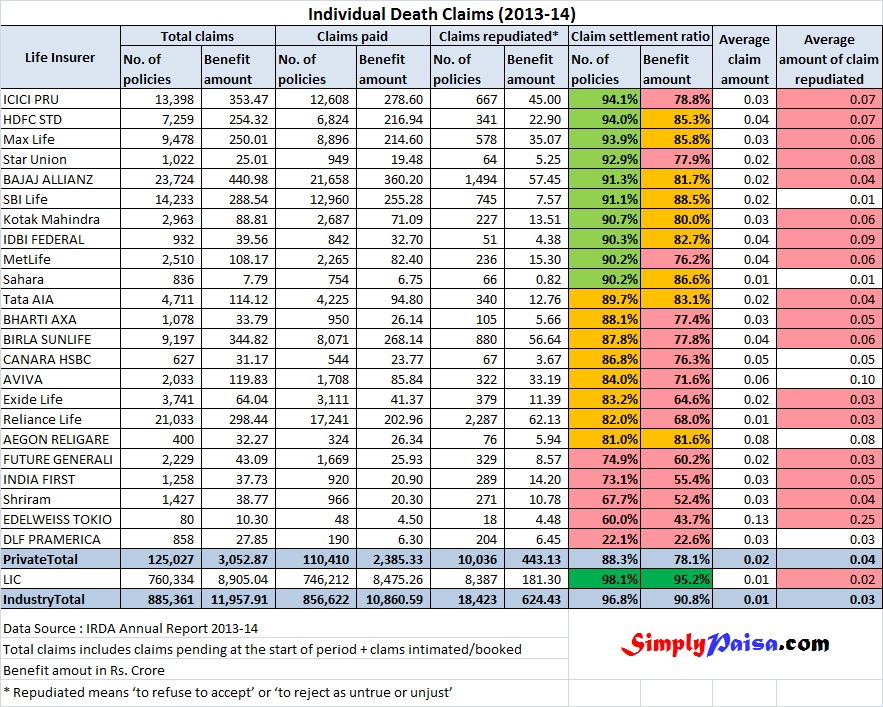

Source: simplypaisa.com

Source: simplypaisa.com

A company with a claim settlement ratio in the range of 91% to 98% may be considered more dependable than a company with a ratio in the range of 80% to 95%. Aditya birla sunlife insurance company limited: Icici prudential life insurance is promoted by icici bank and prudential corporation holdings. Csr is a good indicator of the claim settlement rate of an insurance company. 25 rows hdfc life insurance company limited:

Source: apnaplan.com

Source: apnaplan.com

This is marginally higher than the previous year’s claim settlement ratio of 97.43%. When you are comparing life insurance policies do keep the claim settlement ratio of the insurance companies in mind. While talking about the claim settlement ratio, it is found out that today it has reached 97%. Many private sector insurance companies performed well this year but companies like edelweiss tokio pulled the ratio up. Csr is a good indicator of the claim settlement rate of an insurance company.

Source: insurancefunda.in

Source: insurancefunda.in

Following close behind, tata aia boasts of a claim settlement ratio of 99.06%. Csr is a good indicator of the claim settlement rate of an insurance company. Following is the list of claim settlement ratio of the best life insurance companies in india: Claim settlement ratio of life insurance companies in india. An insurance company may be considered more consistent if its historic claim settlement ratio is in a narrower range.

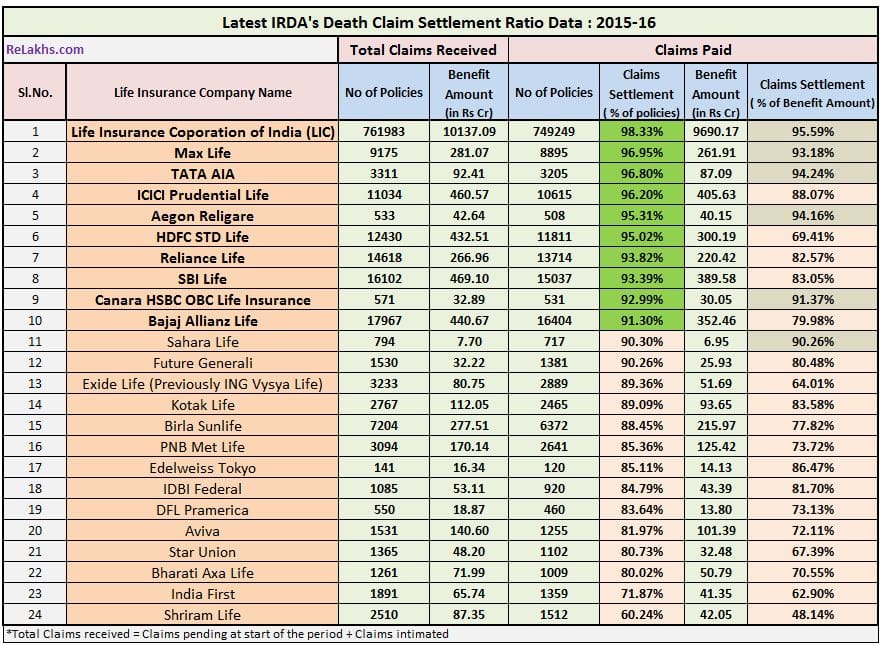

Source: relakhs.com

Source: relakhs.com

In this scenario, the claim settlement ratio of the company for its life insurance business is (1250/1300)*100 = 96.15%. Max life insurance has the highest claim settlement ratio in terms of number of claims with 99.22%. Max life comes first on our list with a claim settlement ratio of 99.22%. Tata aia has 99.07, hdfc has 99.04. Claim settlement ratio of life insurance companies in india.

Source: moneyexcel.com

Source: moneyexcel.com

What is claim settlement ratio life cover insurance company life insurance claim settlement ratios of li While talking about the claim settlement ratio, it is found out that today it has reached 97%. This is marginally higher than the previous year’s claim settlement ratio of 97.43%. Bajaj allianz life insurance company limited. So here is the table which give the claims ratio by amount rather than the number.

Source: relakhs.com

Source: relakhs.com

Icici prudential life insurance company limited: Aditya birla sunlife insurance company limited: We observed a lot of our readers wanting to know the claim amounts too. Tata aia life insurance company. Aviva life insurance company limited.

Source: relakhs.com

Source: relakhs.com

If a company has a claim settlement ratio of 99%. Csr is a good indicator of the claim settlement rate of an insurance company. Following is the list of claim settlement ratio of the best life insurance companies in india: Check updated 2020 list of highest claim settlement ration records; 25 rows hdfc life insurance company limited:

Source: relakhs.com

Source: relakhs.com

Max life insurance has the highest claim settlement ratio in terms of number of claims with 99.22%. Bajaj allianz life insurance company limited. Csr is a good indicator of the claim settlement rate of an insurance company. Aviva life insurance company limited. The claim rejection ratio or claim repudiation ratio is (20/1300)*100 = 1.5%.

Source: testway.in

Source: testway.in

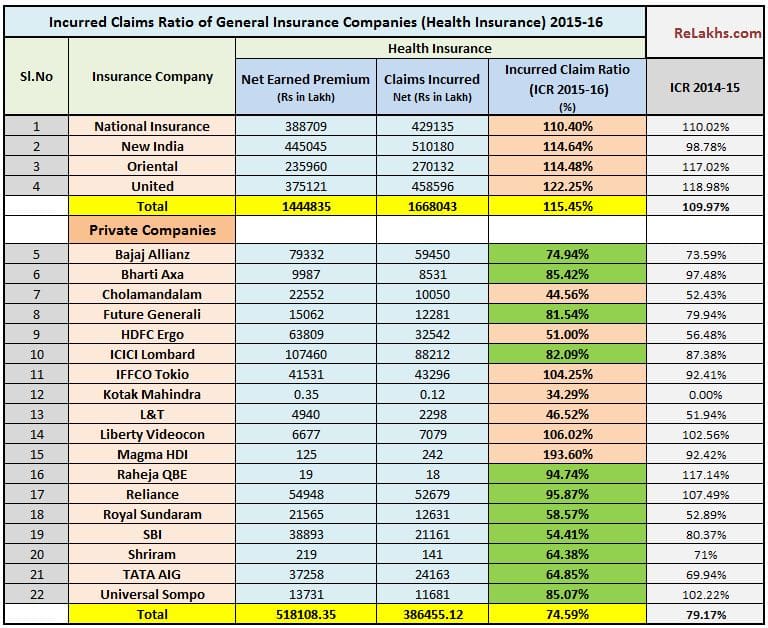

Icici prudential life insurance company limited: The claim settlement ratio by amount was 75.1%, 74.7% and 82.1% for fy2015, fy2016 and fy2017. Normally the claims ratio of a life insurance company is calculated by the number of claims registered and the number of claims which were paid out. An insurance company may be considered more consistent if its historic claim settlement ratio is in a narrower range. When you are comparing life insurance policies do keep the claim settlement ratio of the insurance companies in mind.

Source: relakhs.com

Source: relakhs.com

Csr is a good indicator of the claim settlement rate of an insurance company. The highest claim settlement ratio is of the public insurance company lic at 98.31%. Max life comes first on our list with a claim settlement ratio of 99.22%. An insurance company may be considered more consistent if its historic claim settlement ratio is in a narrower range. Check updated 2020 list of highest claim settlement ration records;

Source: insurancekhabri.blogspot.com

Source: insurancekhabri.blogspot.com

The claim pending ratio of the insurer is (30/1300)*100 = 2.3%. Few points to notice from this annual report are as below. Icici prudential life insurance company limited: The highest claim settlement ratio is of the public insurance company lic at 98.31%. Whereas lic’s rejection ratio was just 1.5%.

Source: insurancefunda.in

Source: insurancefunda.in

Aegon life insurance company limited. The claim rejection ratio or claim repudiation ratio is (20/1300)*100 = 1.5%. Name of the insurance company. Bajaj allianz life insurance company limited. # claim settlement ratio of lic was at 96.69% as at march 31, 2020, when compared to 97.79% as at march 31, 2019.

Source: moneyexcel.com

Source: moneyexcel.com

Following close behind, tata aia boasts of a claim settlement ratio of 99.06%. Assuming the claim settlement ratio of an insurance company is 86%, means that out of 100 claims received 86 claims are approved for being settled and paid out. Claim settlement ratio of life insurance companies in india. A company with a claim settlement ratio in the range of 91% to 98% may be considered more dependable than a company with a ratio in the range of 80% to 95%. Ageas federal life insurance company limited.

Source: relakhs.com

Source: relakhs.com

Many private sector insurance companies performed well this year but companies like edelweiss tokio pulled the ratio up. Tata aia life insurance company. Among the renowned insurance companies, there is lic which settles claims in nearly 26 to 28 days. If a company has a claim settlement ratio of 99%. Csr is a good indicator of the claim settlement rate of an insurance company.

Source: pinterest.com

Source: pinterest.com

Here are the top 5 life insurance companies in india that boast a claim settlement ratio of over 95%: Name of the insurance company. Claim settlement ratio of life insurance company: Tata aia has 99.07, hdfc has 99.04. Csr is a good indicator of the claim settlement rate of an insurance company.

Source: abiteofculture.com

Source: abiteofculture.com

Following is the list of claim settlement ratio of the best life insurance companies in india: Icici prudential life insurance is promoted by icici bank and prudential corporation holdings. Aviva life insurance company limited. Csr is a good indicator of the claim settlement rate of an insurance company. The ratio for the private life insurance sector alone is equal to 93.72%.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title claim ratio of life insurance companies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea