Claim ratio of motor insurance companies in india Idea

Home » Trend » Claim ratio of motor insurance companies in india IdeaYour Claim ratio of motor insurance companies in india images are ready in this website. Claim ratio of motor insurance companies in india are a topic that is being searched for and liked by netizens now. You can Download the Claim ratio of motor insurance companies in india files here. Find and Download all free photos and vectors.

If you’re searching for claim ratio of motor insurance companies in india pictures information connected with to the claim ratio of motor insurance companies in india interest, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for seeking the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

Claim Ratio Of Motor Insurance Companies In India. Among the private general insurance companies, hdfc ergo general insurance tops the chart with 99.8% claims settled in first 3 months of making the claim. You can easily find the claim settlement ratio of various insurers on the website of irda of india. Claim settlement ratio is calculated as claims settled in a year divided by the total claims received in a year multiplied by 100. ##the claim settlement ratio for acko’s own damage cover (part of motor insurance) was 95%.

Claim Settlement Ratio for Health Insurance in India 20132014 From mintwise.com

Claim Settlement Ratio for Health Insurance in India 20132014 From mintwise.com

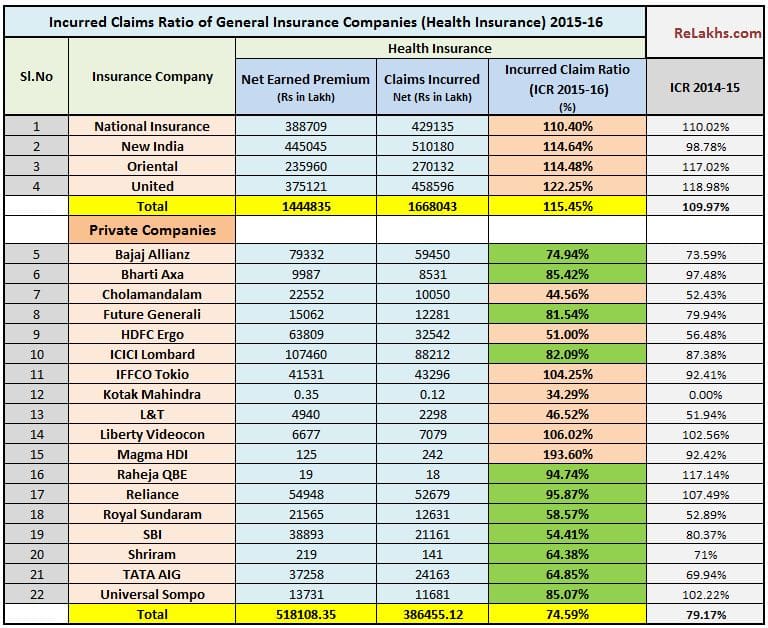

Incurred claims ratio = net claims incurred/ net earned premium. Ten insurance companies are in the range of csr above 90% but less than 95%. Insurers with the percentage of and above 95% are considered secure as the insurer is good at paying the claim amount to most customers. High claim settlement ratio indicates that a company settles a majority of the claims that policyholders raise. Don’t even think of buying the best car insurance policy in india if the csr is not good. It may help you to make a better decision.

Which are good car insurance companies in india?

Hdfc ergo, edelweiss, reliance general are among the top car insurance companies in india. No, car insurance companies in india do not require your proof of marriage for buying a car insurance plan. Click on the link below to know more about the company. Cholamandalam ms general insurance co. Max life insurance has the highest claim settlement ratio in. Icici lombard general insurance company limited.

Source: mintwise.com

Source: mintwise.com

Compared to the previous year, the life insurance premium in india increased by 9.63 per cent whereas global life insurance premium increased by 1.18 per cent. Icici lombard general insurance has a stronghold in the insurance marketplace, particularly for car insurance. Bharti axa general insurance co. When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies. The rejection ratio was 1.5%.

Source: moneyexcel.com

Source: moneyexcel.com

Which are good car insurance companies in india? Needless to say, a lower claim settlement ratio is undesirable. Don’t even think of buying the best car insurance policy in india if the csr is not good. Incurred claim ratio is calculated as the net claim settled by an insurer to the net premiums collected in any given year. The rejection ratio was 1.5%.

Source: abiteofculture.com

Source: abiteofculture.com

Hdfc ergo, edelweiss, reliance general are among the top car insurance companies in india. Incurred claim ratio is calculated as the net claim settled by an insurer to the net premiums collected in any given year. An incurred claim ratio of 75% implies that the company has compensated rs 75 as claim payout for every rs 100 collected as premium. There are more than 1 crore policyholders of the company till date; For example, if in a financial year the company settles claims of inr 5 crores and earns a premium of inr 8 crores, the incurred claims ratio for that financial year would be [(5/8) * 100] = 62.5%

Source: drudgeblog.com

Source: drudgeblog.com

You can easily find the claim settlement ratio of various insurers on the website of irda of india. The higher the ratio, the lower the chances of claim rejection. It is advisable to check the claim settlement ratio of the insurer. Five insurance companies are with claim insurance ratio below 90%. Motor od claim settlement ratio fy20.

Source: mintwise.com

Source: mintwise.com

Incurred claim ratio is calculated as the net claim settled by an insurer to the net premiums collected in any given year. Five insurance companies are with claim insurance ratio below 90%. Compared to the previous year, the life insurance premium in india increased by 9.63 per cent whereas global life insurance premium increased by 1.18 per cent. Proceed only when it is good. Claim settlement ratio is calculated as claims settled in a year divided by the total claims received in a year multiplied by 100.

Source: relakhs.com

Source: relakhs.com

Max life insurance has the highest claim settlement ratio in. Five insurance companies are with claim insurance ratio below 90%. An incurred claim ratio of 75% implies that the company has compensated rs 75 as claim payout for every rs 100 collected as premium. Claim settlement ratio is calculated as claims settled in a year divided by the total claims received in a year multiplied by 100. Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india:

Source: relakhs.com

Source: relakhs.com

Incurred claim ratio is calculated as the net claim settled by an insurer to the net premiums collected in any given year. It is advisable to check the claim settlement ratio of the insurer. There are more than 1 crore policyholders of the company till date; Five insurance companies are with claim insurance ratio below 90%. Bajaj allianz general insurance company

Source: arogyasanjeevani.in

Source: arogyasanjeevani.in

The higher the csr, the better. A claim settlement ratio above 85% is considered too be good. Bajaj allianz general insurance co. Bajaj allianz general insurance company Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india:

Source: basunivesh.com

Source: basunivesh.com

Needless to say, a lower claim settlement ratio is undesirable. Best car insurance companies in india. You can easily find the claim settlement ratio of various insurers on the website of irda of india. Bharti axa general insurance co. For example, if in a financial year the company settles claims of inr 5 crores and earns a premium of inr 8 crores, the incurred claims ratio for that financial year would be [(5/8) * 100] = 62.5%

Source: insurancefunda.in

Source: insurancefunda.in

Incurred claims ratio = net claims incurred/ net earned premium. Icici lombard general insurance company is undoubtedly one of the top private general insurance firms in india. Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india: Motor od claim settlement ratio fy20. Bajaj allianz general insurance company

Source: mintwise.com

Source: mintwise.com

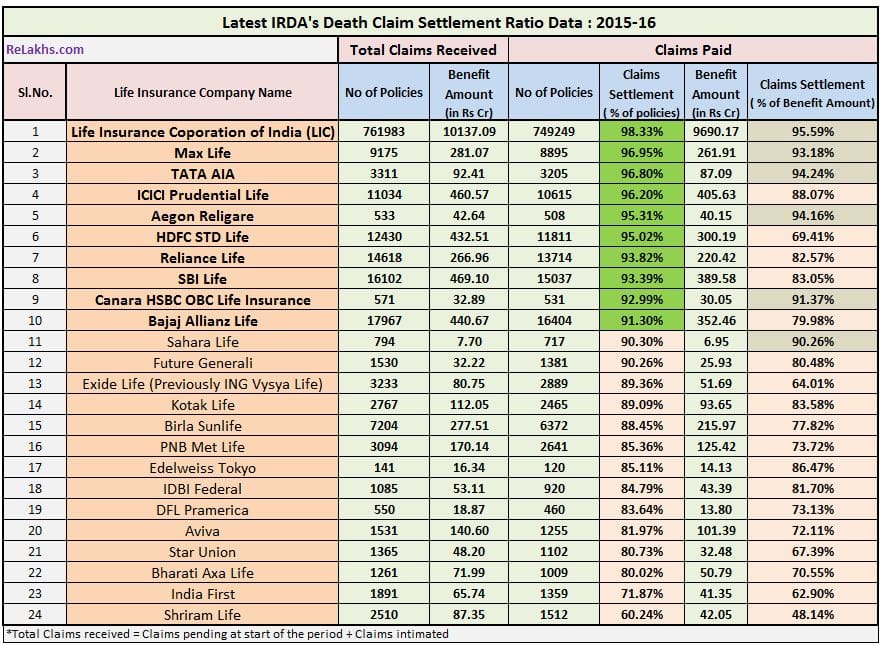

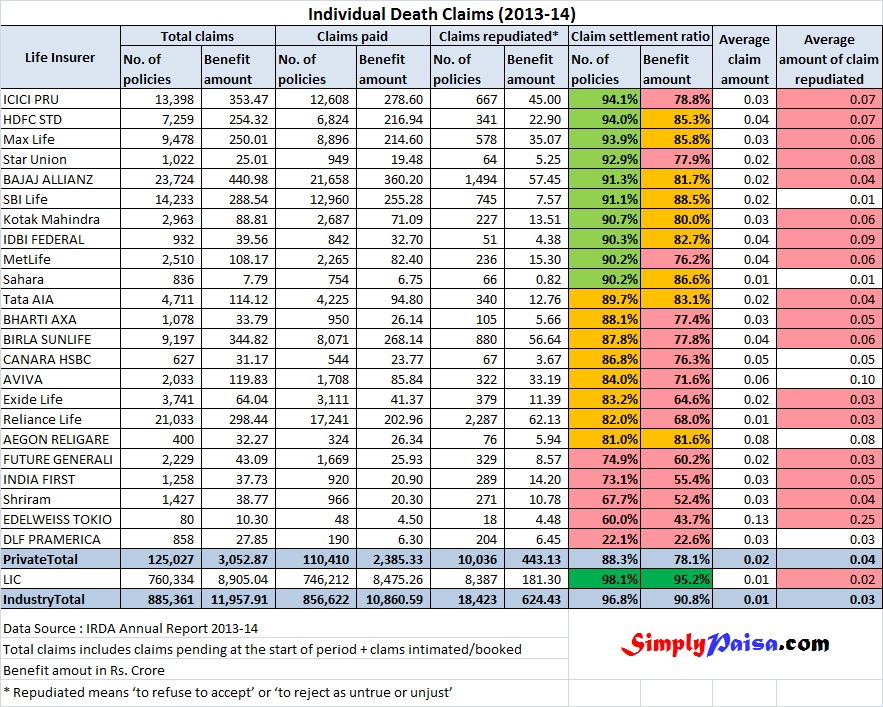

Shriram life is worst with a ratio of 63.53%. Incurred claims ratio is the ratio of the total amount of claims paid by an insurance company against the total amount of premiums earned. Insurance claims ratio in india. Which are good car insurance companies in india? The rejection ratio was 1.5%.

Source: mintwise.com

Source: mintwise.com

For example, if in a financial year the company settles claims of inr 5 crores and earns a premium of inr 8 crores, the incurred claims ratio for that financial year would be [(5/8) * 100] = 62.5% It’s a pet project of icici bank. Cholamandalam ms general insurance co. You can easily find the claim settlement ratio of various insurers on the website of irda of india. Incurred claims ratio is the ratio of the total amount of claims paid by an insurance company against the total amount of premiums earned.

Source: relakhs.com

Source: relakhs.com

It’s a pet project of icici bank. Proceed only when it is good. The higher the csr, the better. It is advisable to check the claim settlement ratio of the insurer. Click on the link below to know more about the company.

Source: relakhs.com

Source: relakhs.com

Compared to the previous year, the life insurance premium in india increased by 9.63 per cent whereas global life insurance premium increased by 1.18 per cent. What this means is that out of every 100 claims received by us (acko), we have settled ~95 claims & rejected ~1.5 claims. Five insurance companies are with claim insurance ratio below 90%. A claim settlement ratio above 85% is considered too be good. Eight out of 23 insurance companies are in the range of csr 95% and above.

Source: pinterest.com

Source: pinterest.com

Insurers with the percentage of and above 95% are considered secure as the insurer is good at paying the claim amount to most customers. The higher the csr, the better. Cholamandalam ms general insurance co. Incurred claims ratio = net claims incurred/ net earned premium. A good claim settlement ratio will improve your chances of getting your insurance policy claims accepted and settled by the insurance company when the situation comes.

Source: moneyexcel.com

Source: moneyexcel.com

Best car insurance companies in india. Needless to say, a lower claim settlement ratio is undesirable. When buying health insurance it is important to check the health insurance claim ratio of all the health insurance companies. Don’t even think of buying the best car insurance policy in india if the csr is not good. Claim settlement ratio is the time taken by an insurer to settle down the claims from its clients.

Source: simplypaisa.com

Source: simplypaisa.com

Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india: ##the claim settlement ratio for acko’s own damage cover (part of motor insurance) was 95%. India�s share in global life insurance market was 2.73 per cent during 2019. Bajaj allianz general insurance company 35 rows company motor health other net premium claim incurred claim ratio in (%) acko general insurance ltd.

Source: relakhs.com

Source: relakhs.com

Check out the table below with claim settlement ratio and incurred claim ratio of different health insurance providers in india: Ten insurance companies are in the range of csr above 90% but less than 95%. Icici lombard general insurance company is undoubtedly one of the top private general insurance firms in india. It’s a pet project of icici bank. The higher the csr, the better.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title claim ratio of motor insurance companies in india by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information