Claimant vs insured information

Home » Trend » Claimant vs insured informationYour Claimant vs insured images are available in this site. Claimant vs insured are a topic that is being searched for and liked by netizens today. You can Find and Download the Claimant vs insured files here. Download all royalty-free photos.

If you’re searching for claimant vs insured images information linked to the claimant vs insured topic, you have pay a visit to the ideal site. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Claimant Vs Insured. A person making a claim, especially in a lawsuit or for a state benefit. Both the insured and a claimant can make a claim in an insurance matter. For example, a person is not insured when they let their policy lapse for nonpayment, even when the policy is later reinstated, if the claim is made during the lapsed period. A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer.

Malpractice Insurance 101 ClaimsMade vs. Occurrence From nl.pinterest.com

Malpractice Insurance 101 ClaimsMade vs. Occurrence From nl.pinterest.com

The word “claimant” means a person making a claim. In many circumstances, a third party will file claims on behalf of the insured, such as in the case of health insurance for routine exams or other covered treatments. You are the claimant when someone else’s insurance company is responsible for repairs to your vehicle. Which party is the claimant? Both the insured and a claimant can make a claim in an insurance matter. The person or entity that purchased the insurance and is listed on the policy�s declarations page (also known as the named insured) someone else deemed eligible to make a claim, such as an employee or a vendor (additional insured)

Simply put, the “insured” is a person or business entity that is covered by insurance.

In this situation, your deductible is applicable. The word “claimant” means a person making a claim. The claimant may be the insured. A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer. You are the claimant when someone else’s insurance company is responsible for repairs to your vehicle. The liability insured will have an incentive to assign the claims:

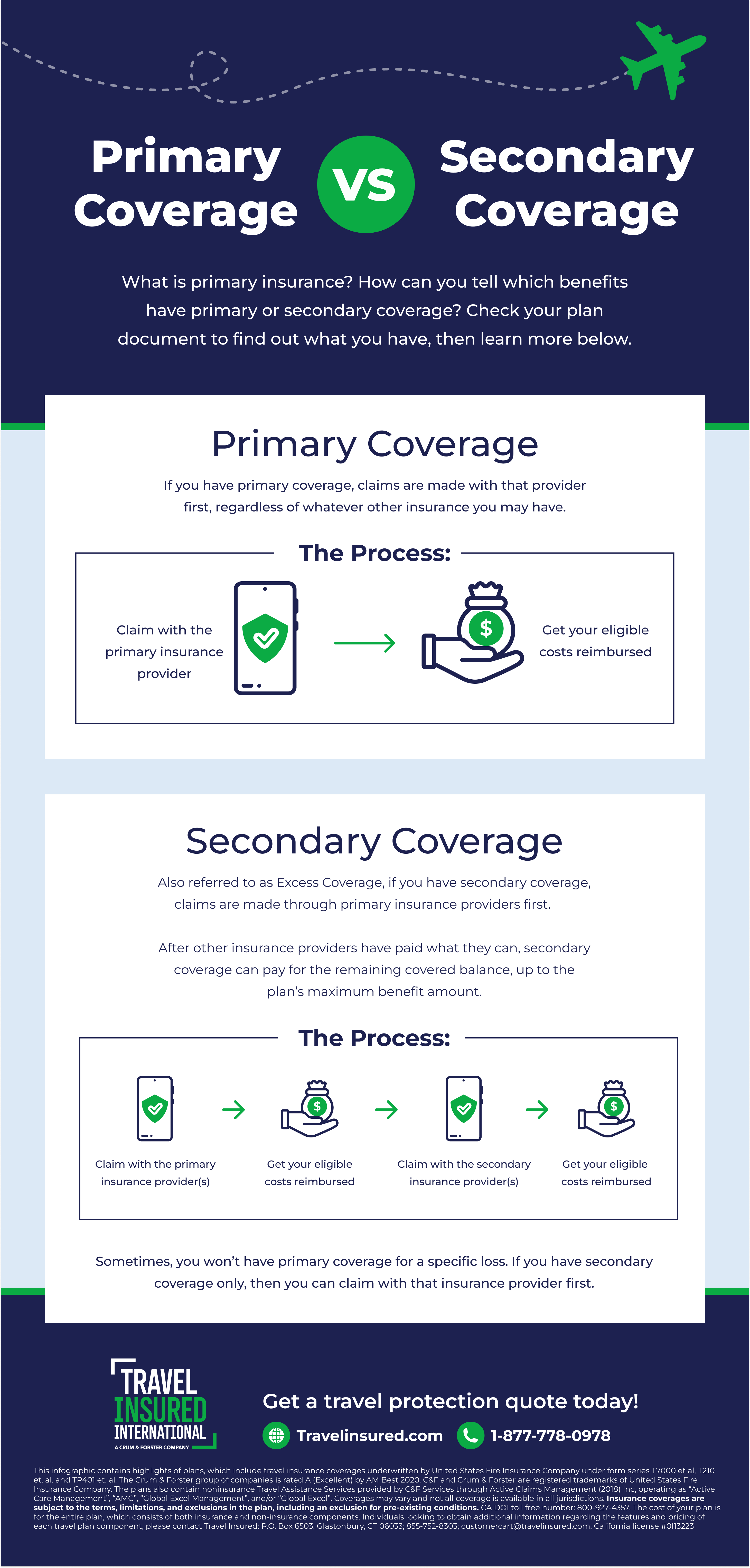

Source: travelinsured.com

Source: travelinsured.com

The claimant may be the insured. The company refused unless the insured would contribute $1,500; Both the insured and a claimant can make a claim in an insurance matter. In any life insurance policy, the insured is the person on whom the protection is purchased. If you represent an insured under a duty to defend and the claimant’s counsel seeks an assignment, the tripartite relationship presents possible conflict.

Source: bergensautobody.ca

Source: bergensautobody.ca

The person or entity that purchased the insurance and is listed on the policy’s declarations page. Upon filing a lawsuit, the claimant becomes a plaintiff, but the terms are often used interchangeably.” If the claimant is insure, the insured may be present with the claims. A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer. A claimant is a person or business entity that files a claim for benefits under the provisions of an insurance policy.

Source: youtube.com

Source: youtube.com

Damages of $12,000 were awarded at trial. If you represent an insured under a duty to defend and the claimant’s counsel seeks an assignment, the tripartite relationship presents possible conflict. A person making a claim, especially in a lawsuit or for a state benefit. The claimant may be the insured. Courts in alabama have recently issued several judgments surrounding the issue of when a claimant is an insured under a specific policy.

Source: embroker.com

Source: embroker.com

The company refused unless the insured would contribute $1,500; ‘one in four eligible claimants failed to register for a rebate’; This commentary examines and criticizes that holding in light of the. By doing so, the plaintiff seeks a legal remedy. The company refused unless the insured would contribute $1,500;

Source: noclutter.cloud

Source: noclutter.cloud

Otherwise, the insured typically must file a claim to receive their policy benefits for a covered loss or damages. I know it might seem (11). In other words, the insured is the covered individual in the life insurance contract. Once a lawsuit is filed, the terminology changes to defendant (insured) and plaintiff (claimant). The insured recovered the $7,000 difference between the judgment and the $5,000 which the company ultimately paid out.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

Otherwise, the insured typically must file a claim to receive their policy benefits for a covered loss or damages. Claimant definition, a person who makes a claim. As such, an insured person is one that has health insurance coverage. Someone else deemed eligible to make a claim, such as an employee or a vendor (additional insured) The liability insured will have an incentive to assign the claims:

Source: firearmsinsuranceagent.com

Source: firearmsinsuranceagent.com

A claimant is a person or business entity that files a claim for benefits under the. Because the named insured is described in this section, that person or entity is an insured. In any life insurance policy, the insured is the person on whom the protection is purchased. The defense obligation ends only when the company has paid its liability limit to satisfy (in whole or in part) a court judgment against the insured or reached a settlement with the claimant. One claim could result in more than one claimant.

Source: hppb.co.uk

For example, a person is not insured when they let their policy lapse for nonpayment, even when the policy is later reinstated, if the claim is made during the lapsed period. The liability insured will have an incentive to assign the claims: Courts in alabama have recently issued several judgments surrounding the issue of when a claimant is an insured under a specific policy. Simply put, the “insured” is a person or business entity that is covered by insurance. Once a lawsuit is filed, the terminology changes to defendant (insured) and plaintiff (claimant).

Source: nl.pinterest.com

Source: nl.pinterest.com

The person or entity that purchased the insurance and is listed on the policy�s declarations page (also known as the named insured) someone else deemed eligible to make a claim, such as an employee or a vendor (additional insured) A claimant is a person or business entity that files a claim for benefits under the provisions of an insurance policy. Simply put, the “insured” is a person or business entity that is covered by insurance. This commentary examines and criticizes that holding in light of the. The life insurance policy rates are based upon the insured’s age, health and lifestyles factors at the time of application.

Source: youtube.com

Source: youtube.com

Once a lawsuit is filed, the terminology changes to defendant (insured) and plaintiff (claimant). In other words, the insured is the covered individual in the life insurance contract. The insured recovered the $7,000 difference between the judgment and the $5,000 which the company ultimately paid out. In many circumstances, a third party will file claims on behalf of the insured, such as in the case of health insurance for routine exams or other covered treatments. A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer.

Source: brown-ohaver.com

Source: brown-ohaver.com

The defense obligation ends only when the company has paid its liability limit to satisfy (in whole or in part) a court judgment against the insured or reached a settlement with the claimant. The word “claimant” means a person making a claim. In any life insurance policy, the insured is the person on whom the protection is purchased. A claimant is a person or business entity that files a claim for benefits under the. National liability & fire insurance co., 716 s.e.2d 696 (w.

Source: warriorsforjustice.com

Source: warriorsforjustice.com

A claimant is a person or business entity that files a claim for benefits under the. Simply put, the “insured” is a person or business entity that is covered by insurance. In the standard liability policy, the term insured means any person or organization that qualifies as such under the heading who is an insured. A 1st party claimant is someone who is making a claim against his/her own insurance policy. A claimant is a person or business entity that files a claim for benefits under the provisions of an insurance policy.

vs. At Fault”) Source: scura.com

Claimant definition, a person who makes a claim. If you represent an insured under a duty to defend and the claimant’s counsel seeks an assignment, the tripartite relationship presents possible conflict. Simply put, the “insured” is a person or business entity that is covered by insurance. Both the insured and a claimant can make a claim in an insurance matter. The person or entity that purchased the insurance and is listed on the policy’s declarations page.

Source: oneillinsurance.com

Source: oneillinsurance.com

The word “claimant” means a person making a claim. The word “claimant” means a person making a claim. If the claimant is insure, the insured may be present with the claims. The insured recovered the $7,000 difference between the judgment and the $5,000 which the company ultimately paid out. You are the insured when your insurance company pays for the cost of repairs to your damaged vehicle.

Source: youtube.com

Source: youtube.com

You are the insured when your insurance company pays for the cost of repairs to your damaged vehicle. In other words, the insured is the covered individual in the life insurance contract. If you represent an insured under a duty to defend and the claimant’s counsel seeks an assignment, the tripartite relationship presents possible conflict. You are the claimant when someone else’s insurance company is responsible for repairs to your vehicle. In the standard liability policy, the term insured means any person or organization that qualifies as such under the heading who is an insured.

Source: clovered.com

Source: clovered.com

The person or entity that purchased the insurance and is listed on the policy�s declarations page (also known as the named insured) someone else deemed eligible to make a claim, such as an employee or a vendor (additional insured) The insured is the first party, the insurer is the second party, and the claimant is the third party. The insured recovered the $7,000 difference between the judgment and the $5,000 which the company ultimately paid out. For example, a person is not insured when they let their policy lapse for nonpayment, even when the policy is later reinstated, if the claim is made during the lapsed period. A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer.

Source: icnj.com

Source: icnj.com

Simply put, the “insured” is a person or business entity that is covered by insurance. In any life insurance policy, the insured is the person on whom the protection is purchased. In many circumstances, a third party will file claims on behalf of the insured, such as in the case of health insurance for routine exams or other covered treatments. Courts in alabama have recently issued several judgments surrounding the issue of when a claimant is an insured under a specific policy. The insured is the first party, the insurer is the second party, and the claimant is the third party.

Source: slideshare.net

Source: slideshare.net

In the standard liability policy, the term insured means any person or organization that qualifies as such under the heading who is an insured. A plaintiff (π in legal shorthand) is the party who initiates a lawsuit (also known as an action) before a court. I know it might seem (11). The company refused unless the insured would contribute $1,500; A “claimant,” on the other hand, can be any person or organization that suffered a loss and files a request to receive benefits from the insurer.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claimant vs insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information