Claims made insurance coverage Idea

Home » Trend » Claims made insurance coverage IdeaYour Claims made insurance coverage images are available in this site. Claims made insurance coverage are a topic that is being searched for and liked by netizens now. You can Get the Claims made insurance coverage files here. Find and Download all royalty-free photos and vectors.

If you’re searching for claims made insurance coverage images information connected with to the claims made insurance coverage keyword, you have visit the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that match your interests.

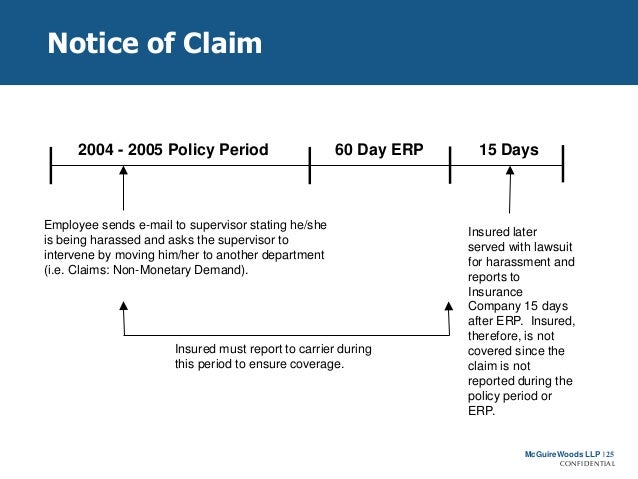

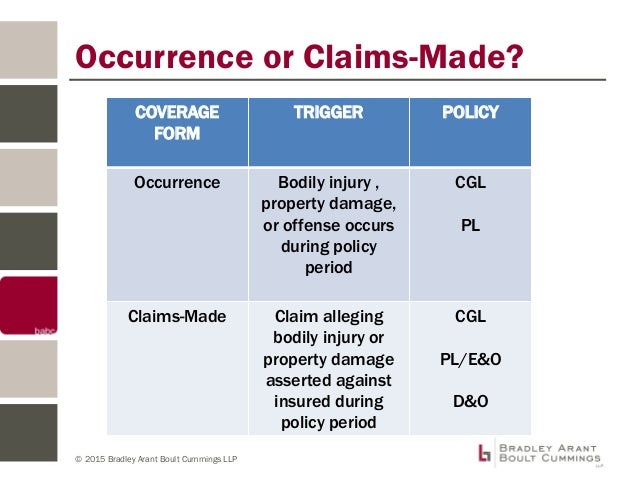

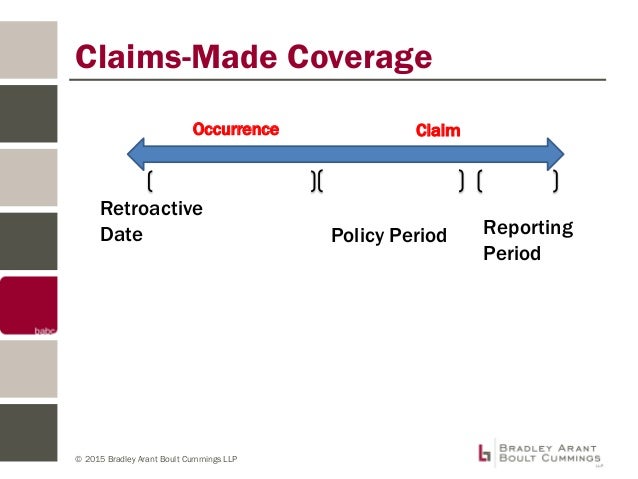

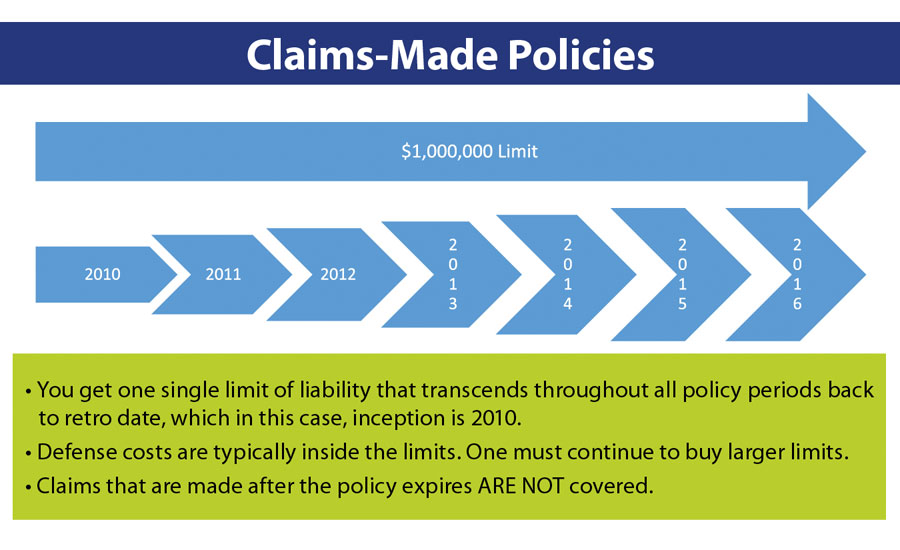

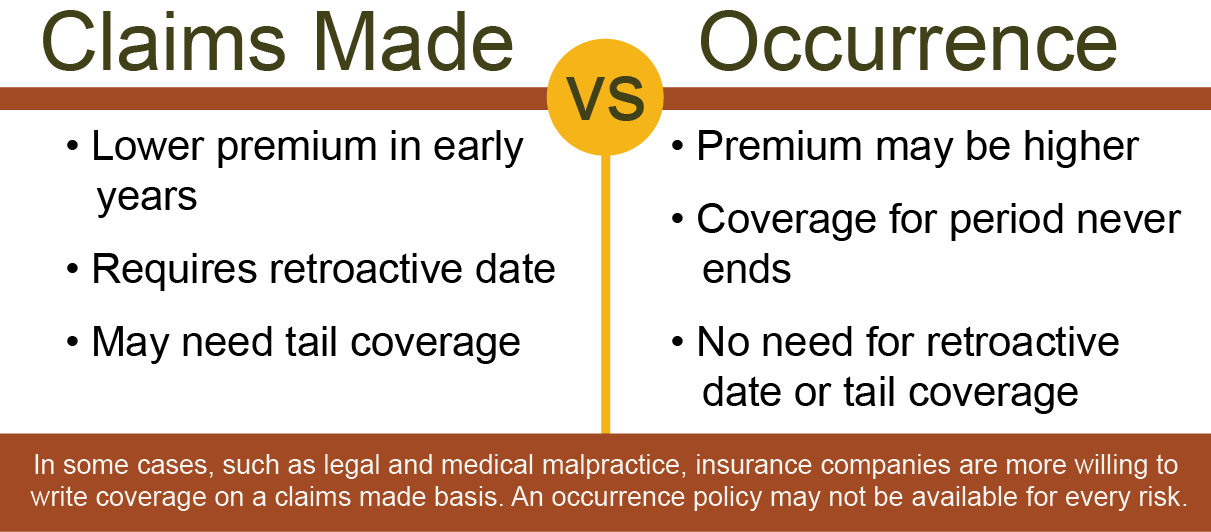

Claims Made Insurance Coverage. This because factors such as “tail coverage” and retroactive dates come into play. Most of the time this coverage form is reserved for professional liability however, it can be used. Anticipating high risk pitfalls navigating claims identification, reporting requirements, late notice, multiple policies and allocation issues richard d. Claims made basis liability coverage refers to liability insurance coverage that only covers claims made during the actual policy period.

Avoiding the Minefields of ClaimsMade Insurance Policies From slideshare.net

Avoiding the Minefields of ClaimsMade Insurance Policies From slideshare.net

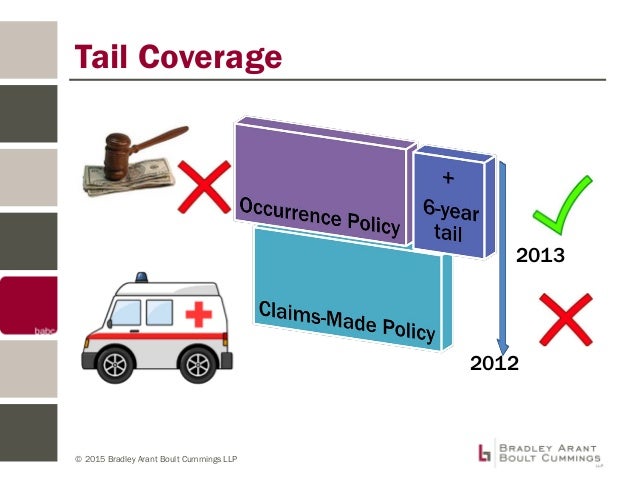

The lower cost for the first four years is especially attractive to professionals just starting their career. Benefits of a claims made form ♦ less expensive than occurrence form, especially in the first four years of coverage of the allied world insurance form. Claims made coverage is a form of liability insurance. This is not a problem for most insureds as long as coverage is kept in effect continuously without a lapse, and as long as continuity is preserved by from one policy term to the next even when. Claims through this form of coverage must meet both criteria for coverage to apply. Tail coverage requires that the insured pay.

Claims made coverage is a form of liability insurance.

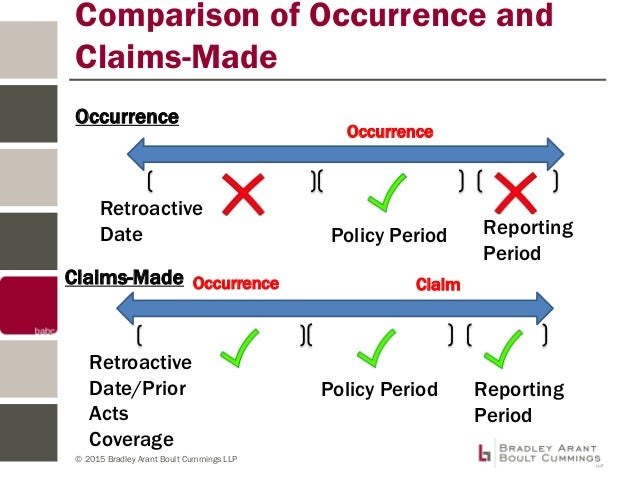

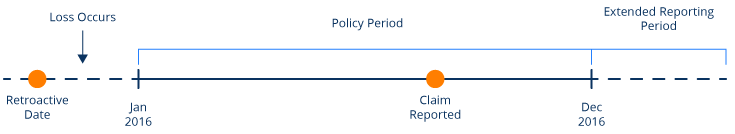

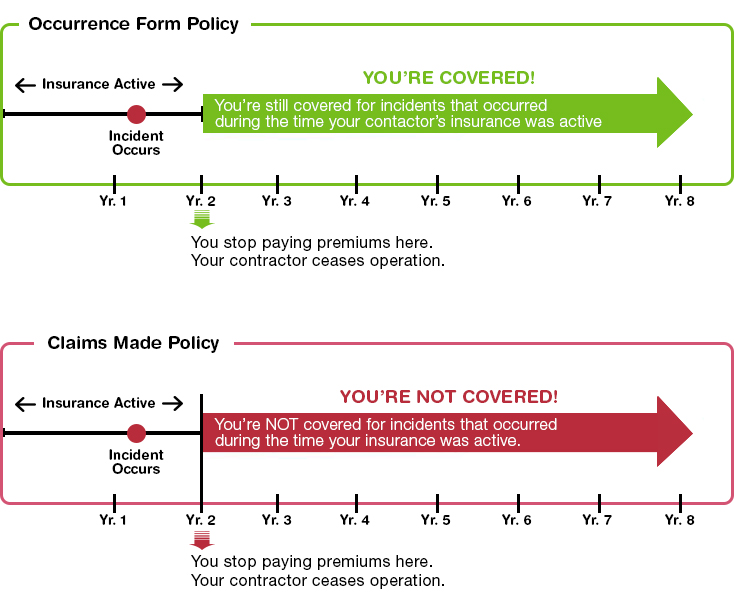

This because factors such as “tail coverage” and retroactive dates come into play. What is a retroactive date? This means your insurer helps cover claims filed during your policy period. In this type of policy, coverage depends on the timing of the claim. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. Occurrence insurance policies pay claims on.

Source: slideshare.net

Source: slideshare.net

In this type of policy, coverage depends on the timing of the claim. Again, simply stated, the policy in effect when the claim is brought defends and/or pays the loss. Occurrence insurance policies pay claims on. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. Claims made policies tend to be more complex than occurrence policies.

Source: massagemag.com

Source: massagemag.com

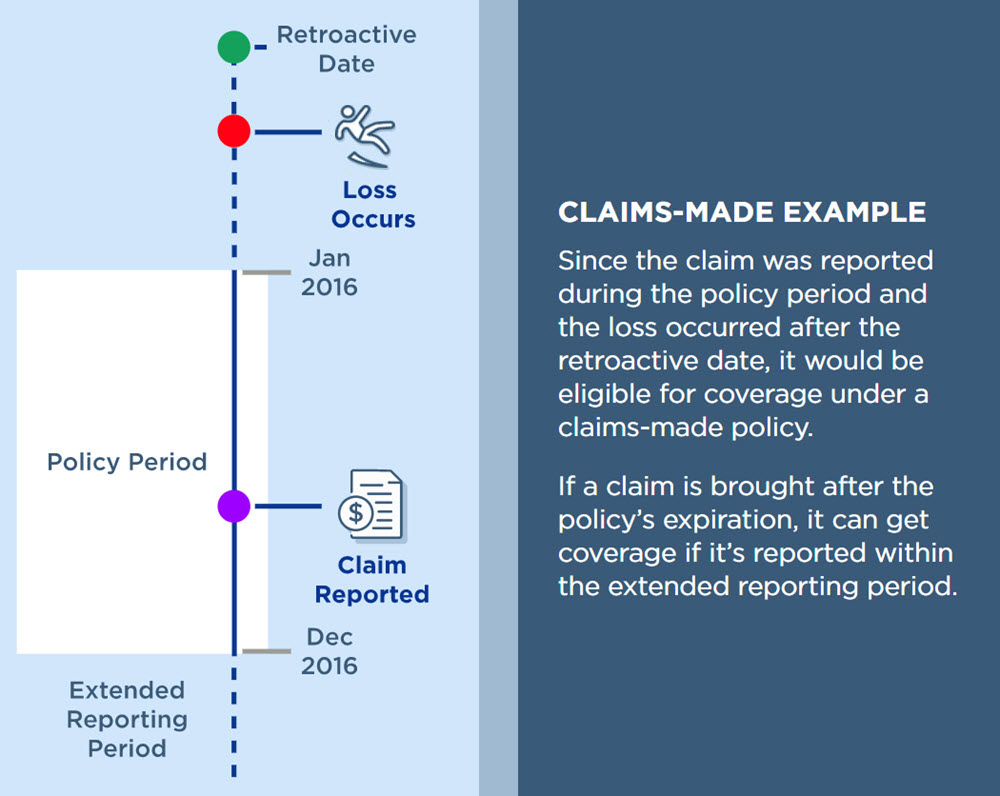

Once the policy ends and is not replaced with a policy that carries forward the retroactive date (known as providing “prior acts”), the coverage stops for any claims that have not already been reported to the insurance company during the coverage period. This means your insurer helps cover claims filed during your policy period. Again, simply stated, the policy in effect when the claim is brought defends and/or pays the loss. Benefits of a claims made form ♦ less expensive than occurrence form, especially in the first four years of coverage of the allied world insurance form. Claims made policies only cover claims made during your policy period;

Source: slideshare.net

Source: slideshare.net

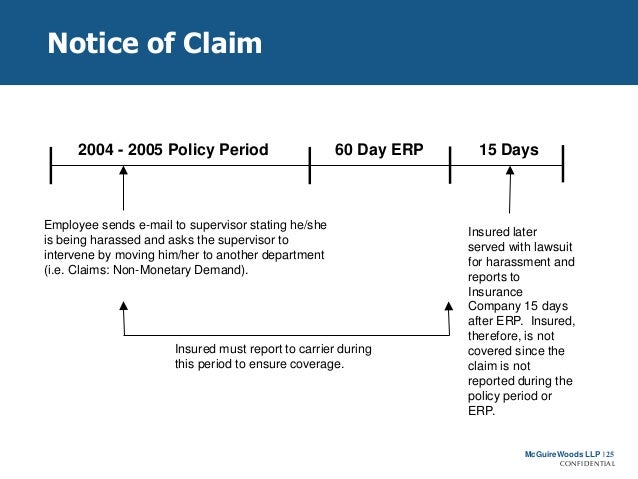

7 www.duanemorris.com claims made and claims made and Anticipating high risk pitfalls navigating claims identification, reporting requirements, late notice, multiple policies and allocation issues richard d. As outlined later, several conditions must be met before prior acts coverage is granted. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. Claims through this form of coverage must meet both criteria for coverage to apply.

Source: slideshare.net

Source: slideshare.net

Most of the time this coverage form is reserved for professional liability however, it can be used. A claims made policy is a type of liability insurance that pays when a claim is filed during the policy period. (the term made means notification to an insured that a demand for money or services is being requested. What is a retroactive date? Claims made extended reporting period or tail coverage.

Source: blog.tmlirp.org

Benefits of a claims made form ♦ less expensive than occurrence form, especially in the first four years of coverage of the allied world insurance form. This is not a problem for most insureds as long as coverage is kept in effect continuously without a lapse, and as long as continuity is preserved by from one policy term to the next even when. It’s unnecessary to determine when the bodily injury or property damage occurred. (the one exception is when a retroactive. With a “claims made” form, coverage is triggered by the claim itself.

Source: slideshare.net

Source: slideshare.net

This means your insurer helps cover claims filed during your policy period. This differs from most insurance policies, which pay if the insured event occurs during the policy period. This is not a problem for most insureds as long as coverage is kept in effect continuously without a lapse, and as long as continuity is preserved by from one policy term to the next even when. Anticipating high risk pitfalls navigating claims identification, reporting requirements, late notice, multiple policies and allocation issues richard d. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy.

Source: randrmagonline.com

Source: randrmagonline.com

This means your insurer helps cover claims filed during your policy period. This differs from most insurance policies, which pay if the insured event occurs during the policy period. This is not a problem for most insureds as long as coverage is kept in effect continuously without a lapse, and as long as continuity is preserved by from one policy term to the next even when. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. Again, simply stated, the policy in effect when the claim is brought defends and/or pays the loss.

Source: nasbp.org

Source: nasbp.org

Claims made coverage is a form of liability insurance. Claims made extended reporting period or tail coverage. Claims made basis liability coverage refers to liability insurance coverage that only covers claims made during the actual policy period. Claims through this form of coverage must meet both criteria for coverage to apply. Claims made policies tend to be more complex than occurrence policies.

Source: thelawyerschoice.com

Source: thelawyerschoice.com

In other words, even if the event that caused the claim happened during the policy period, it will only be. As outlined later, several conditions must be met before prior acts coverage is granted. Tail coverage requires that the insured pay. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. After five years, the claims made premium levels off.

Source: slideshare.net

Source: slideshare.net

Most of the time this coverage form is reserved for professional liability however, it can be used. What is a retroactive date? After five years, the claims made premium levels off. The lower cost for the first four years is especially attractive to professionals just starting their career. Benefits of a claims made form ♦ less expensive than occurrence form, especially in the first four years of coverage of the allied world insurance form.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

This means your insurer helps cover claims filed during your policy period. It’s unnecessary to determine when the bodily injury or property damage occurred. This differs from most insurance policies, which pay if the insured event occurs during the policy period. Occurrence insurance policies pay claims on. Tail policies last indefinitely, so claims can be made for any accidents that happen during the original policy dates.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

Tail coverage requires that the insured pay. Occurrence insurance policies pay claims on. In other words, even if the event that caused the claim happened during the policy period, it will only be. This because factors such as “tail coverage” and retroactive dates come into play. It’s unnecessary to determine when the bodily injury or property damage occurred.

Source: thehartford.com

Source: thehartford.com

Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy. This is not a problem for most insureds as long as coverage is kept in effect continuously without a lapse, and as long as continuity is preserved by from one policy term to the next even when. It’s unnecessary to determine when the bodily injury or property damage occurred. Claims made basis liability coverage refers to liability insurance coverage that only covers claims made during the actual policy period. Tail policies last indefinitely, so claims can be made for any accidents that happen during the original policy dates.

Source: slideshare.net

Source: slideshare.net

Your policy provides coverage if an incident occurs on or after a specified date. Tail coverage requires that the insured pay. As long as an insurable event happened after the policy’s retroactive date, your insurer should provide coverage. Again, simply stated, the policy in effect when the claim is brought defends and/or pays the loss. Claims made policies tend to be more complex than occurrence policies.

Source: slideshare.net

Source: slideshare.net

Claims made extended reporting period or tail coverage. The lower cost for the first four years is especially attractive to professionals just starting their career. (the one exception is when a retroactive. It’s unnecessary to determine when the bodily injury or property damage occurred. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Claims made coverage is a form of liability insurance. Tail policies last indefinitely, so claims can be made for any accidents that happen during the original policy dates. In other words, even if the event that caused the claim happened during the policy period, it will only be. As outlined later, several conditions must be met before prior acts coverage is granted. Occurrence policies require the claim occurrence to be during the policy period but have no limit on when the claim has to be presented to the policy.

Source: optimuminsurance.com.au

7 www.duanemorris.com claims made and claims made and This because factors such as “tail coverage” and retroactive dates come into play. Once the policy ends and is not replaced with a policy that carries forward the retroactive date (known as providing “prior acts”), the coverage stops for any claims that have not already been reported to the insurance company during the coverage period. (the term made means notification to an insured that a demand for money or services is being requested. Anticipating high risk pitfalls navigating claims identification, reporting requirements, late notice, multiple policies and allocation issues richard d.

Source: wwml.ca

Source: wwml.ca

This differs from most insurance policies, which pay if the insured event occurs during the policy period. It’s unnecessary to determine when the bodily injury or property damage occurred. Claims made policies tend to be more complex than occurrence policies. This means your insurer helps cover claims filed during your policy period. Once the policy ends and is not replaced with a policy that carries forward the retroactive date (known as providing “prior acts”), the coverage stops for any claims that have not already been reported to the insurance company during the coverage period.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims made insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information