Claims made medical malpractice insurance information

Home » Trend » Claims made medical malpractice insurance informationYour Claims made medical malpractice insurance images are available. Claims made medical malpractice insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Claims made medical malpractice insurance files here. Download all royalty-free images.

If you’re searching for claims made medical malpractice insurance pictures information connected with to the claims made medical malpractice insurance keyword, you have pay a visit to the ideal blog. Our site always gives you suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

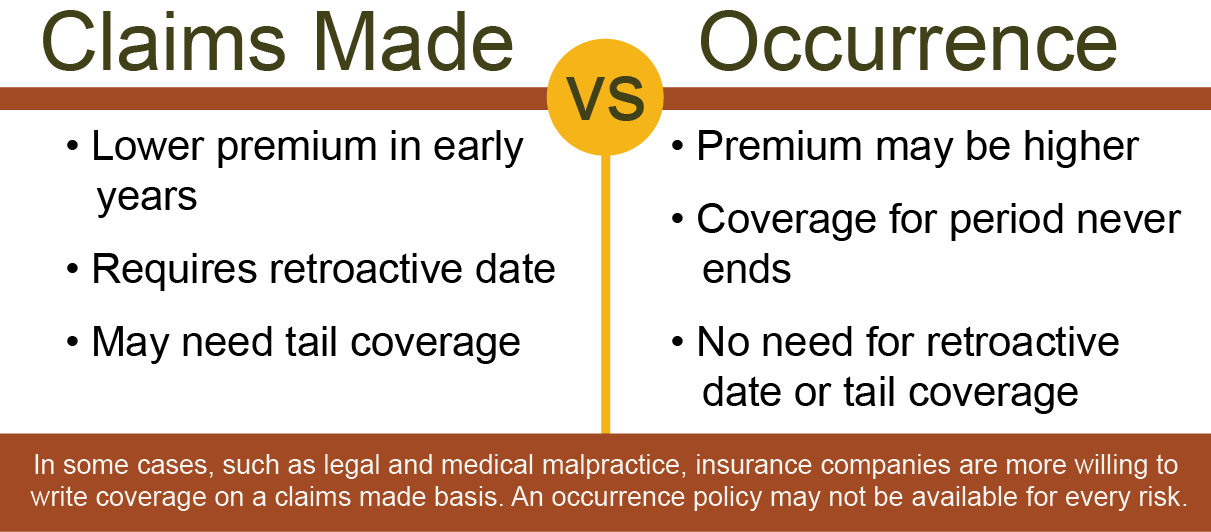

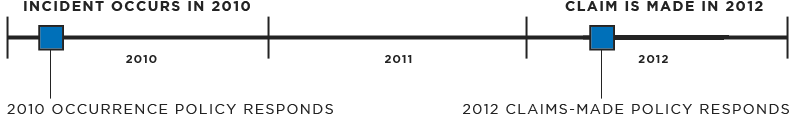

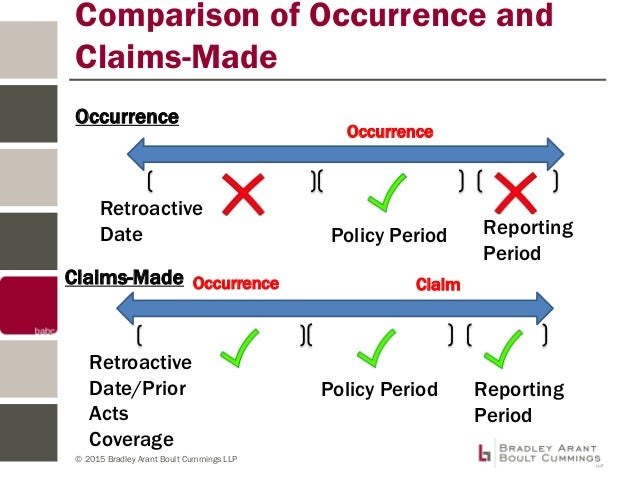

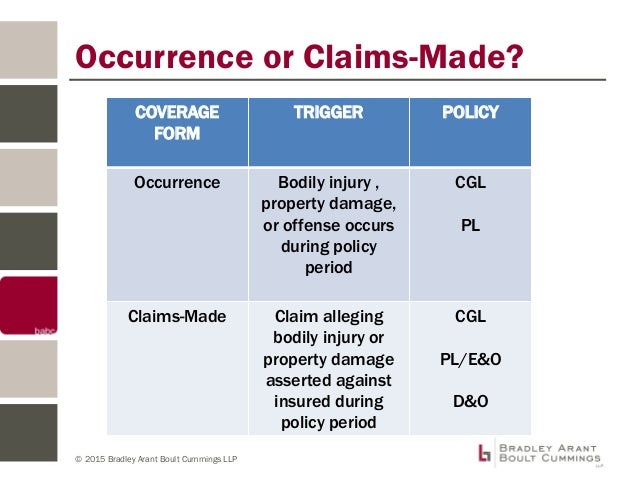

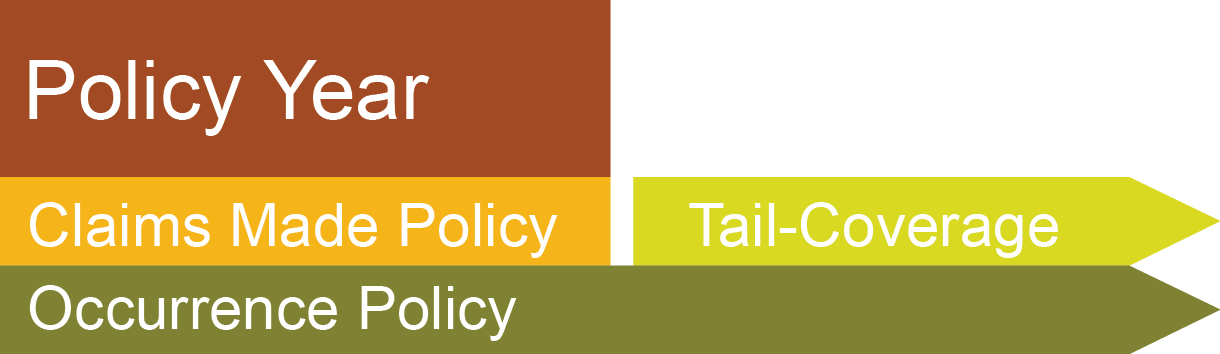

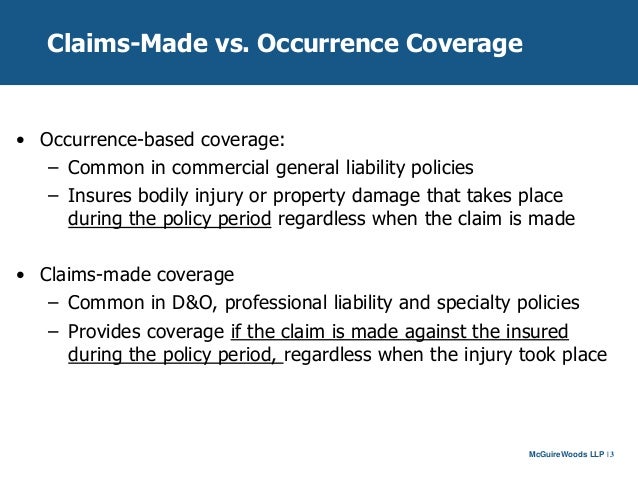

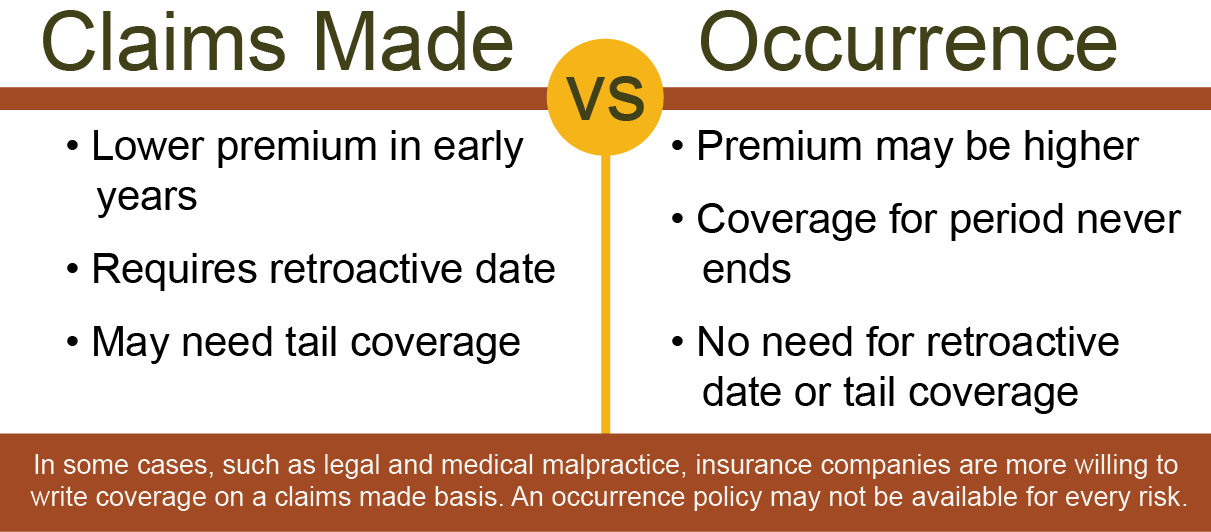

Claims Made Medical Malpractice Insurance. You must be covered by the policy both at the time of an incident and at the time a claim of malpractice is made. Frequently used coverage triggers generally range from including notice of potential claims to restricting coverage to only those initiated. You may very well have a situation where a practitioner is with claims made insurer a for many years and then moves to claims made. In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance.

Claims Made vs Occurrence From generalliabilityshop.com

Claims Made vs Occurrence From generalliabilityshop.com

You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. A claims made policy only provides coverage for as long as premiums are paid. However, this presents a significant problem. Additionally, the incident that caused the claim must also have taken place during the time that policy was active. What are claims made and occurrence policies? You may very well have a situation where a practitioner is with claims made insurer a for many years and then moves to claims made.

If you take the previous example, though you were covered at the time of the incident, you are not covered at.

You must be covered by the policy both at the time of an incident and at the time a claim of malpractice is made. Made policies are the most widely available form of medical malpractice coverage today. When things change, your malpractice coverage should be flexible. You may very well have a situation where a practitioner is with claims made insurer a for many years and then moves to claims made. There are two basic policy forms offered by medical malpractice insurance companies, claims made and occurrence. In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance.

Source: genoa.co.za

Source: genoa.co.za

Additionally, the incident that caused the claim must also have taken place during the time that policy was active. What the data tells us. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. When things change, your malpractice coverage should be flexible. A claims made policy only provides coverage for as long as premiums are paid.

There are two types of policies you can obtain: If you take the previous example, though you were covered at the time of the incident, you are not covered at. There are two types of policies you can obtain: 11 rows paul later reentered the market and, long story short, medical malpractice markets shifted to. What are claims made and occurrence policies?

Source: optimuminsurance.com.au

In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance. This accommodates savvy physicians who expect the best coverage at the most affordable rate. Frequently used coverage triggers generally range from including notice of potential claims to restricting coverage to only those initiated. You have two general coverage options: Former patients can bring claims against you months or even years after the alleged moment of malpractice, long after your effective policy period has ended.

Source: medboard-online.med.state.ma.us

Source: medboard-online.med.state.ma.us

2022 medical malpractice insurance rates: However, this presents a significant problem. It is important to understand the two basic types of malpractice insurance: Which are the maximum amount an insurance company will. There are two types of policies you can obtain:

Source: slideshare.net

Source: slideshare.net

You must be covered by the policy both at the time of an incident and at the time a claim of malpractice is made. This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. However, this presents a significant problem. What are claims made and occurrence policies? A claims made policy only provides coverage for as long as premiums are paid.

Source: optimuminsurance.com.au

When weighing medical malpractice insurance options, it’s important to recognize that a claim may be filed years after the disputed treatment took place. Made policies are the most widely available form of medical malpractice coverage today. Occurrence coverage is the most desirable form of coverage, but it is not available in all states. What the data tells us. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed.

Source: massagemag.com

Source: massagemag.com

The difference between claims made and occurrence coverage for doctors. Former patients can bring claims against you months or even years after the alleged moment of malpractice, long after your effective policy period has ended. This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. When weighing medical malpractice insurance options, it’s important to recognize that a claim may be filed years after the disputed treatment took place. What the data tells us.

Source: slideshare.net

Source: slideshare.net

You have two general coverage options: You may very well have a situation where a practitioner is with claims made insurer a for many years and then moves to claims made. When things change, your malpractice coverage should be flexible. However, this presents a significant problem. Occurrence coverage is the most desirable form of coverage, but it is not available in all states.

Source: nl.pinterest.com

Source: nl.pinterest.com

You must be covered by the policy both at the time of an incident and at the time a claim of malpractice is made. 2022 medical malpractice insurance rates: There are two types of policies you can obtain: What are claims made and occurrence policies? If you take the previous example, though you were covered at the time of the incident, you are not covered at.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Which are the maximum amount an insurance company will. What the data tells us. Frequently used coverage triggers generally range from including notice of potential claims to restricting coverage to only those initiated. There are two types of policies you can obtain: You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed.

Source: slideshare.net

Source: slideshare.net

The difference between claims made and occurrence coverage for doctors. In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance. Types of medical malpractice insurance. Former patients can bring claims against you months or even years after the alleged moment of malpractice, long after your effective policy period has ended. This accommodates savvy physicians who expect the best coverage at the most affordable rate.

Source: blog.tmlirp.org

This accommodates savvy physicians who expect the best coverage at the most affordable rate. Additionally, the incident that caused the claim must also have taken place during the time that policy was active. There are two basic policy forms offered by medical malpractice insurance companies, claims made and occurrence. There are two types of policies you can obtain: In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance.

Source: vault.buildbunker.com

Source: vault.buildbunker.com

A claims made policy only provides coverage for as long as premiums are paid. Occurrence coverage is the most desirable form of coverage, but it is not available in all states. 2022 medical malpractice insurance rates: This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. Types of medical malpractice insurance.

Source: konstancja-kozlov-pisze.blogspot.com

Source: konstancja-kozlov-pisze.blogspot.com

This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. When things change, your malpractice coverage should be flexible. This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. Frequently used coverage triggers generally range from including notice of potential claims to restricting coverage to only those initiated.

Source: slideshare.net

Source: slideshare.net

You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. Made policies are the most widely available form of medical malpractice coverage today. When things change, your malpractice coverage should be flexible. Former patients can bring claims against you months or even years after the alleged moment of malpractice, long after your effective policy period has ended. In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

It is important to understand the two basic types of malpractice insurance: The difference between claims made and occurrence coverage for doctors. Types of medical malpractice insurance. In the hypothetical example above, a claims made policy would not cover any losses because you would no longer be covered by the malpractice insurance. When weighing medical malpractice insurance options, it’s important to recognize that a claim may be filed years after the disputed treatment took place.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

This accommodates savvy physicians who expect the best coverage at the most affordable rate. This means that an insurer provides coverage only for claims resulting from services provided while the policy is continuously in effect, and only for claims reported during that period of continuous coverage. The claim is attached to the policy in effect on the date the claim is reported and is governed by the policy terms, including limits, in effect at that time. Additionally, the incident that caused the claim must also have taken place during the time that policy was active. When weighing medical malpractice insurance options, it’s important to recognize that a claim may be filed years after the disputed treatment took place.

Source: thelawyerschoice.com

Source: thelawyerschoice.com

It is important to understand the two basic types of malpractice insurance: When things change, your malpractice coverage should be flexible. A claims made policy only provides coverage for as long as premiums are paid. This accommodates savvy physicians who expect the best coverage at the most affordable rate. You may very well have a situation where a practitioner is with claims made insurer a for many years and then moves to claims made.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims made medical malpractice insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information