Claims made vs occurrence malpractice insurance information

Home » Trending » Claims made vs occurrence malpractice insurance informationYour Claims made vs occurrence malpractice insurance images are available. Claims made vs occurrence malpractice insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Claims made vs occurrence malpractice insurance files here. Find and Download all free vectors.

If you’re looking for claims made vs occurrence malpractice insurance images information linked to the claims made vs occurrence malpractice insurance keyword, you have come to the ideal blog. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

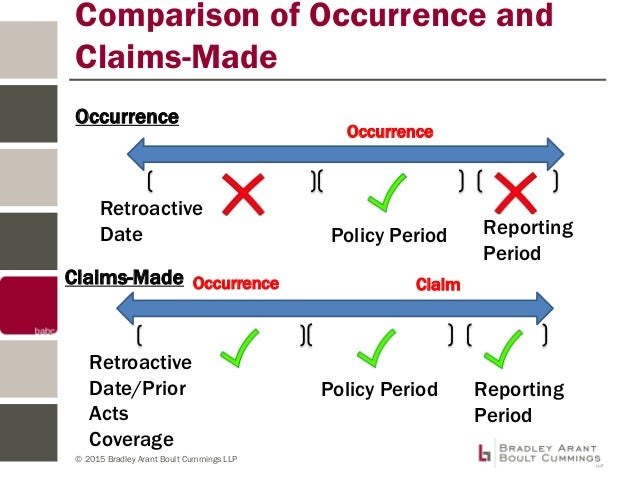

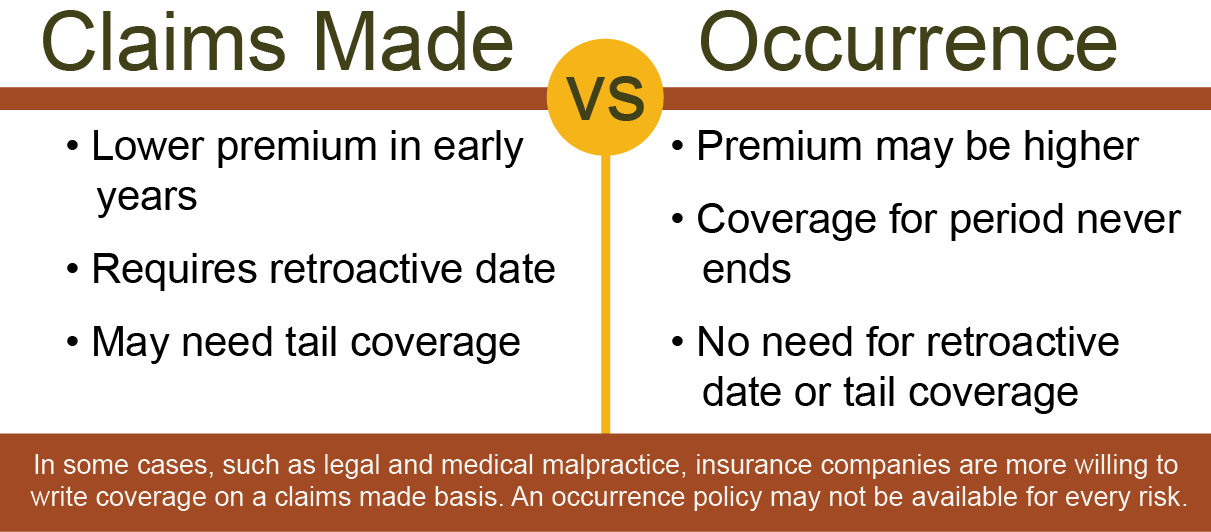

Claims Made Vs Occurrence Malpractice Insurance. When assessing occurrence vs claims made malpractice, this type of insurance is much cheaper. The premium increases during the second year because the policy now. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. Occurrence is the preferred option;

Know Thy Insurance Terms Occurrence vs. ClaimsMade From massagemag.com

Know Thy Insurance Terms Occurrence vs. ClaimsMade From massagemag.com

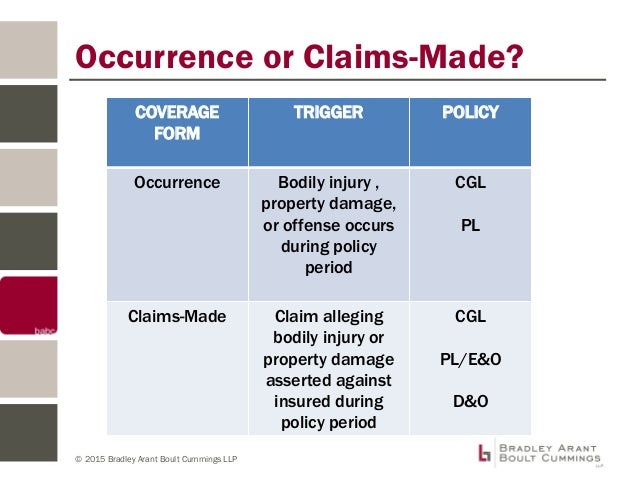

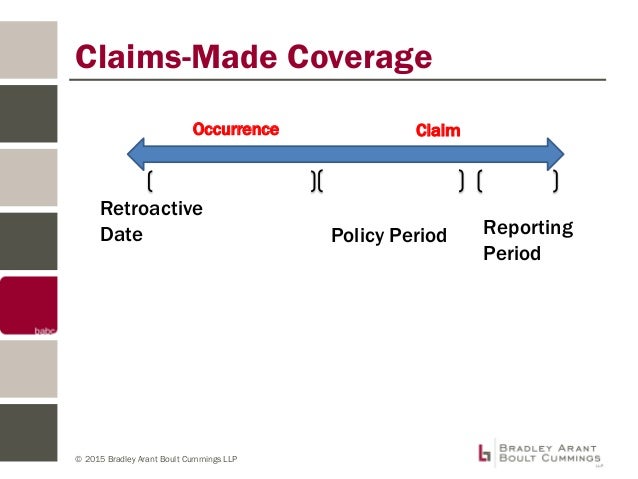

It is important for ods to familiarize themselves with their policy to ensure they are adequately protected. A veteran liability insurance broker from mymedicalmalpracticeinsurance.com explains the difference between the 2 most common medical malpractice insurance policies available across the nation, occurrence and claims. Occurrence — the policy in place at the time treatment is delivered is the policy that will respond to the claim. Although it can be a bit complicated, the easiest way to remember the differences is this: Claims made policies are typically more affordable Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier.

Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim.

So its harder to hit those limits (typically 1mil/3mil). Occurrence malpractice insurance because there was no such thing as claims made insurance. By stuart benas, cic and bruce e. Read aapa’s career resource on malpractice insurance and find out how you can get occurrence vs. Claims made liability differences explained. The incident in which the claim was made also needs to have occurred during the policy period.

Source: thelawyerschoice.com

Source: thelawyerschoice.com

Occurrence malpractice insurance because there was no such thing as claims made insurance. Home / general / insurance / news briefs / malpractice insurance 101: Claims made policies are typically more affordable Decades ago, physicians didn’t have the chance to compare claims made vs. So its harder to hit those limits (typically 1mil/3mil).

Source: slideshare.net

Source: slideshare.net

Difference between claims made and occurrence coverage for physician malpractice insurance. Read aapa’s career resource on malpractice insurance and find out how you can get occurrence vs. This means that your coverage starts when the policy begins, and you are covered for anything that occurs during that period related to malpractice. Occurrence is the preferred option; Decades ago, physicians didn’t have the chance to compare claims made vs.

Source: slideshare.net

Source: slideshare.net

When a claims made policy pays; Occurrence malpractice insurance because there was no such thing as claims made insurance. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. Occurrence malpractice insurance, explained (top) when an occurrence policy pays on claims; Erik leander • jan 14, 2010.

Source: graceybacker.com

Source: graceybacker.com

To understand whether “tail” coverage is needed, one must understand the difference between the main two types of malpractice insurance: Occurrence medical malpractice insurance policies. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. Difference between claims made and occurrence coverage for physician malpractice insurance. Occurrence malpractice insurance because there was no such thing as claims made insurance.

Source: beyogi.com

Source: beyogi.com

If a claim is filed after the end of the policy. If a claim is filed after the end of the policy. The premium increases during the second year because the policy now. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. Claims made policies are typically more affordable

Source: perronservices.com

Source: perronservices.com

Occurrence is the preferred option; Occurrence coverage triggers based on when the incident actually occurred. It is important for ods to familiarize themselves with their policy to ensure they are adequately protected. 1) you need a tail for a claims made policy, which is typically double the mature policy rate (it can take five years or so to hit your mature quote) 2) an occurrence based policy has separate policy limit each year (you basically get a new policy each year). How it differs from occurrence coverage.

Source: embroker.com

Source: embroker.com

How it differs from occurrence coverage. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. This means that they have the same discounts and limits, grant the same coverages, as well as provide defense beyond policies limits. Claims made liability differences explained. Decades ago, physicians didn’t have the chance to compare claims made vs.

Source: slideshare.net

Source: slideshare.net

It is important to understand the two basic types of malpractice insurance: If a claim is filed after the end of the policy. The names describe how the coverage is triggered. When assessing occurrence vs claims made malpractice, this type of insurance is much cheaper. Difference between claims made and occurrence coverage for physician malpractice insurance.

Source: blog.tmlirp.org

When it comes to malpractice insurance policies, there are two main policy types : Occurrence malpractice insurance | acp. Erik leander • jan 14, 2010. Decades ago, physicians didn’t have the chance to compare claims made vs. You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed.

Source: slideshare.net

Source: slideshare.net

Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim. Claims made — the policy in place the day the patient files the claim is the policy that will respond to the claim. Occurrence malpractice insurance, explained (top) when an occurrence policy pays on claims; The premium increases during the second year because the policy now. To understand whether “tail” coverage is needed, one must understand the difference between the main two types of malpractice insurance:

Source: konstancja-kozlov-pisze.blogspot.com

Source: konstancja-kozlov-pisze.blogspot.com

A veteran liability insurance broker from mymedicalmalpracticeinsurance.com explains the difference between the 2 most common medical malpractice insurance policies available across the nation, occurrence and claims. Occurrence malpractice insurance because there was no such thing as claims made insurance. Occurrence is the preferred option; Claims made policies are typically more affordable Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim.

Source: graceybacker.com

Source: graceybacker.com

To understand whether “tail” coverage is needed, one must understand the difference between the main two types of malpractice insurance: It is possible to issue both claims made and occurrence malpractice policies from the same insurance group. Occurrence — the policy in place at the time treatment is delivered is the policy that will respond to the claim. The incident in which the claim was made also needs to have occurred during the policy period. Claims made policies are typically more affordable

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

“in the olden days” all medical malpractice insurance policies were “occurrence” policies. Occurrence coverage triggers based on when the incident actually occurred. The premium increases during the second year because the policy now. Home / general / insurance / news briefs / malpractice insurance 101: Occurrence malpractice insurance | acp.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Occurrence coverage triggers based on when the incident actually occurred. If a claim is filed after the end of the policy. When it comes to malpractice insurance policies, there are two main policy types : Occurrence medical malpractice insurance policies. Read aapa’s career resource on malpractice insurance and find out how you can get occurrence vs.

Source: slideshare.net

Source: slideshare.net

Read aapa’s career resource on malpractice insurance and find out how you can get occurrence vs. With a claims made based policy, it’s the insurer. Although it can be a bit complicated, the easiest way to remember the differences is this: You must be paying for the policy and be covered by it at the time of the incident and the time the malpractice claim is filed. An occurrence policy provides coverage for “alleged incidents” (injuries) that happened during the policy year regardless of when the claim is reported to the (27).

Source: konstancja-kozlov-pisze.blogspot.com

Source: konstancja-kozlov-pisze.blogspot.com

Home / general / insurance / news briefs / malpractice insurance 101: It is important to understand the two basic types of malpractice insurance: Occurrence coverage triggers based on when the incident actually occurred. When a claims made policy pays; With a claims made based policy, it’s the insurer.

Source: nl.pinterest.com

Source: nl.pinterest.com

When it comes to malpractice insurance policies, there are two main policy types : A veteran liability insurance broker from mymedicalmalpracticeinsurance.com explains the difference between the 2 most common medical malpractice insurance policies available across the nation, occurrence and claims. When a claims made policy pays; Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. The names describe how the coverage is triggered.

Source: slideshare.net

Source: slideshare.net

Difference between claims made and occurrence coverage for physician malpractice insurance. Malpractice insurance is a great asset for doctors of optometry who are eager to practice to the full scope with peace of mind. Claims made liability differences explained. This means that they have the same discounts and limits, grant the same coverages, as well as provide defense beyond policies limits. Occurrence coverage triggers based on when the incident actually occurred.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims made vs occurrence malpractice insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea