Claims management in general insurance information

Home » Trend » Claims management in general insurance informationYour Claims management in general insurance images are ready. Claims management in general insurance are a topic that is being searched for and liked by netizens now. You can Download the Claims management in general insurance files here. Find and Download all free images.

If you’re searching for claims management in general insurance pictures information connected with to the claims management in general insurance topic, you have pay a visit to the ideal site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Claims Management In General Insurance. Efficient claims management is the holy grail for insurance companies. Numerous as those of life insurance claims suggests that claims behaviour of general insurers be investigated to minimize operating losses and ensure operational excellence. The process covers the entire timeline of the application; Every insurance carrier with any kind of claims staff has documented general procedures and standards for its claims department that it uses for dealing with common, and even not so common, claims issues.

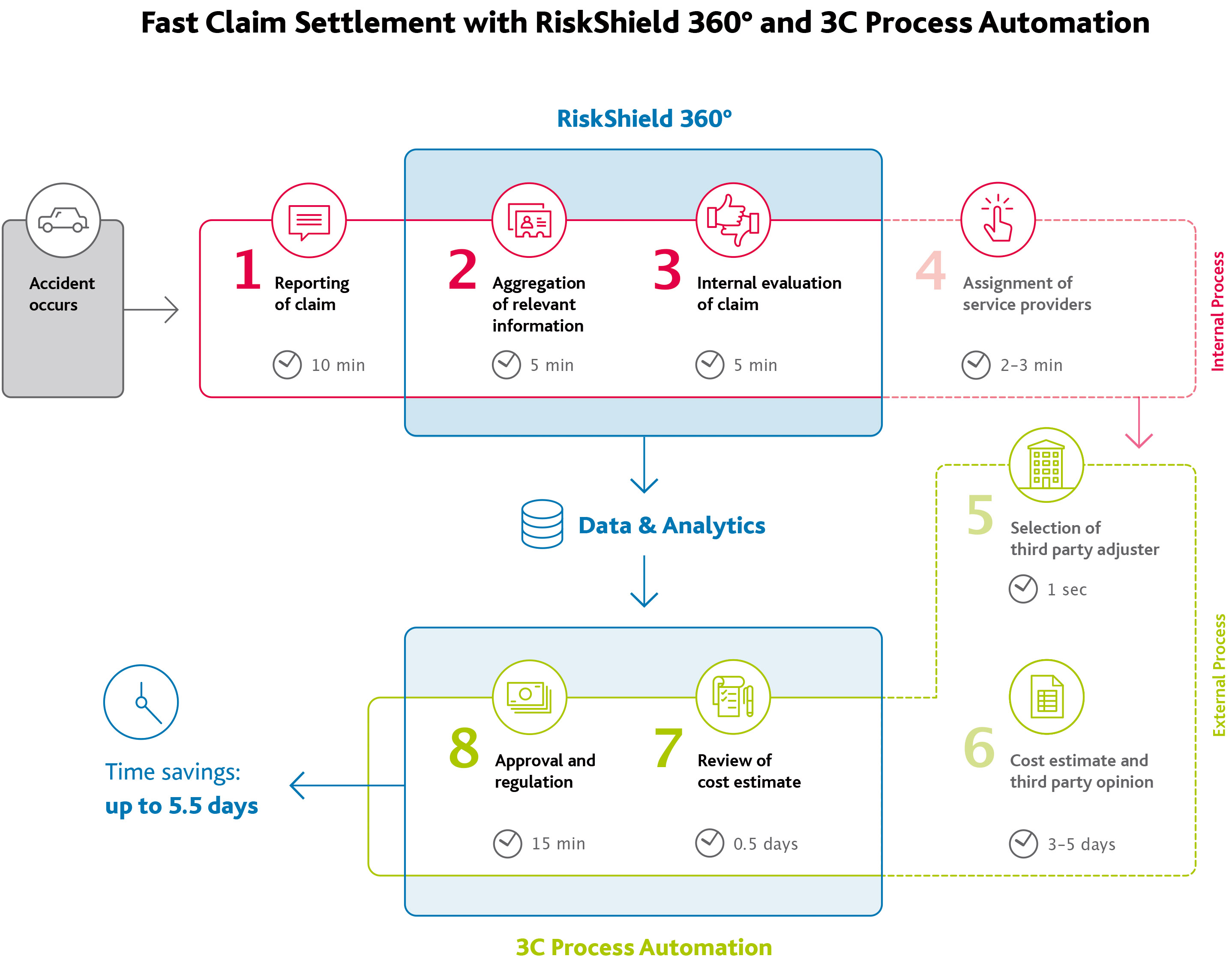

Insurance Claims management Arvato Financial Solutions From finance.arvato.com

Insurance Claims management Arvato Financial Solutions From finance.arvato.com

Aspects like speed, customer satisfaction, professionalism and cost of claims have been proposed to the respondents to rank them for this purpose. When most people think of insurance, they think of insurance claims. Efficient claims management is the holy grail for insurance companies. Our mantra is to proactively manage claims so that losses are mitigated to the benefit of both the insurer and insured while demonstrating real empathy to the insured during their time of high stress. A claim management process in insurance is a procedure or process in which the insured’s claim for compensation on an insured loss or damage is received, validated and verified, so the claim gets approved for compensation. The claims management in sonarwa general insurance.

The process covers the entire timeline of the application;

Line claims people, including those in management positions, do operate under a claims management plan. Insurance claim management is a core issue for the protection of insurance policyholders and hence a priority concern for the oecd insurance committee. Efficient claims management is the holy grail for insurance companies. Numerous as those of life insurance claims suggests that claims behaviour of general insurers be investigated to minimize operating losses and ensure operational excellence. Forbes states that an estimated 5 to 10 percent of all claims, in general, are fraudulent which, according to the fbi, costs us health. Claims management is one of the most visible (and hated, but we’ll get to that later) parts of insurance.

Source: insuranceclaimsolutions.ie

Source: insuranceclaimsolutions.ie

The claims management in sonarwa general insurance. The researcher wanted to know aspects of claims management recognized as efficient characteristics of claims process. Insurance claim management is a core issue for the protection of insurance policyholders and hence a priority concern for the oecd insurance committee. Many insurers have recognized the need to improve the efficiency of their claims management process. Claims management starts with the content of “what to do in the event of a claim” in an.

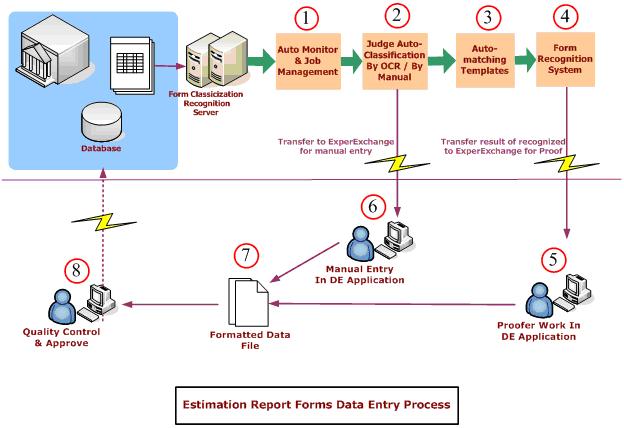

Source: expervision.com

Source: expervision.com

An insurance claim is a formal request to an insurance company asking for a payment based on the terms of the insurance policy. Means the process of identifying, controlling and resolving demands by individuals or public entities to recover losses from any member of the association. Findings on claims management processes in sonarwa general insurance which are claims planning, claims control, claims monitoring and evaluation show that they are frequently undertaken as it is indicated by the weighted means ranging between 1.00 ≤ mean score ≤ 1.50. The process covers the entire timeline of the application; Participants discuss its claim to vote to meet consensus on to coverage.

Source: insurancesupportworld.com

Source: insurancesupportworld.com

Aspects like speed, customer satisfaction, professionalism and cost of claims have been proposed to the respondents to rank them for this purpose. The process covers the entire timeline of the application; Numerous as those of life insurance claims suggests that claims behaviour of general insurers be investigated to minimize operating losses and ensure operational excellence. When most people think of insurance, they think of insurance claims. Underwriting & pricing of product, assessment & management of exposure, perils & clause of insurance policies, operational control.

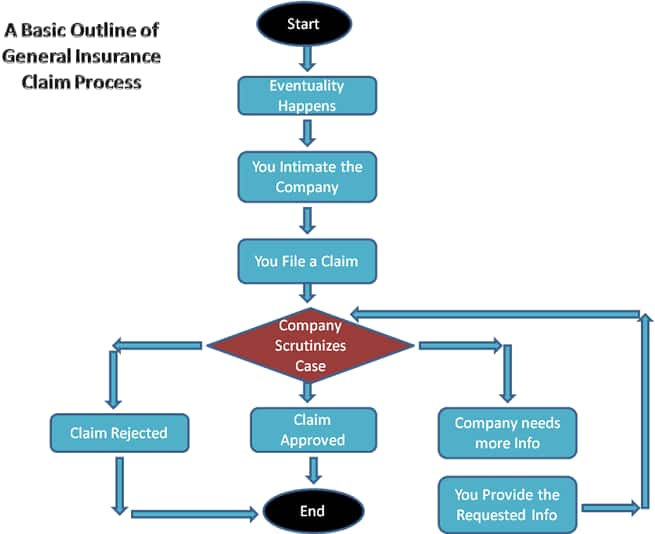

Source: policybazaar.com

Source: policybazaar.com

But since it is a complicated process that consumes a lot of time, it can take days or weeks for a company to pay the total settlement amount usually provided to policyholders in parts. The claims management in sonarwa general insurance. The authority has developed this set of claims management guidelines in order to enhance efficiency, transparency, disclosure of information to policyholders during the claims processing, and increase consumer satisfaction. From when you make a claim to when the. Participants discuss its claim to vote to meet consensus on to coverage.

Source: softwareadvice.com

Source: softwareadvice.com

Efficient claims management is the holy grail for insurance companies. Technical assistance for early and appropriate (fair) settlement ; Claim process based on line of business, and briefing session for client immediately after placement of portfolio ; But since it is a complicated process that consumes a lot of time, it can take days or weeks for a company to pay the total settlement amount usually provided to policyholders in parts. Proactive involvement in claims from intimation till settlement ;

Source: expertsystem.com

Source: expertsystem.com

Underwriting & pricing of product, assessment & management of exposure, perils & clause of insurance policies, operational control. Effective claims management requires speed and accuracy during the entire process. Every insurance carrier with any kind of claims staff has documented general procedures and standards for its claims department that it uses for dealing with common, and even not so common, claims issues. Participants discuss its claim to vote to meet consensus on to coverage. These guidelines are also expected to enhance compliance with the provisions of section 203 of the insurance act by the industry.

Source: cegedim-insurance.com

Source: cegedim-insurance.com

An insurance claim is a formal request to an insurance company asking for a payment based on the terms of the insurance policy. Numerous as those of life insurance claims suggests that claims behaviour of general insurers be investigated to minimize operating losses and ensure operational excellence. Findings on claims management processes in sonarwa general insurance which are claims planning, claims control, claims monitoring and evaluation show that they are frequently undertaken as it is indicated by the weighted means ranging between 1.00 ≤ mean score ≤ 1.50. Every insurance carrier with any kind of claims staff has documented general procedures and standards for its claims department that it uses for dealing with common, and even not so common, claims issues. The authority has developed this set of claims management guidelines in order to enhance efficiency, transparency, disclosure of information to policyholders during the claims processing, and increase consumer satisfaction.

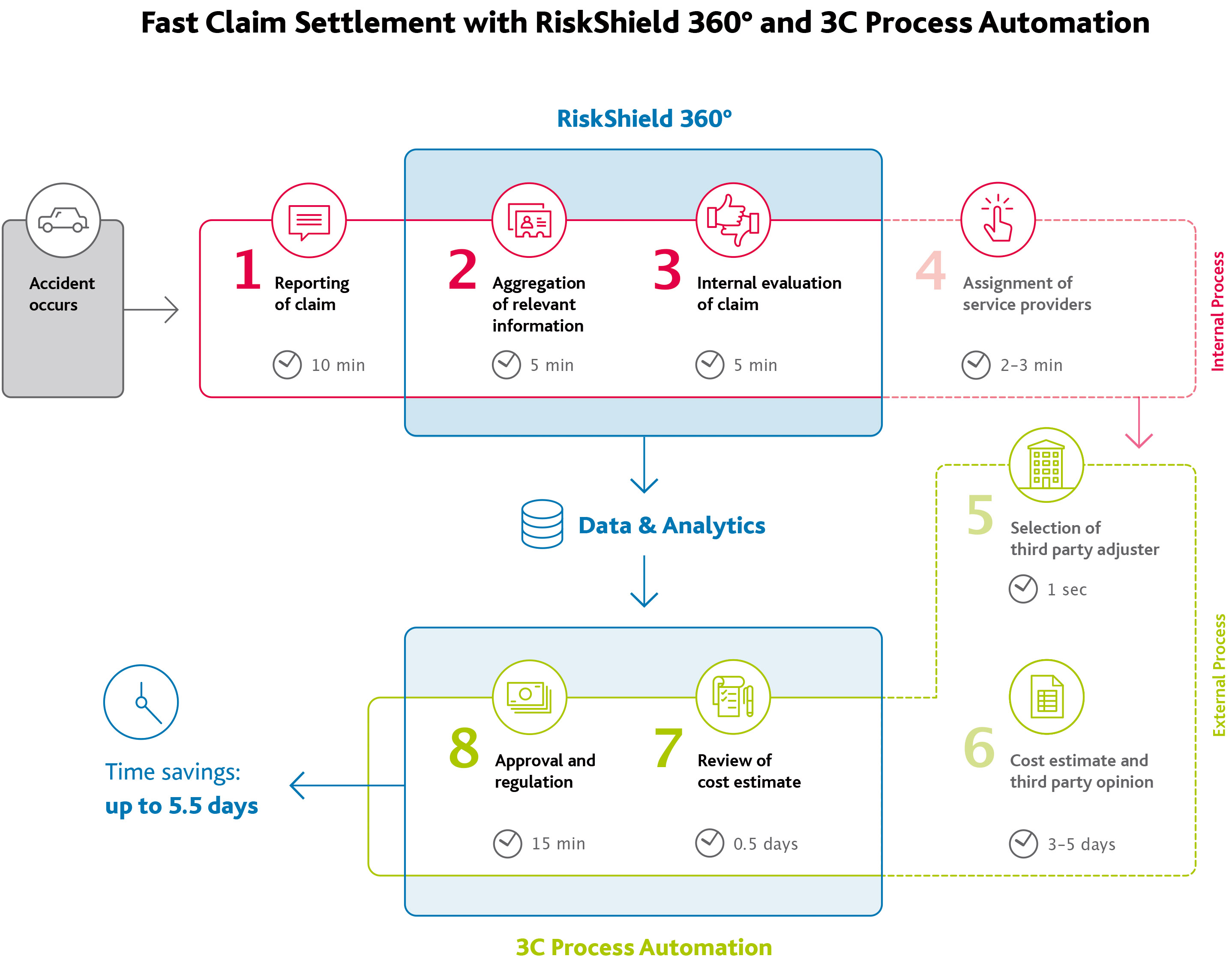

Source: finance.arvato.com

Source: finance.arvato.com

Use our directory to find claims management systems and solutions available to financial institutions such as insurance companies. Line claims people, including those in management positions, do operate under a claims management plan. The insurance company reviews the claim for its validity and then pays out to the insured or requesting party (on behalf of the insured) once approved. Effective claims management requires speed and accuracy during the entire process. Claim process based on line of business, and briefing session for client immediately after placement of portfolio ;

Source: conventusnj.com

Source: conventusnj.com

An insurance claim is a formal request to an insurance company asking for a payment based on the terms of the insurance policy. Means the process of identifying, controlling and resolving demands by individuals or public entities to recover losses from any member of the association. According to irukwub (1997) only genuine claims covered by the terms in the policy should be settled and then must be done promptly and equitable. Claims management international pty ltd (‘cmi’) is a niche third party administrator of general insurance claims. The claims management in sonarwa general insurance.

Source: claimstenshiga.blogspot.com

Source: claimstenshiga.blogspot.com

But since it is a complicated process that consumes a lot of time, it can take days or weeks for a company to pay the total settlement amount usually provided to policyholders in parts. Forbes states that an estimated 5 to 10 percent of all claims, in general, are fraudulent which, according to the fbi, costs us health. Findings on claims management processes in sonarwa general insurance which are claims planning, claims control, claims monitoring and evaluation show that they are frequently undertaken as it is indicated by the weighted means ranging between 1.00 ≤ mean score ≤ 1.50. The strong association of insurance = claims makes sense when you consider the millions of insurance claims filed each year. Aspects like speed, customer satisfaction, professionalism and cost of claims have been proposed to the respondents to rank them for this purpose.

Source: youtube.com

Source: youtube.com

Research the market through our online platform, discover. Technical assistance for early and appropriate (fair) settlement ; Means the process of identifying, controlling and resolving demands by individuals or public entities to recover losses from any member of the association. The process covers the entire timeline of the application; The authority has developed this set of claims management guidelines in order to enhance efficiency, transparency, disclosure of information to policyholders during the claims processing, and increase consumer satisfaction.

Source: gertnelincattorneys.co.za

Source: gertnelincattorneys.co.za

Many insurers have recognized the need to improve the efficiency of their claims management process. Use our directory to find claims management systems and solutions available to financial institutions such as insurance companies. Performance of general insurance companies is expected to be related to various factors, including optimal underwriting and prompt and efficient claims management functions. Disposing of such demands for payment requires skills in insurance law, adjusting/investigation, loss control engineering and general business. Research the market through our online platform, discover.

Source: kmrdpartners.com

Source: kmrdpartners.com

Performance of general insurance companies is expected to be related to various factors, including optimal underwriting and prompt and efficient claims management functions. Contracted brokers, and 205 claimants in kigali city. Our mantra is to proactively manage claims so that losses are mitigated to the benefit of both the insurer and insured while demonstrating real empathy to the insured during their time of high stress. Claims management is the function of supervising legal,. A claim management process in insurance is a procedure or process in which the insured’s claim for compensation on an insured loss or damage is received, validated and verified, so the claim gets approved for compensation.

Source: slideshare.net

Source: slideshare.net

Our mantra is to proactively manage claims so that losses are mitigated to the benefit of both the insurer and insured while demonstrating real empathy to the insured during their time of high stress. Effective claims management requires speed and accuracy during the entire process. Proactive involvement in claims from intimation till settlement ; Numerous as those of life insurance claims suggests that claims behaviour of general insurers be investigated to minimize operating losses and ensure operational excellence. Claims management starts with the content of “what to do in the event of a claim” in an.

Source: slideshare.net

Source: slideshare.net

Our mantra is to proactively manage claims so that losses are mitigated to the benefit of both the insurer and insured while demonstrating real empathy to the insured during their time of high stress. These guidelines are also expected to enhance compliance with the provisions of section 203 of the insurance act by the industry. A claim management process in insurance is a procedure or process in which the insured’s claim for compensation on an insured loss or damage is received, validated and verified, so the claim gets approved for compensation. This study investigated the effect of underwriting and claims management practices on the performance of general insurance firms in east africa. Contracted brokers, and 205 claimants in kigali city.

Source: insurancesupportworld.com

Source: insurancesupportworld.com

A claim management process in insurance is a procedure or process in which the insured’s claim for compensation on an insured loss or damage is received, validated and verified, so the claim gets approved for compensation. The claims management in sonarwa general insurance. Insurance customers in claims general insurance commissioners in general insurance claims management workflow. The objective of their efforts is to lower costs, while also increasing overall throughput. The process covers the entire timeline of the application;

Source: mantralabsglobal.com

Source: mantralabsglobal.com

Efficient claims management is the holy grail for insurance companies. This study investigated the effect of underwriting and claims management practices on the performance of general insurance firms in east africa. Many insurers have recognized the need to improve the efficiency of their claims management process. The modern claims process is even more complex. From when you make a claim to when the.

Source: inetsoft.com

Source: inetsoft.com

Use our directory to find claims management systems and solutions available to financial institutions such as insurance companies. Our mantra is to proactively manage claims so that losses are mitigated to the benefit of both the insurer and insured while demonstrating real empathy to the insured during their time of high stress. A claim management process in insurance is a procedure or process in which the insured’s claim for compensation on an insured loss or damage is received, validated and verified, so the claim gets approved for compensation. Proactive involvement in claims from intimation till settlement ; These guidelines are also expected to enhance compliance with the provisions of section 203 of the insurance act by the industry.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims management in general insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information