Claims management solutions for life insurance information

Home » Trend » Claims management solutions for life insurance informationYour Claims management solutions for life insurance images are available. Claims management solutions for life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Claims management solutions for life insurance files here. Download all free photos.

If you’re looking for claims management solutions for life insurance images information related to the claims management solutions for life insurance interest, you have visit the right site. Our website always provides you with hints for downloading the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

Claims Management Solutions For Life Insurance. Insurance claims management software can provide you with instant access to documents and information surrounding a claim. If it is so, cogneesol can help. Faster intervention by the insurer. Millions of claims paid every year.

Claim Management For Life Insurance ClaimVantage APAC From claimvantage.com

Claim Management For Life Insurance ClaimVantage APAC From claimvantage.com

Our claims processing systems give our clients an edge in this rapidly growing, highly competitive insurance sector. Lexisnexis enables you to automate with confidence by embedding timely, reliable insights directly into your claims management systems. The insurance assessment guide developed by scor a comprehensive underwriting and claims guide developed by scor global life, solem helps global clients to better assess medical, occupational, sports, financial, residence and. We have met the claims processing administration needs of insurance carriers worldwide. In this article, we explore different software solutions and. Increased purchasing power for the insurer.

Components include workflow, business process management (bpm) capabilities, a rule engine, collaboration tools, integration tools, and industry templates that contain claims.

Cogitate insurance claims management system powered by modern technology that streamline insurance claims processing to reduce both time and processing costs. Read more 4.89 ( 27 reviews) compare price demo nextagency These activities include new business, underwriting, distribution channel management, policy administration, claims management, insurance accounting, reinsurance, and many more. Digitising the claims process is not easy, especially when it involves complex living benefits, such as disability. Ping an health uses mobile internet and big data technology in its claims services. The claims management model helps to provide a new understanding of the claim and the context in which claimants are considered.

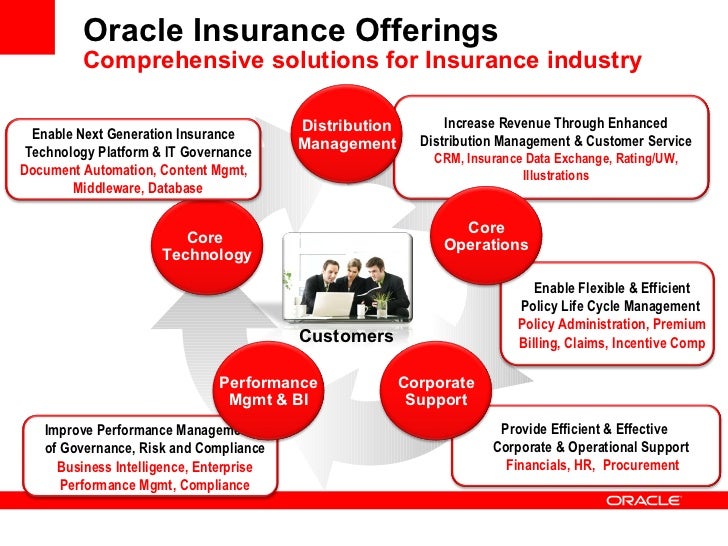

Source: oracle.com

Source: oracle.com

Additionally, underwriting and claims handling processes have a significant influence on your image and reputation as an insurer. Increased purchasing power for the insurer. From the onset of the claim through determination, insurance carriers must complete many tasks — collecting, reviewing and maintaining. They help in the early detection of possible fraud to mitigate the risk of potential losses and litigations. Experience the flexibility of addressing various claim types differently, like death and maturity claims, while improving regulatory compliance and.

Source: inubesolutions.com

Source: inubesolutions.com

Underwriting and claims are the two key pillars of risk management for life insurers. Insurance claims management software can provide you with instant access to documents and information surrounding a claim. With actisure for over 10 years. Key features include roi tracking,. Read more 4.89 ( 27 reviews) compare price demo nextagency

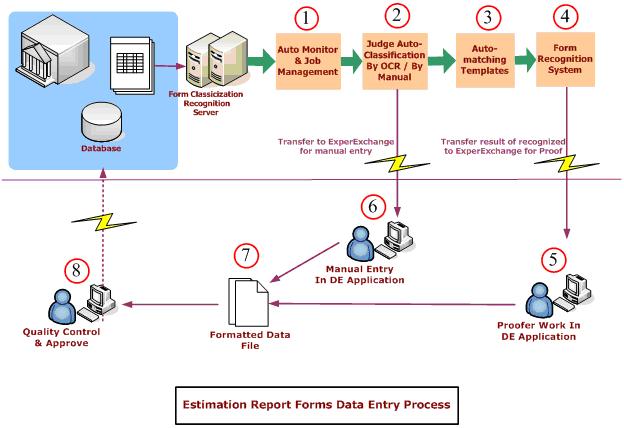

Source: expervision.com

Source: expervision.com

Insurance policy management software supports the core insurance operations in the insurance business. Millions of claims paid every year. Ping an health uses mobile internet and big data technology in its claims services. Better management of fraudulent claims. With actisure for over 10 years.

Source: intercurve.com

Source: intercurve.com

From the onset of the claim through determination, insurance carriers must complete many tasks — collecting, reviewing and maintaining. However, it’s clear that claims departments’ lack of digitisation is piling pressure on claims teams to meet the expectations of customers who want to engage quickly and efficiently via a digital format. So give your business the power to build a. The claims management model helps to provide a new understanding of the claim and the context in which claimants are considered. Millions of claims paid every year.

Source: mybendersolutions.com

Source: mybendersolutions.com

Key features include roi tracking,. Additionally, underwriting and claims handling processes have a significant influence on your image and reputation as an insurer. Experience the flexibility of addressing various claim types differently, like death and maturity claims, while improving regulatory compliance and. The claims management model helps to provide a new understanding of the claim and the context in which claimants are considered. Improve operational efficiency and reduce costs by utilizing data and analytics from fnol through the life of the claim, helping you make better decisions at every step.

Source: iot.tl

Source: iot.tl

Ping an health uses mobile internet and big data technology in its claims services. So give your business the power to build a. Claims management software is important for any insurance firm or large business. With actisure for over 10 years. If it is so, cogneesol can help.

Source: expertsystem.com

Source: expertsystem.com

From the onset of the claim through determination, insurance carriers must complete many tasks — collecting, reviewing and maintaining. Better management of fraudulent claims. Millions of claims paid every year. Cogitate insurance claims management system powered by modern technology that streamline insurance claims processing to reduce both time and processing costs. Claims management software is important for any insurance firm or large business.

Source: innitialliance.com

Source: innitialliance.com

Improve operational efficiency and reduce costs by utilizing data and analytics from fnol through the life of the claim, helping you make better decisions at every step. Singapore, one of the world’s leading fintech and insurtech hubs, is moving fast. These elements determine how profitable and secure a portfolio is and whether or not the insurance risk will ultimately materialise. With actisure for over 10 years. Components include workflow, business process management (bpm) capabilities, a rule engine, collaboration tools, integration tools, and industry templates that contain claims.

Source: claimvantage.com

Source: claimvantage.com

They help in the early detection of possible fraud to mitigate the risk of potential losses and litigations. Digitising the claims process is not easy, especially when it involves complex living benefits, such as disability. Ping an health uses mobile internet and big data technology in its claims services. If it is so, cogneesol can help. Its single interface provides all the claims content, regardless of where it originated or of its format.

Source: wns.com

Source: wns.com

Increased purchasing power for the insurer. Insurance policy management software supports the core insurance operations in the insurance business. However, it’s clear that claims departments’ lack of digitisation is piling pressure on claims teams to meet the expectations of customers who want to engage quickly and efficiently via a digital format. The insurance assessment guide developed by scor a comprehensive underwriting and claims guide developed by scor global life, solem helps global clients to better assess medical, occupational, sports, financial, residence and. So give your business the power to build a.

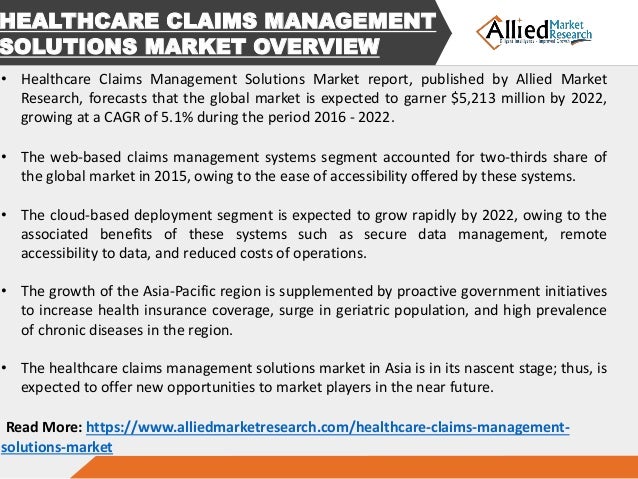

Source: slideshare.net

Source: slideshare.net

Lexisnexis enables you to automate with confidence by embedding timely, reliable insights directly into your claims management systems. The claims management model helps to provide a new understanding of the claim and the context in which claimants are considered. Ping an health uses mobile internet and big data technology in its claims services. Key features include roi tracking,. Increased purchasing power for the insurer.

Source: pinterest.com

Source: pinterest.com

Millions of claims paid every year. Life claims management 4 million+ annual transactions handled 2,000+ life insurance specialists our life offerings are extensive and spread across functions, including new product introduction, specialized new business, underwriting and issue, contract and policy administration, customer support, agency management and claims solutions. Digitising the claims process is not easy, especially when it involves complex living benefits, such as disability. Cogitate insurance claims management system powered by modern technology that streamline insurance claims processing to reduce both time and processing costs. Pega claims for life insurance empowers examiners to focus on claimant needs while streamlining the flow of claims across the organization.

Source: claimvantage.com

Source: claimvantage.com

Key features include roi tracking,. Experience the flexibility of addressing various claim types differently, like death and maturity claims, while improving regulatory compliance and. Millions of claims paid every year. Better management of fraudulent claims. Our claims processing systems give our clients an edge in this rapidly growing, highly competitive insurance sector.

Source: slideshare.net

Source: slideshare.net

These activities include new business, underwriting, distribution channel management, policy administration, claims management, insurance accounting, reinsurance, and many more. The insurance assessment guide developed by scor a comprehensive underwriting and claims guide developed by scor global life, solem helps global clients to better assess medical, occupational, sports, financial, residence and. From the onset of the claim through determination, insurance carriers must complete many tasks — collecting, reviewing and maintaining. Lexisnexis enables you to automate with confidence by embedding timely, reliable insights directly into your claims management systems. In this article, we explore different software solutions and.

Source: thegatewaydigital.com

Source: thegatewaydigital.com

These elements determine how profitable and secure a portfolio is and whether or not the insurance risk will ultimately materialise. Pega claims for life insurance empowers examiners to focus on claimant needs while streamlining the flow of claims across the organization. Millions of claims paid every year. If it is so, cogneesol can help. With hyland�s insurance case management solution, claims administrators or examiners manage all aspects of a claim, from early assessment to investigation to settlement.

Source: ramseysolutions.com

Source: ramseysolutions.com

Its single interface provides all the claims content, regardless of where it originated or of its format. The insurance assessment guide developed by scor a comprehensive underwriting and claims guide developed by scor global life, solem helps global clients to better assess medical, occupational, sports, financial, residence and. With hyland�s insurance case management solution, claims administrators or examiners manage all aspects of a claim, from early assessment to investigation to settlement. These elements determine how profitable and secure a portfolio is and whether or not the insurance risk will ultimately materialise. Lexisnexis enables you to automate with confidence by embedding timely, reliable insights directly into your claims management systems.

Source: pinterest.com

Source: pinterest.com

Pega claims for life insurance empowers examiners to focus on claimant needs while streamlining the flow of claims across the organization. Insurance policy management software supports the core insurance operations in the insurance business. Ping an health uses mobile internet and big data technology in its claims services. Better management of fraudulent claims. Faster intervention by the insurer.

Source: indusnet.co.in

Source: indusnet.co.in

With actisure for over 10 years. Underwriting and claims are the two key pillars of risk management for life insurers. Faster intervention by the insurer. Cogitate insurance claims management system powered by modern technology that streamline insurance claims processing to reduce both time and processing costs. Better management of fraudulent claims.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims management solutions for life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information