Claims vs occurrence based insurance Idea

Home » Trending » Claims vs occurrence based insurance IdeaYour Claims vs occurrence based insurance images are available in this site. Claims vs occurrence based insurance are a topic that is being searched for and liked by netizens now. You can Download the Claims vs occurrence based insurance files here. Download all free photos and vectors.

If you’re looking for claims vs occurrence based insurance images information related to the claims vs occurrence based insurance interest, you have visit the right site. Our website always provides you with suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

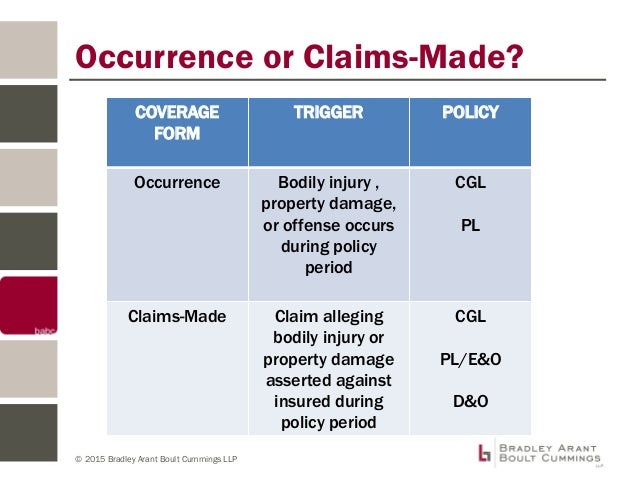

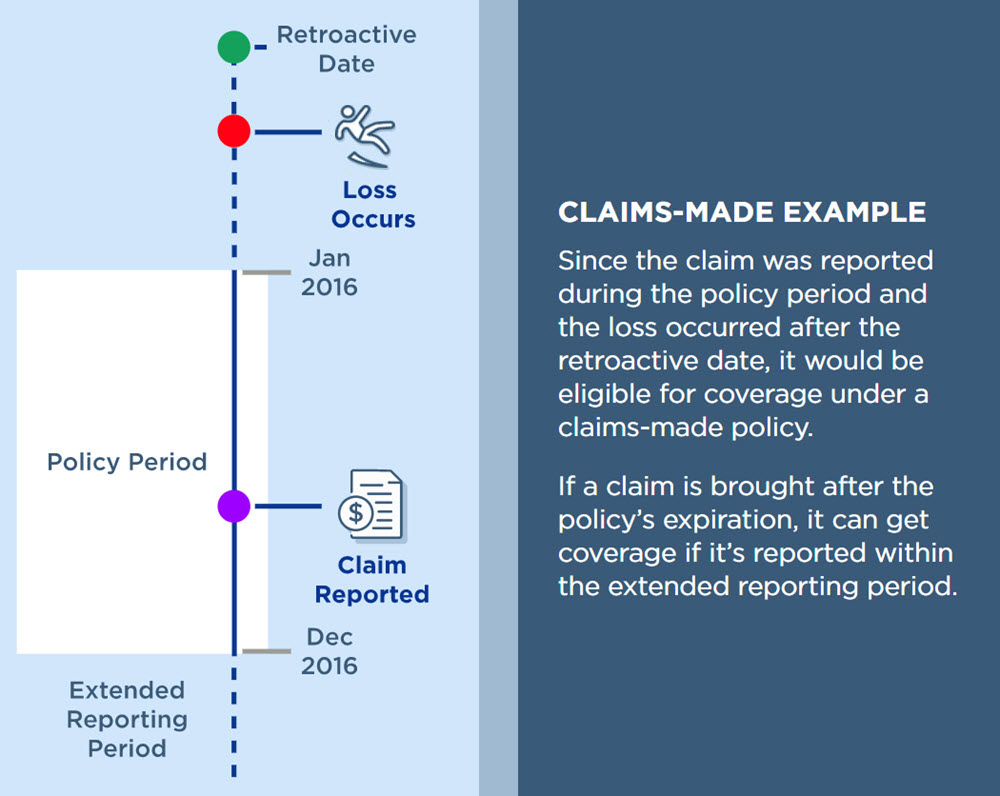

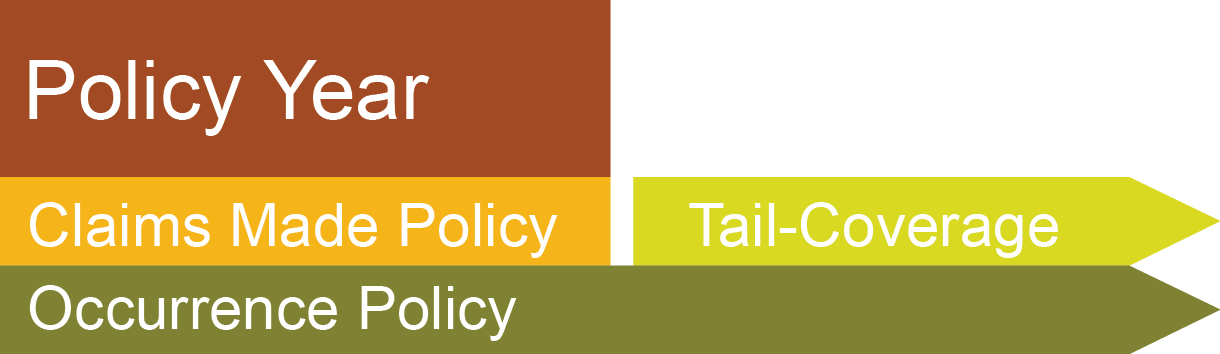

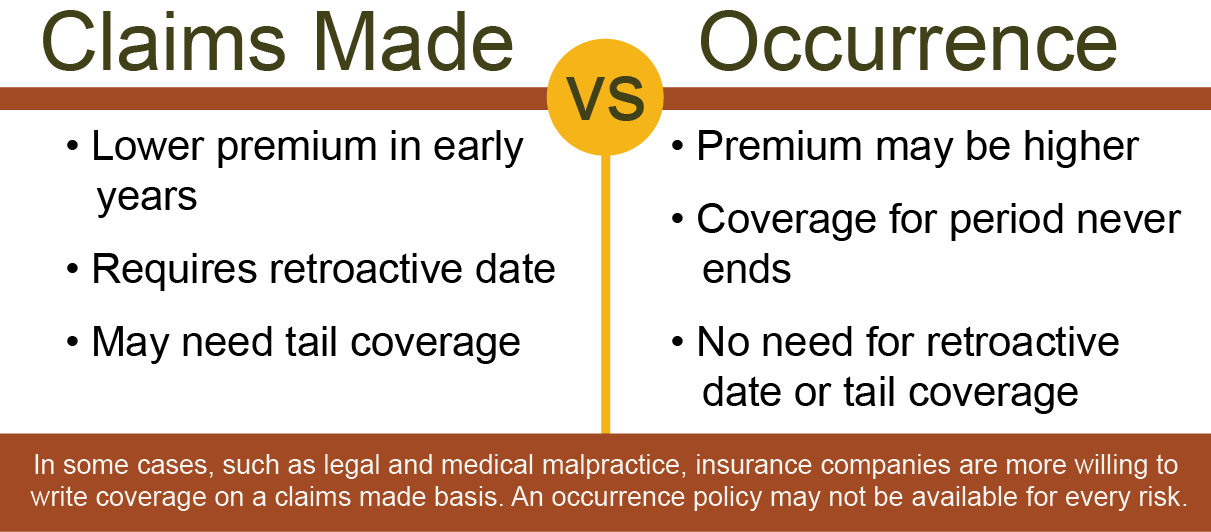

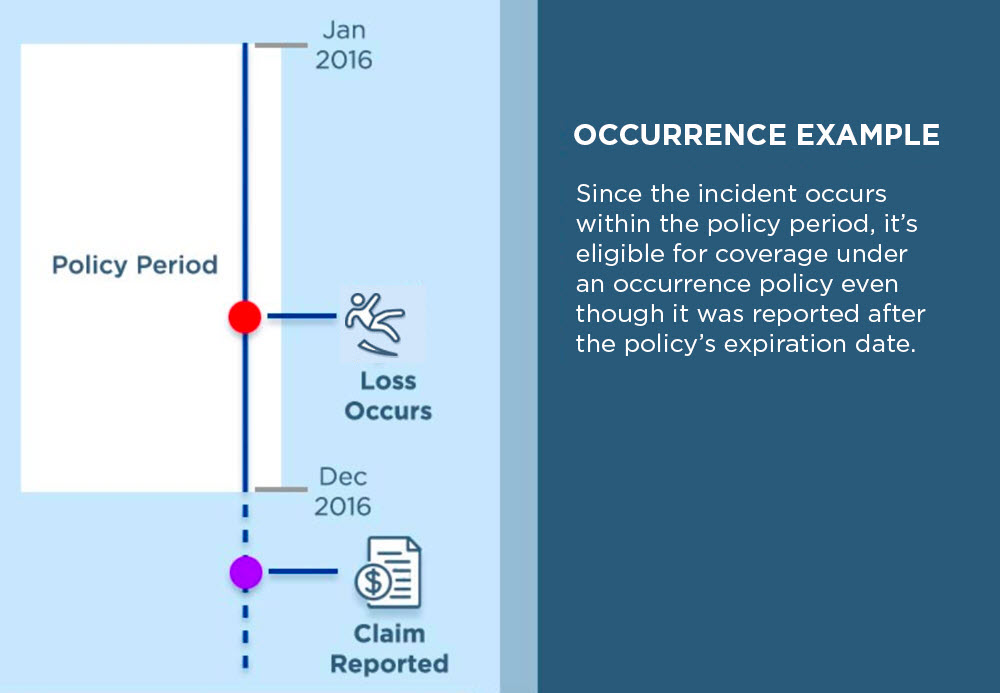

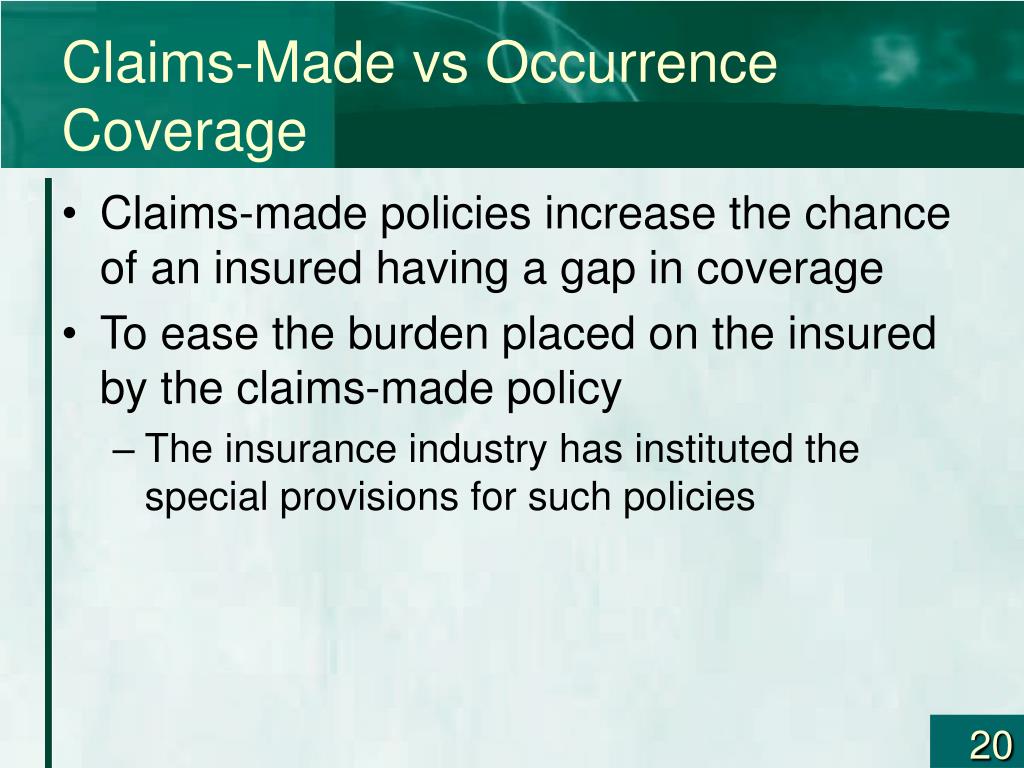

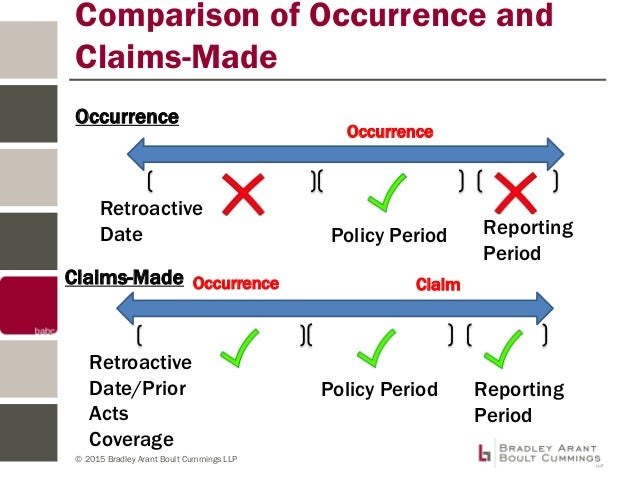

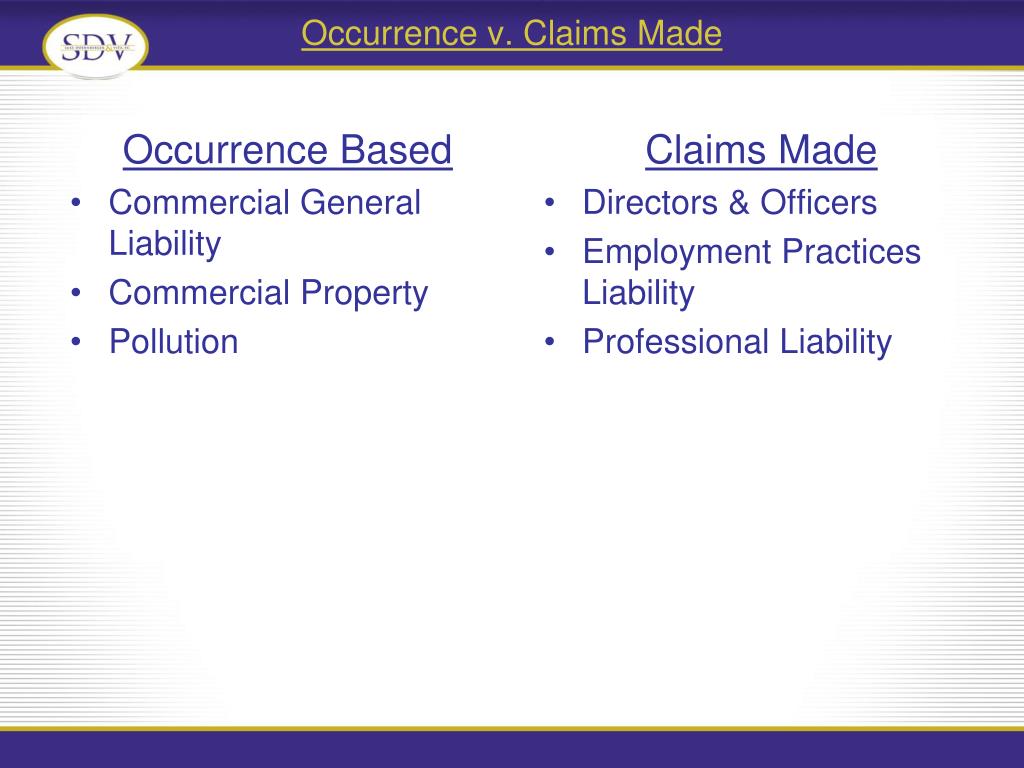

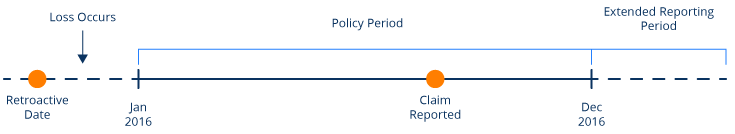

Claims Vs Occurrence Based Insurance. There are two key terms that make the difference when sorting out claims made vs. This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance. An event and a claim. An occurrence policy has lifetime coverage for the incidents that occur during a policy period, regardless of when the claim is reported.

Understanding Claims Made Legal Malpractice Insurance From slideshare.net

Understanding Claims Made Legal Malpractice Insurance From slideshare.net

Claims through this form of coverage must meet both criteria for coverage to apply. Coverage depends on the timing of the event. An occurrence policy covers claims resulting from an injury or another event that occurs during the policy term. Occurrence policies respond to claims that occurred during the policy term, regardless of when they are reported. Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim. There is a lot of chatter about whether an occurrence trigger vs.

This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance.

The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. Claims through this form of coverage must meet both criteria for coverage to apply. This means you won’t have to worry about a large claim exhausting your limit. First, let’s understand the difference. Occurrence policies, such as the policies you may carry on your car or your home, assign a claim to the appropriate policy. The key difference is in the timing—the critical distinction is the coverage provided when a potential incident occurs and when a claim is filed.

Source: ethiqal.co.za

Source: ethiqal.co.za

The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. Contractual insurance policy or discretionary cover? With a claims made based policy, it’s the insurer. The key difference is in the timing—the critical distinction is the coverage provided when a potential incident occurs and when a claim is filed. The only difference lies in the reporting period available for claims.

Source: embroker.com

Source: embroker.com

An event and a claim. Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim. The coverage in each of these policies is the same; The only difference lies in the reporting period available for claims. This means you won’t have to worry about a large claim exhausting your limit.

Source: slideshare.net

Source: slideshare.net

There is a lot of chatter about whether an occurrence trigger vs. First, let’s understand the difference. An event and a claim. Occurrence policies, such as the policies you may carry on your car or your home, assign a claim to the appropriate policy. Occurrence (cgl) what follows is a description of the various issues relating to this topic.

Source: thehartford.com

Source: thehartford.com

Claims through this form of coverage must meet both criteria for coverage to apply. The only difference lies in the reporting period available for claims. Who should pay for the tail insurance? Consultant’s insurance shall be occurrence based and shall insure against loss or damage resulting from or related to the consultant’s performance of this contract regardless of the date the claim is filed or expiration of the policy. First, let’s understand the difference.

Source: presidioinsurance.com

Source: presidioinsurance.com

Occurrence (cgl) what follows is a description of the various issues relating to this topic. Coverage depends on the timing of the event. Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. An occurrence policy has lifetime coverage for the incidents that occur during a policy period, regardless of when the claim is reported.

Source: blog.tmlirp.org

The key difference is in the timing—the critical distinction is the coverage provided when a potential incident occurs and when a claim is filed. There are two key terms that make the difference when sorting out claims made vs. This means you won’t have to worry about a large claim exhausting your limit. Claims through this form of coverage must meet both criteria for coverage to apply. This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Claims through this form of coverage must meet both criteria for coverage to apply. With a claims made based policy, it’s the insurer. Virtually all liability policies fall into one of two categories: The coverage in each of these policies is the same; An occurrence policy covers claims resulting from an injury or another event that occurs during the policy term.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

The key difference is in the timing—the critical distinction is the coverage provided when a potential incident occurs and when a claim is filed. Virtually all liability policies fall into one of two categories: Occurrence policies respond to claims that occurred during the policy term, regardless of when they are reported. Occurrence policies, such as the policies you may carry on your car or your home, assign a claim to the appropriate policy. Occurrence (cgl) what follows is a description of the various issues relating to this topic.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

There are two key terms that make the difference when sorting out claims made vs. Claims through this form of coverage must meet both criteria for coverage to apply. Occurrence policies respond to claims that occurred during the policy term, regardless of when they are reported. This means you won’t have to worry about a large claim exhausting your limit. This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance.

Source: thehartford.com

Source: thehartford.com

The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. An occurrence policy covers claims resulting from an injury or another event that occurs during the policy term. First, let’s understand the difference. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. The only difference lies in the reporting period available for claims.

Source: randrmagonline.com

Source: randrmagonline.com

Occurrence (cgl) what follows is a description of the various issues relating to this topic. An occurrence policy has lifetime coverage for the incidents that occur during a policy period, regardless of when the claim is reported. First, let’s understand the difference. The only difference lies in the reporting period available for claims. The coverage in each of these policies is the same;

Source: slideserve.com

Source: slideserve.com

Claims through this form of coverage must meet both criteria for coverage to apply. Consultant’s insurance shall be occurrence based and shall insure against loss or damage resulting from or related to the consultant’s performance of this contract regardless of the date the claim is filed or expiration of the policy. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. Claims through this form of coverage must meet both criteria for coverage to apply. With a claims made based policy, it’s the insurer.

Source: optimuminsurance.com.au

Who should pay for the tail insurance? Contractual insurance policy or discretionary cover? This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance. This is an impossible requirement. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim.

Source: slideshare.net

Source: slideshare.net

This is an impossible requirement. Coverage depends on the timing of the event. Who should pay for the tail insurance? The coverage in each of these policies is the same; This means you won’t have to worry about a large claim exhausting your limit.

Source: slideserve.com

Source: slideserve.com

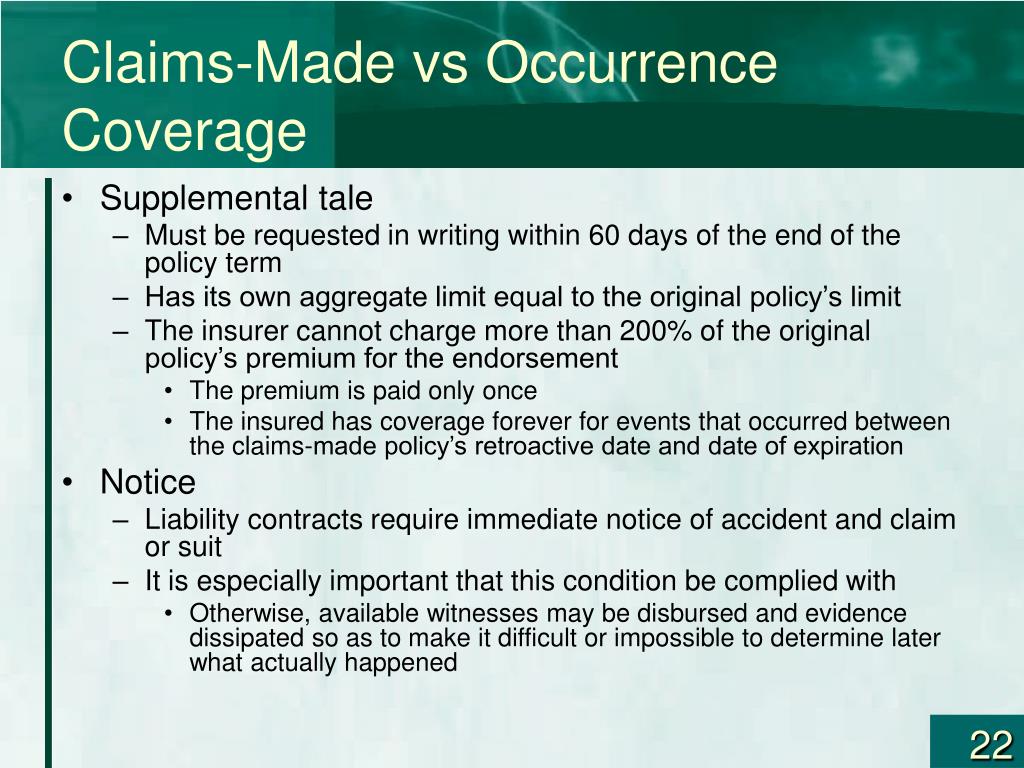

Covers only claims that occur and are reported while the policy is in effect the premium generally increases for about five years until policy is “mature” requires a “tail” to provide coverage if a claim is reported after the expiration date Occurrence policy for insurance, remember that an occurrence policy helps cover incidents that happen during your policy period, regardless of when you file a claim. Covers only claims that occur and are reported while the policy is in effect the premium generally increases for about five years until policy is “mature” requires a “tail” to provide coverage if a claim is reported after the expiration date To recognize the type of insurance that is being offered. Consultant’s insurance shall be occurrence based and shall insure against loss or damage resulting from or related to the consultant’s performance of this contract regardless of the date the claim is filed or expiration of the policy.

Source: slideshare.net

Source: slideshare.net

The coverage in each of these policies is the same; This means you won’t have to worry about a large claim exhausting your limit. An occurrence policy is usually preferred by healthcare professionals; Who should pay for the tail insurance? This is an impossible requirement.

Source: slideserve.com

Source: slideserve.com

This simply means the claim or incident/circumstance which may give rise to a claim, must be notified to the current insurer as soon as the insured is aware of a potential claim but importantly, during the current period of insurance. The major difference then between the two is which insurer will respond to a claim and the length of time a practitioner has to report that claim. This means you won’t have to worry about a large claim exhausting your limit. An event and a claim. Claims through this form of coverage must meet both criteria for coverage to apply.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

The coverage in each of these policies is the same; An event and a claim. The only difference lies in the reporting period available for claims. The coverage in each of these policies is the same; Who should pay for the tail insurance?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title claims vs occurrence based insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea

- Can you put your parents under your health insurance Idea