Cmhc insurance in force information

Home » Trend » Cmhc insurance in force informationYour Cmhc insurance in force images are ready. Cmhc insurance in force are a topic that is being searched for and liked by netizens today. You can Find and Download the Cmhc insurance in force files here. Download all free images.

If you’re searching for cmhc insurance in force pictures information related to the cmhc insurance in force topic, you have pay a visit to the ideal site. Our website frequently provides you with hints for downloading the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

Cmhc Insurance In Force. Annual limits for 2022 as authorized by the minister of finance, cmhc will provide up to $150 billion of new guarantees of market nha mbs and up to $40 billion of new guarantees for cmb in 2022. Approved lender means a person designated as an approved lender by cmhc in accordance with the act. Cmhc insurance does not protect you, it protects your lender. You must provide a down payment of no less than 5% on the first $500,000 of the purchase price, then 10% on the remaining purchase price.

The flip — Greater Fool Authored by Garth Turner The From greaterfool.ca

The flip — Greater Fool Authored by Garth Turner The From greaterfool.ca

The cmhc predicted that these new cmhc mortgage rules will reduce eligibility by 30%. Public safety canada will lead the task force and provide secretariat services throughout the mandate of the task force. Even if a small fraction of the plans need to be paid out, the economic impact would be huge. Approved lender means a person designated as an approved lender by cmhc in accordance with the act. The mortgage default insurance helps canadians buy their house with a low down payment of less than 20% of the house price. You must provide a down payment of no less than 5% on the first $500,000 of the purchase price, then 10% on the remaining purchase price.

The mortgage bond securitization activities of cmhc should also be retained.

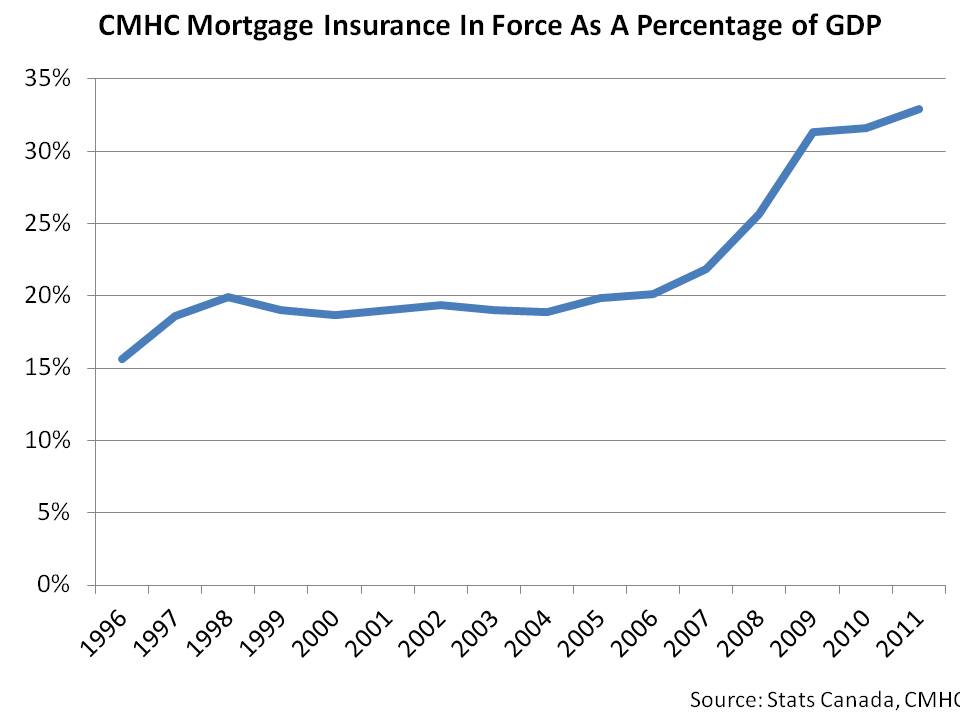

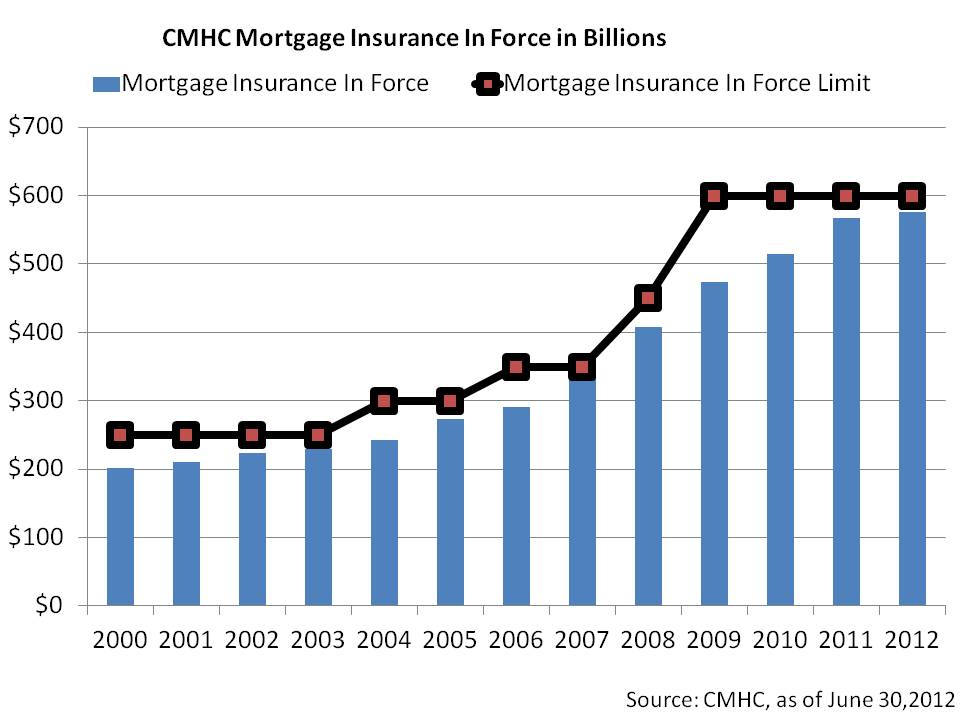

Our quarterly financial reports include unaudited financial statements and explanatory notes outlining our financial results, risks, significant changes in relation to operations, personnel, and programs, as well as report on the use of parliamentary appropriations. The downpayment cannot be a loan. Cmhc is a canadian federal crown corporation mandated to provide mortgage default insurance to approved mortgage lenders in canada. The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. The mortgage default insurance helps canadians buy their house with a low down payment of less than 20% of the house price. Every few years or so, cmhc would ask parliament to get the mortgage in force limit raised.

Source: oig.hhs.gov

Source: oig.hhs.gov

And while your bank is the beneficiary of the insurance. The purchase price of the home must be below $1,000,000. In a privatization, certain aspects of the policy functions of cmhc (affordable housing and housing on first nations reserves) would need to remain with the government. Even if a small fraction of the plans need to be paid out, the economic impact would be huge. Bank of canada rate means the “prime business

Source: torontorealtyblog.com

Source: torontorealtyblog.com

Just a recommendation, try to avoid cmhc. Homebuyers with less than a 20 per cent down payment are required to obtain mortgage default insurance from either cmhc or one of the private mortgage insurers. Cmhc insurance protects the lender (your bank) in case the borrower (you) defaults on their mortgage (is unable to pay). It protects the banks not the borrower. You�re essentially paying extra for the privilege of the bank lending you money.

Source: financialpost.com

Source: financialpost.com

The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. The purchase price of the home must be below $1,000,000. In order to qualify for mortgage default insurance through cmhc you need to meet the following requirements: Homebuyers with less than a 20 per cent down payment are required to obtain mortgage default insurance from either cmhc or one of the private mortgage insurers.

Source: greaterfool.ca

Source: greaterfool.ca

After another round of cmhc tightening last july as well as restricting “bulk insurance” usage, q2 unit volumes are down 26% year over year. In order to qualify for mortgage default insurance through cmhc you need to meet the following requirements: Approved lender means a person designated as an approved lender by cmhc in accordance with the act. After another round of cmhc tightening last july as well as restricting “bulk insurance” usage, q2 unit volumes are down 26% year over year. Bank of canada rate means the “prime business

Source: macleans.ca

Source: macleans.ca

Homebuyers with less than a 20 per cent down payment are required to obtain mortgage default insurance from either cmhc or one of the private mortgage insurers. The mortgage bond securitization activities of cmhc should also be retained. You�re essentially paying extra for the privilege of the bank lending you money. Jurisdiction, or any other requirement having the force of law. Bank of canada rate means the “prime business

Source: ctvnews.ca

Source: ctvnews.ca

This means that taxpayers are potentially on the hook for almost a half trillion dollars if the housing market were to collapse and require the. Cmhc insurance does not protect you, it protects your lender. These new cmhc rules were reversed on july 5, 2021. Bank of canada rate means the “prime business The task force will bring together experts from federal departments and agencies, provincial and territorial ministries, as well as representatives of the insurance industry, including the insurance bureau of canada.

Source: greaterfool.ca

Source: greaterfool.ca

Public safety canada will lead the task force and provide secretariat services throughout the mandate of the task force. Homebuyers with less than a 20 per cent down payment are required to obtain mortgage default insurance from either cmhc or one of the private mortgage insurers. The downpayment cannot be a loan. The cmhc puts a lot of money into government coffers, but again, remember that it is an insurance agency and it has hundreds of billions of dollars of insurance in force. Every few years or so, cmhc would ask parliament to get the mortgage in force limit raised.

Source: nevacie.blogspot.com

Source: nevacie.blogspot.com

Bank of canada rate means the “prime business Wherever possible try to choose a house where you can make the minimum down payment and avoid cmhc, it�s a big waste of money better spent building equity. Annual limits for 2022 as authorized by the minister of finance, cmhc will provide up to $150 billion of new guarantees of market nha mbs and up to $40 billion of new guarantees for cmb in 2022. The mortgage default insurance helps canadians buy their house with a low down payment of less than 20% of the house price. Cmhc insurance does not protect you, it protects your lender.

Source: artinrealestate.ca

Source: artinrealestate.ca

Cmhc is a canadian federal crown corporation mandated to provide mortgage default insurance to approved mortgage lenders in canada. The mortgage bond securitization activities of cmhc should also be retained. Bank of canada rate means the “prime business Annual limits for 2022 as authorized by the minister of finance, cmhc will provide up to $150 billion of new guarantees of market nha mbs and up to $40 billion of new guarantees for cmb in 2022. The overall arrears rate was 0.30%.

Source: teamblueforce.ca

Source: teamblueforce.ca

You�re essentially paying extra for the privilege of the bank lending you money. The cmhc puts a lot of money into government coffers, but again, remember that it is an insurance agency and it has hundreds of billions of dollars of insurance in force. The mortgage bond securitization activities of cmhc should also be retained. Wherever possible try to choose a house where you can make the minimum down payment and avoid cmhc, it�s a big waste of money better spent building equity. The purchase price of the home must be below $1,000,000.

Source: greaterfool.ca

Source: greaterfool.ca

Application means the written request for insurance coverage in respect of a housing loan under the policy in the form required by cmhc. The purchase price of the home must be below $1,000,000. Homebuyers with less than a 20 per cent down payment are required to obtain mortgage default insurance from either cmhc or one of the private mortgage insurers. Approved lender means a person designated as an approved lender by cmhc in accordance with the act. The overall arrears rate was 0.30%.

Source: imeris.ca

Source: imeris.ca

Cmhc insurance does not protect you, it protects your lender. It protects the banks not the borrower. Cmhc is a canadian federal crown corporation mandated to provide mortgage default insurance to approved mortgage lenders in canada. The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. In order to qualify for mortgage default insurance through cmhc you need to meet the following requirements:

And while your bank is the beneficiary of the insurance. The cmhc predicted that these new cmhc mortgage rules will reduce eligibility by 30%. Public safety canada will lead the task force and provide secretariat services throughout the mandate of the task force. In order to qualify for mortgage default insurance through cmhc you need to meet the following requirements: These new cmhc rules were reversed on july 5, 2021.

Source: macleans.ca

Source: macleans.ca

The cmhc predicted that these new cmhc mortgage rules will reduce eligibility by 30%. The cmhc predicted that these new cmhc mortgage rules will reduce eligibility by 30%. The purchase price of the home must be below $1,000,000. Our quarterly financial reports include unaudited financial statements and explanatory notes outlining our financial results, risks, significant changes in relation to operations, personnel, and programs, as well as report on the use of parliamentary appropriations. Its legislative maximum is $600 billion, which iti had been approaching in previous years.

Source: huffingtonpost.ca

Source: huffingtonpost.ca

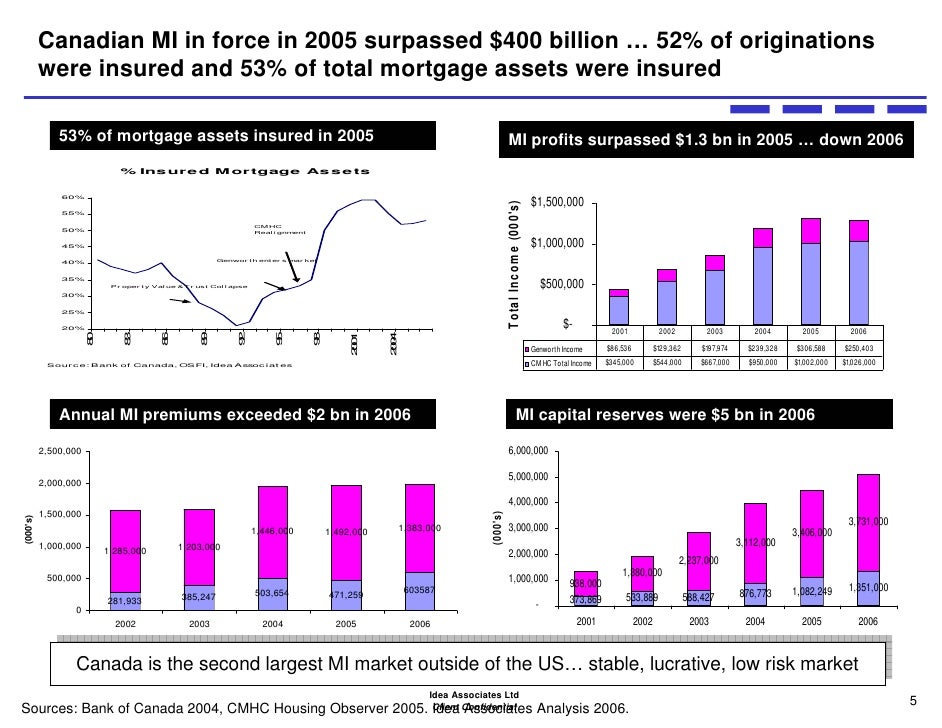

The cmhc puts a lot of money into government coffers, but again, remember that it is an insurance agency and it has hundreds of billions of dollars of insurance in force. The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. The purchase price of the home must be below $1,000,000. The overall arrears rate was 0.30%. The downpayment cannot be a loan.

Source: slideshare.net

Source: slideshare.net

In a privatization, certain aspects of the policy functions of cmhc (affordable housing and housing on first nations reserves) would need to remain with the government. Annual limits for 2022 as authorized by the minister of finance, cmhc will provide up to $150 billion of new guarantees of market nha mbs and up to $40 billion of new guarantees for cmb in 2022. You must provide a down payment of no less than 5% on the first $500,000 of the purchase price, then 10% on the remaining purchase price. Cmhc, which controls a majority of the market, has been reviewing its operations since new chief executive evan siddall, a former investment banker, took over last year. Wherever possible try to choose a house where you can make the minimum down payment and avoid cmhc, it�s a big waste of money better spent building equity.

Source: teamblueforce.ca

Source: teamblueforce.ca

Our quarterly financial reports include unaudited financial statements and explanatory notes outlining our financial results, risks, significant changes in relation to operations, personnel, and programs, as well as report on the use of parliamentary appropriations. The task force will bring together experts from federal departments and agencies, provincial and territorial ministries, as well as representatives of the insurance industry, including the insurance bureau of canada. The downpayment cannot be a loan. The sheer magnitude of cmhc insurance in force militates against an outright sale of the company. Every few years or so, cmhc would ask parliament to get the mortgage in force limit raised.

Source: greaterfool.ca

Source: greaterfool.ca

Its legislative maximum is $600 billion, which iti had been approaching in previous years. Approved lender means a person designated as an approved lender by cmhc in accordance with the act. This means that taxpayers are potentially on the hook for almost a half trillion dollars if the housing market were to collapse and require the. Annual limits for 2022 as authorized by the minister of finance, cmhc will provide up to $150 billion of new guarantees of market nha mbs and up to $40 billion of new guarantees for cmb in 2022. After another round of cmhc tightening last july as well as restricting “bulk insurance” usage, q2 unit volumes are down 26% year over year.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cmhc insurance in force by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information