Co payment insurance singapore Idea

Home » Trending » Co payment insurance singapore IdeaYour Co payment insurance singapore images are available. Co payment insurance singapore are a topic that is being searched for and liked by netizens now. You can Find and Download the Co payment insurance singapore files here. Find and Download all free images.

If you’re looking for co payment insurance singapore pictures information related to the co payment insurance singapore keyword, you have come to the ideal blog. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

Co Payment Insurance Singapore. This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders. Food poisoning which results in death (life insurance claims). Msig car insurance — motormax: Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums.

Co Payment Insurance Singapore / The 6 Best Annual Travel From oliverjean-alittlelovefromyou.blogspot.com

Co Payment Insurance Singapore / The 6 Best Annual Travel From oliverjean-alittlelovefromyou.blogspot.com

Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. Please call our customer care hotlines to schedule an appointment. 49 beach road, great eastern house, singapore 189685 great eastern @ westgate 1. What health insurance should you get? There has been a rise in phishing attacks targeting customers of financial. In singapore, insurance is sold mostly through agents representing.

It is usually expressed as a percentage.

Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums. Please call our customer care hotlines to schedule an appointment. Therefore it is always best to consult an experienced financial advisor in singapore to ensure that you only get what you need and what is best for you. It encourages policyholders and their doctors, to consider the necessity of the medical treatment and its cost, so that they can make an informed decision on the appropriate healthcare services. Msig car insurance — motormax: Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums.

Source: thehearttruths.com

Source: thehearttruths.com

Pandemic fuels demand for some insurance products A car accident which results in damage to property (property damage or personal injury claims ). Insurers may carry on insurance business in singapore as licensed insurers, authorised reinsurers, approved marine, aviation and transit (mat) insurers, or foreign insurers. For singapore general hospital, tan tock seng hospital, alexandra hospital, changi general hospital, national university hospital, national heart centre and national cancer centre, khoo teck puat. In singapore, insurance is sold mostly through agents representing.

Source: arthkohsl.blogspot.com

Source: arthkohsl.blogspot.com

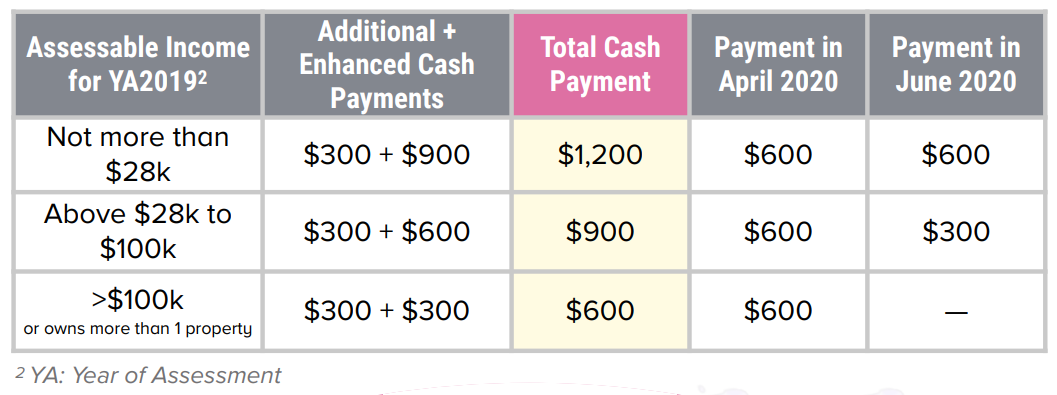

This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders. $9,650 (10% of $96,500) $3,000 (5% of $100,000, capped at $3,000) what you pay. These benefits vary across the riders, ip, and the insurance provider you choose. There are limits to what you can claim under a policy. Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders. However, most of singapore�s credit cards exclude insurance payments from earning rewards. There has been a rise in phishing attacks targeting customers of financial. Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders.

Source: areyouready.gov.sg

It is the percentage of bill you need to pay above the deductible. Examples of insured events may be: What health insurance should you get? Therefore it is always best to consult an experienced financial advisor in singapore to ensure that you only get what you need and what is best for you. Pandemic fuels demand for some insurance products

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

It is the initial amount you need to pay (once per policy year) for claim(s) made in a policy year, before medishield coverage kicks in. Msig car insurance — motormax: It encourages policyholders and their doctors, to consider the necessity of the medical treatment and its cost, so that they can make an informed decision on the appropriate healthcare services. Food poisoning which results in death (life insurance claims). Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums.

Source: sgmoneymatters.com

Source: sgmoneymatters.com

What health insurance should you get? It is usually expressed as a percentage. These benefits vary across the riders, ip, and the insurance provider you choose. For singapore general hospital, tan tock seng hospital, alexandra hospital, changi general hospital, national university hospital, national heart centre and national cancer centre, khoo teck puat. Insurance premiums are expensive, offering a great opportunity to earn rewards on payments.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders. It is usually expressed as a percentage. What health insurance should you get? Insurers may carry on insurance business in singapore as licensed insurers, authorised reinsurers, approved marine, aviation and transit (mat) insurers, or foreign insurers. These benefits vary across the riders, ip, and the insurance provider you choose.

Source: argusglobal.co

Source: argusglobal.co

Insurance premiums are expensive, offering a great opportunity to earn rewards on payments. Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. Insurers may carry on insurance business in singapore as licensed insurers, authorised reinsurers, approved marine, aviation and transit (mat) insurers, or foreign insurers. Examples of insured events may be: A car accident which results in damage to property (property damage or personal injury claims ).

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

$9,650 (10% of $96,500) $3,000 (5% of $100,000, capped at $3,000) what you pay. Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. It encourages policyholders and their doctors, to consider the necessity of the medical treatment and its cost, so that they can make an informed decision on the appropriate healthcare services. For singapore general hospital, tan tock seng hospital, alexandra hospital, changi general hospital, national university hospital, national heart centre and national cancer centre, khoo teck puat. 49 beach road, great eastern house, singapore 189685 great eastern @ westgate 1.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

There has been a rise in phishing attacks targeting customers of financial. For singapore general hospital, tan tock seng hospital, alexandra hospital, changi general hospital, national university hospital, national heart centre and national cancer centre, khoo teck puat. $9,650 (10% of $96,500) $3,000 (5% of $100,000, capped at $3,000) what you pay. There has been a rise in phishing attacks targeting customers of financial. There are limits to what you can claim under a policy.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

Insurance premiums are expensive, offering a great opportunity to earn rewards on payments. Therefore it is always best to consult an experienced financial advisor in singapore to ensure that you only get what you need and what is best for you. Insurance premiums are expensive, offering a great opportunity to earn rewards on payments. These benefits vary across the riders, ip, and the insurance provider you choose. The loss on the value of a portfolio of investments as a result of negligence on the part of a financial manager (economic loss claims).

Source: uob.co.th

Source: uob.co.th

It encourages policyholders and their doctors, to consider the necessity of the medical treatment and its cost, so that they can make an informed decision on the appropriate healthcare services. Insurance premiums are expensive, offering a great opportunity to earn rewards on payments. This is to encourage prudent provision and consumption of healthcare services by both healthcare providers and policyholders. 49 beach road, great eastern house, singapore 189685 great eastern @ westgate 1. It is the initial amount you need to pay (once per policy year) for claim(s) made in a policy year, before medishield coverage kicks in.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

However, most of singapore�s credit cards exclude insurance payments from earning rewards. There are limits to what you can claim under a policy. It is the percentage of bill you need to pay above the deductible. Insurers may carry on insurance business in singapore as licensed insurers, authorised reinsurers, approved marine, aviation and transit (mat) insurers, or foreign insurers. Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums.

Source: oliverjean-alittlelovefromyou.blogspot.com

Source: oliverjean-alittlelovefromyou.blogspot.com

Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. Insurance brokers may conduct insurance broking activities in singapore as registered insurance brokers or approved insurance brokers. Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums. In singapore, insurance is sold mostly through agents representing. There has been a rise in phishing attacks targeting customers of financial.

Source: singaporesportsclinic.com

Source: singaporesportsclinic.com

Examples of insured events may be: However, most of singapore�s credit cards exclude insurance payments from earning rewards. There has been a rise in phishing attacks targeting customers of financial. Therefore it is always best to consult an experienced financial advisor in singapore to ensure that you only get what you need and what is best for you. The loss on the value of a portfolio of investments as a result of negligence on the part of a financial manager (economic loss claims).

Source: learn.insureguru.com

Source: learn.insureguru.com

49 beach road, great eastern house, singapore 189685 great eastern @ westgate 1. These benefits vary across the riders, ip, and the insurance provider you choose. It is usually expressed as a percentage. Please call our customer care hotlines to schedule an appointment. Examples of insured events may be:

Source: fintechnews.sg

Source: fintechnews.sg

A car accident which results in damage to property (property damage or personal injury claims ). Insurers may carry on insurance business in singapore as licensed insurers, authorised reinsurers, approved marine, aviation and transit (mat) insurers, or foreign insurers. It is usually expressed as a percentage. However, most of singapore�s credit cards exclude insurance payments from earning rewards. It encourages policyholders and their doctors, to consider the necessity of the medical treatment and its cost, so that they can make an informed decision on the appropriate healthcare services.

Source: singaporelegaladvice.com

Source: singaporelegaladvice.com

A car accident which results in damage to property (property damage or personal injury claims ). Our credit card experts carefully read through the terms & conditions for 100+ credit cards to identify which options actually offer rebates or miles on premiums. It is the percentage of bill you need to pay above the deductible. There has been a rise in phishing attacks targeting customers of financial. It is usually expressed as a percentage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title co payment insurance singapore by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea