Collateral car insurance information

Home » Trend » Collateral car insurance informationYour Collateral car insurance images are ready in this website. Collateral car insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Collateral car insurance files here. Download all royalty-free images.

If you’re looking for collateral car insurance images information connected with to the collateral car insurance topic, you have pay a visit to the right blog. Our site always gives you suggestions for seeing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Collateral Car Insurance. This usually applies to vehicle insurance. But along with a car come costs like loan payments, fuel, parking, and car insurance. Cpi is ordered by the lender, who wants to protect the vehicle until the loan is paid off, and the borrower is. However, personal car insurance policies also provide liability protection.

What is Collateral Protection Insurance (CPI) and How Does From insurancepanda.com

What is Collateral Protection Insurance (CPI) and How Does From insurancepanda.com

Insurance for collateral accidents covered. When a customer does not have collision coverage on their car, you as the lender can place the vehicle on cpi. However, personal car insurance policies also provide liability protection. Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan. You add that vehicle to your auto insurance policy and name the lender as the loss payee. Collateral — assets that are provided as security to ensure satisfaction of a future liability.

Insurance for collateral accidents covered.

A complex definition made simple when taking out an auto loan, borrowers agree to maintain physical damage insurance on the vehicle, naming the financial institution as an additional interest on the policy. Collateral protection insurance, or cpi, insures property held as collateral for loans made by lending institutions. What is collateral protection insurance (cpi)? A complex definition made simple when taking out an auto loan, borrowers agree to maintain physical damage insurance on the vehicle, naming the financial institution as an additional interest on the policy. As an example, when you purchase a $25,000 vehicle and put down $5,000, you would then have a loan with a balance of $20,000. The insurance covers the lender, and not you, and is often much more expensive than an auto insurance policy you can purchase on your own.

Source: verifacto.com

Source: verifacto.com

Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan. The most effective method for minimizing this risk is cpi: Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. The insurance covers the lender, and not you, and is often much more expensive than an auto insurance policy you can purchase on your own.

Source: peekerautomotive.com

Source: peekerautomotive.com

Reduces your cost of insurance. Collateral protection insurance (cpi) is enacted when an individual who takes out an auto loan fails to adequately insure a vehicle. The cost of cpi is then passed onto and collected from your customer with their car payment. Collateral protection insurance — or cpi — is a type of car insurance purchased by your lender to protect your vehicle if you don�t have the required amount of insurance coverage. A driver with cpi is uncovered in the event of a liability claim.

Source: insurify.com

Source: insurify.com

Collateral protection insurance — or cpi — is a type of car insurance purchased by your lender to protect your vehicle if you don�t have the required amount of insurance coverage. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. Cpi is ordered by the lender, who wants to protect the vehicle until the loan is paid off, and the borrower is. Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. When a customer does not have collision coverage on their car, you as the lender can place the vehicle on cpi.

Source: seekingalpha.com

Source: seekingalpha.com

However, personal car insurance policies also provide liability protection. In many states, this means they would be operating the vehicle illegally. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. But when the borrower does not have insurance, the damages are covered out of the. Collateral insurance is intended to cover any physical damage done to your car, which means, at bare minimum, it typically comes with collision and comprehensive coverage (though it may come with.

Source: insurance.us

Source: insurance.us

Obviously, from a lender’s perspective, this makes sense, as those are the only direct risks to their collateral. Is a great place to start. When a customer does not have collision coverage on their car, you as the lender can place the vehicle on cpi. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan.

Source: classaction.org

Source: classaction.org

Collateral protection insurance (cpi) is enacted when an individual who takes out an auto loan fails to adequately insure a vehicle. A driver with cpi is uncovered in the event of a liability claim. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. As an example, when you purchase a $25,000 vehicle and put down $5,000, you would then have a loan with a balance of $20,000. Collateral protection insurance, or cpi, insures property held as collateral for loans made by lending institutions.

Source: insurancewins.com

Source: insurancewins.com

Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. Collateral protection insurance, or cpi, insures property held as collateral for loans made by lending institutions. But along with a car come costs like loan payments, fuel, parking, and car insurance. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. Insurance for collateral accidents covered.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

This usually applies to vehicle insurance. Insurance for collateral accidents covered. You add that vehicle to your auto insurance policy and name the lender as the loss payee. Obviously, from a lender’s perspective, this makes sense, as those are the only direct risks to their collateral. If the borrower defaults, the lender can seize the asset to repay the loan.

Source: verifacto.com

Source: verifacto.com

The details cpi, collateral protection insurance, is a force placed insurance product that is placed by the creditor to protect their interest in the vehicle against physical damage should the customer fail to obtain or maintain physical damage insurance as required in the. What is collateral protection insurance (cpi)? Often required by ceding companies to minimize their credit risk or offset a nonadmitted balance. Fails to insure the car adequately. But along with a car come costs like loan payments, fuel, parking, and car insurance.

Source: goldeneagle-insurance.com

This usually applies to vehicle insurance. A direct writing captive writing deductible reimbursement coverage may provide collateral to the insurance company that has issued a deductible policy. A complex definition made simple when taking out an auto loan, borrowers agree to maintain physical damage insurance on the vehicle, naming the financial institution as an additional interest on the policy. Collateral insurance is intended to cover any physical damage done to your car, which means, at bare minimum, it typically comes with collision and comprehensive coverage (though it may come with. Obviously, from a lender’s perspective, this makes sense, as those are the only direct risks to their collateral.

Source: insuranceinforme.blogspot.com

Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. The insurance covers the lender, and not you, and is often much more expensive than an auto insurance policy you can purchase on your own. This usually applies to vehicle insurance. As an example, when you purchase a $25,000 vehicle and put down $5,000, you would then have a loan with a balance of $20,000. The cost of cpi is then passed onto and collected from your customer with their car payment.

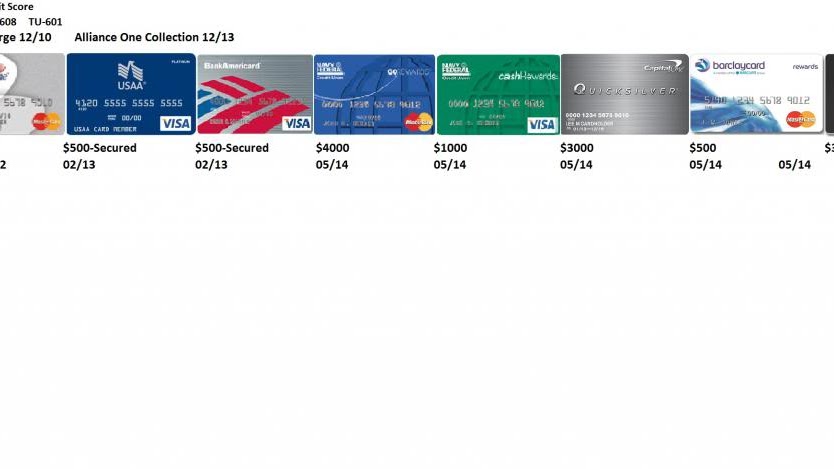

Source: pinterest.com

Source: pinterest.com

Also known as cpi, it allows you to have protection for all types of collateral, including vehicles and real estate portfolios. Collateral protection insurance — or cpi — is a type of car insurance purchased by your lender to protect your vehicle if you don�t have the required amount of insurance coverage. Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. Obviously, from a lender’s perspective, this makes sense, as those are the only direct risks to their collateral. Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage.

Source: insuranceinforme.blogspot.com

Source: insuranceinforme.blogspot.com

Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan. Collateral protection insurance protecting your interests. Collateral — assets that are provided as security to ensure satisfaction of a future liability. When a customer does not have collision coverage on their car, you as the lender can place the vehicle on cpi. However, personal car insurance policies also provide liability protection.

Source: verifacto.com

Source: verifacto.com

Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. Fails to purchase auto insurance; Collateral protection insurance, or cpi, insures property held as collateral for loans made by lending institutions. Mortgages and car loans are two types of collateralized loans. However, personal car insurance policies also provide liability protection.

Source: insurancepanda.com

Source: insurancepanda.com

Is a great place to start. What is collateral protection insurance (cpi)? Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. Collateral protection insurance (cpi) is insurance used by lienholders to protect themselves from financial loss. This usually applies to vehicle insurance.

Source: verifacto.com

Source: verifacto.com

But along with a car come costs like loan payments, fuel, parking, and car insurance. Cpi is ordered by the lender, who wants to protect the vehicle until the loan is paid off, and the borrower is. A driver with cpi is uncovered in the event of a liability claim. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance.normally, when a borrower gets into a car accident, their auto insurance covers the damages. For instance, if the borrower’s insurance lapses or changes during the life of the loan, the lender may be allowed to:

Source: tpfcu.com

Source: tpfcu.com

But when the borrower does not have insurance, the damages are covered out of the. For instance, if the borrower’s insurance lapses or changes during the life of the loan, the lender may be allowed to: This usually applies to vehicle insurance. Collateral insurance protection (cpi) is a type of insurance arrangement that requires the borrower to maintain enough insurance to protect the lender’s interest in the collateral. Often required by ceding companies to minimize their credit risk or offset a nonadmitted balance.

Source: avpadmin.com

Source: avpadmin.com

With such lending, the home or car the loan helps to buy can become the collateral; Cpi is more expensive than standard car insurance, and the policy doesn�t always offer full auto insurance coverage. Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan. But along with a car come costs like loan payments, fuel, parking, and car insurance. Also known as cpi, it allows you to have protection for all types of collateral, including vehicles and real estate portfolios.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title collateral car insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information