Collateral protection insurance Idea

Home » Trending » Collateral protection insurance IdeaYour Collateral protection insurance images are ready. Collateral protection insurance are a topic that is being searched for and liked by netizens today. You can Get the Collateral protection insurance files here. Find and Download all free photos and vectors.

If you’re looking for collateral protection insurance images information linked to the collateral protection insurance interest, you have visit the ideal site. Our site always gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

Collateral Protection Insurance. Cpi lets you directly insure vehicles when your customer’s insurance cancels, expires or is missing altogether. In essence, the issued cpi policy protects against collateral default. How to tell if it’s worth it”, i mentioned the marginal cost of. This kind of insurance is more expensive than auto insurance coverage the borrower could purchase on their own, and it is designed to protect the lender and not the borrower.

Collateral Protection Insurance CPI Assured Vehicle From avpadmin.com

Collateral Protection Insurance CPI Assured Vehicle From avpadmin.com

Cpi lets you directly insure vehicles when your customer’s insurance cancels, expires or is missing altogether. The cpi does not provide comprehensive coverage since it only protects what you purchased. We provide an unmatched level of service with our insurance tracking program that creates an exemplary experience for your borrowers. Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. You further state that, pursuant to the terms of a promissory note, an fcu that has to purchase cpi normally adds the cpi premiums to a member�s loan balance, which results in increasing the monthly loan payments or, in. Electronic data interchange (edi) allows immediate update to client�s portfolio.

Collateral protection insurance is a policy that a lender takes out to protect itself from the loss of a financed vehicle if the borrower does not obtain adequate insurance coverage.

Collateral protection insurance (cpi) when you have a loan with redwood credit union (rcu), providing proof of insurance on your loan is a requirement. At the beginning of the covid era, in my article, “collateral protection insurance: Keep reading to learn everything you need to know about collateral protection insurance and how it works. In essence, the issued cpi policy protects against collateral default. The cpi does not provide comprehensive coverage since it only protects what you purchased. Fails to purchase auto insurance;

Normally, when a borrower gets into a car accident, their auto insurance covers the damages. Keep reading to learn everything you need to know about collateral protection insurance and how it works. In the event of an accident, the collateral is now covered, eliminating the chance of uninsured loss to you as the lender. Also known as cpi, it allows you to have protection for all types of collateral, including vehicles and real estate portfolios. Cpi lets you directly insure vehicles when your customer’s insurance cancels, expires or is missing altogether.

![]() Source: iconfinder.com

Source: iconfinder.com

In essence, the issued cpi policy protects against collateral default. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance. Collateral protection insurance is a policy that a lender takes out to protect itself from the loss of a financed vehicle if the borrower does not obtain adequate insurance coverage. We provide an unmatched level of service with our insurance tracking program that creates an exemplary experience for your borrowers. In essence, the issued cpi policy protects against collateral default.

Source: goldeneagle-insurance.com

At the beginning of the covid era, in my article, “collateral protection insurance: American risk services issues a collateral protection insurance policy for your finance company. Cpi, collateral protection insurance, is a force placed insurance product that is placed by the creditor to protect their interest in the vehicle against physical damage should the customer fail to obtain or maintain physical damage insurance as required in the credit agreement. In the event of an accident, the collateral is now covered, eliminating the chance of uninsured loss to you as the lender. You further state that, pursuant to the terms of a promissory note, an fcu that has to purchase cpi normally adds the cpi premiums to a member�s loan balance, which results in increasing the monthly loan payments or, in.

![]() Source: frostinsure.com

Source: frostinsure.com

Collateral protection insurance (cpi) when you have a loan with redwood credit union (rcu), providing proof of insurance on your loan is a requirement. American risk services issues a collateral protection insurance policy for your finance company. Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. You further state that, pursuant to the terms of a promissory note, an fcu that has to purchase cpi normally adds the cpi premiums to a member�s loan balance, which results in increasing the monthly loan payments or, in. Borrowers may, however, have to pay the.

Source: insurancepanda.com

Source: insurancepanda.com

Electronic data interchange (edi) allows immediate update to client�s portfolio. Collateral protection insurance is a policy that a lender takes out to protect itself from the loss of a financed vehicle if the borrower does not obtain adequate insurance coverage. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Borrowers may, however, have to pay the. If proof of insurance isn’t offered to your rcu lending agent at the time your loan is funded, collateral protection insurance (cpi) is automatically added to your loan at your expense.

Source: slideshare.net

Source: slideshare.net

This kind of insurance is more expensive than auto insurance coverage the borrower could purchase on their own, and it is designed to protect the lender and not the borrower. Cpi, collateral protection insurance, is a force placed insurance product that is placed by the creditor to protect their interest in the vehicle against physical damage should the customer fail to obtain or maintain physical damage insurance as required in the credit agreement. Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. We provide an unmatched level of service with our insurance tracking program that creates an exemplary experience for your borrowers. Keep reading to learn everything you need to know about collateral protection insurance and how it works.

Source: insurance.us

Source: insurance.us

Collateral protection insurance is a policy that a lender takes out to protect itself from the loss of a financed vehicle if the borrower does not obtain adequate insurance coverage. Or fails to insure the car adequately In the event of an accident, the collateral is now covered, eliminating the chance of uninsured loss to you as the lender. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance. Reduces your cost of insurance.

Source: cuinsight.com

Source: cuinsight.com

The cpi does not provide comprehensive coverage since it only protects what you purchased. In essence, the issued cpi policy protects against collateral default. Fails to purchase auto insurance; Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. Collateral protection insurance is a type of car insurance that protects a vehicle if a borrower fails to insure that vehicle.

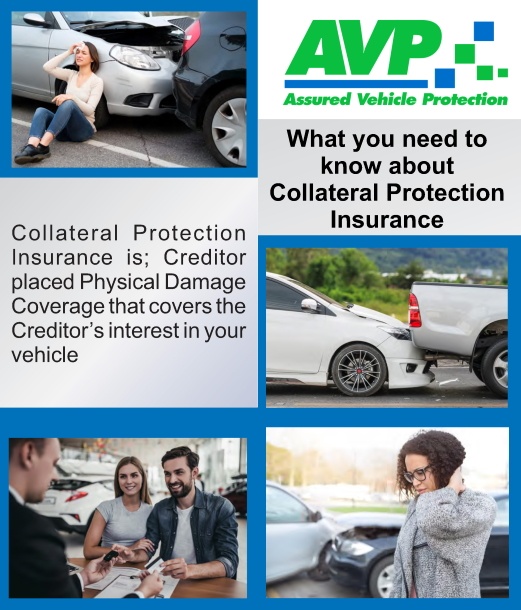

Source: avpadmin.com

Source: avpadmin.com

Collateral protection insurance is a type of car insurance that protects a vehicle if a borrower fails to insure that vehicle. In essence, the issued cpi policy protects against collateral default. Keep reading to learn everything you need to know about collateral protection insurance and how it works. It protects the lender’s loan balance in case of loss of collateral while uninsured. This kind of insurance is more expensive than auto insurance coverage the borrower could purchase on their own, and it is designed to protect the lender and not the borrower.

Source: verifacto.com

Source: verifacto.com

Fails to purchase auto insurance; Tracking and placement can be done in house by your staff or can be outsourced to one of our tracking companies. Collateral protection insurance (cpi) provides a vehicle through which an owner of intellectual property (ip) can use their ip as collateral for a loan, up to the value of the ip. How to tell if it’s worth it”, i mentioned the marginal cost of. This kind of insurance is more expensive than auto insurance coverage the borrower could purchase on their own, and it is designed to protect the lender and not the borrower.

Source: insurify.com

Source: insurify.com

Cpi lets you directly insure vehicles when your customer’s insurance cancels, expires or is missing altogether. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance. Collateral protection insurance (cpi) provides a vehicle through which an owner of intellectual property (ip) can use their ip as collateral for a loan, up to the value of the ip. Electronic data interchange (edi) allows immediate update to client�s portfolio. It protects the lender’s loan balance in case of loss of collateral while uninsured.

Source: youtube.com

Source: youtube.com

You further state that, pursuant to the terms of a promissory note, an fcu that has to purchase cpi normally adds the cpi premiums to a member�s loan balance, which results in increasing the monthly loan payments or, in. How to tell if it’s worth it”, i mentioned the marginal cost of. If proof of insurance isn’t offered to your rcu lending agent at the time your loan is funded, collateral protection insurance (cpi) is automatically added to your loan at your expense. American risk services issues a collateral protection insurance policy for your finance company. Electronic data interchange (edi) allows immediate update to client�s portfolio.

Source: verifacto.com

Source: verifacto.com

The customer is responsible for the cost of the cpi premium. Collateral protection insurance is a policy that a lender takes out to protect itself from the loss of a financed vehicle if the borrower does not obtain adequate insurance coverage. Fails to purchase auto insurance; Or fails to insure the car adequately Normally, when a borrower gets into a car accident, their auto insurance covers the damages.

Source: verifacto.com

Source: verifacto.com

Cpi, collateral protection insurance, is a force placed insurance product that is placed by the creditor to protect their interest in the vehicle against physical damage should the customer fail to obtain or maintain physical damage insurance as required in the credit agreement. Also known as cpi, it allows you to have protection for all types of collateral, including vehicles and real estate portfolios. When the customer loan is issued, you then add the vehicle to your cpi policy. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. It makes sense that the industry’s best insurance tracking company would offer the best collateral protection insurance (cpi).

Source: youtube.com

Source: youtube.com

Collateral protection insurance (cpi) provides a vehicle through which an owner of intellectual property (ip) can use their ip as collateral for a loan, up to the value of the ip. You state that cpi protects an fcu from the risk of a loss when a member fails to maintain the required insurance on a vehicle securing a loan. Collateral protection insurance is an insurance policy that protects auto loan lenders from financial losses resulting from having to pay claims when someone does not have auto insurance. How to tell if it’s worth it”, i mentioned the marginal cost of. Keep reading to learn everything you need to know about collateral protection insurance and how it works.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Reduces your cost of insurance. American risk services issues a collateral protection insurance policy for your finance company. Collateral protection insurance (cpi) provides a vehicle through which an owner of intellectual property (ip) can use their ip as collateral for a loan, up to the value of the ip. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Collateral protection insurance cp insurance associates provides you with the means to reduce labor expense, increase departmental income, improve borrower relation, and decrease loan losses.

Source: avpadmin.com

Source: avpadmin.com

When borrows won’t or can’t obtain coverage, lender placed dual interest insurance is your safeguard against physical damage losses. Collateral protection insurance (cpi) when you have a loan with redwood credit union (rcu), providing proof of insurance on your loan is a requirement. How to tell if it’s worth it”, i mentioned the marginal cost of. When borrows won’t or can’t obtain coverage, lender placed dual interest insurance is your safeguard against physical damage losses. Normally, when a borrower gets into a car accident, their auto insurance covers the damages.

Source: linkpico.com

Source: linkpico.com

In essence, the issued cpi policy protects against collateral default. American risk services issues a collateral protection insurance policy for your finance company. In addition, cpi insurance policies can protect borrowers as well by repairing a damaged vehicle. Reduces your cost of insurance. Keep reading to learn everything you need to know about collateral protection insurance and how it works.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title collateral protection insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea