Commercial construction insurance requirements Idea

Home » Trend » Commercial construction insurance requirements IdeaYour Commercial construction insurance requirements images are ready in this website. Commercial construction insurance requirements are a topic that is being searched for and liked by netizens today. You can Find and Download the Commercial construction insurance requirements files here. Get all royalty-free photos and vectors.

If you’re searching for commercial construction insurance requirements images information linked to the commercial construction insurance requirements interest, you have pay a visit to the right blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

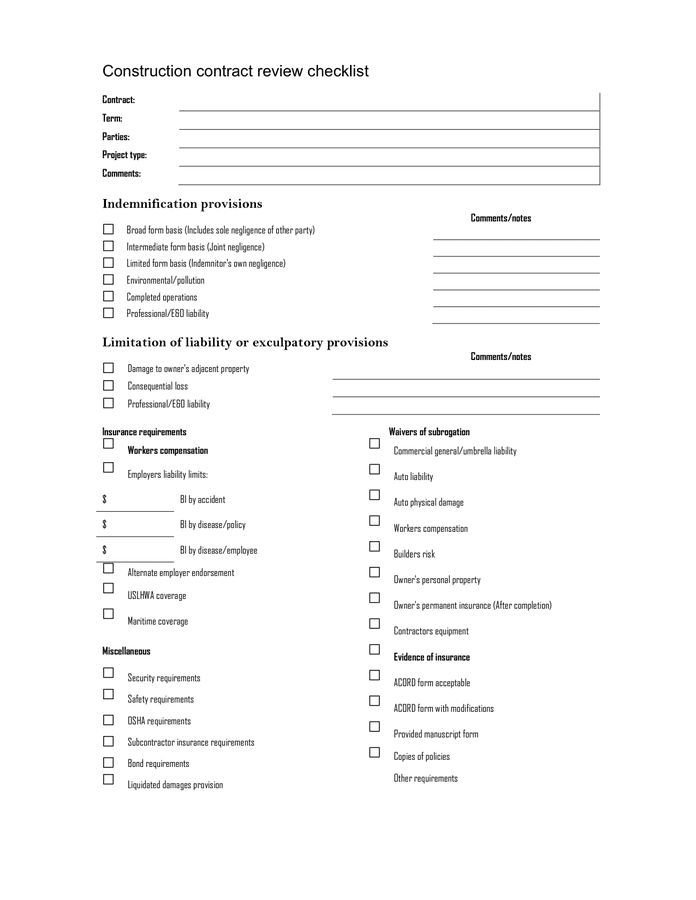

Commercial Construction Insurance Requirements. Commercial auto insurance is required by law. The most common ones are: For construction contracts between $1,000,001 and up to $5,000,000 the limits of liability required will be: This type of coverage is specifically made to protect businesses who contract construction work.

Commercial Construction Insurance Requirements at Insurance From revisi.net

Commercial Construction Insurance Requirements at Insurance From revisi.net

Maintaining documentation and records of insurance policies and certificates can help you stay out of legal trouble, understand all commercial construction requirements, help you protect your employees, and avoid being charged for accidental. This common construction liability coverage protects your business if it’s responsible for events like property damage, bodily injury or defective work.; Flood insurance requirements for commercial property. Vehicle and heavy machinery insurance; Required insurance from the closing date until the termination date, borrower shall maintain the following insurance policies and comply with the following obligations (those policies and obligations, collectively, the “required insurance”). Tools, plant and equipment insurance for tradespeople

For construction contracts up to $1,000,000 the limits of liability required will be:

Depending on your clients and the type of work you do, you may also need builder’s risk insurance or surety bonds. Risk insurance $1,000,000.00 aggregate bodily injury liability $1,000,000.00 each person Construction insurances can provide coverage for material, risks, natural disasters, employees, and even your own business. Other commercial insurance policies to consider: Maintaining documentation and records of insurance policies and certificates can help you stay out of legal trouble, understand all commercial construction requirements, help you protect your employees, and avoid being charged for accidental. This common construction liability coverage protects your business if it’s responsible for events like property damage, bodily injury or defective work.;

Source: revisi.net

Source: revisi.net

Insurance | risk management | consulting | employee. Risk insurance $1,000,000.00 aggregate bodily injury liability $1,000,000.00 each person When it comes to construction contractor insurance requirements, some are an actual legal obligation. The right insurance agent can help construction businesses find affordable construction insurance at an affordable cost. For construction contracts up to $1,000,000 the limits of liability required will be:

Source: marketbusinessnews.com

Source: marketbusinessnews.com

The right insurance agent can help construction businesses find affordable construction insurance at an affordable cost. Connect with one of our agents by completing the form at the top of the page. Some might be asking, “is construction insurance necessary?” actually, in many cases, it’s not only necessary, but required. A natural disaster can be incredibly difficult for businesses to endure. Construction insurances are required for every single construction project.

Source: winnaijatv.com

Source: winnaijatv.com

The drafting of insurance clauses usually requires a contractors to “warrant” (or, in other words, guarantee) that it has satisfied all the requirements imposed by the construction contract. To meet state requirements in new york, general contractors with employees must provide workers’ compensation insurance, which covers lost wages and medical bills for work injuries. A national flood insurance program policy offers coverage for building property up to $500,000 & business personal property up to $500,000. Product liability insurance protects against liability for injury to people or damage to property, arising out of products supplied by a business. What are typical commercial tenant insurance requirements?

Source: picpedia.org

Source: picpedia.org

Insurance for contractors doesn�t have to be expensive. Some might be asking, “is construction insurance necessary?” actually, in many cases, it’s not only necessary, but required. The right insurance agent can help construction businesses find affordable construction insurance at an affordable cost. What are typical commercial tenant insurance requirements? The drafting of insurance clauses usually requires a contractors to “warrant” (or, in other words, guarantee) that it has satisfied all the requirements imposed by the construction contract.

Source: revisi.net

Source: revisi.net

Depending on your clients and the type of work you do, you may also need builder’s risk insurance or surety bonds. Many contractors and builders are required to have a minimum amount of. Connect with one of our agents by completing the form at the top of the page. To meet state requirements in new york, general contractors with employees must provide workers’ compensation insurance, which covers lost wages and medical bills for work injuries. This type of coverage is specifically made to protect businesses who contract construction work.

Source: revisi.net

Source: revisi.net

Many contractors and builders are required to have a minimum amount of. Alongside compulsory insurances, the building and construction industry has specific insurances. This common construction liability coverage protects your business if it’s responsible for events like property damage, bodily injury or defective work.; Required insurance from the closing date until the termination date, borrower shall maintain the following insurance policies and comply with the following obligations (those policies and obligations, collectively, the “required insurance”). Vehicle and heavy machinery insurance;

Source: topcontractorsins.com

Source: topcontractorsins.com

Tools, plant and equipment insurance for tradespeople In many instances, it is a requirement to have some sort of specific coverage in order to be awarded. The right insurance agent can help construction businesses find affordable construction insurance at an affordable cost. It allows for liability protection in case of bodily harm or property damage that can come from faulty construction work. If you undertake domestic building work worth more than $16,000, then you need domestic building insurance.

Source: revisi.net

Source: revisi.net

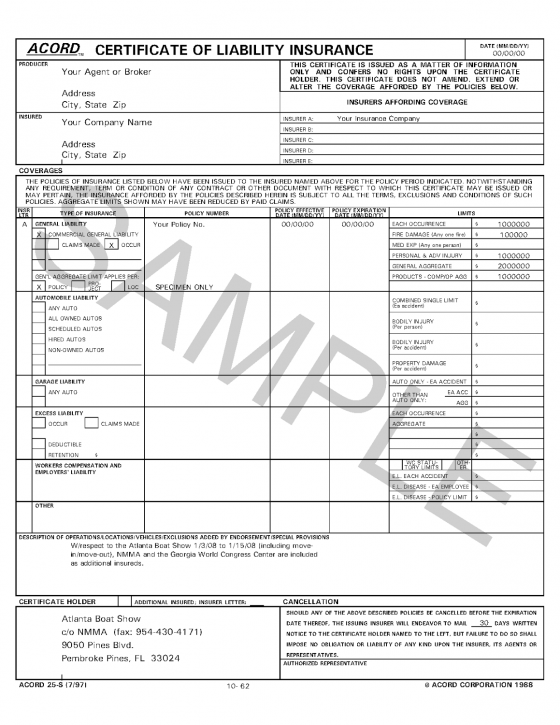

Insurance requirements/certificate of insurance insurance, and specifically liability insurance, is an absolute must for contractors. Insurance for contractors doesn�t have to be expensive. Commercial general liability insurance almost all construction contracts require that contractors and subcontractors carry commercial general liability (“cgl”) insurance. In many instances, it is a requirement to have some sort of specific coverage in order to be awarded. This common construction liability coverage protects your business if it’s responsible for events like property damage, bodily injury or defective work.;

Source: nextinsurance.com

Source: nextinsurance.com

All states and the federal government have laws that set minimum requirements for auto liability insurance. Other commercial insurance policies to consider: All states and the federal government have laws that set minimum requirements for auto liability insurance. Before taking a deposit or any money, building practitioners must provide their client with both a copy of the policy and a certificate of currency covering the client�s property. That is, if you’re working in the construction industry, you are legally required to have them in order to do your job.

Source: riskmanagementmonitor.com

Source: riskmanagementmonitor.com

Risk insurance $1,000,000.00 aggregate bodily injury liability $1,000,000.00 each person Protects vehicles used in your business including those that transport your tools and equipment.adding physical damage coverage to your policy gives you the. A national flood insurance program policy offers coverage for building property up to $500,000 & business personal property up to $500,000. $1,000,000 per occurrence and $2,000,000 aggregate. Insurance to protect the contractor and owner against claims for bodily injury or death or for damage to property occurring upon, in or about the project, with limits in amounts at least equal to those specified below:

Source: airtro.com

Source: airtro.com

Certificate of insurance showing all oter requh ired coverages. When it comes to construction contractor insurance requirements, some are an actual legal obligation. $1,000,000 per occurrence and $2,000,000 aggregate. Required insurance from the closing date until the termination date, borrower shall maintain the following insurance policies and comply with the following obligations (those policies and obligations, collectively, the “required insurance”). Before taking a deposit or any money, building practitioners must provide their client with both a copy of the policy and a certificate of currency covering the client�s property.

Source: nextinsurance.com

Source: nextinsurance.com

What are typical commercial tenant insurance requirements? Many contractors and builders are required to have a minimum amount of. Construction insurances are required for every single construction project. The most common ones are: Vehicle and heavy machinery insurance;

Source: pinterest.jp

Source: pinterest.jp

Many contractors and builders are required to have a minimum amount of. Commercial and contractor general liability insurance. When it comes to construction contractor insurance requirements, some are an actual legal obligation. That is, if you’re working in the construction industry, you are legally required to have them in order to do your job. The most common ones are:

Source: contractorsliability.com

Source: contractorsliability.com

Insurance | risk management | consulting | employee. Risk insurance $1,000,000.00 aggregate bodily injury liability $1,000,000.00 each person A natural disaster can be incredibly difficult for businesses to endure. Depending on your clients and the type of work you do, you may also need builder’s risk insurance or surety bonds. What are typical commercial tenant insurance requirements?

Source: dexform.com

Source: dexform.com

Depending on your clients and the type of work you do, you may also need builder’s risk insurance or surety bonds. Certificate of insurance showing all oter requh ired coverages. Alongside compulsory insurances, the building and construction industry has specific insurances. Vehicle and heavy machinery insurance; $1,000,000 per occurrence and $2,000,000 aggregate.

Source: e2fi2.blogspot.com

Source: e2fi2.blogspot.com

Insurance to protect the contractor and owner against claims for bodily injury or death or for damage to property occurring upon, in or about the project, with limits in amounts at least equal to those specified below: Good contracts also specify the cgl industry forms permitted for the project, the minimum coverage amounts, the required endorsements, and the policy duration. Connect with one of our agents by completing the form at the top of the page. Certificate of insurance showing all oter requh ired coverages. A natural disaster can be incredibly difficult for businesses to endure.

Source: eandlinsurance.com

Source: eandlinsurance.com

A national flood insurance program policy offers coverage for building property up to $500,000 & business personal property up to $500,000. A natural disaster can be incredibly difficult for businesses to endure. Vehicle and heavy machinery insurance; That is, if you’re working in the construction industry, you are legally required to have them in order to do your job. What are typical commercial tenant insurance requirements?

Source: amwins.com

Source: amwins.com

Commercial and contractor general liability insurance. A natural disaster can be incredibly difficult for businesses to endure. Flood insurance requirements for commercial property. Certificate of insurance showing all oter requh ired coverages. Construction insurances can provide coverage for material, risks, natural disasters, employees, and even your own business.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial construction insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information