Commercial general liability insurance virginia Idea

Home » Trending » Commercial general liability insurance virginia IdeaYour Commercial general liability insurance virginia images are available in this site. Commercial general liability insurance virginia are a topic that is being searched for and liked by netizens now. You can Get the Commercial general liability insurance virginia files here. Find and Download all free images.

If you’re looking for commercial general liability insurance virginia pictures information linked to the commercial general liability insurance virginia keyword, you have come to the right blog. Our site always gives you hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Commercial General Liability Insurance Virginia. Free, unlimited and instant certificates of insurance online. This is the most common business insurance coverage and nearly all businesses in virginia should have it. About commercial liability insurance for va businesses. General liability insurance through virginia farm bureau provides basic coverage every business needs to protect themselves in case of accidents, mistakes, or even lawsuits.

Business Insurance, General Liability Hopewell, VA From a1insuranceva.com

Business Insurance, General Liability Hopewell, VA From a1insuranceva.com

At goodrich & watson, we specialize in helping businesses throughout virginia evaluate their exposures and put into place a comprehensive insurance program that helps to transfer these risks. Commercial general liability insurance is a standard policy for businesses that help protect it from injury to persons or property, as well as for other liabilities. Free, unlimited and instant certificates of insurance online. This type of insurance protects your business from liability due to a variety of different potential losses. The hartford has been providing va business insurance for over 100 years. Additionally, general liability insurance may be a requirement before some businesses will sign a contract with you.

Get your instant quote now!

At goodrich & watson, we specialize in helping businesses throughout virginia evaluate their exposures and put into place a comprehensive insurance program that helps to transfer these risks. Commercial general liability insurance is a standard policy for businesses that help protect it from injury to persons or property, as well as for other liabilities. A cgl insurance policy will usually cover the costs of your legal defense and will pay on your behalf all damages if you are found liable—up to the limits of your policy. About commercial liability insurance for va businesses. It can offer protection against claims of bodily injury, property damage and more. Ad small business general liability insurance that�s affordable & tailored for you!

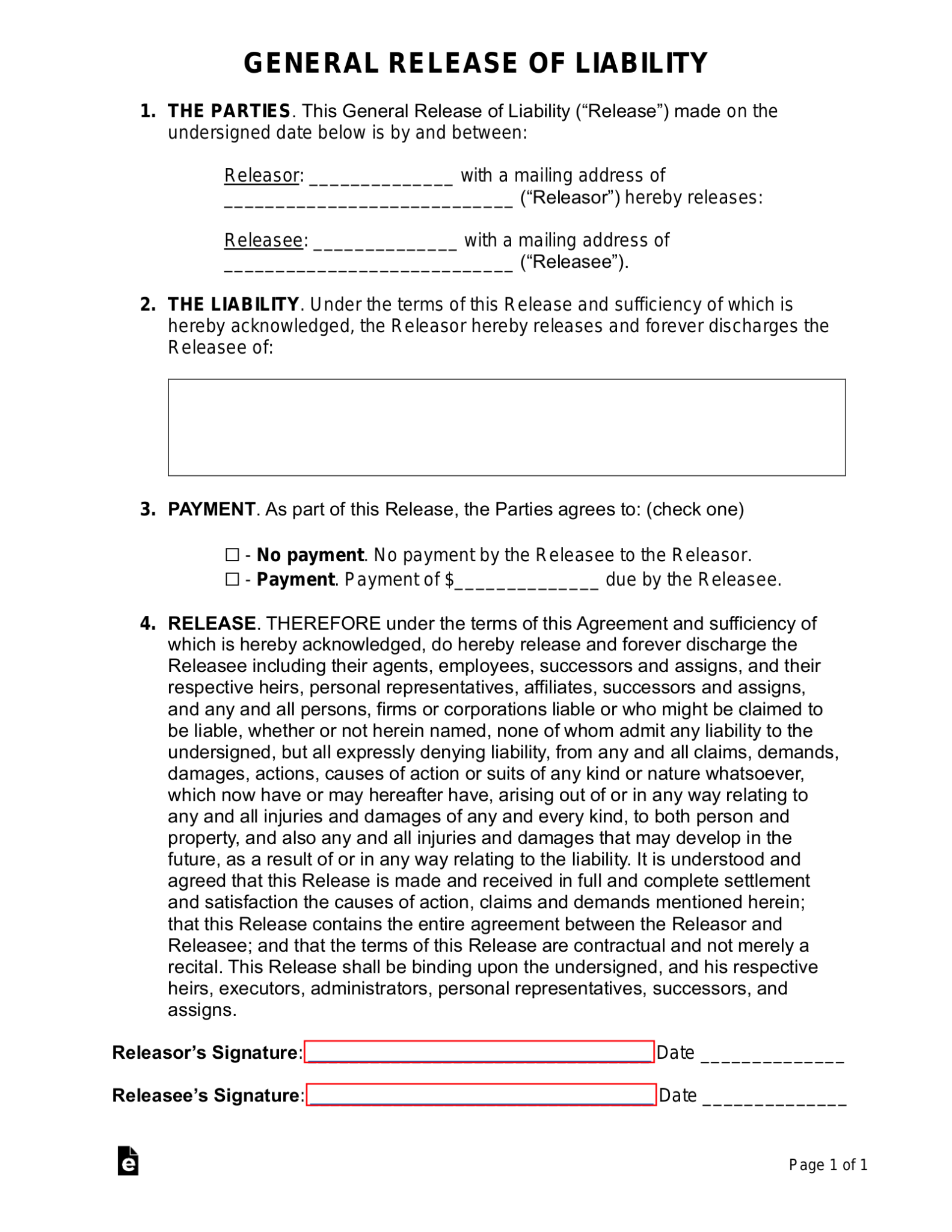

Source: eforms.com

Source: eforms.com

A cgl insurance policy will usually cover the costs of your legal defense and will pay on your behalf all damages if you are found liable—up to the limits of your policy. Commercial general liability insurance is a standard policy for businesses that help protect it from injury to persons or property, as well as for other liabilities. Cgl coverage is one of the most important insurance products, due to the negative impact that a lawsuit can have on a. What commercial general liability insurance covers. Can prevent major financial losses if your business is sued or held legally responsible in the event of bodily injury or damage.

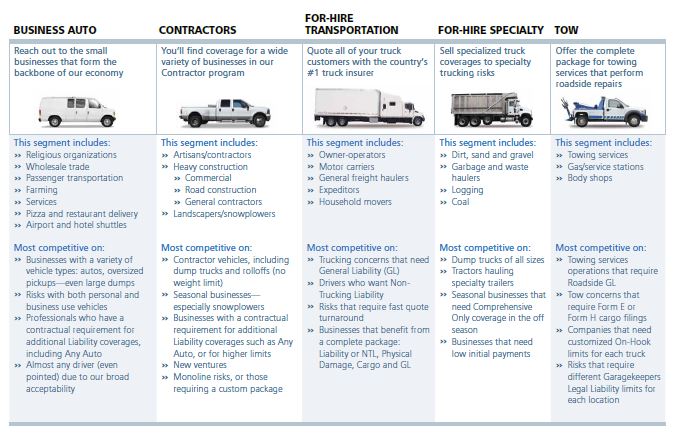

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Commercial general liability insurance is an essential business coverage that protects you and your business from claims and lawsuits against you in that might occur in the course of operating your business. With the proper policy, you can have most medical expenses, attorney fees, settlements, and reimbursements covered. $30,000 bodily injury liability per person What commercial general liability insurance covers. Commercial general liability insurance is a standard policy for businesses that help protect it from injury to persons or property, as well as for other liabilities.

Source: sunshinecontractingcorp.com

Source: sunshinecontractingcorp.com

A cgl insurance policy will usually cover the costs of your legal defense and will pay on your behalf all damages if you are found liable—up to the limits of your policy. Risk protection of virginia, inc has a lot of experience with, and we. Read this page to learn more about general liability insurance policies and call us to get started on your quote today! What general liability insurance does and does not cover. Virginia�s minimum requirements for auto liability insurance are:.

Source: brayandoakley.com

Source: brayandoakley.com

Additionally, general liability insurance may be a requirement before some businesses will sign a contract with you. What general liability insurance does and does not cover. Cgl coverage is one of the most important insurance products, due to the negative impact that a lawsuit can have on a. There are many different plans and options when choosing a general liability plan, and our experienced agents at bradley insurance services, inc. We cover small businesses across many industries.

Source: myhomeimprovementllc.com

Source: myhomeimprovementllc.com

In addition to va general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types. It can offer protection against claims of bodily injury, property damage and more. Free, unlimited and instant certificates of insurance online. General liability insurance coverage can protect your virginia business from these unexpected expenses. If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance.

Source: commercialinsurancewv.com

Source: commercialinsurancewv.com

This type of insurance protects your business from liability due to a variety of different potential losses. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your virginia business from financial loss resulting from claims of injury or damage cause to others by you or your employees. If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance. Ad small business general liability insurance that�s affordable & tailored for you! It’s also known as commercial general.

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

Your business needs general liability insurance if you ever meet clients (at your business or theirs), or have any physical access to their equipment. About commercial liability insurance for va businesses. What general liability insurance does and does not cover. A few exceptions to this principle include data loss and reputation damage (for example, if one of your business’ staff members defames a client). General liability insurance usually covers:

Source: kviscoe.com

Source: kviscoe.com

Get your instant quote now! It takes many different forms that can be tweaked based on your business needs and how you interact with the public. What commercial general liability insurance covers. General liability insurance (also referred to as business liability coverage) isn�t required in virginia but we recommend it for all business owners. Can assist you in finding the right plan at the right budget.

Source: myhomeimprovementllc.com

Source: myhomeimprovementllc.com

There are many different plans and options when choosing a general liability plan, and our experienced agents at bradley insurance services, inc. There are many different plans and options when choosing a general liability plan, and our experienced agents at bradley insurance services, inc. If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance. Ad small business general liability insurance that�s affordable & tailored for you! About commercial liability insurance for va businesses.

Source: vaip.net

Source: vaip.net

Free, unlimited and instant certificates of insurance online. Read this page to learn more about general liability insurance policies and call us to get started on your quote today! Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your virginia business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Free, unlimited and instant certificates of insurance online. About commercial liability insurance for va businesses.

Source: entretriperos.blogspot.com

Source: entretriperos.blogspot.com

If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance. A cgl insurance policy will usually cover the costs of your legal defense and will pay on your behalf all damages if you are found liable—up to the limits of your policy. If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance. The hartford has been providing va business insurance for over 100 years. Free, unlimited and instant certificates of insurance online.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

$30,000 bodily injury liability per person Get your instant quote now! Free, unlimited and instant certificates of insurance online. General liability insurance coverage can protect your virginia business from these unexpected expenses. Additionally, general liability insurance may be a requirement before some businesses will sign a contract with you.

Source: stoveragency.com

Source: stoveragency.com

This type of insurance protects your business from liability due to a variety of different potential losses. Depending on the size and scope your business, you may also need directors and officers liability insurance, employee practices liability insurance, and additional coverage types. Virginia�s minimum requirements for auto liability insurance are:. Learn about our options from small business insurance to commercial general liability insurance in virginia and everything in between. Get your instant quote now!

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

General liability insurance usually covers: We cover small businesses across many industries. About commercial liability insurance for va businesses. At goodrich & watson, we specialize in helping businesses throughout virginia evaluate their exposures and put into place a comprehensive insurance program that helps to transfer these risks. $30,000 bodily injury liability per person

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

General liability insurance usually covers: In addition to va general liability insurance, businesses will typically need commercial auto insurance, workers’ compensation and other key coverage types. It takes many different forms that can be tweaked based on your business needs and how you interact with the public. Commercial liability insurance (also called business liability insurance and commercial general liability insurance) protects your virginia business from financial loss resulting from claims of injury or damage cause to others by you or your employees. Risk protection of virginia, inc has a lot of experience with, and we.

Source: freshsince87.blogspot.com

Source: freshsince87.blogspot.com

When a claim or lawsuit is brought against a company with general liability insurance, the insurer will pay for most or all of the fees, depending on the general liability insurance policy. Virginia�s minimum requirements for auto liability insurance are:. It takes many different forms that can be tweaked based on your business needs and how you interact with the public. General liability insurance through virginia farm bureau provides basic coverage every business needs to protect themselves in case of accidents, mistakes, or even lawsuits. General commercial liability insurance is a common necessity for most businesses.

Source: a1insuranceva.com

Source: a1insuranceva.com

When a claim or lawsuit is brought against a company with general liability insurance, the insurer will pay for most or all of the fees, depending on the general liability insurance policy. This type of insurance protects your business from liability due to a variety of different potential losses. General liability insurance through virginia farm bureau provides basic coverage every business needs to protect themselves in case of accidents, mistakes, or even lawsuits. We cover small businesses across many industries. If you own a business, a big part of being a responsible business owner is protecting your business with va commercial property insurance.

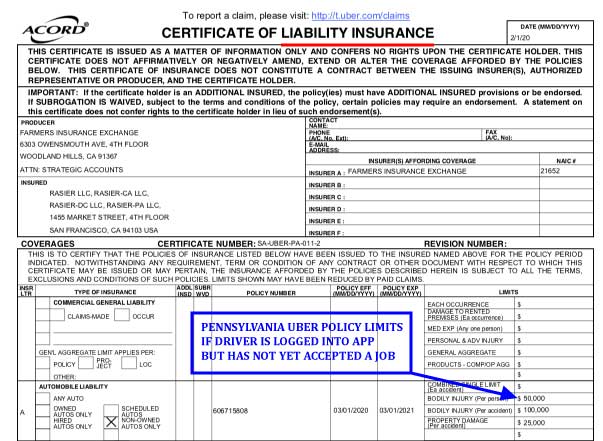

Source: pdffiller.com

Source: pdffiller.com

Virginia general liability insurance exists in order to help companies protect their hard earned investments. Learn about our options from small business insurance to commercial general liability insurance in virginia and everything in between. Commercial general liability insurance is an essential business coverage that protects you and your business from claims and lawsuits against you in that might occur in the course of operating your business. Get your instant quote now! Identifying potential business liability risks is something.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial general liability insurance virginia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea