Commercial insurance exclusions information

Home » Trending » Commercial insurance exclusions informationYour Commercial insurance exclusions images are ready in this website. Commercial insurance exclusions are a topic that is being searched for and liked by netizens now. You can Download the Commercial insurance exclusions files here. Find and Download all free photos.

If you’re searching for commercial insurance exclusions pictures information connected with to the commercial insurance exclusions keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Commercial Insurance Exclusions. The exclusions detailed within a policy may vary based on different factors but are generally decided by the provider’s discretion. Deliberate or willful act of negligence or mishandling that may result in financial liability Exclusions are provisions in business insurance policies that eliminate coverage for certain types of property, perils, situations, or hazards. You should be aware of these exclusions, so you can get necessary additional coverage and avoid any situations in which your policy won’t take care of the damages.

Bankers Be Aware of These Common Professional Liability From fgib.com

Bankers Be Aware of These Common Professional Liability From fgib.com

But there are some reasonably standard exclusions. Common roofing insurance exclusions in commercial property insurance 1. In enfield, ct, your commercial insurance policy is going to cover the most common hazards, most damages, and most losses, if you have an adequate policy. The type of insurance you need to cover vehicular accidents is commercial auto insurance or fleet insurance. The list mentioned here does not include all the exclusions. A user�s guide to pollution exclusions and environmental insurance.

Coverage a provides protection in the event of bodily injury or property damage liability, such as to customers or vendors.

While offering coverage, insurance companies do not include all cases and situations. Exclusions found in a commercial general liability policy. The damage and loss that are not covered by the insurance firms are called exclusions. Coverage a provides protection in the event of bodily injury or property damage liability, such as to customers or vendors. Any other documents asked by the insurance company; Although they are the property of your business, your company’s vehicles are not covered under your commercial property insurance policy.

Source: archerinsgroup.com

Source: archerinsgroup.com

Between the various exceptions and exclusions, and constantly changing laws, you might qualify for benefits even if it appears at your first glance that you do not. While many exclusions are covered by other insurance policies, there are some perils that are simply too risky for insurers to cover. Expected or intended damage or injury The type of insurance you need to cover vehicular accidents is commercial auto insurance or fleet insurance. Risks described in exclusions aren�t covered by the policy.

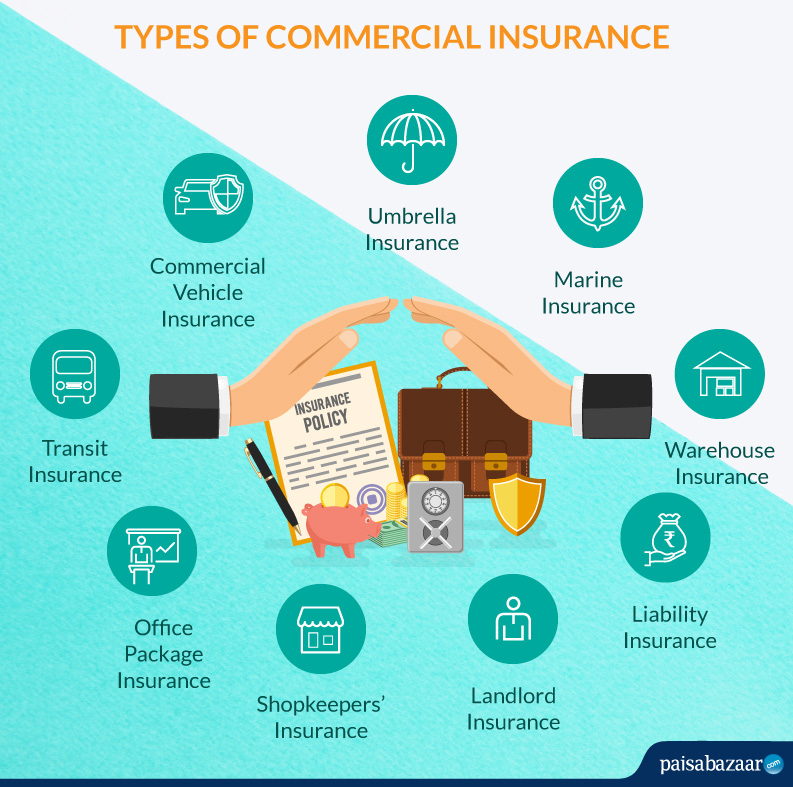

Source: paisabazaar.com

Source: paisabazaar.com

The damage and loss that are not covered by the insurance firms are called exclusions. Expected/intentional injuries or property damage commercial auto covers bodily injury and property damage liability, but not if it was done intentionally. The roof is not insurable due to its age. There are different sets of exclusions for different insurance types and plans. Commercial use can cover a range of business activities such as taxi use or delivering grocery items;

Source: stricklerinsurance.com

Source: stricklerinsurance.com

But there are some reasonably standard exclusions. February 10, 2022 by stratosphere marketing comments are off commercial auto insurance, possible exclusions commercial auto insurance helps protect your business from a potential financial disaster. If the roof of your commercial building, hotel, apartment complex, and other types of structure is 20 years old or older, it may not be covered in some commercial property insurance plans. Either way, you need to be aware of potential exclusions in your commercial car insurance so you can find the best way to plug up these “gaps” if you feel they are too risky. Exclusions found in a commercial general liability policy.

Source: atlantainsurance.com

Source: atlantainsurance.com

You should be aware of these exclusions, so you can get necessary additional coverage and avoid any situations in which your policy won’t take care of the damages. You should be aware of these exclusions, so you can get necessary additional coverage and avoid any situations in which your policy won’t take care of the damages. There are a few notable exclusions from commercial auto insurance policies. Exclusions found in a commercial general liability policy. Exclusions under commercial general liability insurance.

Source: fgib.com

Source: fgib.com

This type of policy generally provides coverage in the event of bodily injury and/or property. Exclusions found in a commercial general liability policy. The damage and loss that are not covered by the insurance firms are called exclusions. For example, these policies cover bodily injury and property damage liability, but not. Risks described in exclusions aren�t covered by the policy.

Source: nsins.com

Source: nsins.com

Commercial use can cover a range of business activities such as taxi use or delivering grocery items; Commercial use can cover a range of business activities such as taxi use or delivering grocery items; Personal property that is under the insured’s care, custody, or control As it is with homeowners insurance, damage. In enfield, ct, your commercial insurance policy is going to cover the most common hazards, most damages, and most losses, if you have an adequate policy.

Source: paisabazaar.com

Source: paisabazaar.com

You should be aware of these exclusions, so you can get necessary additional coverage and avoid any situations in which your policy won’t take care of the damages. Insurers utilize exclusions to remove coverage for. In enfield, ct, your commercial insurance policy is going to cover the most common hazards, most damages, and most losses, if you have an adequate policy. Commercial use can cover a range of business activities such as taxi use or delivering grocery items; Exclusions under commercial general liability insurance.

Source: warhurstlaw.com

Source: warhurstlaw.com

To read more about exclusions, click here. However, property damage or physical injury caused by your commercial vehicle is among the cgl exclusions. Traditionally, a personal auto insurance policy does not cover aspects such as liability, physical damage, medical payments, or uninsured motorists for drivers who use their vehicles for commercial use. While basic commercial insurance policies do cover a lot, there are also many situations they exclude. Generally, commercial insurance protects a business from standard risks, or liabilities, including:

Source: uscaptiveinsurancelaw.com

Source: uscaptiveinsurancelaw.com

Intentional damage, damage from pollutants, and injuries covered by workers’ compensation are just a few of the notable exceptions to most commercial auto liability insurance plans. February 10, 2022 by stratosphere marketing comments are off commercial auto insurance, possible exclusions commercial auto insurance helps protect your business from a potential financial disaster. Intentional damage, damage from pollutants, and injuries covered by. Not all cases and situations are covered by commercial general liability insurance. The roof is not insurable due to its age if the roof of your commercial building, hotel, apartment complex, and other types of structure is 20 years old or older, it may not be covered in some commercial property insurance plans.

Source: upsideinsurancegreenville.com

Source: upsideinsurancegreenville.com

Generally, commercial insurance protects a business from standard risks, or liabilities, including: The damage and loss that are not covered by the insurance firms are called exclusions. While many exclusions are covered by other insurance policies, there are some perils that are simply too risky for insurers to cover. To read more about exclusions, click here. For example, these policies cover bodily injury and property damage liability, but not.

Source: presidioinsurance.com

Source: presidioinsurance.com

Insurance exclusions are policy provisions that waive coverage for certain types of risks or ‘events.’. Although they are the property of your business, your company’s vehicles are not covered under your commercial property insurance policy. There are a few notable exclusions from commercial auto insurance policies. Generally, commercial insurance protects a business from standard risks, or liabilities, including: Between the various exceptions and exclusions, and constantly changing laws, you might qualify for benefits even if it appears at your first glance that you do not.

Source: thebalancesmb.com

Source: thebalancesmb.com

For example, these policies cover bodily injury and property damage liability, but not. Common roofing insurance exclusions in commercial property insurance. Between the various exceptions and exclusions, and constantly changing laws, you might qualify for benefits even if it appears at your first glance that you do not. The type of insurance you need to cover vehicular accidents is commercial auto insurance or fleet insurance. The damage and loss that are not covered by the insurance firms are called exclusions.

Source: thebalancesmb.com

Source: thebalancesmb.com

The following exclusions are common in most general commercial liability insurance policies. The damage and loss that are not covered by the insurance firms are called exclusions. Risks described in exclusions aren�t covered by the policy. Generally, commercial insurance protects a business from standard risks, or liabilities, including: Insurers utilize exclusions to remove coverage for.

Source: restorationmasterfinder.com

Source: restorationmasterfinder.com

Some of the events not covered are: The roof is not insurable due to its age. It won�t protect a business against everything, but business insurance can be a lifesaver in (potentially) expensive situations. Although they are the property of your business, your company’s vehicles are not covered under your commercial property insurance policy. Any other documents asked by the insurance company;

Source: csisinsuranceservices.com

Source: csisinsuranceservices.com

If the roof of your commercial building, hotel, apartment complex, and other types of structure is 20 years old or older, it may not be covered in some commercial property insurance plans. Deliberate or willful act of negligence or mishandling that may result in financial liability The type of insurance you need to cover vehicular accidents is commercial auto insurance or fleet insurance. Traditionally, a personal auto insurance policy does not cover aspects such as liability, physical damage, medical payments, or uninsured motorists for drivers who use their vehicles for commercial use. There are different sets of exclusions for different insurance types and plans.

Source: gilbertsrisksolutions.com

Source: gilbertsrisksolutions.com

The need for environmental coverage in the property and liability insurance packages sold to commercial insurance buyers has expanded over a hundred fold in the past decade. As it is with homeowners insurance, damage. For example, these policies cover bodily injury and property damage liability, but not. They are an important way that an insurer can narrow the range of coverage—with an exclusion clause—for risks that they are unwilling to cover. Intentional damage, damage from pollutants, and injuries covered by.

Source: everquote.com

Source: everquote.com

There are different sets of exclusions for different insurance types and plans. For example, these policies cover bodily injury and property damage liability, but not. Expected/intentional injuries or property damage commercial auto covers bodily injury and property damage liability, but not if it was done intentionally. You’ll usually find most exclusions after the main coverage sections in your policy, referring to named perils, additional coverage, medical payments, personal property, personal liability. In enfield, ct, your commercial insurance policy is going to cover the most common hazards, most damages, and most losses, if you have an adequate policy.

Source: beyondradiation.blogs.com

In enfield, ct, your commercial insurance policy is going to cover the most common hazards, most damages, and most losses, if you have an adequate policy. You should be aware of these exclusions, so you can get necessary additional coverage and avoid any situations in which your policy won’t take care of the damages. As it is with homeowners insurance, damage. Any other documents asked by the insurance company; Because of that, a policy is largely defined by its various exclusions.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title commercial insurance exclusions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea