Commercial insurance industry trends Idea

Home » Trend » Commercial insurance industry trends IdeaYour Commercial insurance industry trends images are available. Commercial insurance industry trends are a topic that is being searched for and liked by netizens now. You can Find and Download the Commercial insurance industry trends files here. Get all royalty-free photos.

If you’re looking for commercial insurance industry trends images information linked to the commercial insurance industry trends topic, you have visit the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Commercial Insurance Industry Trends. This annual report monitors global insurance market trends to support a better understanding of the insurance industry�s overall performance and health. • both individual and commercial customers see greater need for insurance solutions. The following major trends could shape and upend the insurance industry over the coming years, with profound implications for both policyholders and insurers. New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business.

Insurance trends on the rise in 2020 and 2021 Blog.axway From blog.axway.com

Insurance trends on the rise in 2020 and 2021 Blog.axway From blog.axway.com

How you ride the wave of change is what will matter most in the coming year. Consider a fully automated dark warehouse run by robotic. Here are some of the key findings from deloitte’s 2022 insurance industry outlook. New customers + new world = new solutions Commercial insurance market size, share, statistics, trends, types, applications, analysis and forecast, global industry research 2026 • the insurance industry suffered far less economic and reputational damage than many observers initially feared in the first days of the pandemic.

This annual report monitors global insurance market trends to support a better understanding of the insurance industry�s overall performance and health.

The industry is evolving at a fast pace in the wake of challenges and opportunities put forward by Both personal and commercial, therefore will likely face a slowing growth in the coming years. In many cases, however, the software vendors. A commercial insurance plan offers various types of insurance policies such as liability insurance, fire insurance, burglary insurance, plant & machinery insurance, business insurance, and others. While there were signs of a hardening market, there were also major challenges, including the ongoing increase in catastrophic claims, persistently low interest rates and uncertainty around who would win the us elections. That’s why new business insurance trends show that more and more companies are expanding their insurance coverages.

Source: xprimm.com

Source: xprimm.com

How you ride the wave of change is what will matter most in the coming year. In many cases, however, the software vendors. Increased rates, reduced capacity, and coverage reductions are affecting many commercial insurance buyers. More change has occurred in the industry in the past year than in the previous several years combined and its pace is only accelerating. Here are some of the key findings from deloitte’s 2022 insurance industry outlook.

Source: nowblitz.com

Source: nowblitz.com

Consider a fully automated dark warehouse run by robotic. New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business. Drastic shift in risk profile and how insurers partner with their customers to manage it. Risk controls are being evaluated within every coverage. Woodruff sawyer warns that “insurers’ optimism around continued rate increases may be wishful thinking,” noting that a second quarter survey by ciab reported that average commercial lines rate.

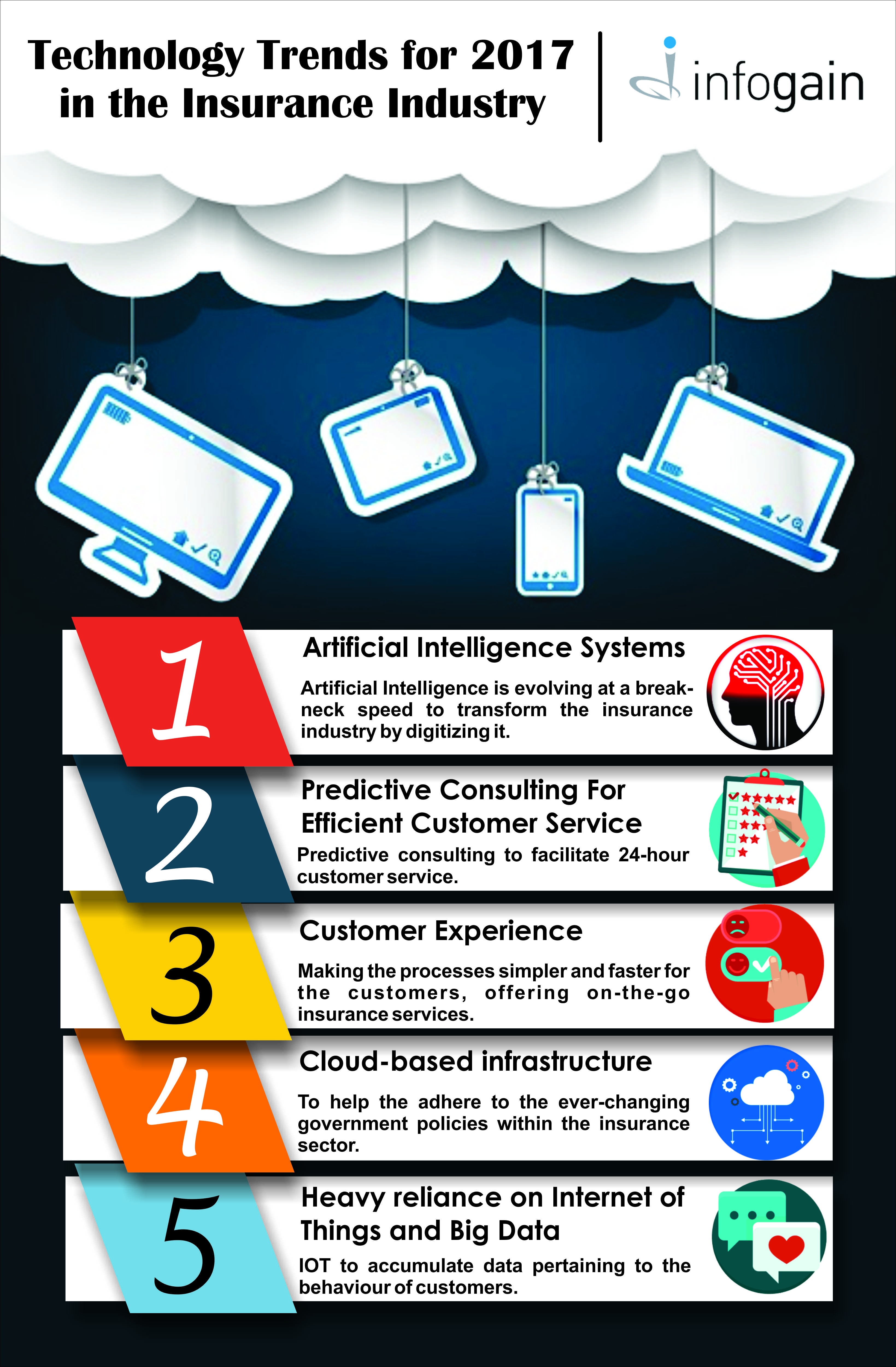

Source: itvoice.in

Source: itvoice.in

New customers + new world = new solutions More change has occurred in the industry in the past year than in the previous several years combined and its pace is only accelerating. • the insurance industry suffered far less economic and reputational damage than many observers initially feared in the first days of the pandemic. 4 future of commercial insurance broking research report future of commercial insurance broking research report5. The global insurance industry is undergoing turbulent times with the continuing low interest.

Source: hylant.com

Source: hylant.com

Drastic shift in risk profile and how insurers partner with their customers to manage it. In many cases, however, the software vendors. How you ride the wave of change is what will matter most in the coming year. Woodruff sawyer warns that “insurers’ optimism around continued rate increases may be wishful thinking,” noting that a second quarter survey by ciab reported that average commercial lines rate. The global insurance industry is undergoing turbulent times with the continuing low interest.

Source: pinterest.com

Source: pinterest.com

But, they can also introduce new risks. New customers + new world = new solutions Both personal and commercial, therefore will likely face a slowing growth in the coming years. Drastic shift in risk profile and how insurers partner with their customers to manage it. New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business.

Source: mubashirsoftware.blogspot.com

Source: mubashirsoftware.blogspot.com

That’s why new business insurance trends show that more and more companies are expanding their insurance coverages. Both personal and commercial, therefore will likely face a slowing growth in the coming years. New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business. In many cases, however, the software vendors. Consider a fully automated dark warehouse run by robotic.

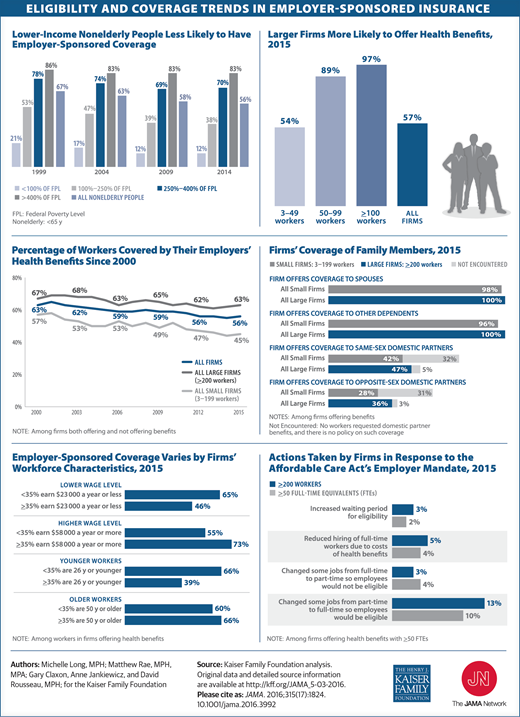

Source: shadac.org

Source: shadac.org

The expense ratio trend is driven by increasing commercial lines, where expense ratios have risen from 34.1% to 40.8% from 2013 to 2018. 4 future of commercial insurance broking research report future of commercial insurance broking research report5. E ven before the global pandemic struck in early 2020, the commercial insurance industry was undergoing significant change: Explore the latest commercial lines insights, trends and breaking news from property/casualty insurance industry authority insurance journal Another trend i�ve seen in the insurance industry is adding value through prevention services and noninsurance products.

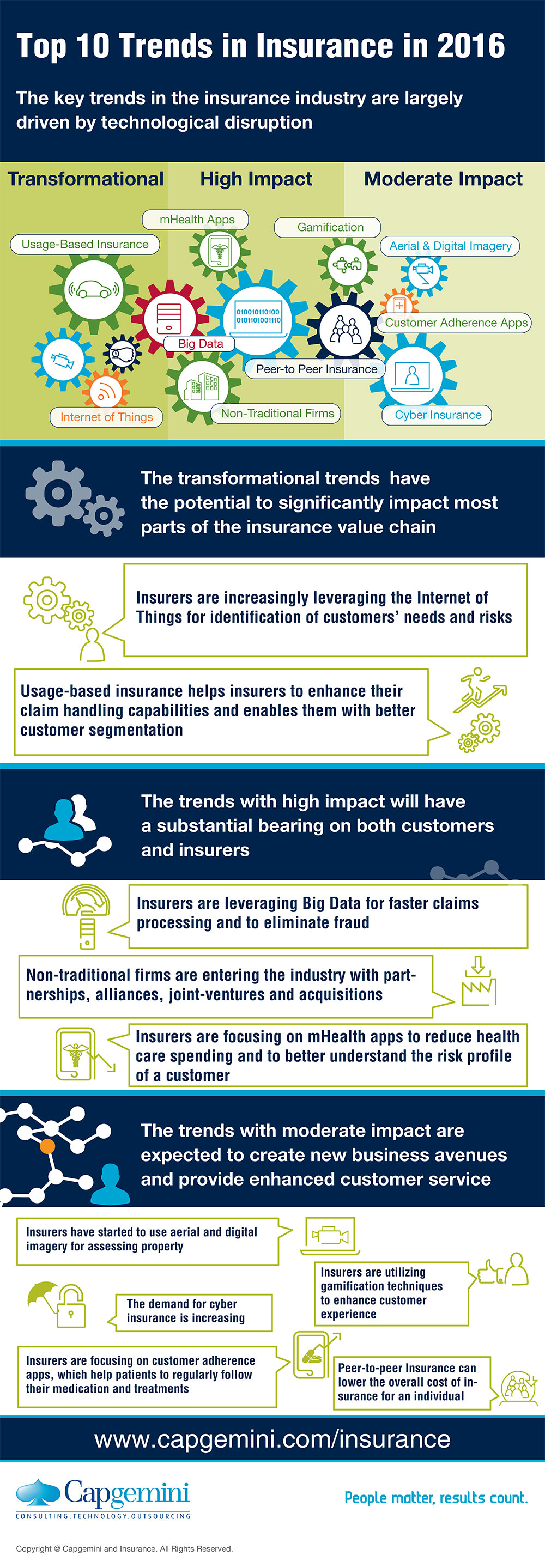

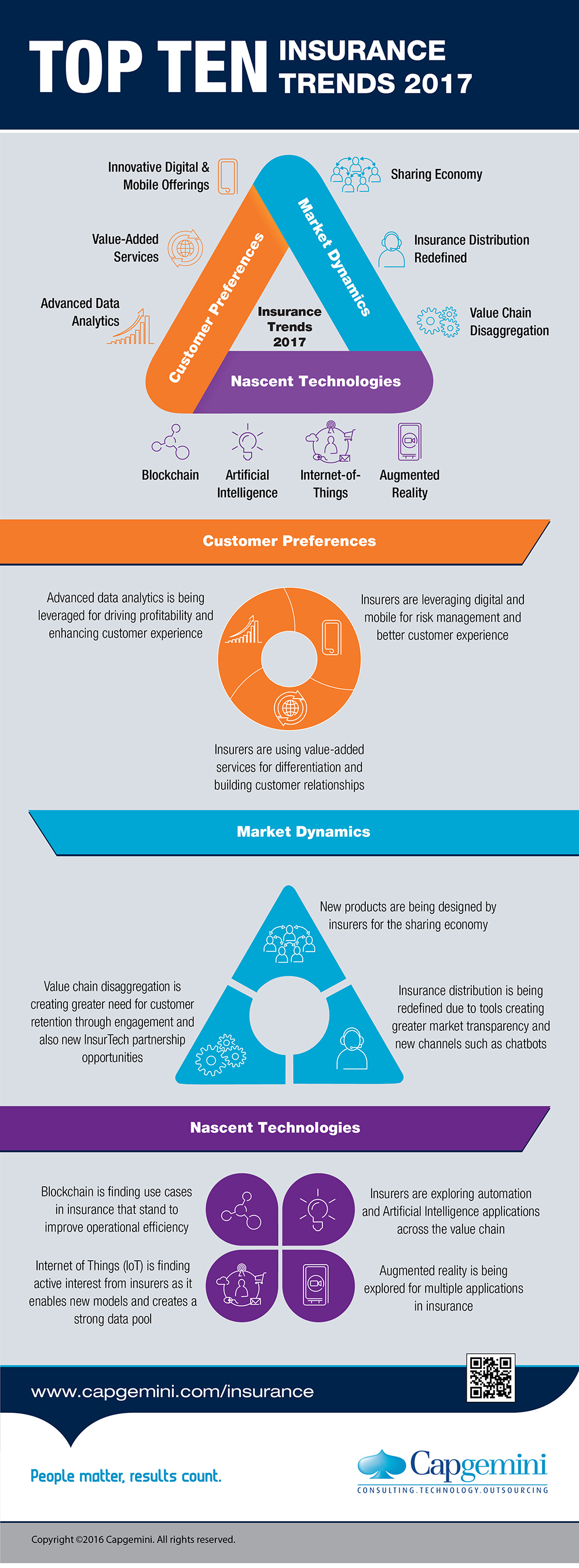

Source: capgemini.com

Source: capgemini.com

Consider a fully automated dark warehouse run by robotic. The global insurance industry is undergoing turbulent times with the continuing low interest. 4 future of commercial insurance broking research report future of commercial insurance broking research report5. With life eroding and p&c flattening, the mature markets have exhibited slower. Another trend i�ve seen in the insurance industry is adding value through prevention services and noninsurance products.

Source: blog.axway.com

Source: blog.axway.com

How you ride the wave of change is what will matter most in the coming year. Explore the latest commercial lines insights, trends and breaking news from property/casualty insurance industry authority insurance journal New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business. Risk controls are being evaluated within every coverage. How you ride the wave of change is what will matter most in the coming year.

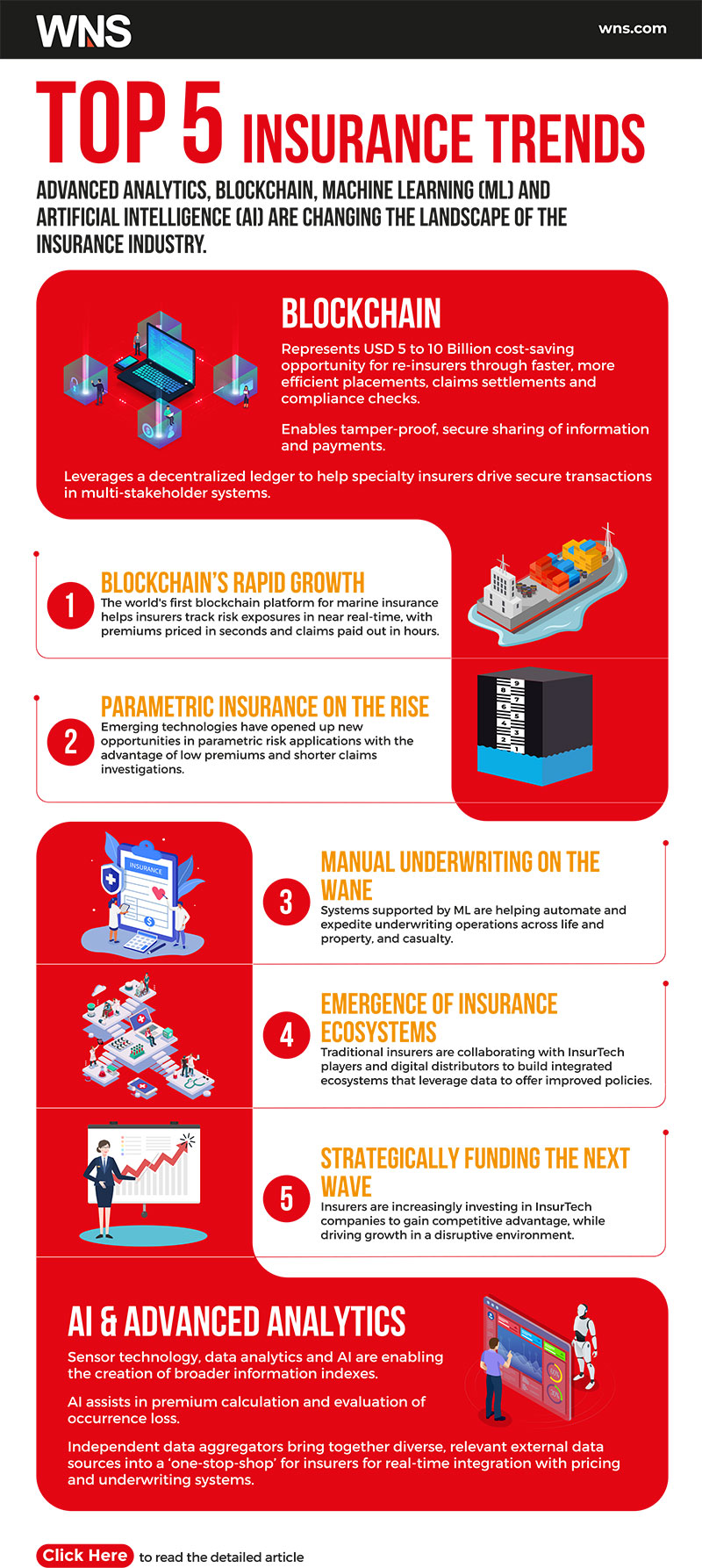

Source: wns.com

Source: wns.com

A commercial insurance plan offers various types of insurance policies such as liability insurance, fire insurance, burglary insurance, plant & machinery insurance, business insurance, and others. Of change in the industry and there are many new entrants to the sector. Increased rates, reduced capacity, and coverage reductions are affecting many commercial insurance buyers. The expense ratio trend is driven by increasing commercial lines, where expense ratios have risen from 34.1% to 40.8% from 2013 to 2018. The following major trends could shape and upend the insurance industry over the coming years, with profound implications for both policyholders and insurers.

Source: hylant.com

Source: hylant.com

Risk controls are being evaluated within every coverage. While there were signs of a hardening market, there were also major challenges, including the ongoing increase in catastrophic claims, persistently low interest rates and uncertainty around who would win the us elections. New technologies, like robotics, artificial intelligence (ai) and drones can help grow your business. The expense ratio trend is driven by increasing commercial lines, where expense ratios have risen from 34.1% to 40.8% from 2013 to 2018. How you ride the wave of change is what will matter most in the coming year.

Source: blogs.lexisnexis.com

Source: blogs.lexisnexis.com

Economic and societal trends that will impact insurance broking but much of the analysis focuses on. In many cases, however, the software vendors. With life eroding and p&c flattening, the mature markets have exhibited slower. 4 future of commercial insurance broking research report future of commercial insurance broking research report5. Of change in the industry and there are many new entrants to the sector.

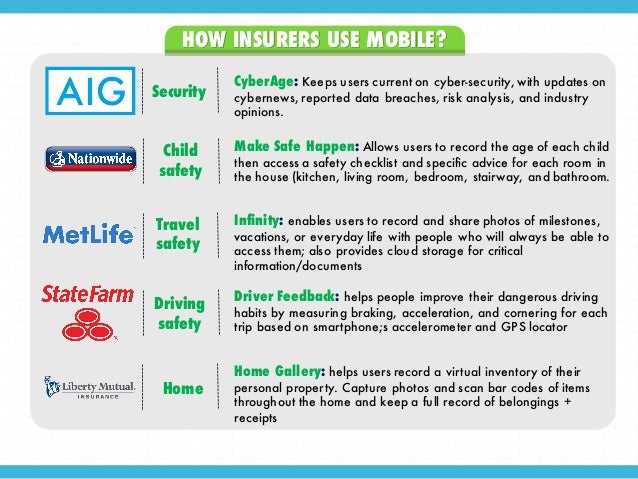

Source: pinterest.com

Source: pinterest.com

In many cases, however, the software vendors. Drastic shift in risk profile and how insurers partner with their customers to manage it. Of change in the industry and there are many new entrants to the sector. • the insurance industry suffered far less economic and reputational damage than many observers initially feared in the first days of the pandemic. The global insurance industry is undergoing turbulent times with the continuing low interest.

Source: slideshare.net

Source: slideshare.net

New customers + new world = new solutions Drastic shift in risk profile and how insurers partner with their customers to manage it. While there were signs of a hardening market, there were also major challenges, including the ongoing increase in catastrophic claims, persistently low interest rates and uncertainty around who would win the us elections. Woodruff sawyer warns that “insurers’ optimism around continued rate increases may be wishful thinking,” noting that a second quarter survey by ciab reported that average commercial lines rate. How you ride the wave of change is what will matter most in the coming year.

Source: slideshare.net

Source: slideshare.net

In many cases, however, the software vendors. Of change in the industry and there are many new entrants to the sector. The industry is evolving at a fast pace in the wake of challenges and opportunities put forward by New customers + new world = new solutions The oecd has collected and analysed data on insurance such as the number of insurance companies and employees, insurance premiums and investments by insurance companies dating back to the.

Source: hylant.com

Source: hylant.com

Here are some of the key findings from deloitte’s 2022 insurance industry outlook. In many cases, however, the software vendors. Increased rates, reduced capacity, and coverage reductions are affecting many commercial insurance buyers. With life eroding and p&c flattening, the mature markets have exhibited slower. The global insurance industry is undergoing turbulent times with the continuing low interest.

Source: capgemini.com

Source: capgemini.com

Explore the latest commercial lines insights, trends and breaking news from property/casualty insurance industry authority insurance journal • both individual and commercial customers see greater need for insurance solutions. The oecd has collected and analysed data on insurance such as the number of insurance companies and employees, insurance premiums and investments by insurance companies dating back to the. Of change in the industry and there are many new entrants to the sector. But, they can also introduce new risks.

Source: peoplekeep.com

Source: peoplekeep.com

Economic and societal trends that will impact insurance broking but much of the analysis focuses on. The following major trends could shape and upend the insurance industry over the coming years, with profound implications for both policyholders and insurers. Consider a fully automated dark warehouse run by robotic. That’s why new business insurance trends show that more and more companies are expanding their insurance coverages. 4 future of commercial insurance broking research report future of commercial insurance broking research report5.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial insurance industry trends by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information