Commercial property and casualty insurance Idea

Home » Trend » Commercial property and casualty insurance IdeaYour Commercial property and casualty insurance images are available in this site. Commercial property and casualty insurance are a topic that is being searched for and liked by netizens now. You can Get the Commercial property and casualty insurance files here. Download all royalty-free images.

If you’re searching for commercial property and casualty insurance images information connected with to the commercial property and casualty insurance interest, you have pay a visit to the ideal blog. Our website always provides you with hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video content and images that fit your interests.

Commercial Property And Casualty Insurance. Owns ironshore, ohio casualty, peerless insurance, and safeco. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. Now a global company that offers commercial and personal insurance coverages. Commercial property and casualty insurance—also referred to as p&c insurance or commercial lines insurance—is a category of business insurance.

Property and casualty insurance From slideshare.net

Property and casualty insurance From slideshare.net

This cost containment unit is. Now a global company that offers commercial and personal insurance coverages. A mutual insurer that was initially created to provide workers compensation insurance. Owns ironshore, ohio casualty, peerless insurance, and safeco. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. Casualty (liability) casualty insurance mainly protects you against legal liability for bodily injury (bi) and/or property damage (pd) you cause to other people.

With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests.

Commercial property and casualty insurance is key for ensuring your business’ success both now and in the future. Commercial property and casualty insurance—also referred to as p&c insurance or commercial lines insurance—is a category of business insurance. Commercial property and casualty insurance is a category of business insurance that protects businesses — including small businesses — from the financial consequences of accidents that could threaten not only the success of the. Protect your business with commercial property and casualty insurance. But our policies don’t end at your physical property. A professional with a p&c insurance license should be able.

Source: entrepreneurbusinessblog.com

Source: entrepreneurbusinessblog.com

Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. Commercial property and casualty insurance. For example, property insurance would repair your car if it was damaged in an accident, while casualty insurance would pay for the repair of someone else’s car if you were. Things like theft, vandalism, fire and weather are covered under such policies. What are these commercial insurance policies?

Source: madpow.com

Source: madpow.com

With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests. Things like theft, vandalism, fire and weather are covered under such policies. Protect your business with commercial property and casualty insurance. Each property & casualty policy is specifically tailored to the specific business that it covers. Property and casualty insurance or p&c is the type of insurance that protects individuals and businesses from losses associated with property, while also covering liability for damage to others.

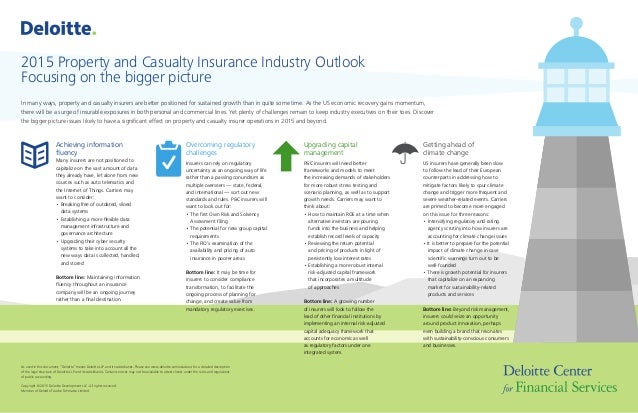

Source: slideshare.net

Source: slideshare.net

If your business suffers a loss or damage from a fire, a theft, a storm, a plumbing disaster, or other physical destruction, a commercial property policy will protect your property and its contents. For example, property insurance would repair your car if it was damaged in an accident, while casualty insurance would pay for the repair of someone else’s car if you were. With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests. Now a global company that offers commercial and personal insurance coverages. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings.

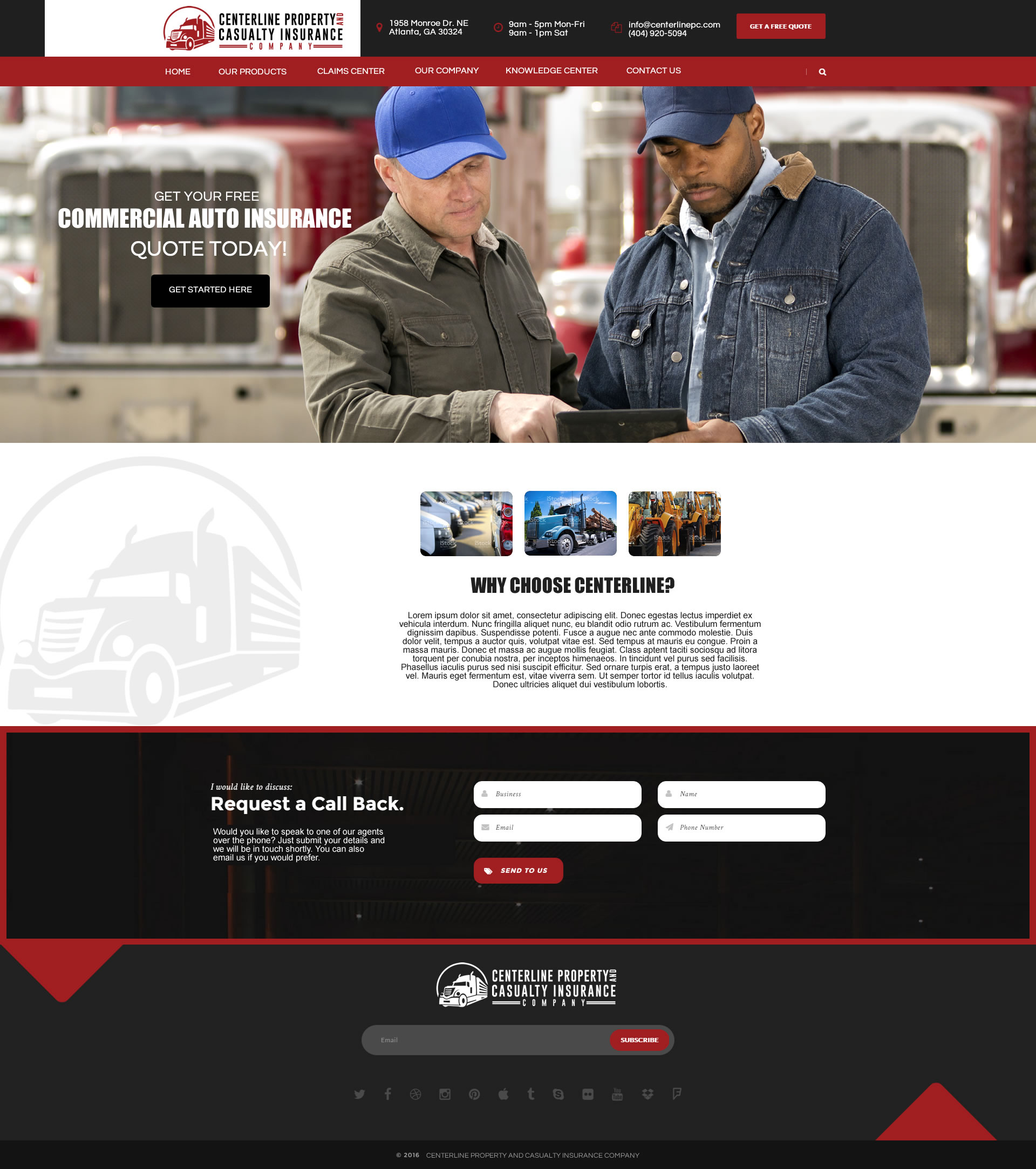

Source: greensagegroup.com

Source: greensagegroup.com

At face value, commercial property insurance (also known as commercial property and casualty insurance) seems relatively straightforward. What are these commercial insurance policies? Protect your business with commercial property and casualty insurance. Whether your business vehicle is broken into, belongings are damaged on the job, or a storm destroys your building, you need protection for your people, your property, and yourself. Let’s break it down further.

Source: thebalancesmb.com

Source: thebalancesmb.com

A mutual insurer that was initially created to provide workers compensation insurance. Each property & casualty policy is specifically tailored to the specific business that it covers. The client manager works with and supports account leaders to manage overall client service delivery and administration throughout the insurance issuance and renewal life cycle. Commercial property and casualty insurance is used to specify policies specifically for businesses. Commercial property and casualty insurance is a category of business insurance that protects businesses — including small businesses — from the financial consequences of accidents that could threaten not only the success of the.

Source: info.bks-partners.com

Source: info.bks-partners.com

If your business suffers a loss or damage from a fire, a theft, a storm, a plumbing disaster, or other physical destruction, a commercial property policy will protect your property and its contents. The client manager works with and supports account leaders to manage overall client service delivery and administration throughout the insurance issuance and renewal life cycle. Commercial property and casualty insurance is a category of business insurance that protects businesses — including small businesses — from the financial consequences of accidents that could threaten not only the success of the. Commercial and specialty p&c insurance sector (globally) might evolve in one to three years to help leaders: Products include homeowners, auto, boat, and commercial auto insurance.

Source: griffingriffin.net

Source: griffingriffin.net

Commercial property and casualty insurance is key for ensuring your business’ success both now and in the future. A mutual insurer that was initially created to provide workers compensation insurance. Commercial property and casualty insurance is used to specify policies specifically for businesses. Brabo’s commercial property and casualty insurance services will set you up with a protection plan that covers all your bases. Commercial and specialty p&c insurance sector (globally) might evolve in one to three years to help leaders:

Source: pinterest.com

Source: pinterest.com

Property insurance covers you for any belongings that have been stolen or damaged due to events such as fires, theft or damages. Commercial property and casualty insurance—also referred to as p&c insurance or commercial lines insurance—is a category of business insurance. Property and casualty insurance caters to personal property damage and liability claims. This type of insurance includes policies that protect small businesses from a range of threats. Things like theft, vandalism, fire and weather are covered under such policies.

Source: slideshare.net

Source: slideshare.net

According to the council of insurance agents and brokers q2 2021 rate survey, rates increased by just 0.3% in the beginning of 2021. It’s one of the most commonly requested type of commercial insurance. Now a global company that offers commercial and personal insurance coverages. This position is a client facing role utilizing professional skills in commercial property and casualty insurance to maintain and enhance client relationships while also insuring client. Property insurance covers you for any belongings that have been stolen or damaged due to events such as fires, theft or damages.

Source: mahoneygps.com

Source: mahoneygps.com

Let’s break it down further. Explore how trends we see during the pandemic could shape what p&c commercial and specialty insurance may look like in the medium term 2. The client manager works with and supports account leaders to manage overall client service delivery and administration throughout the insurance issuance and renewal life cycle. Property and casualty (p&c) insurers are companies that provide coverage on assets, as well as liability insurance for accidents, injuries, and damage to others or their belongings. A professional with a p&c insurance license should be able.

Source: elegantimagestudios.com

Source: elegantimagestudios.com

Have productive conversations around the lasting implications and impacts of the crisis 3. Things like theft, vandalism, fire and weather are covered under such policies. Property and casualty insurance caters to personal property damage and liability claims. Commercial property and casualty insurance is key for ensuring your business’ success both now and in the future. Now a global company that offers commercial and personal insurance coverages.

Source: slideshare.net

Source: slideshare.net

Property insurance covers you for any belongings that have been stolen or damaged due to events such as fires, theft or damages. Protect your business with commercial property and casualty insurance. It’s one of the most commonly requested type of commercial insurance. Things like theft, vandalism, fire and weather are covered under such policies. It commonly refers to both commercial property insurance and casualty insurance.

Source: innitialliance.com

Source: innitialliance.com

A professional with a p&c insurance license should be able. But our policies don’t end at your physical property. With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests. This position is a client facing role utilizing professional skills in commercial property and casualty insurance to maintain and enhance client relationships while also insuring client. Property and casualty insurance caters to personal property damage and liability claims.

Source: investedwallet.com

Source: investedwallet.com

Protect your business with commercial property and casualty insurance. Have productive conversations around the lasting implications and impacts of the crisis 3. This cost containment unit is. Each property & casualty policy is specifically tailored to the specific business that it covers. Commercial property and casualty insurance is used to specify policies specifically for businesses.

Source: dalebarton.com

Source: dalebarton.com

Property and casualty insurance caters to personal property damage and liability claims. A mutual insurer that was initially created to provide workers compensation insurance. Whether your business vehicle is broken into, belongings are damaged on the job, or a storm destroys your building, you need protection for your people, your property, and yourself. Commercial casualty insurance is broad protection to address loss from injuries to people and/or damage to their property and the legal liability arising from these accidents. It’s one of the most commonly requested type of commercial insurance.

Source: slideshare.net

Source: slideshare.net

Protect your business with commercial property and casualty insurance. Explore how trends we see during the pandemic could shape what p&c commercial and specialty insurance may look like in the medium term 2. At face value, commercial property insurance (also known as commercial property and casualty insurance) seems relatively straightforward. This position is a client facing role utilizing professional skills in commercial property and casualty insurance to maintain and enhance client relationships while also insuring client. Property insurance covers you for any belongings that have been stolen or damaged due to events such as fires, theft or damages.

Source: worldinsurtechreport.com

Source: worldinsurtechreport.com

Whether your business vehicle is broken into, belongings are damaged on the job, or a storm destroys your building, you need protection for your people, your property, and yourself. With property insurance, any insurance benefit payments by the insurance company will be paid directly to the insured or other specifically named interests. In other words, liability or casualty coverage. Now a global company that offers commercial and personal insurance coverages. Commercial and specialty p&c insurance sector (globally) might evolve in one to three years to help leaders:

Source: hexaware.com

Source: hexaware.com

Things like theft, vandalism, fire and weather are covered under such policies. Commercial property and casualty insurance is used to specify policies specifically for businesses. If your business suffers a loss or damage from a fire, a theft, a storm, a plumbing disaster, or other physical destruction, a commercial property policy will protect your property and its contents. Property and casualty insurance or p&c is the type of insurance that protects individuals and businesses from losses associated with property, while also covering liability for damage to others. It commonly refers to both commercial property insurance and casualty insurance.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial property and casualty insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information