Commercial property insurance cost per square foot information

Home » Trending » Commercial property insurance cost per square foot informationYour Commercial property insurance cost per square foot images are available. Commercial property insurance cost per square foot are a topic that is being searched for and liked by netizens now. You can Find and Download the Commercial property insurance cost per square foot files here. Get all free photos.

If you’re looking for commercial property insurance cost per square foot images information connected with to the commercial property insurance cost per square foot keyword, you have visit the ideal site. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

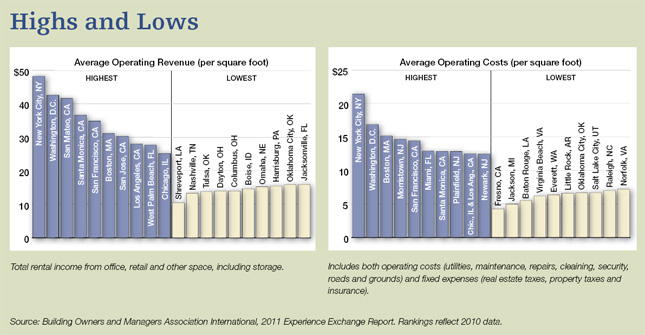

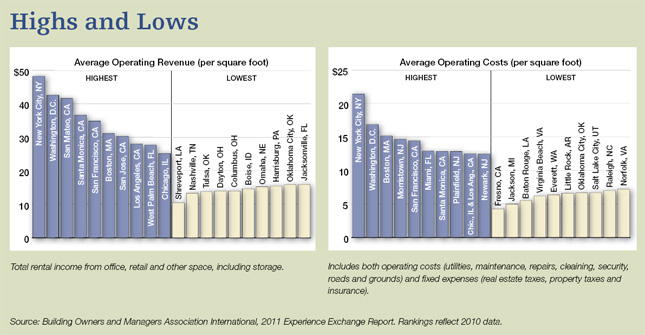

Commercial Property Insurance Cost Per Square Foot. Leases normally require an upfront deposit with rents (a third of overall costs) payable on an annual or quarterly basis. The median cost of commercial property insurance is $63 per month or $755 per year with a limit of $60,000 and a median deductible of $1,000. Operating costs are calculated per square foot of rentable space. The average business owner pays between $1,000 and $3,000 annually for commercial property insurance.

Commercial Property Insurance Cost Per Square Foot From kevyemminkohtitulevaisuutta.blogspot.com

Commercial Property Insurance Cost Per Square Foot From kevyemminkohtitulevaisuutta.blogspot.com

These expenses are annual estimates for the total maintenance of the property and may change from year to year. Commercial property rates vary due to things like: What is commercial property insurance? According to a 2017 study by howmuch.net, a small business owner might pay as little as $500 a year for commercial property insurance, whereas a major corporation will pay $500,000 or more. On average, the same source estimates that you�ll pay between $1,000 and $3,000 per $1 million of insurance coverage, with an average annual rate of $742. How to determine the rates of commercial property insurance per square foot.

The average business owner pays between $1,000 and $3,000 annually for commercial property insurance.

On average, commercial building costs range from $16 to $20 per square foot. These nnn expenses are also quoted on a square footage basis. What is commercial property insurance? The median cost of commercial property insurance is $63 per month or $755 per year with a limit of $60,000 and a median deductible of $1,000. Per square foot learn how to calculate cap rate from tracy treger, sr. After dividing the price by the square footage, it’s clear that the price per square foot for this deal is $324.

Source: 420property.com

Source: 420property.com

It�s a worst case scenario figure. However, there are significant variations in average prices based on location and real estate class. You may obtain an independent insurance appraisal that provides a cost to. These expenses are annual estimates for the total maintenance of the property and may change from year to year. Commercial building insurance costs can be found for around £218 to insure a typical small business property in the uk with a £200,000 rebuild cost.

It�s a worst case scenario figure. Based on historical data, we can see observe that: Commercial building insurance costs can be found for around £218 to insure a typical small business property in the uk with a £200,000 rebuild cost. Cope is a way that an insurance company can look at a risk and evaluate if with an appropriate rating; The coverage would depend on numerous factors.

Source: 420property.com

Source: 420property.com

Impossible to say without more information. Based on historical data, we can see observe that: Leases normally require an upfront deposit with rents (a third of overall costs) payable on an annual or quarterly basis. The coverage would depend on numerous factors. The median cost of commercial property insurance is $63 per month or $755 per year with a limit of $60,000 and a median deductible of $1,000.

Source: 420property.com

Source: 420property.com

According to a 2017 study by howmuch.net, a small business owner might pay as little as $500 a year for commercial property insurance, whereas a major corporation will pay $500,000 or more. The average business owner pays between $1,000 and $3,000 annually for commercial property insurance. Commercial building insurance costs can be found for around £218 to insure a typical small business property in the uk with a £200,000 rebuild cost. As of 2015, the average cost of commercial property over the past five years for all clients surveyed was $742 per year. Price psf = property value / property size (in sf) price per unit = property value / number of units.

Source: 420property.com

Source: 420property.com

For example, a commercial building with a £500k rebuild cost would probably be around twice as much to insure. The average business owner pays between $1,000 and $3,000 annually for commercial property insurance. As mentioned previously, the rates you will see will largely depend on the specific factors associated with your commercial property investment. Commercial property rates vary due to things like: 450 + 2,450 = 2,900) average cost per square footage.

Source: kevyemminkohtitulevaisuutta.blogspot.com

Source: kevyemminkohtitulevaisuutta.blogspot.com

Here is a summary of average commercial rates in key usa cities: 450 + 2,450 = 2,900) average cost per square footage. Your insurance agent should know exactly what questions to ask to get you the right insurance for your needs! 450 + 2,450 = 2,900) average cost per square footage. Cope is a way that an insurance company can look at a risk and evaluate if with an appropriate rating;

Source: benchmarkbroker.com

Source: benchmarkbroker.com

You may obtain an independent insurance appraisal that provides a cost to. It�s a worst case scenario figure. Per square foot learn how to calculate cap rate from tracy treger, sr. These nnn expenses are also quoted on a square footage basis. Impossible to say without more information.

Source: benchmarkbroker.com

Source: benchmarkbroker.com

Commercial property rates vary due to things like: The coverage would depend on numerous factors. The formulas below show the calculation for each metric. The average cost of building a steel structure is $16 to $20 per square foot, but with customization, this can cost up to $40 per square foot. What is commercial property insurance?

Source: kevyemminkohtitulevaisuutta.blogspot.com

Source: kevyemminkohtitulevaisuutta.blogspot.com

$32.00 per square foot nnn with an estimated $3.00 per square foot in nnn expenses. The rebuild cost of a commercial property is a calculation that reflects all of the costs that would be incurred if the existing structure was damaged or destroyed and needed to be torn down and rebuilt. For example, if the rentable square footage is 1,130 and the price is $1 per square foot, your monthly lease amount is $1,130. Each of these variations is useful if the comparison is apples to apples, meaning price per unit is compared to price per unit, price psf compared to price psf, etc. For example, a commercial building with a £500k rebuild cost would probably be around twice as much to insure.

Source: speedcres.com

Source: speedcres.com

You may obtain an independent insurance appraisal that provides a cost to. Per square foot learn how to calculate cap rate from tracy treger, sr. However, there are significant variations in average prices based on location and real estate class. The average price of a standard commercial property insurance policy for small businesses ranges from $37 to $79 per month based on location, square footage, building usage, building age and more. The median cost of commercial property insurance is $63 per month or $755 per year with a limit of $60,000 and a median deductible of $1,000.

Source: 420property.com

Source: 420property.com

The coverage would depend on numerous factors. Based on historical data, we can see observe that: According to a 2017 study by howmuch.net, a small business owner might pay as little as $500 a year for commercial property insurance, whereas a major corporation will pay $500,000 or more. For example, a commercial building with a £500k rebuild cost would probably be around twice as much to insure. What is the average cost per square foot for a commercial building?

Source: revisi.net

Source: revisi.net

These expenses are annual estimates for the total maintenance of the property and may change from year to year. As mentioned previously, the rates you will see will largely depend on the specific factors associated with your commercial property investment. How to determine the rates of commercial property insurance per square foot. 450 + 2,450 = 2,900) average cost per square footage. The formulas below show the calculation for each metric.

Source: selefans-news.blogspot.com

Source: selefans-news.blogspot.com

Impossible to say without more information. Here is a summary of average commercial rates in key usa cities: The average cost of building a steel structure is $16 to $20 per square foot, but with customization, this can cost up to $40 per square foot. This amount only accounts for the property insurance portion of the business insurance policy and represents policies that had business personal property for contents and building coverage. As of 2015, the average cost of commercial property over the past five years for all clients surveyed was $742 per year.

Commercial building insurance costs can be found for around £218 to insure a typical small business property in the uk with a £200,000 rebuild cost. Cope is a way that an insurance company can look at a risk and evaluate if with an appropriate rating; On average, commercial building costs range from $16 to $20 per square foot. Retail averaged out to $18.09 / square foot, and industrial space came in at just under $8 / square foot. Here is a summary of average commercial rates in key usa cities:

Source: selefans-news.blogspot.com

Source: selefans-news.blogspot.com

What is commercial property insurance? Leases normally require an upfront deposit with rents (a third of overall costs) payable on an annual or quarterly basis. For example, a commercial building with a £500k rebuild cost would probably be around twice as much to insure. These expenses are annual estimates for the total maintenance of the property and may change from year to year. Note the tenant must pay opex not just for their office space.

Source: nanalyze.com

Source: nanalyze.com

Many factors are taken into account when calculating a commercial property reinstatement valuation, such as materials, tradespeople. 450 + 2,450 = 2,900) average cost per square footage. How to determine the rates of commercial property insurance per square foot. 450 + 2,450 = 2,900) average cost per square footage. However, there are significant variations in average prices based on location and real estate class.

Source: kijiji.ca

Source: kijiji.ca

On average, the same source estimates that you�ll pay between $1,000 and $3,000 per $1 million of insurance coverage, with an average annual rate of $742. However, properties that cost more to rebuild also cost more to insure. As of 2015, the average cost of commercial property over the past five years for all clients surveyed was $742 per year. The average cost of building a steel structure is $16 to $20 per square foot, but with customization, this can cost up to $40 per square foot. Here is a summary of average commercial rates in key usa cities:

450 + 2,450 = 2,900) average cost per square footage. Price per key = property value / number of. What is commercial property insurance? However, there are significant variations in average prices based on location and real estate class. $32.00 per square foot nnn with an estimated $3.00 per square foot in nnn expenses.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial property insurance cost per square foot by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea