Commercial tenant liability insurance Idea

Home » Trending » Commercial tenant liability insurance IdeaYour Commercial tenant liability insurance images are ready in this website. Commercial tenant liability insurance are a topic that is being searched for and liked by netizens now. You can Download the Commercial tenant liability insurance files here. Download all royalty-free vectors.

If you’re searching for commercial tenant liability insurance images information connected with to the commercial tenant liability insurance topic, you have come to the ideal site. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video content and images that fit your interests.

Commercial Tenant Liability Insurance. Combined with the numerous other coverages you. The purpose of tenant legal liability insurance is to protect you and your business from having to pay medical bills for injured third parties, repair or replacement costs for damaged property and lawyer’s fees, settlement costs and awards for damages if you’re served with a lawsuit pertaining to your liability as a tenant. No matter how much planning you do, something could go wrong. Most landlords commercial tenant insurance requirements will require that.

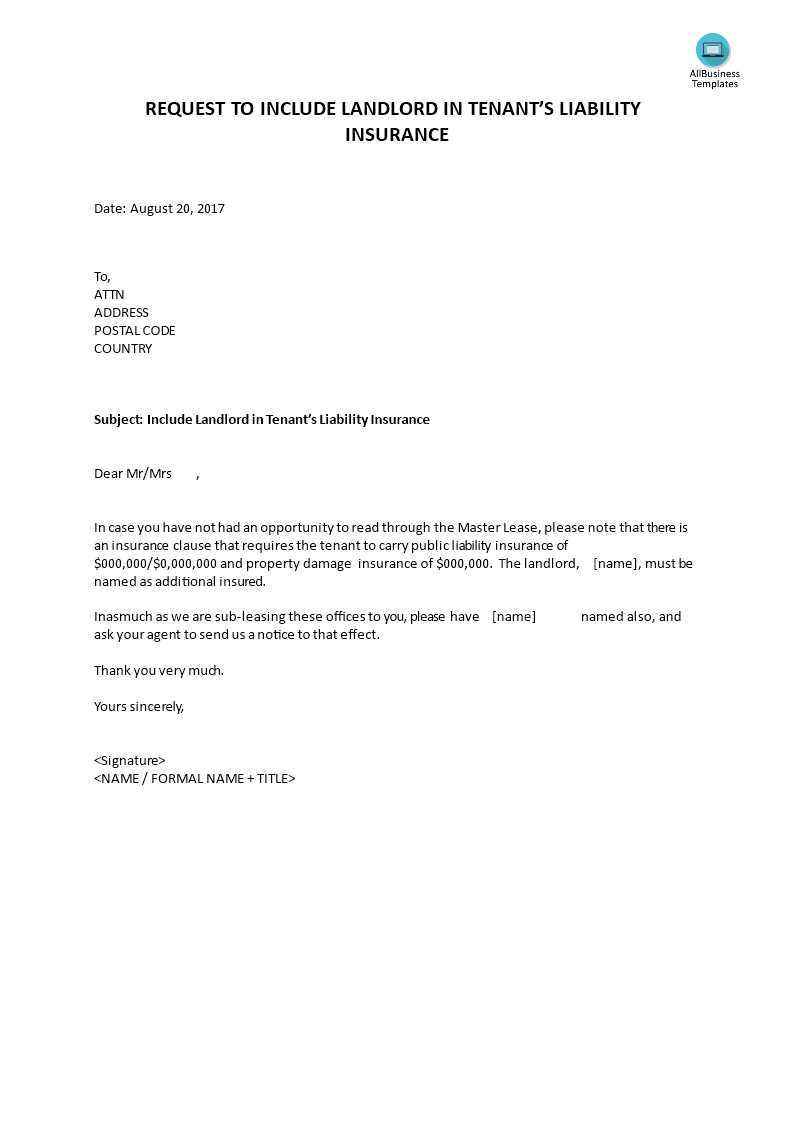

Request to include landlord in tenant�s liability From allbusinesstemplates.com

Request to include landlord in tenant�s liability From allbusinesstemplates.com

Tenant agrees to maintain in full force on or before the earlier of (i) the date on which any tenant party first enters the premises for any reason or (ii) the lease commencement date throughout the lease term of this lease, and thereafter, so long as tenant is in occupancy of any part of the premises, a policy of. Tenant’s commercial general liability insurance. However, more and more landlords are now including these provisions in their rental agreements. Insurance becomes more important in the case of commercial property. Commercial general liability insurance with a combined single limit for bodily injury, including death, to any person or persons, and for property damages, of not less than $500,000.00 per occurrence, $1,000,000.00 aggregate, plus excess/umbrella liability insurance containing a per occurrence combined single limit of $1,000,000.00 aggregate. This type of insurance policy (sometimes.

Commercial tenant insurance requirements commercial insurance types that lessors typically require.

$10 or $20 million cover is typically required. Commercial general liability insurance with a combined single limit for bodily injury, including death, to any person or persons, and for property damages, of not less than $500,000.00 per occurrence, $1,000,000.00 aggregate, plus excess/umbrella liability insurance containing a per occurrence combined single limit of $1,000,000.00 aggregate. Here is a brief overview of what tll insurance is, what it covers and why all. Average rates are around $53 per month or $636 annually. Insurance becomes more important in the case of commercial property. Commercial tenants are not permitted to take possession of leased space until their insurance policy is effective.

Source: pinterest.com

Source: pinterest.com

Whether you are a landlord or a tenant of commercial premises, it is extremely important that the lease sets out full details of who will insure and exactly what they will insure. Additional coverage can get expensive. For this reason, part of your business planning involves purchasing insurance policies to cover different eventualities that could occur during the course of your business. Two fulton square, llc , 47 misc. Tenant agrees to maintain in full force on or before the earlier of (i) the date on which any tenant party first enters the premises for any reason or (ii) the lease commencement date throughout the lease term of this lease, and thereafter, so long as tenant is in occupancy of any part of the premises, a policy of.

Source: business-in-a-box.com

Source: business-in-a-box.com

General liability insurance is by far the most common insurance coverage required in a commercial lease. Most landlords commercial tenant insurance requirements will require that. If a person falls down the stairs and breaks their leg and then sues the tenant, liability insurance pays for the settlement. Tenants legal liability insurance can cover damage you or your employees may cause to the unit and/or building you rent or lease. This can range from things as small as a stain.

Source: edinsure.co.uk

Source: edinsure.co.uk

Also known as commercial general liability insurance or public liability insurance, it protects against someone getting hurt on the property. Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. Combined with the numerous other coverages you. Two fulton square, llc , 47 misc. As a commercial tenant, your orange county landlord.

Source: pinterest.com

Source: pinterest.com

This can range from things as small as a stain. This is different from a tenant�s content insurance content policy which covers your own possessions. Commercial tenants are not permitted to take possession of leased space until their insurance policy is effective. $10 or $20 million cover is typically required. This would mean that you would be covered for any accidents or injuries in the establishment with general liability and against any damage done to the establishment itself.

Source: income.ca

Source: income.ca

Here is a brief overview of what tll insurance is, what it covers and why all. Commercial tenant insurance typically may cover: Whether you are a landlord or a tenant of commercial premises, it is extremely important that the lease sets out full details of who will insure and exactly what they will insure. A commercial liability insurance policy is the first step in developing insurance coverage for a business. Prior to assuming occupancy of a commercial space, a tenant must provide their landlord with a certificate of insurance and copies of their insurance policy.

Source: coulsonpritchard.com

Source: coulsonpritchard.com

Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. If a person falls down the stairs and breaks their leg and then sues the tenant, liability insurance pays for the settlement. This can range from things as small as a stain. Average rates are around $53 per month or $636 annually. If the lease is silent, there is no implied obligation on either party to insure the property and/or to lay out any insurance monies received in reinstating it.

Source: affinitychoiceinsurance.com

Source: affinitychoiceinsurance.com

Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. 2015), the new york state supreme court held that a commercial tenant’s failure to prove that it maintained insurance throughout the term of the lease constituted an incurable material, default resulting in lease. It’s also frequently required by mortgage lenders and in client contracts. For this reason, part of your business planning involves purchasing insurance policies to cover different eventualities that could occur during the course of your business. This is different from a tenant�s content insurance content policy which covers your own possessions.

Source: pinterest.com

Source: pinterest.com

Commercial general liability insurance with a combined single limit for bodily injury, including death, to any person or persons, and for property damages, of not less than $500,000.00 per occurrence, $1,000,000.00 aggregate, plus excess/umbrella liability insurance containing a per occurrence combined single limit of $1,000,000.00 aggregate. This would mean that you would be covered for any accidents or injuries in the establishment with general liability and against any damage done to the establishment itself. 2015), the new york state supreme court held that a commercial tenant’s failure to prove that it maintained insurance throughout the term of the lease constituted an incurable material, default resulting in lease. Combined with the numerous other coverages you. Workers compensation every employer must provide workers compensation insurance for their employees.

Source: absoluteinsurance.ca

Source: absoluteinsurance.ca

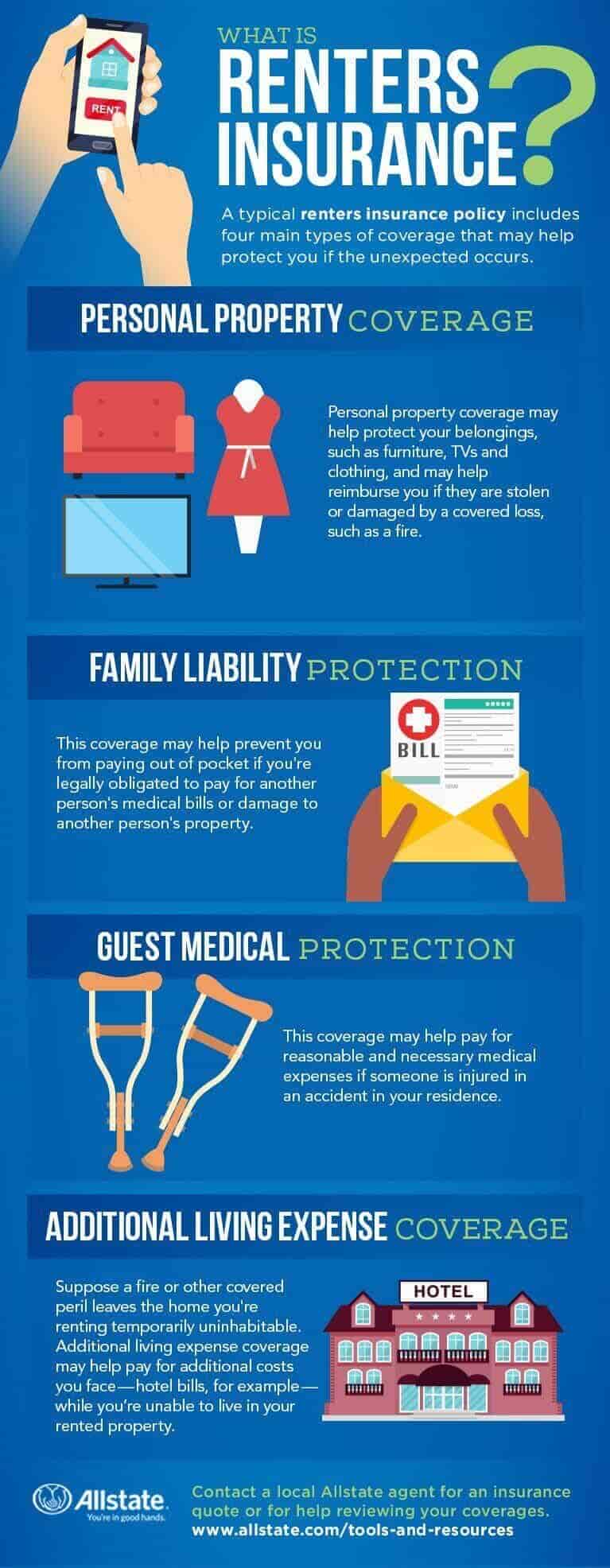

New york city landlords require their tenants to have liability insurance. Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. Average rates are around $53 per month or $636 annually. Tenants’ liability insurance is specifically designed for renters.

Source: allstate.com

Source: allstate.com

Tenant agrees to maintain in full force on or before the earlier of (i) the date on which any tenant party first enters the premises for any reason or (ii) the lease commencement date throughout the lease term of this lease, and thereafter, so long as tenant is in occupancy of any part of the premises, a policy of. Combined with the numerous other coverages you. Tenant�s legal liability coverage is insurance for loss or damage of a property resulting from an action of a person renting space at that property. Tenants’ liability insurance is specifically designed for renters. General liability insurance is by far the most common insurance coverage required in a commercial lease.

Source: allbusinesstemplates.com

Source: allbusinesstemplates.com

General liability insurance is by far the most common insurance coverage required in a commercial lease. It is a master commercial insurance policy in the name of the owner/manager (landlord) with tenants named as additional insureds, resulting in protection for both the landlord and the. It gives peace of mind that you’ll be able to pay for any damages or injuries your actions cause to a third party, like a customer or fellow tenant. Accidentally damage your landlord’s fixtures or fittings. Accidentally damage any of your landlord’s furniture.

Source: pinterest.com

Source: pinterest.com

Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. This would mean that you would be covered for any accidents or injuries in the establishment with general liability and against any damage done to the establishment itself. It is a master commercial insurance policy in the name of the owner/manager (landlord) with tenants named as additional insureds, resulting in protection for both the landlord and the. 2015), the new york state supreme court held that a commercial tenant’s failure to prove that it maintained insurance throughout the term of the lease constituted an incurable material, default resulting in lease. Also known as commercial general liability insurance or public liability insurance, it protects against someone getting hurt on the property.

Source: thebuzzernews.blogspot.com

Source: thebuzzernews.blogspot.com

Additional coverage can get expensive. Commercial tenant insurance typically may cover: It gives peace of mind that you’ll be able to pay for any damages or injuries your actions cause to a third party, like a customer or fellow tenant. Prior to assuming occupancy of a commercial space, a tenant must provide their landlord with a certificate of insurance and copies of their insurance policy. General liability insurance is by far the most common insurance coverage required in a commercial lease.

Source: revisi.net

Source: revisi.net

Tenant agrees to maintain in full force on or before the earlier of (i) the date on which any tenant party first enters the premises for any reason or (ii) the lease commencement date throughout the lease term of this lease, and thereafter, so long as tenant is in occupancy of any part of the premises, a policy of. It is a master commercial insurance policy in the name of the owner/manager (landlord) with tenants named as additional insureds, resulting in protection for both the landlord and the. Tenants liability insurance, also known as tenants liability cover or tenancy liability insurance is usually advised by landlords or agencies and can help protect your deposit if you: As a commercial tenant, your orange county landlord. Two fulton square, llc , 47 misc.

Source: fundera.com

Source: fundera.com

Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. Commercial general liability insurance with a combined single limit for bodily injury, including death, to any person or persons, and for property damages, of not less than $500,000.00 per occurrence, $1,000,000.00 aggregate, plus excess/umbrella liability insurance containing a per occurrence combined single limit of $1,000,000.00 aggregate. However, more and more landlords are now including these provisions in their rental agreements. A commercial liability insurance policy is the first step in developing insurance coverage for a business. Tenants legal liability insurance can cover damage you or your employees may cause to the unit and/or building you rent or lease.

Source: safaughnan.ie

Source: safaughnan.ie

Tenants legal liability insurance can cover damage you or your employees may cause to the unit and/or building you rent or lease. Tenant’s commercial general liability insurance. Liability insurance is essential for a commercial tenant. During the lease term, tenant shall keep and maintain, or cause to be kept and maintained, at tenant’s sole cost and expense, a policy or policies of commercial general public liability insurance, showing, as an additional insured in respect of the premises, landlord, tenant, any management company retained by landlord to manage the premises, any ground lessor and. Workers compensation every employer must provide workers compensation insurance for their employees.

Source: revisi.net

Source: revisi.net

Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. It is a master commercial insurance policy in the name of the owner/manager (landlord) with tenants named as additional insureds, resulting in protection for both the landlord and the. Prior to assuming occupancy of a commercial space, a tenant must provide their landlord with a certificate of insurance and copies of their insurance policy. Tenant’s commercial general liability insurance. Additional coverage can get expensive.

Source: revisi.net

Source: revisi.net

During the lease term, tenant shall keep and maintain, or cause to be kept and maintained, at tenant’s sole cost and expense, a policy or policies of commercial general public liability insurance, showing, as an additional insured in respect of the premises, landlord, tenant, any management company retained by landlord to manage the premises, any ground lessor and. Tenants legal liability insurance can cover damage you or your employees may cause to the unit and/or building you rent or lease. Commercial tenant insurance, contains a key coverage known as tenant legal liability insurance, that can and typically should be be included as part of a commercial general liability insurance policy. For this reason, part of your business planning involves purchasing insurance policies to cover different eventualities that could occur during the course of your business. $10 or $20 million cover is typically required.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial tenant liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea