Commercial van insurance vs personal Idea

Home » Trending » Commercial van insurance vs personal IdeaYour Commercial van insurance vs personal images are ready. Commercial van insurance vs personal are a topic that is being searched for and liked by netizens today. You can Find and Download the Commercial van insurance vs personal files here. Get all free vectors.

If you’re searching for commercial van insurance vs personal pictures information linked to the commercial van insurance vs personal keyword, you have come to the right blog. Our website frequently gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

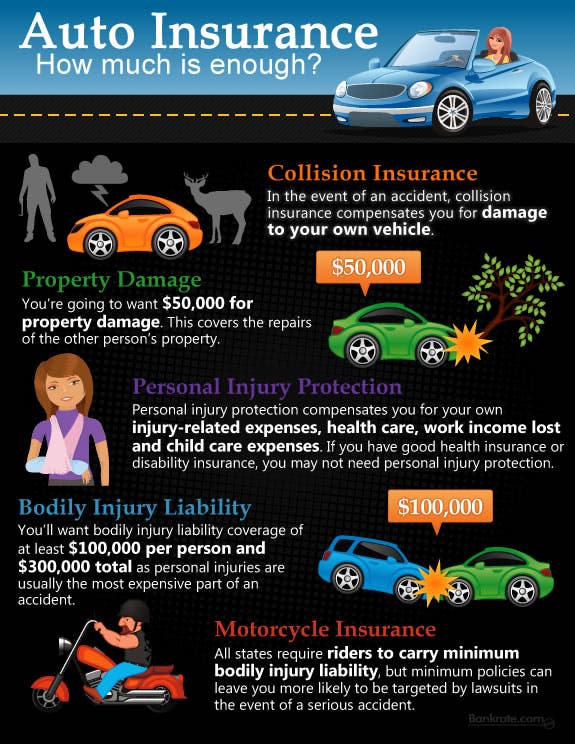

Commercial Van Insurance Vs Personal. Private van insurance is known for social use, visiting friends, and if you use the van for hobbies. Personal auto insurance policies can provide enough auto. Offers personal accident cover of the driver. Coverage limits in commercial policies are higher than in personal policies;

Commercial Car Insurance Vs. Personal Car Insurance From caminofinancial.com

Commercial Car Insurance Vs. Personal Car Insurance From caminofinancial.com

Commercial and business car insurance have a higher level of risk, which means higher insurance rates. Offers personal accident cover of the driver. Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles. That applies even if you just use it for commuting to a single workplace. So your cover has to be ready for even the most expensive situations. Even if you�re a part time dj or window washer, using your van to transport equipment or tools on a regular basis, it pays to purchase business insurance to make sure you�re properly covered.

Because we work directly with the underwriters, we are often able.

It’s important to understand what is and what isn’t included in your policy to ensure you’re not leaving yourself vulnerable to risk and potentially a loss. It can cover travel to multiple places of work, as well as the transport of goods and materials. This sort of van cover is often referred to as private van insurance. How to determine if you need commercial auto insurance. Both can cover costs for auto accidents and related injuries, however, the main difference is commercial vehicle insurance protects your business by protecting the vehicles, drivers, and property within. So your cover has to be ready for even the most expensive situations.

Source: youtube.com

Source: youtube.com

Commercial van insurance is also known as business van insurance. Both personal and commercial auto policies pay for legal expenses, bodily injury, and property damage related to auto accidents. Commercial auto insurance policies typically offer higher limits than personal auto insurance policies. It’s important to understand what is and what isn’t included in your policy to ensure you’re not leaving yourself vulnerable to risk and potentially a loss. If by chance you have more than one vehicle then they will all need cover.

Source: caminofinancial.com

Source: caminofinancial.com

Business auto insurance is not the coverage but the level of risk the vehicle is exposed to. Personal & commercial van insurance. So your cover has to be ready for even the most expensive situations. This sort of van cover is often referred to as private van insurance. Personal auto insurance policies can provide enough auto.

Source: ecstacy-kundan.blogspot.com

Source: ecstacy-kundan.blogspot.com

It covers your work vans and your personal or professional possessions, like tools. A personal auto policy provides coverage to protect you, your personal assets and prevent you and your family from experiencing financial hardship. Both personal and commercial auto policies pay for legal expenses, bodily injury, and property damage related to auto accidents. Commercial van insurance is if you use your van for work, commuting, and transporting goods for work purposes. Offers financial security to the policyholder’s business financially due to losses or damages to the commercial car in case of an accident.

Source: rilesandallen.com

Source: rilesandallen.com

It includes third party, fire & theft and pays out for van repairs or a replacement if it’s damaged maliciously or in an accident. The main difference between commercial and personal auto insurance is the coverage provided. That applies even if you just use it for commuting to a single workplace. Offers personal accident cover of the driver. Van insurance will protect you financially if your van is damaged, stolen, or vandalised.

Source: ecstacy-kundan.blogspot.com

Source: ecstacy-kundan.blogspot.com

If your business owns a vehicle, it must be covered by commercial auto insurance. If you regularly use your van to sell at events, for example, car boot sales, fairs or flea markets, you should choose business van insurance. Commercial auto insurance is needed for commercial drivers; It covers your work vans and your personal or professional possessions, like tools. Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles.

Source: segurosenhouston.com

Source: segurosenhouston.com

Private van insurance is known as ‘social use only’. Offers financial security to the policyholder’s business financially due to losses or damages to the commercial car in case of an accident. It includes third party, fire & theft and pays out for van repairs or a replacement if it’s damaged maliciously or in an accident. There is no practical difference between commercial and private insurance policies, they both protect you financially from. What does van insurance cover?

Source: bankrate.com

Source: bankrate.com

There is no practical difference between commercial and private insurance policies, they both protect you financially from. Typical hobbies that people use their vans for include surfing, golf and camping. It includes third party, fire & theft and pays out for van repairs or a replacement if it’s damaged maliciously or in an accident. Offers personal accident cover of the driver. Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles.

Source: emma01r.blogspot.com

Source: emma01r.blogspot.com

Commercial auto insurance policies typically offer higher limits than personal auto insurance policies. Van insurance will protect you financially if your van is damaged, stolen, or vandalised. If you feel like you don’t need comprehensive cover, third party, fire &. Offers financial security to the policyholder’s business financially due to losses or damages to the commercial car in case of an accident. If your business owns a vehicle, it must be covered by commercial auto insurance.

Source: 1800-generalinsurance.com

Source: 1800-generalinsurance.com

Commercial auto insurance policies typically offer higher limits than personal auto insurance policies. What does van insurance cover? Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles. Insurers will distinguish between the social activity of a driver who uses a van for this type of event just occasionally, or. You never know when one might be severe and lawsuits will be involved.

Source: compass-insurance-agency.com

Source: compass-insurance-agency.com

We actively work with over 20 different van insurers all over the uk to provide our customers with the absolute cheapest van insurance policies. Coverage limits in commercial policies are higher than in personal policies; That applies even if you just use it for commuting to a single workplace. In this respect, van insurance is much stricter than car insurance, which can include commuting to your workplace. The policy will also cover.

Source: syndicatedinsuranceresources.com

Source: syndicatedinsuranceresources.com

If you do use your personal vehicle for business purposes, then there�s a good chance that your insurer will not cover any accidents that occur during its business use. Van insurance will protect you financially if your van is damaged, stolen, or vandalised. Commercial auto insurance policies typically offer higher limits than personal auto insurance policies. If your business owns a vehicle, it must be covered by commercial auto insurance. The policy will also cover.

Source: infinityauto.com

Source: infinityauto.com

If your business owns a vehicle, it must be covered by commercial auto insurance. Coverage limits in commercial policies are higher than in personal policies; So your cover has to be ready for even the most expensive situations. Because we work directly with the underwriters, we are often able. If you regularly use your van to sell at events, for example, car boot sales, fairs or flea markets, you should choose business van insurance.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

Business auto insurance is not the coverage but the level of risk the vehicle is exposed to. There is no practical difference between commercial and private insurance policies, they both protect you financially from. How to determine if you need commercial auto insurance. Offers personal accident cover of the driver. Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles.

Source: 2getherinsurance.com

Source: 2getherinsurance.com

Offers personal accident cover of the driver. Even if you�re a part time dj or window washer, using your van to transport equipment or tools on a regular basis, it pays to purchase business insurance to make sure you�re properly covered. Commercial van insurance is if you use your van for work, commuting, and transporting goods for work purposes. Private van insurance is known as ‘social use only’. It works around the possibility that each company employee can handle the vehicles, so liability protection is usually higher compared to the protection offered by a personal auto insurance plan.

Source: amigoinsurance.com

Source: amigoinsurance.com

This is the highest level of cover. A personal auto policy provides coverage to protect you, your personal assets and prevent you and your family from experiencing financial hardship. It can cover travel to multiple places of work, as well as the transport of goods and materials. Unlike a personal auto insurance plan, commercial coverage is designed for the needs of businesses with multiple drivers and multiple vehicles. The main difference between commercial and personal auto insurance is the coverage provided.

Source: exilaurenmarketing.com

Source: exilaurenmarketing.com

Whether a pap (personal auto) or bap (commercial auto), the same rules & laws applies when resolving auto claims. It includes third party, fire & theft and pays out for van repairs or a replacement if it’s damaged maliciously or in an accident. Commercial and business car insurance have a higher level of risk, which means higher insurance rates. Both personal and commercial auto policies pay for legal expenses, bodily injury, and property damage related to auto accidents. One sure insurance have grown to become one of the uk�s leading independent van insurance brokers.

Source: bluelimeins.com

Source: bluelimeins.com

Usually the coverage limits are much higher than for personal insurance policies, and businesses. Coverage against total loss due to theft, fire and natural disaster. The main difference between commercial and personal auto insurance is the coverage provided. The main difference between personal and commercial auto insurance is who owns the vehicle. Whether a pap (personal auto) or bap (commercial auto), the same rules & laws applies when resolving auto claims.

Source: carpart.com.au

Source: carpart.com.au

Commercial auto insurance policies typically offer higher limits than personal auto insurance policies. Commercial auto insurance also provides unique coverages for businesses If you regularly use your van to sell at events, for example, car boot sales, fairs or flea markets, you should choose business van insurance. Commercial auto insurance is designed to fit the needs of your business, rather than your personal needs and policy options can vary from one insurance company to another. Commercial van insurance is also known as business van insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commercial van insurance vs personal by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea