Commission disclosure general insurance information

Home » Trend » Commission disclosure general insurance informationYour Commission disclosure general insurance images are available. Commission disclosure general insurance are a topic that is being searched for and liked by netizens now. You can Get the Commission disclosure general insurance files here. Get all royalty-free photos and vectors.

If you’re searching for commission disclosure general insurance pictures information related to the commission disclosure general insurance keyword, you have come to the right blog. Our website frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Commission Disclosure General Insurance. (g) bring to the notice of the insurer any adverse. Category of life insurance product or policy maximum commission/ remuneration on single premium payable to insurance intermediary; An insurance intermediary must, on a commercial customer�s request, promptly disclose the commission that it and any associate receives in connection with a policy. For annual reporting purposes, general agents often take the position that, because they are hired and paid by the carrier and not by the group health plan, their commissions need not be disclosed.

Consent for Dual Agency Real Estate Commission Disclosure From dmspropertiesllc.com

Consent for Dual Agency Real Estate Commission Disclosure From dmspropertiesllc.com

An insurance intermediary must, on a commercial customer�s request, promptly disclose the commission that it and any associate receives in connection with a policy. The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale. Here is a quick rundown of the regulation: (g) bring to the notice of the insurer any adverse. To the extent this is not possible, the firm must give the basis for calculation. And also the importance of disclosure of material information in the purchase of an insurance contract;

So, we recommend using wording similar to the above, personalised as needed.

(2) in relation to contracts of insurance, the Here is a summary of what needs to be included in the disclosure: Proposed timing for disclosure notices the new law requires brokers to disclose commissions for contracts entered into, on or after december 27, 2021. The full amount of the fee the insured will pay. And also the importance of disclosure of material information in the purchase of an insurance contract; The full amount of any commission you will receive from the insurer.

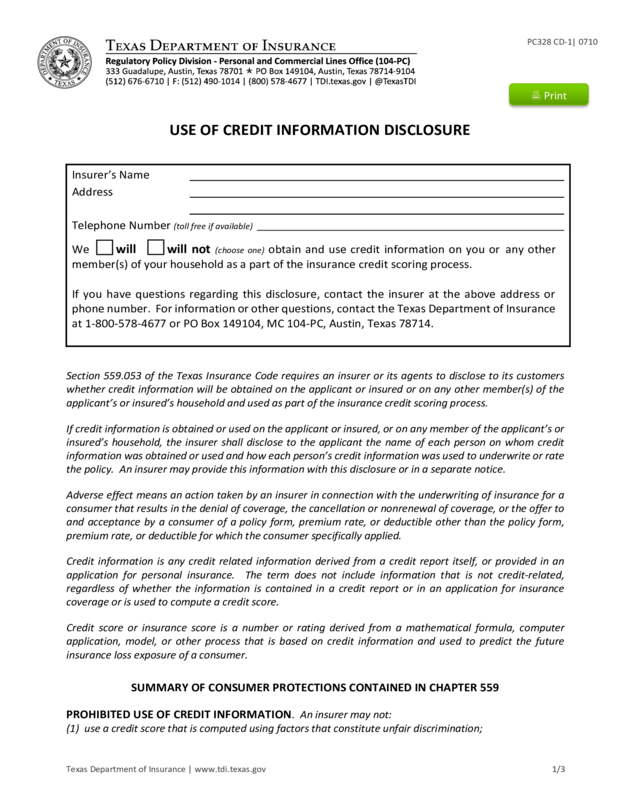

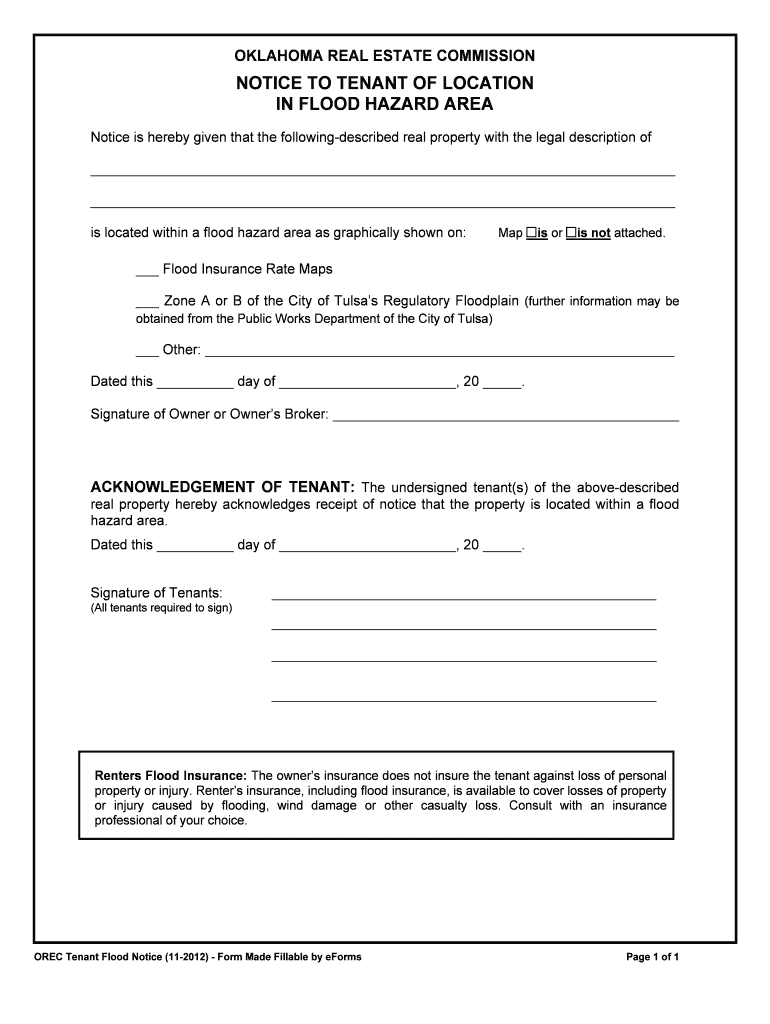

Source: eforms.com

Source: eforms.com

The full amount of any commission you will receive from the insurer. Currently, general insurance is exempt from the conflicted remuneration provisions under s963b of the corporations act 2001. All individual life products except pure risk products: We will also receive a commission expressed as a percentage of the loan made to you from any third party premium finance provider we may use to fund your insurance premiums. Improving understanding� discussion paper (discussion paper).

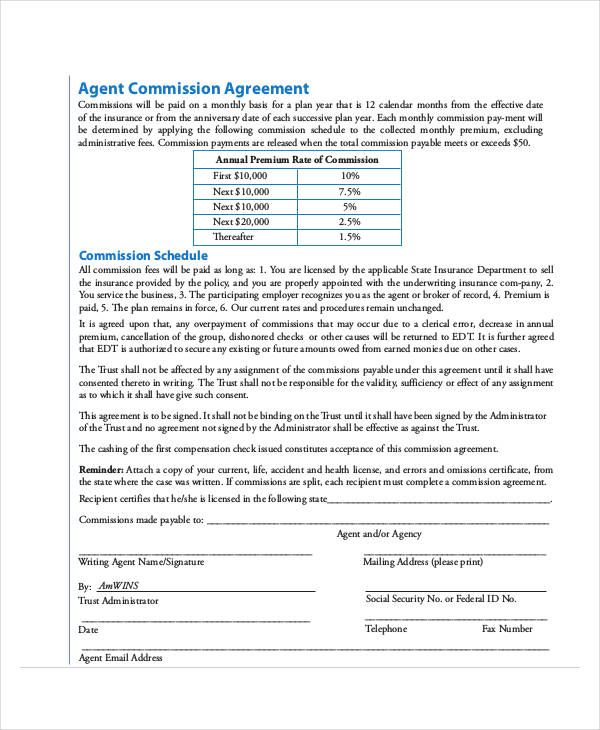

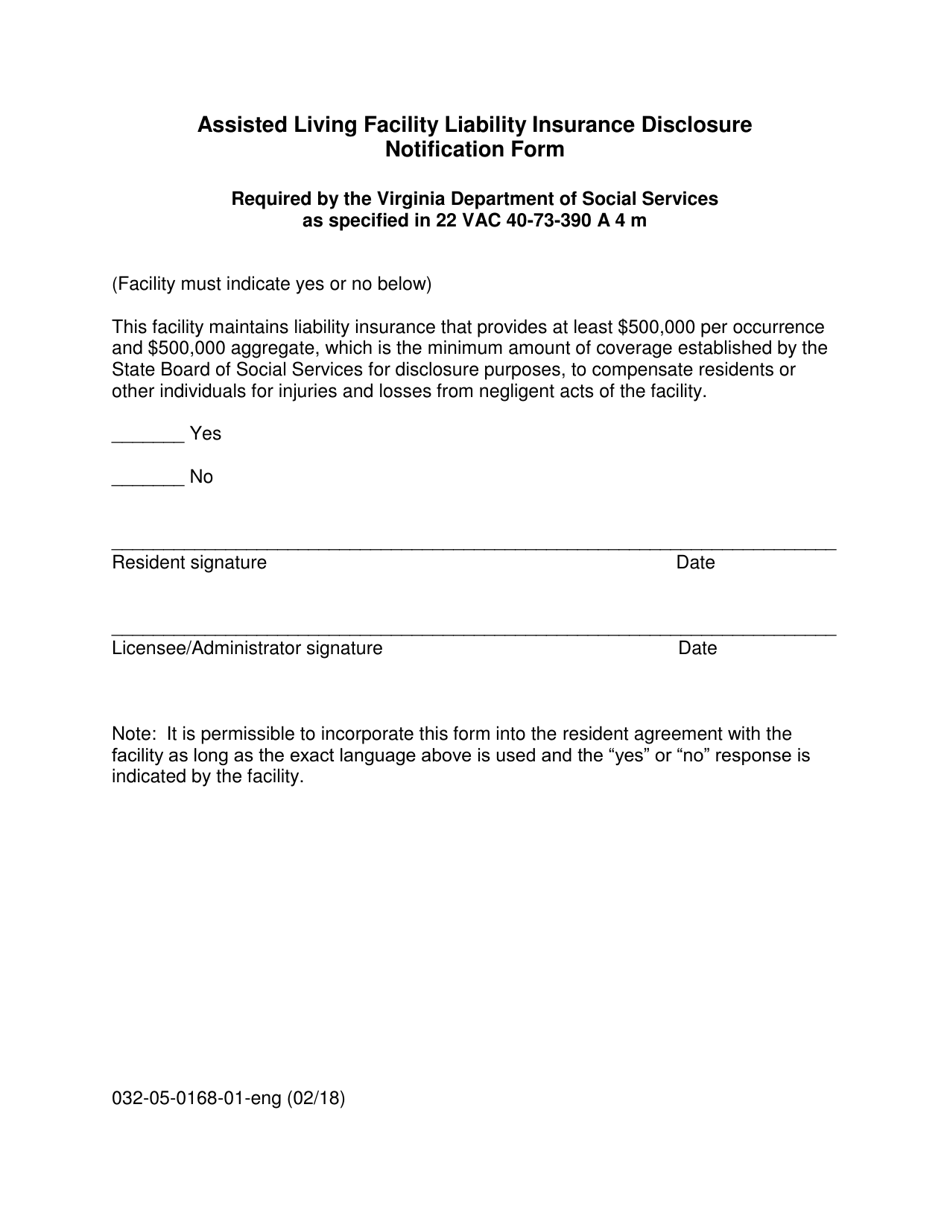

Source: handypdf.com

Source: handypdf.com

This law only applies if the broker reasonably expects to earn more than $1,000 in “direct compensation” and/or more than $250 in “indirect compensation” from the health plan or insurance carrier. The law society�s business law committee contributed to this submission. Following the supreme court�s decision in the 2014 plevin case, in which an intermediary failed to disclose commission payments earned in the sale of payment protection insurance, the fca consulted on whether to introduce additional uk commission disclosure rules which went beyond those in the idd. I want to know what is commission of general insurance agent and which general insurance company is best for joining as a agent so please reply with detail. Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance:

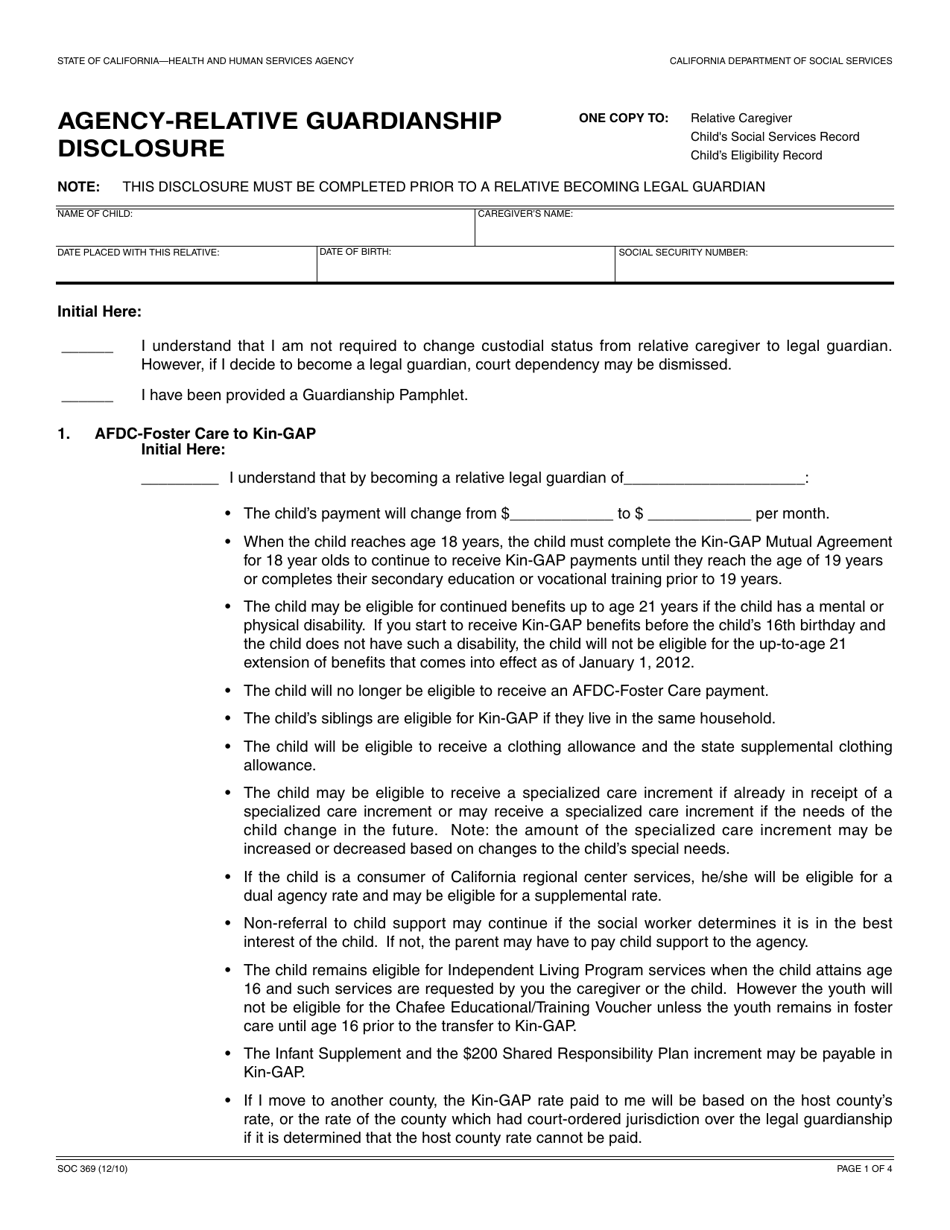

Source: template.net

Source: template.net

For annual reporting purposes, general agents often take the position that, because they are hired and paid by the carrier and not by the group health plan, their commissions need not be disclosed. For annual reporting purposes, general agents often take the position that, because they are hired and paid by the carrier and not by the group health plan, their commissions need not be disclosed. The law society�s business law committee contributed to this submission. One year renewable group pure risk insurance The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale.

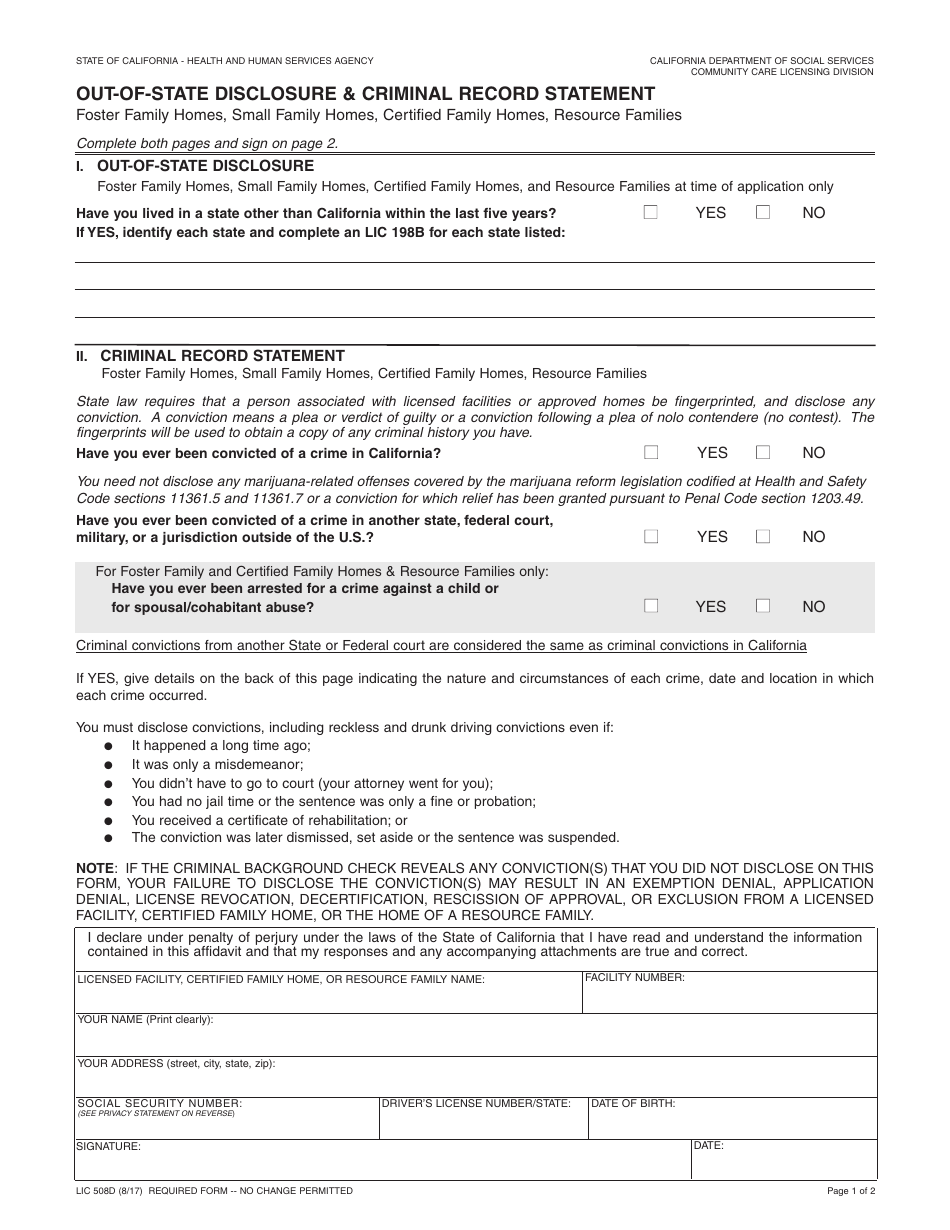

Source: insight.rwabusiness.com

Source: insight.rwabusiness.com

Regulation 194 states that unless the purchaser asks for additional information, only the following information is required at or prior to application for Regulation 194 states that unless the purchaser asks for additional information, only the following information is required at or prior to application for Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance: The full amount of the fee the insured will pay. The content of this article is intended to provide a general guide to the subject matter.

Source: formsbank.com

Source: formsbank.com

Maximum commission/ remuneration on single premium payable to insurance intermediary. So, we recommend using wording similar to the above, personalised as needed. Here is a summary of what needs to be included in the disclosure: One year renewable group pure risk insurance The british insurance brokers� association is warning that europe could force mandatory commission disclosure on brokers by 2019.

Source: blackrockinsurance.ie

Source: blackrockinsurance.ie

Category of life insurance product or policy maximum commission/ remuneration on single premium payable to insurance intermediary; The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale. All individual life products except pure risk products: Improving understanding� discussion paper (discussion paper). Following the supreme court�s decision in the 2014 plevin case, in which an intermediary failed to disclose commission payments earned in the sale of payment protection insurance, the fca consulted on whether to introduce additional uk commission disclosure rules which went beyond those in the idd.

Source: templateroller.com

Source: templateroller.com

4.1 general requirements for insurance intermediaries and insurers 4.1a means of communication to customers 4.2 additional requirements for protection policies for insurance intermediaries and insurers 4.3 remuneration disclosure 4.4 commission disclosure for commercial customers 4.6 commission disclosure for pure protection contracts sold with. Legal documents to be made available in bahasa malaysia : Applicant intentionally or through gross negligence fails in its duty of disclosure and these facts would be sufficient to affect the decision of the insurer to underwrite the risks or raise the insurance premium, the insurer may cancel the contract and would not be liable to pay the indemnity or insurance proceeds. Improving understanding� discussion paper (discussion paper). The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale.

Source: signnow.com

Source: signnow.com

Improving understanding� discussion paper (discussion paper). For annual reporting purposes, general agents often take the position that, because they are hired and paid by the carrier and not by the group health plan, their commissions need not be disclosed. And also the importance of disclosure of material information in the purchase of an insurance contract; The content of this article is intended to provide a general guide to the subject matter. The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale.

Source: imbillionaire.net

Source: imbillionaire.net

Currently, general insurance is exempt from the conflicted remuneration provisions under s963b of the corporations act 2001. The law commission and scottish law commission, consumer insurance law: Regulation 194 states that unless the purchaser asks for additional information, only the following information is required at or prior to application for So, we recommend using wording similar to the above, personalised as needed. The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale.

Source: templateroller.com

Source: templateroller.com

All individual life products except pure risk products: (g) bring to the notice of the insurer any adverse. Following the supreme court�s decision in the 2014 plevin case, in which an intermediary failed to disclose commission payments earned in the sale of payment protection insurance, the fca consulted on whether to introduce additional uk commission disclosure rules which went beyond those in the idd. One year renewable group pure risk insurance Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance:

Source: theearthe.com

Source: theearthe.com

Commission disclosure for general insurance / takaful, standalone medical and health insurance / takaful and group medical and health insurance / takaful and group medical and health insurance / takaful : For the last few years our commercial renewal letters and quotations have clearly stated that “we act as your agent in negotiating, placing and administering your policy and dealing with your claims and for this work we receive a commission from insurers.you are entitled, at any time, to request information regarding the commission we receive.” in this time the number of clients. Legal documents to be made available in bahasa malaysia : All individual life products except pure risk products: Here is a summary of what needs to be included in the disclosure:

Source: blackrockinsurance.ie

Source: blackrockinsurance.ie

Applicant intentionally or through gross negligence fails in its duty of disclosure and these facts would be sufficient to affect the decision of the insurer to underwrite the risks or raise the insurance premium, the insurer may cancel the contract and would not be liable to pay the indemnity or insurance proceeds. Specialist advice should be sought about your specific circumstances. The content of this article is intended to provide a general guide to the subject matter. Here is a quick rundown of the regulation: The commission disclosure rule is additional to the general law on the fiduciary obligations of an agent in that it applies whether or not the insurance intermediary is an agent of the commercial customer.

Source: insight.rwabusiness.com

Source: insight.rwabusiness.com

Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance: Legal documents to be made available in bahasa malaysia : Improving understanding� discussion paper (discussion paper). (2) disclosure must be in cash terms (estimated, if necessary) and in writing or another durable medium. Commission disclosure for general insurance / takaful, standalone medical and health insurance / takaful and group medical and health insurance / takaful and group medical and health insurance / takaful :

Source: templateroller.com

Source: templateroller.com

One year renewable group pure risk insurance The commission disclosure rule is additional to the general law on the fiduciary obligations of an agent in that it applies whether or not the insurance intermediary is an agent of the commercial customer. One year renewable group pure risk insurance The current product disclosure regime for general insurance was first introduced as part of the broader financial services reforms (fsr) in 2001. Following the supreme court�s decision in the 2014 plevin case, in which an intermediary failed to disclose commission payments earned in the sale of payment protection insurance, the fca consulted on whether to introduce additional uk commission disclosure rules which went beyond those in the idd.

Source: dmspropertiesllc.com

Source: dmspropertiesllc.com

Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance: Proposed timing for disclosure notices the new law requires brokers to disclose commissions for contracts entered into, on or after december 27, 2021. Regulation 194 states that unless the purchaser asks for additional information, only the following information is required at or prior to application for The european commission published its proposed revisions to the insurance mediation directive in july and has come down firmly in support of the mandatory disclosure of commission. For the last few years our commercial renewal letters and quotations have clearly stated that “we act as your agent in negotiating, placing and administering your policy and dealing with your claims and for this work we receive a commission from insurers.you are entitled, at any time, to request information regarding the commission we receive.” in this time the number of clients.

Source: templateroller.com

Source: templateroller.com

(g) bring to the notice of the insurer any adverse. Biba said that the revision of the insurance mediation directive could result in mandatory disclosure of commission for the insurance industry by 2019, and the potential for an increase in the regulatory cost burden. Legal documents to be made available in bahasa malaysia : Regulation 194 states that unless the purchaser asks for additional information, only the following information is required at or prior to application for Following broadly negative feedback to the proposal, it.

Source: templateroller.com

Source: templateroller.com

The content of this article is intended to provide a general guide to the subject matter. Improvinq consumer understandinq the law society of nsw appreciates the opportunity to comment on the �disclosure in general insurance: (g) bring to the notice of the insurer any adverse. For the last few years our commercial renewal letters and quotations have clearly stated that “we act as your agent in negotiating, placing and administering your policy and dealing with your claims and for this work we receive a commission from insurers.you are entitled, at any time, to request information regarding the commission we receive.” in this time the number of clients. Improving understanding� discussion paper (discussion paper).

Source: templateroller.com

Source: templateroller.com

Of course, you still need to disclose all fees �upfront� and in addition, as you do now. Specialist advice should be sought about your specific circumstances. The principal means of disclosure for retail classes of general insurance, including home and motor policies, is the mandated provision of a product disclosure statement (pds) to a consumer at the point of sale. The content of this article is intended to provide a general guide to the subject matter. The full amount of the fee the insured will pay.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title commission disclosure general insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information