Community letter for flood insurance Idea

Home » Trending » Community letter for flood insurance IdeaYour Community letter for flood insurance images are available. Community letter for flood insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Community letter for flood insurance files here. Get all royalty-free vectors.

If you’re looking for community letter for flood insurance images information related to the community letter for flood insurance topic, you have visit the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly surf and find more informative video articles and images that match your interests.

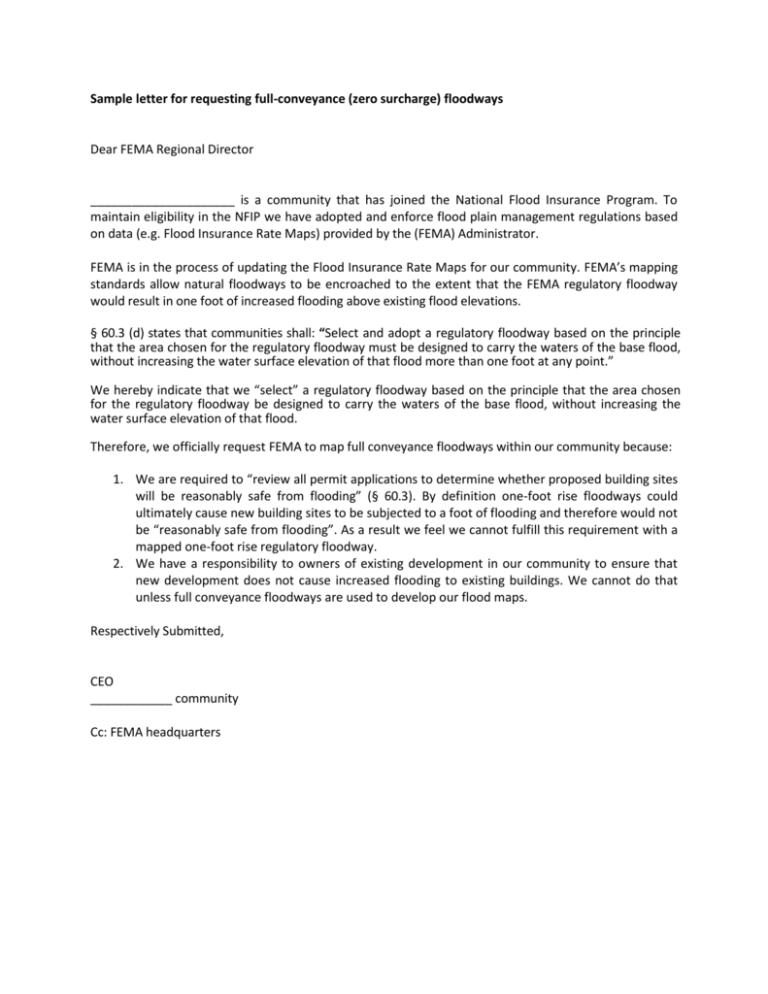

Community Letter For Flood Insurance. Information for lenders attached is an example letter that states the case of flood zone determination and mandatory purchase of flood insurance accurately. When the flood insurance policy declarations page for the building shows a flood zone other than the one reported on. These letters of map revision are the first step to removing the flood insurance requirement. Flood data for the red river in fargo has been collected since the late 1800s.

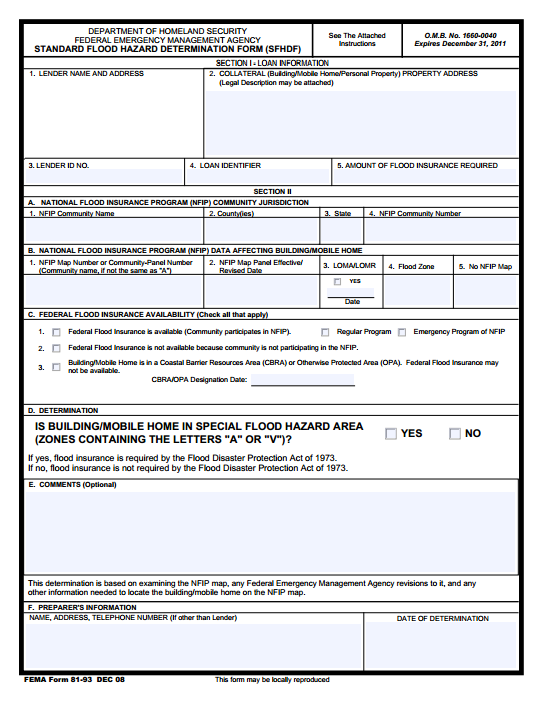

Flood Zone Determination Company FEMA Flood Zones From floodpartners.com

Flood Zone Determination Company FEMA Flood Zones From floodpartners.com

Preferred risk policy (prp) letter g: The city of longmont participates in the community rating system (crs), a floodplain management effort that is part of the national flood insurance program. The national flood insurance program�s (nfip) community rating system (crs) is a voluntary incentive program that recognizes and encourages community and state floodplain management activities that exceed the minimum nfip requirements. The letters, which were mailed in These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2021 has been set. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set.

The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain.

The community rating system (crs) is a voluntary incentive program that recognizes and encourages community floodplain management practices that exceed the minimum requirements of the national flood insurance program (nfip).over 1,500. This brochure addresses several questions about community adoption of the flood insurance rate map Over 21,000 communities participate in the program. The community rating system (crs) is a voluntary incentive program that recognizes and encourages community floodplain management practices that exceed the minimum requirements of the national flood insurance program (nfip).over 1,500. Flood insurance study users communities participating in the national flood insu rance program have established repositories of. Building based on the current flood insurance rate map for each community.

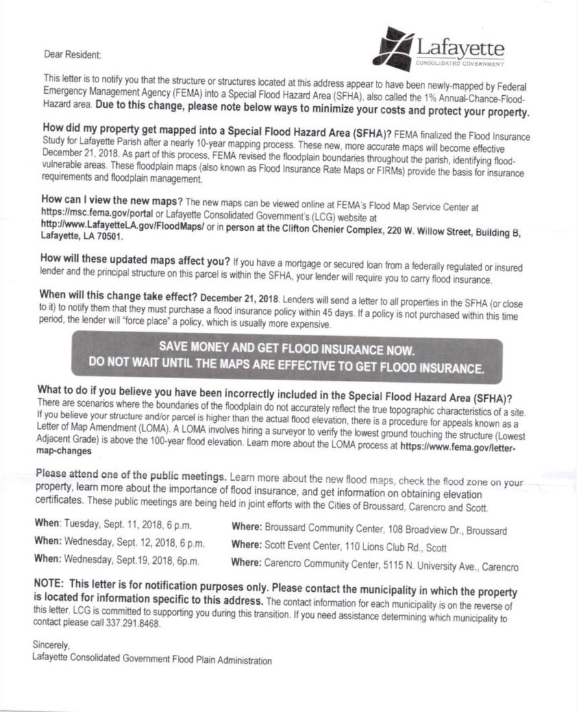

Source: katc.com

Source: katc.com

The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. Building based on the current flood insurance rate map for each community. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set. Communities typically issue a certificate of occupancy after the lomr letter is issued, however the flood insurance requirement is not officially removed until the lomr becomes effective.

Source: cityofdubuque.org

Effective may 1, 2019, longmont�s crs rating increased to class 5. Information for lenders attached is an example letter that states the case of flood zone determination and mandatory purchase of flood insurance accurately. The flood disaster protection act of 1973 and the national flood insurance reform act of 1994 made the purchase of flood insurance mandatory for federally backed mortgages on buildings located in a special flood hazard area (sfha). Flood insurance study users communities participating in the national flood insu rance program have established repositories of. Over 21,000 communities participate in the program.

Source: studylib.net

Source: studylib.net

To community and community letter for flood insurance? A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. The flood insurance rate map changes to reflect the new. Participating communities to purchase insurance as a protection against flood losses in exchange for state and community floodplain management regulations that reduce future flood damages. Building based on the current flood insurance rate map for each community.

Source: floodpartners.com

Source: floodpartners.com

These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set. A coalition letter send a letter to the u.s. Flood insurance is recommended for properties in areas that have the potential for flooding. The flood disaster protection act of 1973 and the national flood insurance reform act of 1994 made the purchase of flood insurance mandatory for federally backed mortgages on buildings located in a special flood hazard area (sfha). Senate and house of representative leadership in support of public policies to improve the flood resilience of homes and within communities.

Source: nap.edu

Source: nap.edu

Know when flood risk and depths for similar property. Flood insurance study users communities participating in the national flood insu rance program have established repositories of. Over 21,000 communities participate in the program. The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. The objective of the crs program is to support the goals of the nfip, which include:

Source: secondlookflood.com

Source: secondlookflood.com

Recently, the city of bellaire was downgraded from a crs classification of a 7 to a 10, thus resulting in. These letters of map revision are the first step to removing the flood insurance requirement. Case studies, blogs & fact sheets. Revised by the letter of map revision process, whic h does not involve republication or redistribution of the fis. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set.

Source: ky3.com

Source: ky3.com

The flood insurance rate map changes to reflect the new. Building based on the current flood insurance rate map for each community. A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. The city of bellaire participates in the community rating system (crs), a voluntary federal program that rewards communities for implementing higher flood mitigation standards by providing discounts on flood insurance policies to residents. Flood data for the red river in fargo has been collected since the late 1800s.

Source: neptunetownship.org

It is, therefore, the responsibility of the user to consult with community officials and to. Flood insurance is recommended for properties in areas that have the potential for flooding. Revised by the letter of map revision process, whic h does not involve republication or redistribution of the fis. The city of longmont participates in the community rating system (crs), a floodplain management effort that is part of the national flood insurance program. Communities typically issue a certificate of occupancy after the lomr letter is issued, however the flood insurance requirement is not officially removed until the lomr becomes effective.

Source: hubcityspokes.com

Communities typically issue a certificate of occupancy after the lomr letter is issued, however the flood insurance requirement is not officially removed until the lomr becomes effective. A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. The city of longmont participates in the community rating system (crs), a floodplain management effort that is part of the national flood insurance program. Building based on the current flood insurance rate map for each community.

-1534198317-5233.jpg “REMINDER Aug 27 FEMA Flood Zone Insurance Required”) Source: patch.com

Flood insurance is recommended for properties in areas that have the potential for flooding. The national flood insurance program�s (nfip) community rating system (crs) is a voluntary incentive program that recognizes and encourages community and state floodplain management activities that exceed the minimum nfip requirements. Recently, the city of bellaire was downgraded from a crs classification of a 7 to a 10, thus resulting in. The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. The letters, which were mailed in

Source: forumdelideresup.blogspot.com

Source: forumdelideresup.blogspot.com

Recently, the city of bellaire was downgraded from a crs classification of a 7 to a 10, thus resulting in. Over 21,000 communities participate in the program. The national flood insurance program�s (nfip) community rating system (crs) is a voluntary incentive program that recognizes and encourages community and state floodplain management activities that exceed the minimum nfip requirements. Lomas are usually issued because a property has been inadvertently mapped as being in the floodplain, but is actually on. Information for lenders attached is an example letter that states the case of flood zone determination and mandatory purchase of flood insurance accurately.

Source: patch.com

Source: patch.com

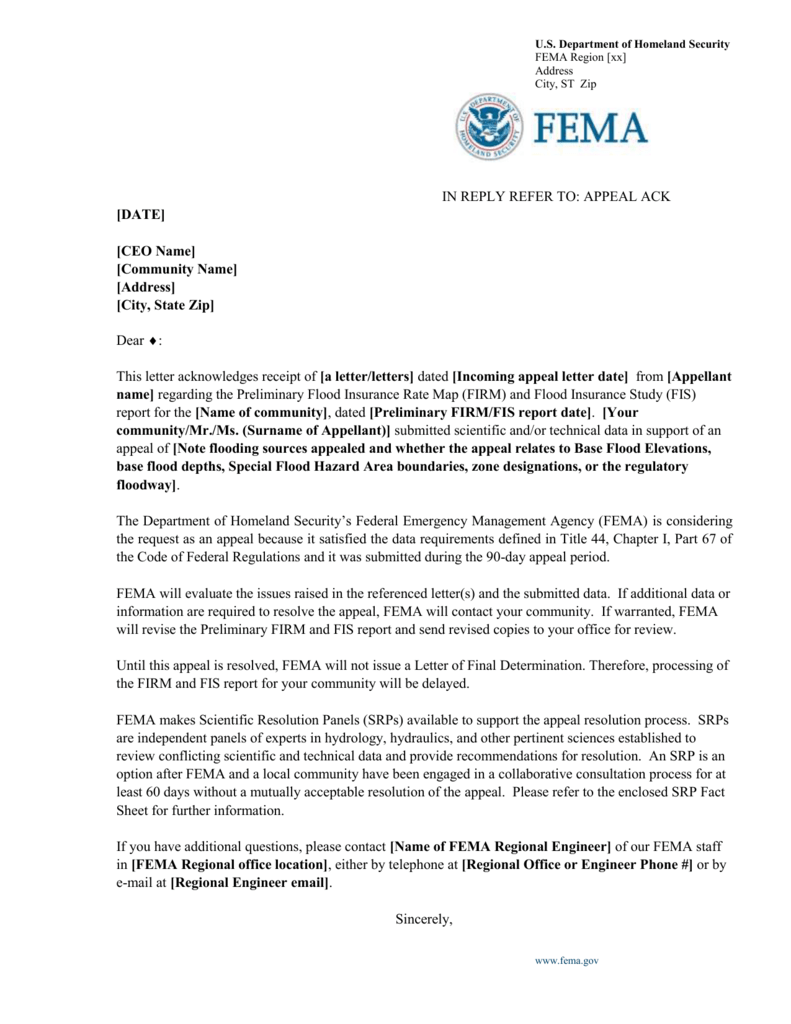

A letter of map amendment (loma) is an official amendment, by letter, to an effective national flood insurance program (nfip) map. To community and community letter for flood insurance? In an effort to inform affected communities of these ramifications, fema mailed letters to approximately 1,500 communities nationwide that have identified sfhas depicted on a flood hazard boundary map or flood insurance rate map, but do not participate in the nfip. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set. The objective of the crs program is to support the goals of the nfip, which include:

Source: tapinto.net

Source: tapinto.net

A loma establishes a property�s location in relation to the special flood hazard area (sfha). Flood insurance study users communities participating in the national flood insu rance program have established repositories of. Congress, calls on fema and other agencies to make a number of changes to the way the national flood insurance program (nfip) is run, some of which are already in effect. Information for lenders attached is an example letter that states the case of flood zone determination and mandatory purchase of flood insurance accurately. The objective of the crs program is to support the goals of the nfip, which include:

Source: pardonmeforasking.blogspot.com

Source: pardonmeforasking.blogspot.com

Lomas are usually issued because a property has been inadvertently mapped as being in the floodplain, but is actually on. A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2021 has been set. The flood disaster protection act of 1973 and the national flood insurance reform act of 1994 made the purchase of flood insurance mandatory for federally backed mortgages on buildings located in a special flood hazard area (sfha). The letters, which were mailed in

Source: forumdelideresup.blogspot.com

Source: forumdelideresup.blogspot.com

A letter of map amendment (loma) is an official amendment, by letter, to an effective national flood insurance program (nfip) map. The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. These documents hold listings of all communities for which letters of final determination (lfd) have been sent and an effective date in 2022 has been set. Over 21,000 communities participate in the program. The national flood insurance program�s (nfip) community rating system (crs) is a voluntary incentive program that recognizes and encourages community and state floodplain management activities that exceed the minimum nfip requirements.

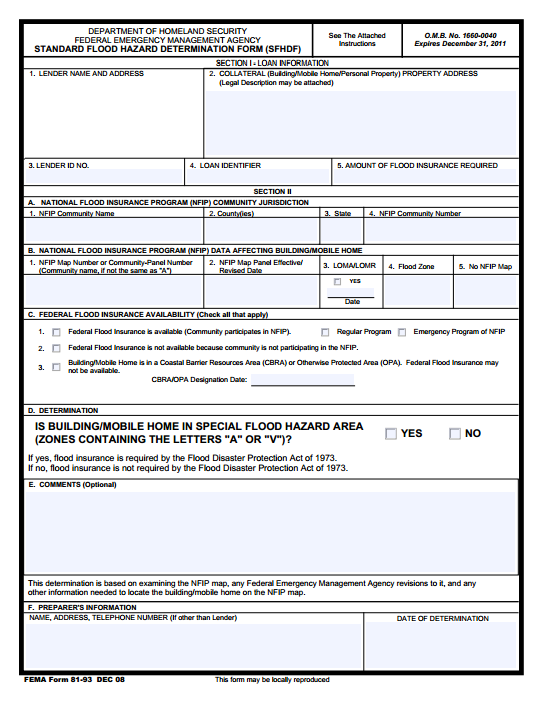

Source: studylib.net

Source: studylib.net

The letters, which were mailed in Flood insurance is recommended for properties in areas that have the potential for flooding. Effective may 1, 2019, longmont�s crs rating increased to class 5. A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. It is, therefore, the responsibility of the user to consult with community officials and to.

Source: nap.edu

Source: nap.edu

To community and community letter for flood insurance? Revised by the letter of map revision process, whic h does not involve republication or redistribution of the fis. Over 21,000 communities participate in the program. Senate and house of representative leadership in support of public policies to improve the flood resilience of homes and within communities. A loma establishes a property�s location in relation to the special flood hazard area (sfha).

Source: nhma.info

Source: nhma.info

A letter of final determination (lfd) is a letter fema mails to the chief executive officer of a community stating that a new or updated flood insurance rate map (firm) or digital flood insurance rate map (dfirm) will become effective in six months. Effective may 1, 2019, longmont�s crs rating increased to class 5. The lfd is a letter sent to each affected community stating that a new or updated flood insurance rate map (firm) will become effective on a certain. A loma establishes a property�s location in relation to the special flood hazard area (sfha). Over 21,000 communities participate in the program.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title community letter for flood insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea