Company car insurance can claim gst Idea

Home » Trending » Company car insurance can claim gst IdeaYour Company car insurance can claim gst images are ready. Company car insurance can claim gst are a topic that is being searched for and liked by netizens now. You can Find and Download the Company car insurance can claim gst files here. Find and Download all royalty-free photos.

If you’re looking for company car insurance can claim gst pictures information related to the company car insurance can claim gst interest, you have pay a visit to the ideal site. Our website always provides you with hints for seeing the highest quality video and image content, please kindly surf and locate more informative video content and graphics that match your interests.

Company Car Insurance Can Claim Gst. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. If sp and sr both are belong to same line of business, in such a case s.r. Gst/vat incurred for purchases made overseas e.g. In this case the buyer is eligible to claim itc if gst paid on the goods provided he pays the gst to the buyer in full.

GST In Malaysia Explained From loanstreet.com.my

GST In Malaysia Explained From loanstreet.com.my

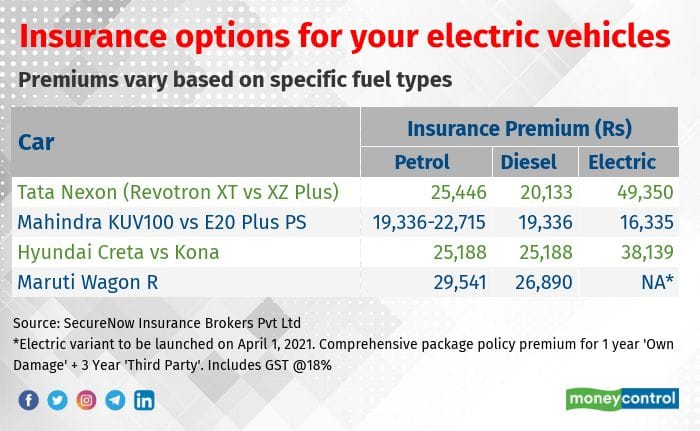

1.supply of other vehicles or conveyances, vessels or aircraft. Before implementation of goods and service tax (gst), service tax was charged at the rate of 15% on most of the insurance plans, whereas now gst is charged at the rate of 18% on majority of insurance plans. If you are engaged in the business of transportation of passengers, then you can claim itc for gst paid on purchase of motor vehicles like car. Gst/vat incurred for purchases made overseas e.g. The purchaser can claim itc on purchase of motor vehicles only if he engaged in any of the following business: You can�t claim a gst credit for any part of your insurance that relates to:

Before implementation of goods and service tax (gst), service tax was charged at the rate of 15% on most of the insurance plans, whereas now gst is charged at the rate of 18% on majority of insurance plans.

Generally, gst is charged on insurance policies other than: Whether assesee required to pay gst on car sale ? Whether assesse is required to pay any gst on insurance claim received ? Input tax claims are disallowed because the gst/ vat was paid to a party outside of singapore tax jurisdiction. Our today’s article is on gst on insurance like life insurance, general insurance including car insurance, fire insurance, marine insurance, etc. Yes, you are required to charge gst on the sale of your company vehicle even though you did not claim gst on the purchase of the vehicle.

Source: godigit.com

Source: godigit.com

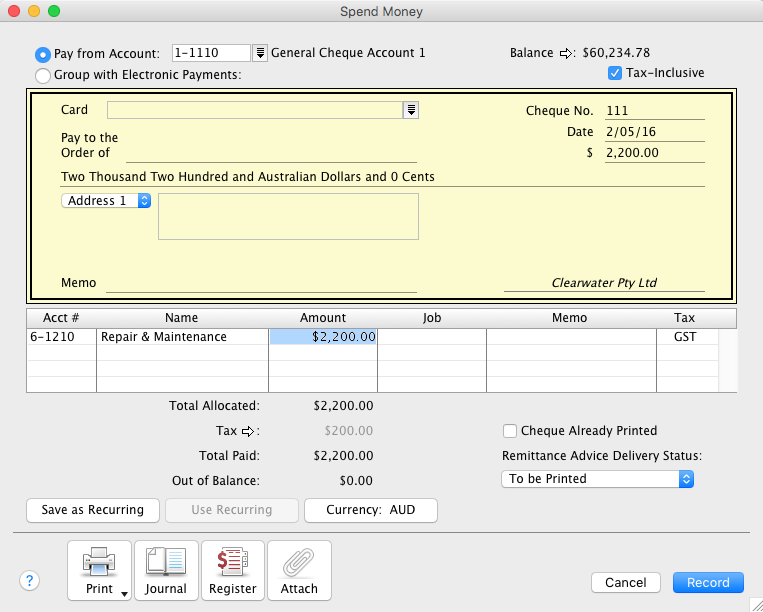

Claiming gst credits in car insurance settlements depends on who the insurer pays and whether the insurer has a contract with the repairer to repair cars it has provided policies for. The goods are insured for any damage during transit. Car cost limit for depreciation. Before implementation of goods and service tax (gst), service tax was charged at the rate of 15% on most of the insurance plans, whereas now gst is charged at the rate of 18% on majority of insurance plans. Generally, gst is charged on insurance policies other than:

Source: newsilike.in

Source: newsilike.in

You can�t claim a gst credit for any part of your insurance that relates to: Input tax claims are disallowed because the gst/ vat was paid to a party outside of singapore tax jurisdiction. Whether assesee required to pay gst on car sale ? However if you started the cover after 1 july 2003, you will be able to claim a gst credit on the premium component, which is the total insurance expenditure minus stamp duty. Companies providing services of general insurance, servicing, repair and maintenance in so far as they relate to motor vehicles, vessels or aircraft can also take the itc benefit.

Source: vehiclesolutions.com.au

Source: vehiclesolutions.com.au

In this case, hariom tour and travels is eligible to take itc for gst. If you have started the cover before 1 july 2003, you cannot claim a gst credit on this insurance. Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. Whether assesee required to pay gst on car sale ? When the expenses occurred on the travelling of the kmp, or the person by the company for which it is obligatory in nature than the company shall be eligible to claim the.

Source: dipsegovia.info

Source: dipsegovia.info

You can�t claim a gst credit for any part of your insurance that relates to: The goods are insured for any damage during transit. Further, beside insurance claim, car is old for ₹ 50,000 as scrap to buyer. If you have started the cover before 1 july 2003, you cannot claim a gst credit on this insurance. You can only claim gst incurred on the portion of premiums not relating to the coverage of medical costs.

Source: zqindustry.com

Source: zqindustry.com

If sp and sr both are belong to same line of business, in such a case s.r. Gst/vat incurred for purchases made overseas e.g. In this case the buyer is eligible to claim itc if gst paid on the goods provided he pays the gst to the buyer in full. Car cost limit for depreciation. For example, hariom tour and travels is in the business of providing taxi services to tourists through cars.

Source: traducionario.blogspot.com

Source: traducionario.blogspot.com

If you have started the cover before 1 july 2003, you cannot claim a gst credit on this insurance. The gst mechanism is applicable to insurance (general insurance) claims as well, and the application in the case of occasional repairs or repairs that are covered in the gst policy is applied if the service provider is a registered sales tax, however, the treatment/bill issuance will depend on the status of the gst registration claimants. In this case the buyer is eligible to claim itc if gst paid on the goods provided he pays the gst to the buyer in full. Generally, you cannot claim a gst credit for payments your insurer makes to a service provider if the insurer: Moreover the insurance claim had been lodged for the value of goods excluding gst paid.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Yes, the invoice has to be raised for selling capital goods with gst. In this case, hariom tour and travels is eligible to take itc for gst. The goods get damaged due to rain only in transit. The insured business claims the gst back from the taxation department as a credit when filing the next gst return. If you have started the cover before 1 july 2003, you cannot claim a gst credit on this insurance.

Source: loanstreet.com.my

Source: loanstreet.com.my

You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. Gst/vat incurred for purchases made overseas e.g. If you are engaged in the business of transportation of passengers, then you can claim itc for gst paid on purchase of motor vehicles like car. The gst which has been paid by the employee on the insurance premium could be claimed by him as a deduction from income along with the premium amount in order to save tax. For example, hariom tour and travels is in the business of providing taxi services to tourists through cars.

Source: revisi.net

Source: revisi.net

Therefore the insurance company will only reimburse you for your net cost. You should only claim input tax in the accounting period corresponding to the date of the invoice or import permit. Australian gst credit process in australia, an insurance company does not pay the gst component of the cost of any repairs made to a car following an accident, if the car owner is a business that is gst registered. If you are engaged in the business of transportation of passengers, then you can claim itc for gst paid on purchase of motor vehicles like car. Claiming gst credits in car insurance settlements depends on who the insurer pays and whether the insurer has a contract with the repairer to repair cars it has provided policies for.

Source: sincreticdesign.blogspot.com

Therefore the insurance company will only reimburse you for your net cost. You can only claim a gst credit for the part of the insurance relating to your business. However if you started the cover after 1 july 2003, you will be able to claim a gst credit on the premium component, which is the total insurance expenditure minus stamp duty. The gst mechanism is applicable to insurance (general insurance) claims as well, and the application in the case of occasional repairs or repairs that are covered in the gst policy is applied if the service provider is a registered sales tax, however, the treatment/bill issuance will depend on the status of the gst registration claimants. If sp and sr both are belong to same line of business, in such a case s.r.

Source: emilyvega.blogspot.com

When the expenses occurred on the travelling of the kmp, or the person by the company for which it is obligatory in nature than the company shall be eligible to claim the. Generally, gst is charged on insurance policies other than: On with a property claim, say damage to a building, the insured pays the builder say, $11,000 and claim $10,000 from the insurer. There is loss on sale of car ₹ 2 lakhs as per income tax act. If sp and sr both are belong to same line of business, in such a case s.r.

Source: coverfox.com

Source: coverfox.com

Gst/vat incurred for purchases made overseas e.g. If sp and sr both are belong to same line of business, in such a case s.r. On with a property claim, say damage to a building, the insured pays the builder say, $11,000 and claim $10,000 from the insurer. If you have started the cover before 1 july 2003, you cannot claim a gst credit on this insurance. Yes, you are required to charge gst on the sale of your company vehicle even though you did not claim gst on the purchase of the vehicle.

Source: slideshare.net

Source: slideshare.net

Generally, gst is charged on insurance policies other than: 1.supply of other vehicles or conveyances, vessels or aircraft. Employer, who is not an investment holding company, tax exempt body or service company that adopts the cost plus mark up basis of tax assessment, can elect not to claim a tax deduction for the said group insurance premiums in the corporate/business tax filing for the relevant year so that the group insurance premiums will be exempt from tax in the hands of the employees. The goods are insured for any damage during transit. You can only claim a gst credit for the part of the insurance relating to your business.

Source: traducionario.blogspot.com

Source: traducionario.blogspot.com

Generally, you cannot claim a gst credit for payments your insurer makes to a service provider if the insurer: When the expenses occurred on the travelling of the kmp, or the person by the company for which it is obligatory in nature than the company shall be eligible to claim the. If sp and sr both are belong to same line of business, in such a case s.r. You can only claim a gst credit for the part of the insurance relating to your business. In this case the buyer is eligible to claim itc if gst paid on the goods provided he pays the gst to the buyer in full.

Source: traducionario.blogspot.com

The insured business claims the gst back from the taxation department as a credit when filing the next gst return. Whether assesee required to pay gst on car sale ? Our today’s article is on gst on insurance like life insurance, general insurance including car insurance, fire insurance, marine insurance, etc. Therefore the insurance company will only reimburse you for your net cost. Australian gst credit process in australia, an insurance company does not pay the gst component of the cost of any repairs made to a car following an accident, if the car owner is a business that is gst registered.

Source: nkansala.in

Source: nkansala.in

Our today’s article is on gst on insurance like life insurance, general insurance including car insurance, fire insurance, marine insurance, etc. Generally, gst is charged on insurance policies other than: Whether assesse is required to pay any gst on insurance claim received ? Before implementation of goods and service tax (gst), service tax was charged at the rate of 15% on most of the insurance plans, whereas now gst is charged at the rate of 18% on majority of insurance plans. Gst/vat incurred for purchases made overseas e.g.

Source: packersmoversbillinhyderabad.blogspot.com

Source: packersmoversbillinhyderabad.blogspot.com

Our today’s article is on gst on insurance like life insurance, general insurance including car insurance, fire insurance, marine insurance, etc. You should only claim input tax in the accounting period corresponding to the date of the invoice or import permit. The goods get damaged due to rain only in transit. Now, insurance company gave ₹ 3 lakhs as compensation. Input tax claims are disallowed because the gst/ vat was paid to a party outside of singapore tax jurisdiction.

Source: referenceinsurance.blogspot.com

Source: referenceinsurance.blogspot.com

The goods are insured for any damage during transit. Therefore the insurance company will only reimburse you for your net cost. Generally, you cannot claim a gst credit for payments your insurer makes to a service provider if the insurer: Now, insurance company gave ₹ 3 lakhs as compensation. A lessor who is a gst/hst registrant is eligible to claim an itc for the gst/hst paid or payable on repair services for a leased vehicle covered by an insurance policy if the lessor is liable to pay the consideration for the repair services, the vehicle is used in their commercial activities and all other conditions for claiming an itc are met.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title company car insurance can claim gst by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea