Company national insurance rates information

Home » Trend » Company national insurance rates informationYour Company national insurance rates images are available. Company national insurance rates are a topic that is being searched for and liked by netizens today. You can Find and Download the Company national insurance rates files here. Get all royalty-free images.

If you’re searching for company national insurance rates pictures information linked to the company national insurance rates keyword, you have visit the right blog. Our site frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Company National Insurance Rates. The cheapest state average is idaho at $40.17 per month followed by south carolina at $53.99 per month. Employer’s national insurance rates 2020/21. This equates to a rise of 10.4% in the national insurance that most employees pay. Employer national insurance rates this table shows how much employers pay towards employees’ national insurance for the.

National Insurance rates 201920 Surya & Co Accountants From suryaandco.co.uk

National Insurance rates 201920 Surya & Co Accountants From suryaandco.co.uk

So we are able to pass this information on to you ahead of the officail hmrc website. Employers and employees currently pay class 1 national insurance, which is based on how much an employee earns. Class 1 nics are payable on any salaried income you receive, regardless of the business structure you work under. Employers start paying national insurance: Employer class 1 national insurance rates employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees. On average, american national p&c charges approximately $52.97 per month.

The company’s history began in 1920, in north carolina, when integon, a life insurance company, was founded:

The rate of nics that employers contribute depends on the national insurance category letter of the employee. If you earn less than this amount you�ll pay no national insurance contributions. £184 to £967 a week (£797 to £4,189 a month). A staggering premium of rs. Liability above primary threshold at 12% / 13.25%. 2654 crores from the preceding income of rs.

Source: suryaandco.co.uk

Source: suryaandco.co.uk

11282.64 crore was recorded by the national insurance company in the fiscal year 2015. You can calculate your health insurance premium for health insurance policies by national insurance company online by visiting the company’s website or from the official website of insurancedekho, i.e. National insurance two wheeler plans come with the following unique features and benefits: 2654 crores from the preceding income of rs. Before this, it was rs.

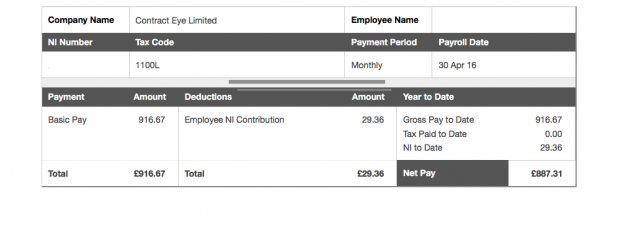

Source: itcontracting.com

Source: itcontracting.com

Liability above primary threshold at 12% / 13.25%. Anything earned over this amount is taxed at 2%. Employer national insurance rates this table shows how much employers pay towards employees’ national insurance for the. From april 2023 the levy will become a separate. Class 1 national insurance rate.

2654 crores from the preceding income of rs. Below is a list of the average rates that drivers typically pay with american national p&c. Liability above primary threshold at 12% / 13.25%. £184 to £967 a week (£797 to £4,189 a month). One part of the company became national general insurance and the second was motor insurance company, founded in 1925, by general motors.

Source: fidelityeugene.com

11282.64 crore was recorded by the national insurance company in the fiscal year 2015. If you earn less than this amount you�ll pay no national insurance contributions. The current class 2 nic rate is £3.05 (2020/221) per. The secondary threshold is £732/month. Employer’s national insurance rates 2020/21.

Source: suryaandco.co.uk

Source: suryaandco.co.uk

Anything earned over this amount is taxed at 2%. For most workers they come out at the same time as their income tax with little extra thought. Employer national insurance rates this table shows how much employers pay towards employees’ national insurance for the. On average, american national p&c charges approximately $52.97 per month. Employers and employees currently pay class 1 national insurance, which is based on how much an employee earns.

Source: fidelityeugene.com

Source: fidelityeugene.com

One part of the company became national general insurance and the second was motor insurance company, founded in 1925, by general motors. This means your national insurance payment will be £94.62 for the week. Employer’s national insurance rates 2020/21. Before this, it was rs. The tables below show the earnings thresholds and the.

Source: blogarama.com

Source: blogarama.com

The company’s history began in 1920, in north carolina, when integon, a life insurance company, was founded: For most workers they come out at the same time as their income tax with little extra thought. This equates to a rise of 10.4% in the national insurance that most employees pay. Premium calculator is an efficient tool that lets the customers get an estimate of the premium of the health insurance policy they are planning. The secondary threshold is £732/month.

The rate of nics that employers contribute depends on the national insurance category letter of the employee. Class 1 national insurance rate. Employer class 1 national insurance rates employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees. Premium calculator is an efficient tool that lets the customers get an estimate of the premium of the health insurance policy they are planning. Employers start paying national insurance:

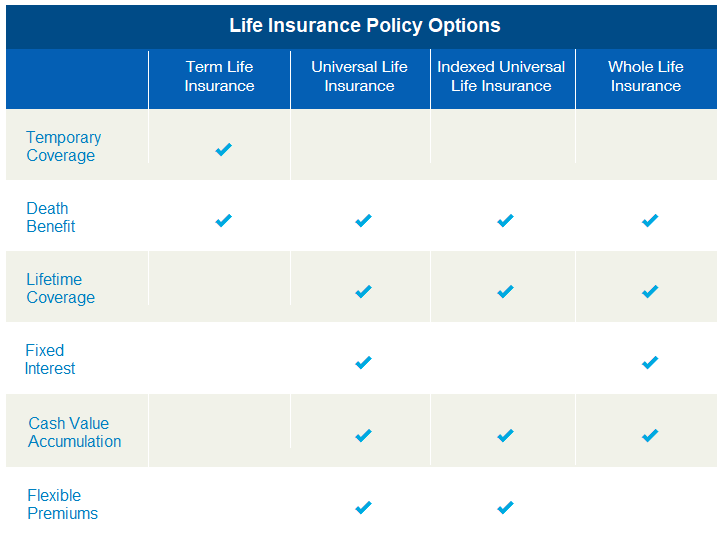

Source: choicelifequote.com

Source: choicelifequote.com

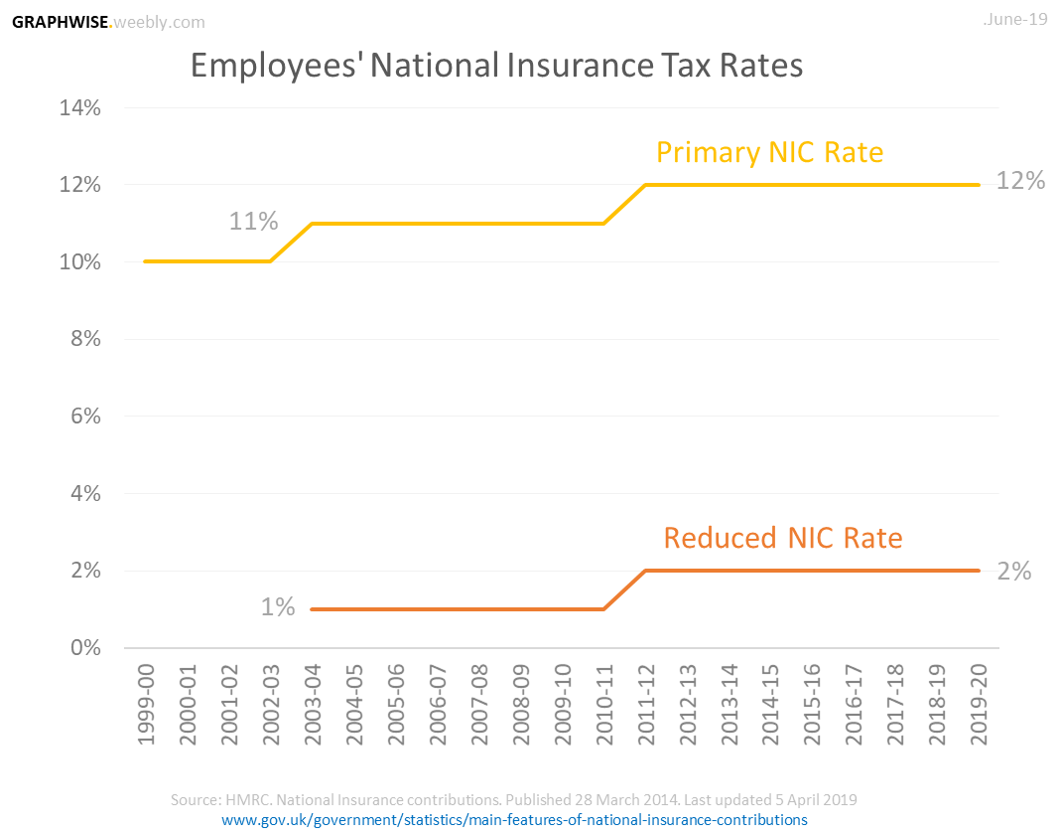

Most employees currently pay 12% of their income between £9,568 and £50,270 each year in national insurance, and 2% of income above £50,270. You can calculate your health insurance premium for health insurance policies by national insurance company online by visiting the company’s website or from the official website of insurancedekho, i.e. The investment income of the national insurance company also grew up to rs. Employer class 1 national insurance rates employers pay class 1 nics of 13.8% on all earnings above the secondary threshold for almost all employees. Class 1 nics are payable on any salaried income you receive, regardless of the business structure you work under.

Source: graphwise.weebly.com

Source: graphwise.weebly.com

The rate of nics that employers contribute depends on the national insurance category letter of the employee. Rates vary from company to company. What rates of national insurance apply to the self employed (sole traders)? Below is a list of the average rates that drivers typically pay with american national p&c. The rate of nics that employers contribute depends on the national insurance category letter of the employee.

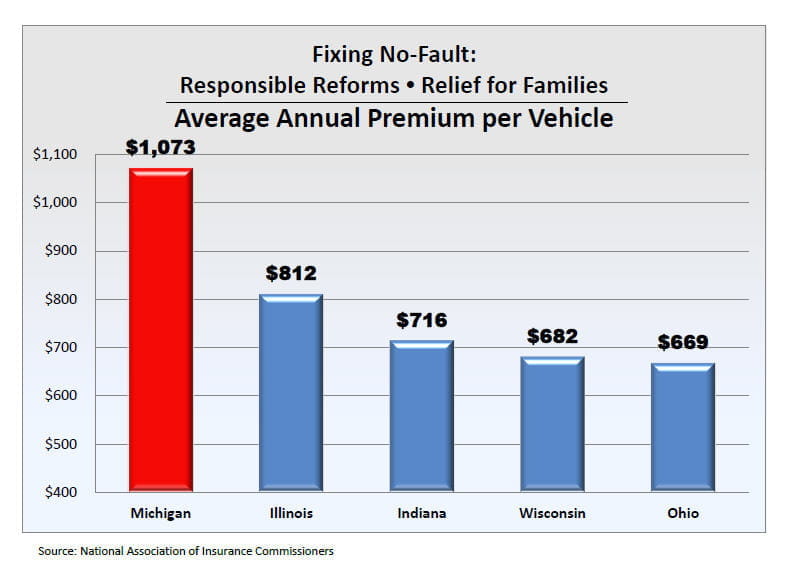

Source: michiganautolaw.com

Source: michiganautolaw.com

Employers start paying national insurance: The secondary threshold is £732/month. Liability above primary threshold at 12% / 13.25%. The current rates employers pay towards most employees� national insurance are 13.8% above the secondary threshold. From april 2023 the levy will become a separate.

Source: valuepenguin.com

Source: valuepenguin.com

One part of the company became national general insurance and the second was motor insurance company, founded in 1925, by general motors. The tables below show the earnings thresholds and the. Most employees currently pay 12% of their income between £9,568 and £50,270 each year in national insurance, and 2% of income above £50,270. Online two wheeler insurance purchase and renewal; Class 1 national insurance rate.

Source: kashflow.com

Source: kashflow.com

If you are a sole trader, or member or a partnership, you do not pay class 1 contributions on your income. Class 1 nics are payable on any salaried income you receive, regardless of the business structure you work under. The rate of nics that employers contribute depends on the national insurance category letter of the employee. Employer’s national insurance rates 2020/21. National insurance two wheeler plans come with the following unique features and benefits:

Source: policydunia.com

Source: policydunia.com

For most workers they come out at the same time as their income tax with little extra thought. You can calculate your health insurance premium for health insurance policies by national insurance company online by visiting the company’s website or from the official website of insurancedekho, i.e. One part of the company became national general insurance and the second was motor insurance company, founded in 1925, by general motors. Class 1 national insurance rate. National insurance two wheeler plans come with the following unique features and benefits:

Source: policydunia.com

Source: policydunia.com

Below is a list of the average rates that drivers typically pay with american national p&c. The current class 2 nic rate is £3.05 (2020/221) per. During the 2021/22 tax year, employees must pay nics of 12% on income falling between £184 and £967 per week, and at 2% on income above £967 per week. The company’s history began in 1920, in north carolina, when integon, a life insurance company, was founded: The rate is 13.8% for employers, while employees pay 12% of their earnings, up to £50,000 a year.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

This equates to a rise of 10.4% in the national insurance that most employees pay. On average, american national p&c charges approximately $52.97 per month. The tables below show the earnings thresholds and the. This means your national insurance payment will be £94.62 for the week. This equates to a rise of 10.4% in the national insurance that most employees pay.

Rates vary from company to company. On average, american national p&c charges approximately $52.97 per month. Employers start paying national insurance: Below is a list of the average rates that drivers typically pay with american national p&c. Rates vary from company to company.

Source: choicelifequote.com

Source: choicelifequote.com

The tables below show the earnings thresholds and the. If you are a sole trader, or member or a partnership, you do not pay class 1 contributions on your income. The rate is 13.8% for employers, while employees pay 12% of their earnings, up to £50,000 a year. Employer’s national insurance rates 2020/21. The investment income of the national insurance company also grew up to rs.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title company national insurance rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information