Company owned life insurance Idea

Home » Trend » Company owned life insurance IdeaYour Company owned life insurance images are ready in this website. Company owned life insurance are a topic that is being searched for and liked by netizens now. You can Download the Company owned life insurance files here. Find and Download all royalty-free photos.

If you’re searching for company owned life insurance images information connected with to the company owned life insurance topic, you have come to the right blog. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

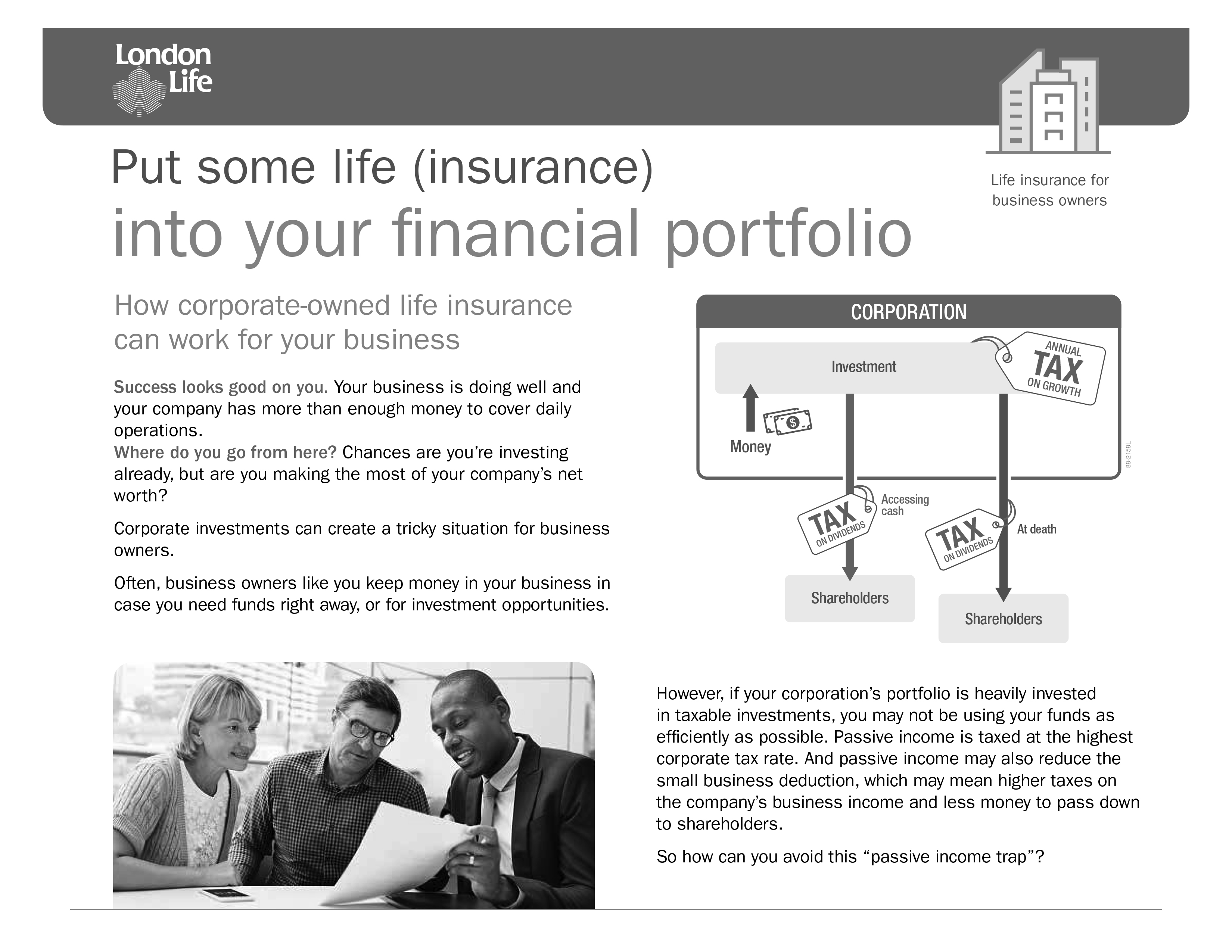

Company Owned Life Insurance. The employee or employees are listed as the. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. $5,000 life insurance income account: Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Why Corporate Owned Life Insurance is Essential in an ESOP From glistrategies.com

Why Corporate Owned Life Insurance is Essential in an ESOP From glistrategies.com

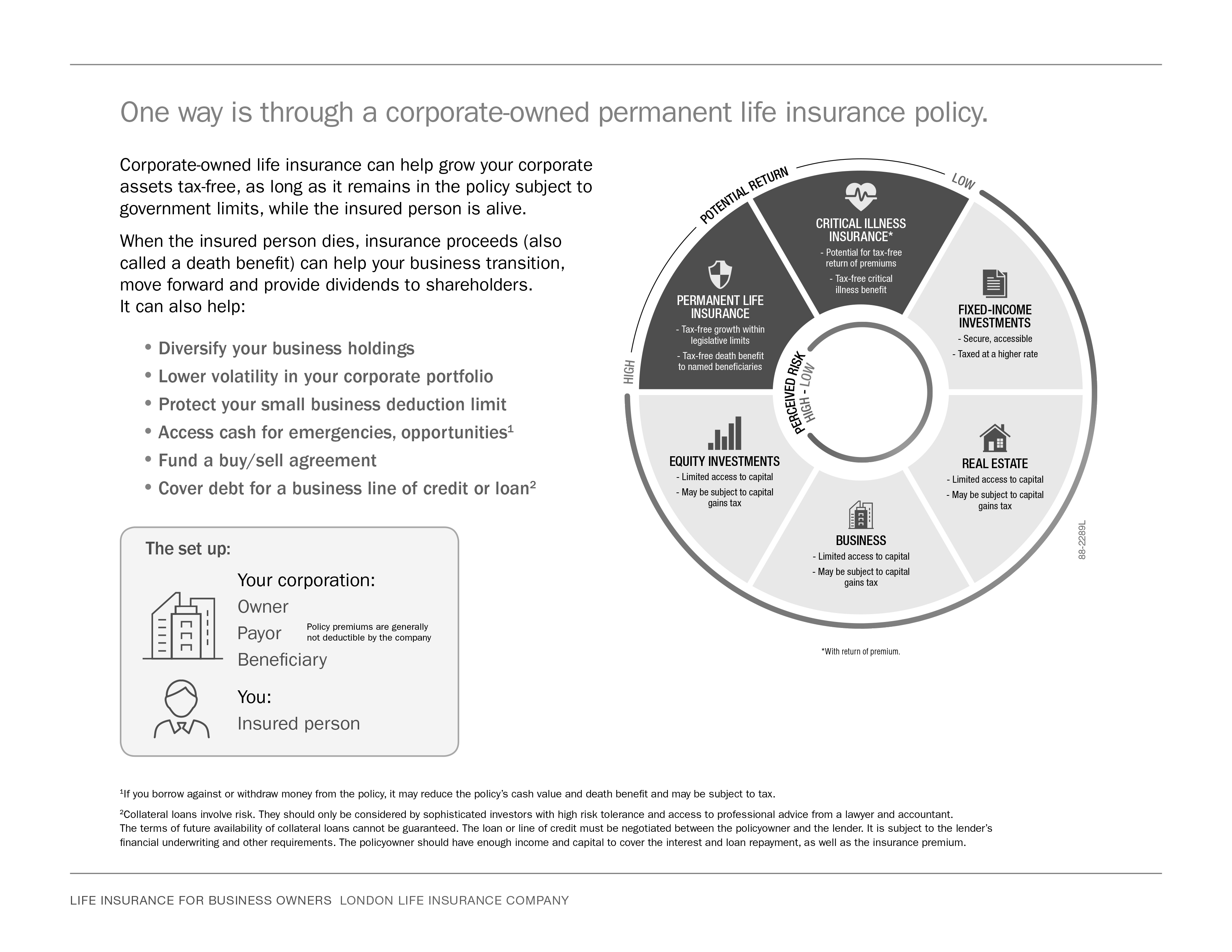

It is usually funded with a single premium deposit. 2 insurance company owned life insurance (icoli) like most corporations, insurance companies are faced with the challenge of managing the growing liability and expense of their benefit plans. The employee or employees are listed as the. Allianz care is the leading provider of health and wellbeing insurance internationally. 101(j)(1), an insurance arrangement can still qualify for the general exclusion under sec. This type of life insurance is a tax efficient method for.

2005 national association of insurance commissioners.

Allianz care is the leading provider of health and wellbeing insurance internationally. It also provides liquidity should the need arise. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. The business is the one who purchases the policy, pays the premiums on the plan, and is the named beneficiary of the policy. $5,000 life insurance income account: A type of life insurance policy taken out by a company on the lives of employees whom the company considers to be of vital importance to its operations.

Source: rockharbour.ca

Source: rockharbour.ca

Before changing the ownership it is important to know the policy�s fair market value, understand any tax issues that may exist upon transferring ownership, and the best way to distribute the policy. $5,000 life insurance income account: With coli, the employer is generally the applicant, owner, premium payer and beneficiary of thepolicy. It also provides liquidity should the need arise. Firstly, i will point out that the corporate owner needs to be the same as the beneficiary;

Source: slideshare.net

Source: slideshare.net

$5,000 life insurance income account: This type of life insurance is a tax efficient method for. It is also important to understand some cautions with corporate owned life insurance. With coli, the employer is generally the applicant, owner, premium payer and beneficiary of thepolicy. 2005 national association of insurance commissioners.

Source: rockharbour.ca

Source: rockharbour.ca

Corporate owned life insurance (coli) is life insurance a corporate employer buys covering one or more employees. Before changing the ownership it is important to know the policy�s fair market value, understand any tax issues that may exist upon transferring ownership, and the best way to distribute the policy. Firstly, i will point out that the corporate owner needs to be the same as the beneficiary; It is usually funded with a single premium deposit. With coli, the employer is generally the applicant, owner, premium payer and beneficiary of thepolicy.

Source: youtube.com

Source: youtube.com

Before changing the ownership it is important to know the policy�s fair market value, understand any tax issues that may exist upon transferring ownership, and the best way to distribute the policy. It is also important to understand some cautions with corporate owned life insurance. The corporation is either the total or partial beneficiary on the policy, with benefits payable either to the employer or directly to the employee�s named beneficiary. The business is the one who purchases the policy, pays the premiums on the plan, and is the named beneficiary of the policy. With coli, the corporation purchases and owns a life insurance policy on a key employee or employees.

Source: raterush.com

Source: raterush.com

Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. 2005 national association of insurance commissioners. The corporation is either the total or partial beneficiary on the policy, with benefits payable either to the employer or directly to the employee�s named beneficiary. 101(j)(1), an insurance arrangement can still qualify for the general exclusion under sec. This article will focus on liquidity;

Source: bankownedlifeinsurance.org

Source: bankownedlifeinsurance.org

With coli, the employer is generally the applicant, owner, premium payer and beneficiary of thepolicy. It is also important to understand some cautions with corporate owned life insurance. Guidelines on corporate owned life insurance. Banking, finance and accounting business law corporate taxes employee benefits taxation expense deductions laws, regulations and rules life insurance Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy.

Source: ggfl.ca

Source: ggfl.ca

Banking, finance and accounting business law corporate taxes employee benefits taxation expense deductions laws, regulations and rules life insurance Guidelines on corporate owned life insurance. The company purchases a specially designed life insurance policy on key executives other senior employees. These companies offer services ranging from health insurance, to life insurance policy, which are masterminded by life insurance companies, travel insurance, auto insurance, liberty and allianz. When it comes to addressing immediate and future financial obligations, icoli is a means to leverage and maximize a.

Source: glistrategies.com

Source: glistrategies.com

With coli, the corporation purchases and owns a life insurance policy on a key employee or employees. The company purchases a specially designed life insurance policy on key executives other senior employees. 2 insurance company owned life insurance (icoli) like most corporations, insurance companies are faced with the challenge of managing the growing liability and expense of their benefit plans. The corporation is either the total or partial beneficiary on the policy, with benefits payable either to the employer or directly to the employee�s named beneficiary. Corporate owned life insurance (coli) is life insurance a corporate employer buys covering one or more employees.

Source: abbreviations.com

Source: abbreviations.com

The company purchases a specially designed life insurance policy on key executives other senior employees. The business is the one who purchases the policy, pays the premiums on the plan, and is the named beneficiary of the policy. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. Despite being defined as eoli under sec. $3,200 conclusion the use of life insurance may be a key financial decision for your business.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

$5,000 life insurance income account: With coli, the corporation purchases and owns a life insurance policy on a key employee or employees. Guidelines on corporate owned life insurance. Life insurance premium expense account: Despite being defined as eoli under sec.

Source: knigozal.com

Source: knigozal.com

Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli). Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. 2 insurance company owned life insurance (icoli) like most corporations, insurance companies are faced with the challenge of managing the growing liability and expense of their benefit plans. 2005 national association of insurance commissioners. Other names for the practice include janitor�s insurance and dead peasants insurance.when the employer is a bank, the insurance is known as a bank owned life insurance (boli).

Source: capcorp.ca

Source: capcorp.ca

$3,200 conclusion the use of life insurance may be a key financial decision for your business. A type of life insurance policy taken out by a company on the lives of employees whom the company considers to be of vital importance to its operations. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. It is also important to understand some cautions with corporate owned life insurance. It also provides liquidity should the need arise.

Source: proinsure.ca

Source: proinsure.ca

101(j)(1), an insurance arrangement can still qualify for the general exclusion under sec. The company purchases and owns a life insurance policy on a key employee and is the primary beneficiary. Before changing the ownership it is important to know the policy�s fair market value, understand any tax issues that may exist upon transferring ownership, and the best way to distribute the policy. Banking, finance and accounting business law corporate taxes employee benefits taxation expense deductions laws, regulations and rules life insurance 2 insurance company owned life insurance (icoli) like most corporations, insurance companies are faced with the challenge of managing the growing liability and expense of their benefit plans.

Source: glistrategies.com

Source: glistrategies.com

101(a) if the eoli conforms with the notice and consent procedures prescribed under sec. It also provides liquidity should the need arise. The business is the one who purchases the policy, pays the premiums on the plan, and is the named beneficiary of the policy. $5,000 life insurance income account: Despite being defined as eoli under sec.

![]() Source: bdo.ca

Source: bdo.ca

This article will focus on liquidity; It is also important to understand some cautions with corporate owned life insurance. $3,200 conclusion the use of life insurance may be a key financial decision for your business. A type of life insurance policy taken out by a company on the lives of employees whom the company considers to be of vital importance to its operations. 101(a) if the eoli conforms with the notice and consent procedures prescribed under sec.

Source: clearmanlaw.com

Source: clearmanlaw.com

Allianz worldwide cares insurance company: These companies offer services ranging from health insurance, to life insurance policy, which are masterminded by life insurance companies, travel insurance, auto insurance, liberty and allianz. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. $3,200 conclusion the use of life insurance may be a key financial decision for your business. The corporation is either the total or partial beneficiary on the policy, with benefits payable either to the employer or directly to the employee�s named beneficiary.

Source: youtube.com

Source: youtube.com

This type of life insurance is a tax efficient method for. Corporate owned life insurance (coli) is life insurance a corporate employer buys covering one or more employees. These companies offer services ranging from health insurance, to life insurance policy, which are masterminded by life insurance companies, travel insurance, auto insurance, liberty and allianz. It is usually funded with a single premium deposit. $3,200 conclusion the use of life insurance may be a key financial decision for your business.

Source: partners4prosperity.com

Source: partners4prosperity.com

The business is the one who purchases the policy, pays the premiums on the plan, and is the named beneficiary of the policy. 2 insurance company owned life insurance (icoli) like most corporations, insurance companies are faced with the challenge of managing the growing liability and expense of their benefit plans. $3,200 conclusion the use of life insurance may be a key financial decision for your business. Any companies recognize that the skills and abilities of their employees are invaluable to the conduct of their businesses. It is also the primary beneficiary.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title company owned life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information