Compare comprehensive and third party insurance Idea

Home » Trending » Compare comprehensive and third party insurance IdeaYour Compare comprehensive and third party insurance images are ready in this website. Compare comprehensive and third party insurance are a topic that is being searched for and liked by netizens now. You can Get the Compare comprehensive and third party insurance files here. Get all free vectors.

If you’re looking for compare comprehensive and third party insurance images information connected with to the compare comprehensive and third party insurance interest, you have visit the ideal blog. Our website always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

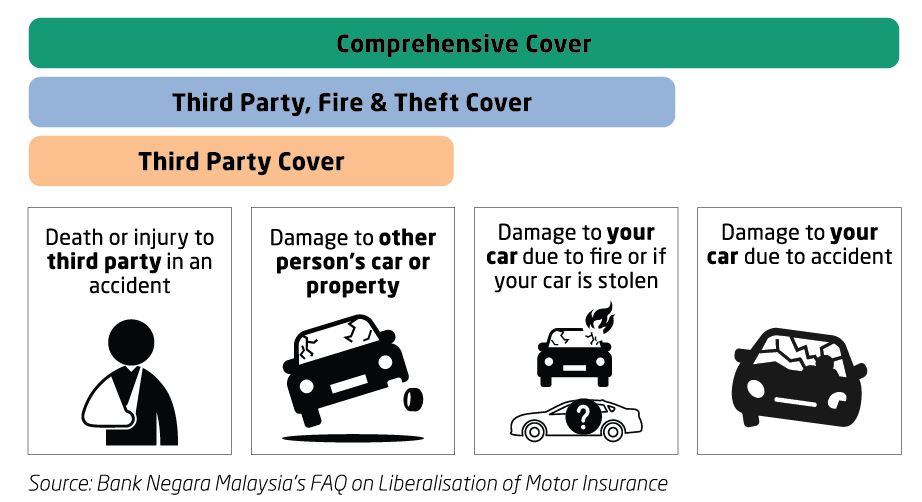

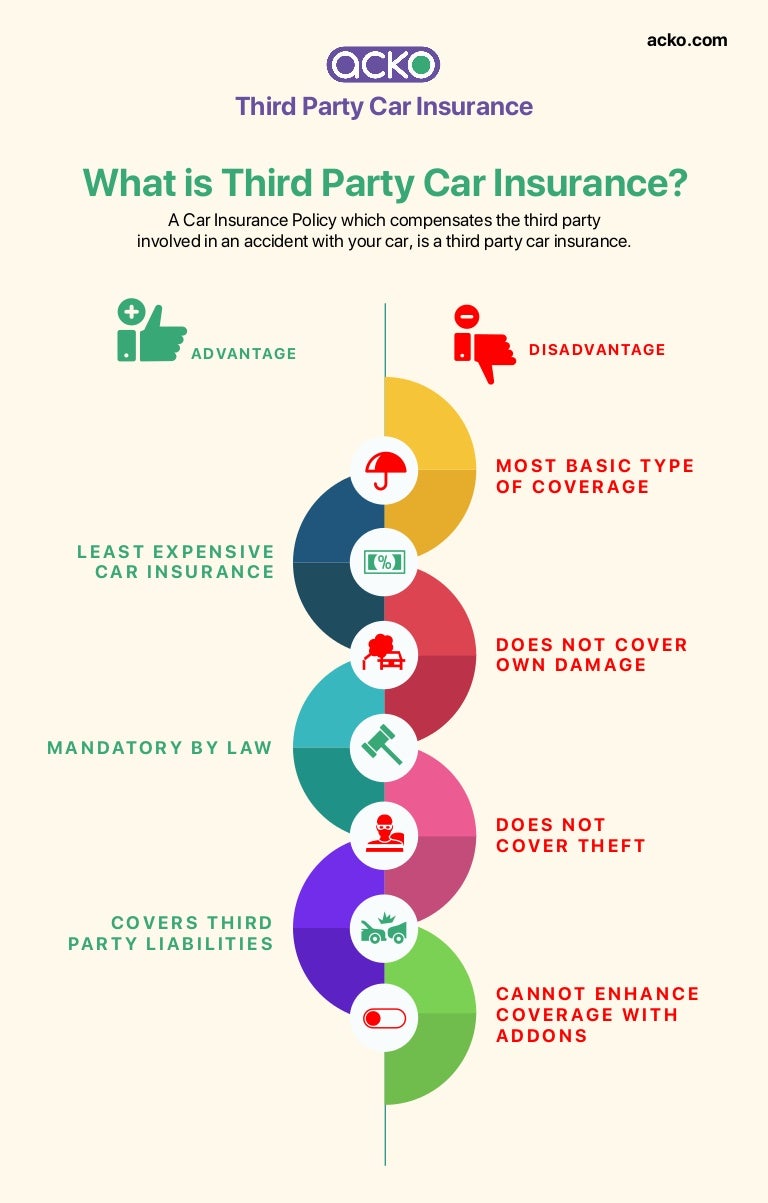

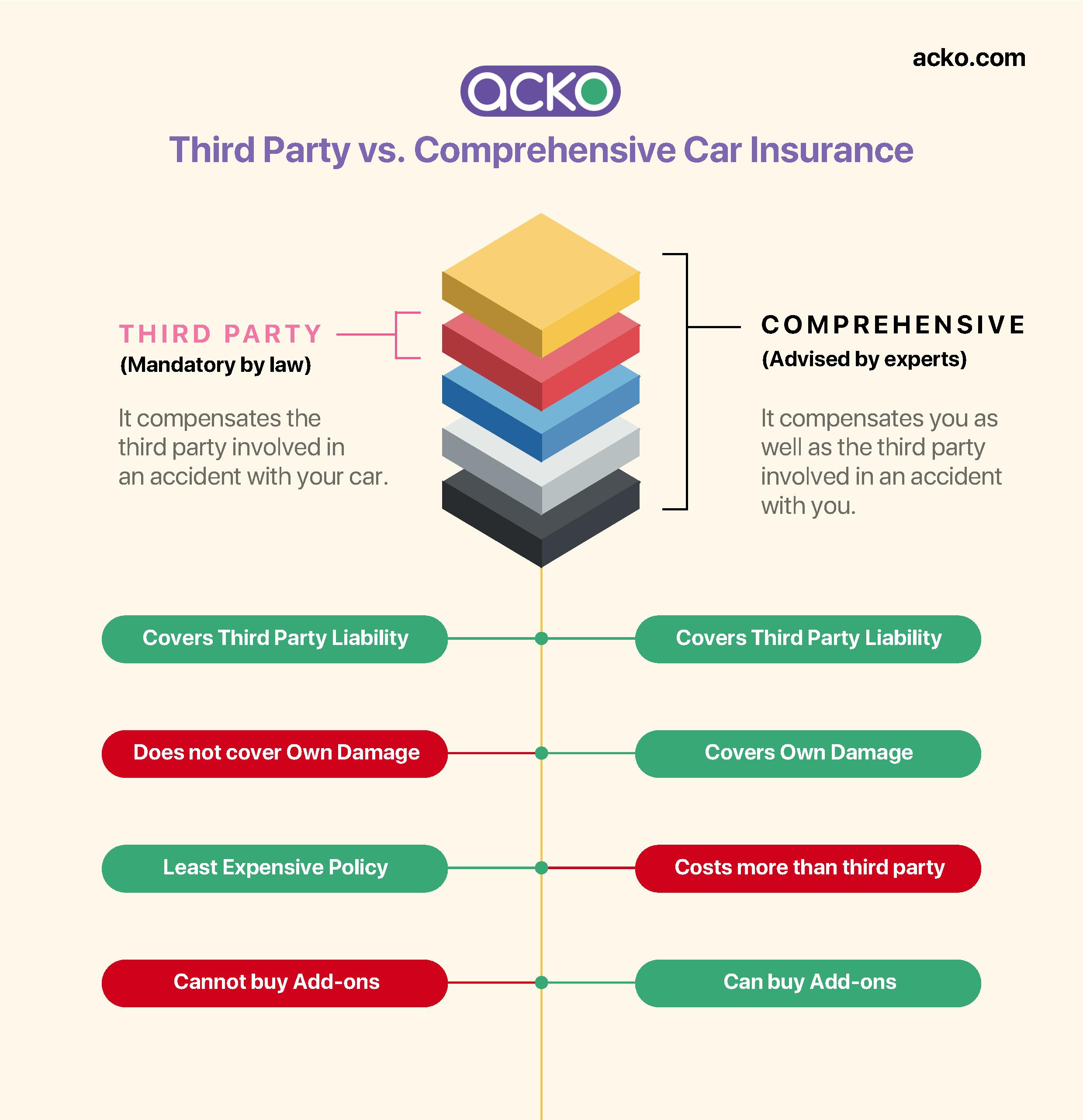

Compare Comprehensive And Third Party Insurance. On comparing, the comprehensive car insurance in kenya will certainly turn out be more costly than third party insurance. One can buy one of two type of car insurance policies available in india. Third party car insurance is often the basic level of cheap insurance that drivers with older vehicles or young drivers take out because it is cheaper than comprehensive insurance. Options to enhance the insurance cover

Comprehensive Third Party Insurance CTP Vs Third Party From iselect.com.au

Comprehensive Third Party Insurance CTP Vs Third Party From iselect.com.au

Choosing the right kind of insurance for your vehicle is crucial in india. Third party is the most basic type of car insurance. As the third party insurance plan gives limited coverage to bike owners, its premium amount is less expensive, while, due to extensive coverage, the comprehensive insurance policy comes with a higher premium price as compared to the third party insurance policy. Owning a new car is a delightful experience and a. £221, third party, fire and theft: If you just want cover for the essentials and most common risks, third party may be enough.

Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else.

This can help reduce the cost of your cover. You might consider things such as the value of your car, how you use your car or who will be driving your car. There is often a considerable price variation between insurers for a ctp green slip in nsw, so it is worth the effort to make a greenslip cost comparison. On comparing, the comprehensive car insurance in kenya will certainly turn out be more costly than third party insurance. Third party insurance covers you in the event of an accident that is your fault. Ctp (compulsory third party) insurance:

If your car is damaged, or you’re injured, you won’t get any compensation. Compulsory third party (ctp) greenslips can be difficult and time consuming to acquire. If your car is damaged, or you’re injured, you won’t get any compensation. Ctp (compulsory third party) insurance: Owning a new car is a delightful experience and a.

Source: banksathi.com

Source: banksathi.com

As the third party insurance plan gives limited coverage to bike owners, its premium amount is less expensive, while, due to extensive coverage, the comprehensive insurance policy comes with a higher premium price as compared to the third party insurance policy. The information provided further details which policy to be chosen in particular scenarios. Compulsory third party (ctp) greenslips can be difficult and time consuming to acquire. It is necessary that you choose the policy according to the circumstances and your needs. There are 3 primary types of car insurance cover;

Source: ilainfo.com

Source: ilainfo.com

£221, third party, fire and theft: As the third party insurance plan gives limited coverage to bike owners, its premium amount is less expensive, while, due to extensive coverage, the comprehensive insurance policy comes with a higher premium price as compared to the third party insurance policy. It is necessary that you choose the policy according to the circumstances and your needs. The drivers must be at least 30 years old. Third party only third party only will cover damage to other people’s cars and property, but not your.

It is necessary that you choose the policy according to the circumstances and your needs. In general, a comprehensive car insurance policy will cover you for a wide range of damages, injuries, and loss to your passengers, your vehicle, and other property. Six insurers provide compulsory third party insurance (ctp) in nsw. Third party insurance and comprehensive insurance are two options available for owners who want to insure their automobiles. Third party is the most basic type of car insurance.

Source: pinterest.com

Source: pinterest.com

Third party is the most basic type of car insurance. You might consider things such as the value of your car, how you use your car or who will be driving your car. Yes, you need compulsory third party (ctp) insurance as it covers you, your passengers, and others for injuries relating to a motor vehicle accident. Third party insurance vs comprehensive insurance. Gary hunter gary hunter is a writer at finder, specialising in insurance.

Source: pinterest.com

Source: pinterest.com

For example, if you want to be covered for damage to a new or expensive car, you might decide you want the benefits of comprehensive. Owning a new car is a delightful experience and a. Comprehensive is better than third party in so far as it covers you for more, but it depends on what you�re looking for. Ctp (compulsory third party) insurance: But contrary to what you might expect, it isn’t always cheaper than comprehensive cover.

Source: ringgitplus.com

Source: ringgitplus.com

It is necessary that you choose the policy according to the circumstances and your needs. In this article, we will compare these types of car insurance policies. Ctp (compulsory third party) insurance: Third party car insurance is often the basic level of cheap insurance that drivers with older vehicles or young drivers take out because it is cheaper than comprehensive insurance. Third party insurance vs comprehensive insurance.

Source: debep.blogspot.com

Source: debep.blogspot.com

Compulsory third party (ctp) greenslips can be difficult and time consuming to acquire. First, let’s understand what each type. It will only cover harm you cause to other people, cars or property, and won’t pay out for any damage to your own car or any medical costs you incur. Comprehensive is better than third party in so far as it covers you for more, but it depends on what you�re looking for. Fully comprehensive, third party (fire and theft) and third party only.

Source: oaklandnewsupdate.blogspot.com

Source: oaklandnewsupdate.blogspot.com

Six insurers provide compulsory third party insurance (ctp) in nsw. £221, third party, fire and theft: In this article, we will compare these types of car insurance policies. It will only cover harm you cause to other people, cars or property, and won’t pay out for any damage to your own car or any medical costs you incur. If you just want cover for the essentials and most common risks, third party may be enough.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

On comparing, the comprehensive car insurance in kenya will certainly turn out be more costly than third party insurance. Third party car insurance is often the basic level of cheap insurance that drivers with older vehicles or young drivers take out because it is cheaper than comprehensive insurance. Third party insurance and comprehensive insurance are two options available for owners who want to insure their automobiles. You can also avail of a wide range of rider options such as zero depreciation, roadside assistance, personal accident cover, and more at the cost of an additional premium. Comprehensive car insurance does not offer this type of cover.

Source: iselect.com.au

Source: iselect.com.au

You might consider things such as the value of your car, how you use your car or who will be driving your car. Compulsory third party insurance (ctp) or ‘greenslip’, as it’s most commonly known as in nsw, is something all vehicles are required to be covered by in all states within australia. Choosing the right kind of insurance for your vehicle is crucial in india. Options to enhance the insurance cover Third party car insurance is more restrictive, covering damage to other vehicles and their passengers, but typically not much else.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

But contrary to what you might expect, it isn’t always cheaper than comprehensive cover. For a more experienced driver, quotes for third party fire and theft cover came out cheaper than comprehensive. On comparing, the comprehensive car insurance in kenya will certainly turn out be more costly than third party insurance. If you just want cover for the essentials and most common risks, third party may be enough. Compulsory third party (ctp) greenslips can be difficult and time consuming to acquire.

Source: tennis-games-best.blogspot.com

Source: tennis-games-best.blogspot.com

Of course, third party with fire and theft is exactly the same as third party except you’re covered if your car is stolen, broken into, set on fire or vandalised. If you just want cover for the essentials and most common risks, third party may be enough. For example, if you want to be covered for damage to a new or expensive car, you might decide you want the benefits of comprehensive. Comprehensive insurance covers both sides. Third party insurance vs comprehensive insurance.

Source: bemoneyaware.com

Source: bemoneyaware.com

Compulsory third party insurance (ctp) or ‘greenslip’, as it’s most commonly known as in nsw, is something all vehicles are required to be covered by in all states within australia. Ctp (compulsory third party) insurance: Compulsory third party (ctp) greenslips can be difficult and time consuming to acquire. • your car against theft, fire or damage. Third party car insurance is affordable as compared to comprehensive insurance as it provides only the mandatory third party liability cover.

Source: iselect.com.au

Source: iselect.com.au

You can also avail of a wide range of rider options such as zero depreciation, roadside assistance, personal accident cover, and more at the cost of an additional premium. Comprehensive is better than third party in so far as it covers you for more, but it depends on what you�re looking for. Compulsory third party (ctp) insurance is,. First, let’s understand what each type. Options to enhance the insurance cover

Source: insurancedekho.com

You might consider things such as the value of your car, how you use your car or who will be driving your car. Comprehensive is better than third party in so far as it covers you for more, but it depends on what you�re looking for. Yes, you need compulsory third party (ctp) insurance as it covers you, your passengers, and others for injuries relating to a motor vehicle accident. First, let’s understand what each type. It is necessary that you choose the policy according to the circumstances and your needs.

Source: banksathi.com

Source: banksathi.com

For example, if you want to be covered for damage to a new or expensive car, you might decide you want the benefits of comprehensive. Was this content helpful to you? Fully comprehensive, third party (fire and theft) and third party only. Third party only third party only will cover damage to other people’s cars and property, but not your. If your car is damaged, or you’re injured, you won’t get any compensation.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

Comprehensive insurance covers both sides. One can buy one of two type of car insurance policies available in india. Options to enhance the insurance cover For a more experienced driver, quotes for third party fire and theft cover came out cheaper than comprehensive. There are 3 primary types of car insurance cover;

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title compare comprehensive and third party insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea