Compare lic jeevan arogya and star health insurance information

Home » Trending » Compare lic jeevan arogya and star health insurance informationYour Compare lic jeevan arogya and star health insurance images are available. Compare lic jeevan arogya and star health insurance are a topic that is being searched for and liked by netizens today. You can Get the Compare lic jeevan arogya and star health insurance files here. Find and Download all free images.

If you’re searching for compare lic jeevan arogya and star health insurance images information related to the compare lic jeevan arogya and star health insurance topic, you have come to the right blog. Our site frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

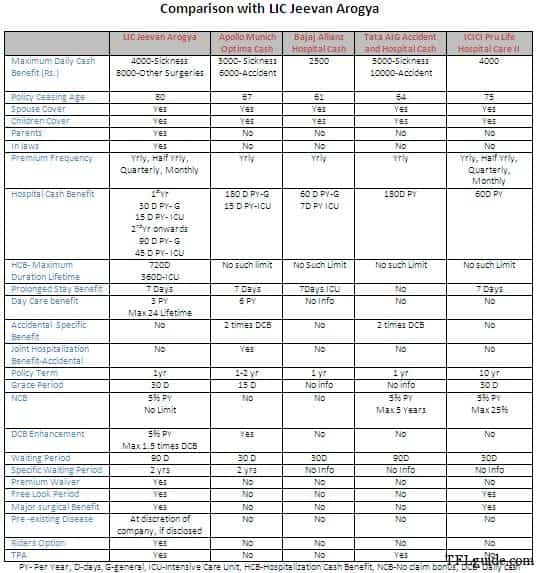

Compare Lic Jeevan Arogya And Star Health Insurance. Compare features and benefits of sbi general arogya plus individual 1 to 3 lakh and star health family health optima family floater 4 lakh india�s 1st. In this article, we will. Visit the star health website or mobile app and find the arogya sanjeevani policy. 18 rows we have already reviewed lic’s jeevan arogya & health protection.

Lic Jeevan Labh, Age Limit 8 To 59 Years, Poonam From indiamart.com

Lic Jeevan Labh, Age Limit 8 To 59 Years, Poonam From indiamart.com

All about lic health insurance policy. In this article, we will. We know that lic offers life insurance products. Even though it launched long back, but i felt that, many of us have not aware of this plan. You can buy health insurance policy jeevan arogya from lic, as an addition to your regular “indemnity health insurance policy jeevan arogya is a “ fixed benefit health insurance policy”. However, it is an individual health insurance plan with regular premium payment modes.

Lic’s jeevan arogya provides 360 days of intensive care hospitalisation for the entire policy period.

Major surgical expenses jeevan arogya provides health insurance cover against certain specified health risks. Both these plans cover major illnesses and provide the policyholder with financial assistance if the covered illnesses strike. However, it is an individual health insurance plan with regular premium payment modes. Major surgical expenses jeevan arogya provides health insurance cover against certain specified health risks. It also covers major surgical expenses too. In health insurance lic has two products jeevan arogya cancer cover jeevan arogya is a health insurance policy which covers all hospitalizations where as cancer cover only covers cancer treatment.

Option to enhance the coverage: Both policy have their own unique features. So let us review it in today�s post. 18 rows we have already reviewed lic’s jeevan arogya & health protection. We know that lic offers life insurance products.

Source: skondor.com

Source: skondor.com

It also covers major surgical expenses too. So let us review it in today�s post. 18 rows we have already reviewed lic’s jeevan arogya & health protection. The main point to remember is that the benefits provided are independent of the actual expenses. It also covers major surgical expenses too.

Source: skiran-financialadvisor.blogspot.com

Source: skiran-financialadvisor.blogspot.com

Both these plans cover major illnesses and provide the policyholder with financial assistance if the covered illnesses strike. Rising cost of healthcare is a primary concern among individuals, and so, to cater to this, lic jeevan arogya provides financial protection to you and your family in case of medical emergencies. Visit the star health website or mobile app and find the arogya sanjeevani policy. Lic jeevan arogya (t 904) is a family floater health insurance plan from the public sector insurer, life insurance corporation (lic) of india. Lic jeevan arogya is lic�s health insurance plan for individuals as well as their family members.

Source: adviceinsure.com

Source: adviceinsure.com

18 rows we have already reviewed lic’s jeevan arogya & health protection. It covers expenses for specified minor & major illness as given in the brochure/policy. It also covers major surgical expenses too. Rising cost of healthcare is a primary concern among individuals, and so, to cater to this, lic jeevan arogya provides financial protection to you and your family in case of medical emergencies. Maximum number of days in icu is restricted to 360 days.

Source: licguruji.com

Source: licguruji.com

Lic’s jeevan arogya is a non participating, non linked plan which provides the health insurance cover against the specified health risks covered in the plan.this plan helps you to become financially independent in the event of hospitalization. 18 rows we have already reviewed lic’s jeevan arogya & health protection. Which health insurance is right for you? With the cost of medical treatments rising quickly, the insurance giant has introduced health insurance products to safeguard one’s finances in the event of an illness or injury. The main point to remember is that the benefits provided are independent of the actual expenses.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

The policy caters to the healthcare needs of the indian customers and provides the sum. This video covers all the plan details of lic jeevan arogya. It is not a comprehensive medical insurance policy as it works only against certain specified health risks. Lic’s jeevan arogya is a non participating, non linked plan which provides the health insurance cover against the specified health risks covered in the plan.this plan helps you to become financially independent in the event of hospitalization. Visit the star health website or mobile app and find the arogya sanjeevani policy.

Source: indiamart.com

Source: indiamart.com

Name of this plan is jeevan arogya. We know that lic offers life insurance products. Even though it launched long back, but i felt that, many of us have not aware of this plan. Both these plans cover major illnesses and provide the policyholder with financial assistance if the covered illnesses strike. Compare features and benefits of sbi general arogya plus individual 1 to 3 lakh and star health family health optima family floater 4 lakh india�s 1st.

Source: licguruji.com

Source: licguruji.com

You will have to match them as pr your need and requirement and compare it with the max insurance one. With the cost of medical treatments rising quickly, the insurance giant has introduced health insurance products to safeguard one’s finances in the event of an illness or injury. Lic jeevan arogya (t 904) is a family floater health insurance plan from the public sector insurer, life insurance corporation (lic) of india. You will have to match them as pr your need and requirement and compare it with the max insurance one. Option to enhance the coverage:

Source: youtube.com

Source: youtube.com

This video covers all the plan details of lic jeevan arogya. We know that lic offers life insurance products. Lic’s jeevan arogya is a non participating, non linked plan which provides the health insurance cover against the specified health risks covered in the plan.this plan helps you to become financially independent in the event of hospitalization. So let us review it in today�s post. Option to enhance the coverage:

Source: wealthyinsurance.com

Source: wealthyinsurance.com

So let us review it in today�s post. In this article, we will. Lic’s jeevan arogya provides 360 days of intensive care hospitalisation for the entire policy period. This video covers all the plan details of lic jeevan arogya. 18 rows we have already reviewed lic’s jeevan arogya & health protection.

Source: revisi.net

Source: revisi.net

Lic offers two types of health insurance products, namely lic jeevan arogya and lic cancer cover. So let us review it in today�s post. We know that lic offers life insurance products. Lic’s jeevan arogya policy is one such lic mediclaim policy which covers specific medical expenses and gives you financial assistance. Lic jeevan arogya is lic�s health insurance plan for individuals as well as their family members.

Source: slideshare.net

Source: slideshare.net

Lic’s jeevan arogya plan 904. Lic’s jeevan arogya plan 904. You will have to match them as pr your need and requirement and compare it with the max insurance one. All about lic health insurance policy. Lic jeevan arogya is lic�s health insurance plan for individuals as well as their family members.

Source: revisi.net

Source: revisi.net

Which health insurance is right for you? We�ll listen and give you the best health insurance plan. Both these plans cover major illnesses and provide the policyholder with financial assistance if the covered illnesses strike. 18 rows we have already reviewed lic’s jeevan arogya & health protection. Lic jeevan arogya (t 904) is a family floater health insurance plan from the public sector insurer, life insurance corporation (lic) of india.

Source: indoclassified.com

Source: indoclassified.com

Major surgical expenses jeevan arogya provides health insurance cover against certain specified health risks. It also covers major surgical expenses too. However, do you know lic also offers a health insurance or medical insurance plan? Compare features and benefits of sbi general arogya plus individual 1 to 3 lakh and star health family health optima family floater 4 lakh india�s 1st. This video covers all the plan details of lic jeevan arogya.

Source: plaininsurance.blogspot.com

Source: plaininsurance.blogspot.com

Major surgical expenses jeevan arogya provides health insurance cover against certain specified health risks. The insurer saw its new business premium growth to be at 554.1% in h1fy22, compared to 394.76% during the same period of the previous financial year. It also covers major surgical expenses too. Maximum number of days in icu is restricted to 360 days. Lic’s jeevan arogya is a non participating, non linked plan which provides the health insurance cover against the specified health risks covered in the plan.this plan helps you to become financially independent in the event of hospitalization.

Source: indiamart.com

Source: indiamart.com

It covers expenses for specified minor & major illness as given in the brochure/policy. Name of this plan is jeevan arogya. We know that lic offers life insurance products. Visit the star health website or mobile app and find the arogya sanjeevani policy. Enter a few key details, the number of people you want to take the policy for (if buying for family), birth date, policy term.

Source: revisi.net

Source: revisi.net

It is not a comprehensive medical insurance policy as it works only against certain specified health risks. With the cost of medical treatments rising quickly, the insurance giant has introduced health insurance products to safeguard one’s finances in the event of an illness or injury. 18 rows we have already reviewed lic’s jeevan arogya & health protection. Visit the star health website or mobile app and find the arogya sanjeevani policy. All about lic health insurance policy.

Source: revisi.net

Source: revisi.net

It is not a comprehensive medical insurance policy as it works only against certain specified health risks. Buying arogya sanjeevani policy online is very simple: Both policy have their own unique features. Name of this plan is jeevan arogya. The policy caters to the healthcare needs of the indian customers and provides the sum.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title compare lic jeevan arogya and star health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Claims vs occurrence based insurance Idea

- Cheap tablet insurance Idea

- Calling insurance leads Idea

- Disability insurance for postal workers Idea

- Business insurance peoria il information

- Bright health insurance reviews Idea

- Carrier liability vs cargo insurance Idea

- Can you insure a written off car Idea

- Can convicted felons get life insurance information

- Car insurance administrator Idea