Compensation in lieu of health insurance information

Home » Trend » Compensation in lieu of health insurance informationYour Compensation in lieu of health insurance images are ready. Compensation in lieu of health insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Compensation in lieu of health insurance files here. Get all royalty-free images.

If you’re searching for compensation in lieu of health insurance images information connected with to the compensation in lieu of health insurance keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

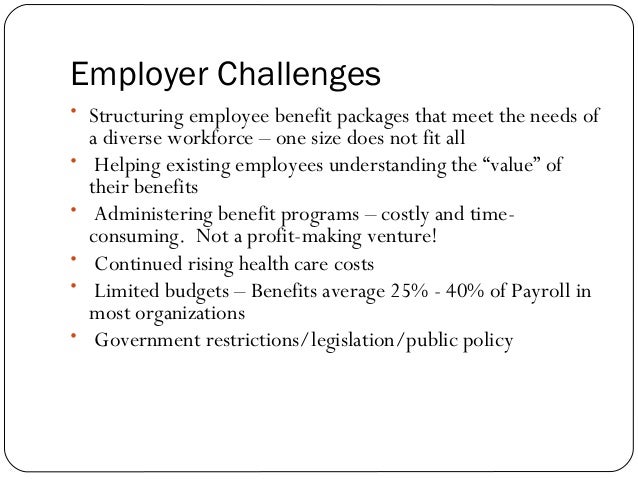

Compensation In Lieu Of Health Insurance. The company does indeed pay you about $2k a year not to take the health insurance. Since you asked about health coverage vs. In the past, many employers have helped employees pay for individual health insurance policies (i.e. Compensation is at the heart center of every company!

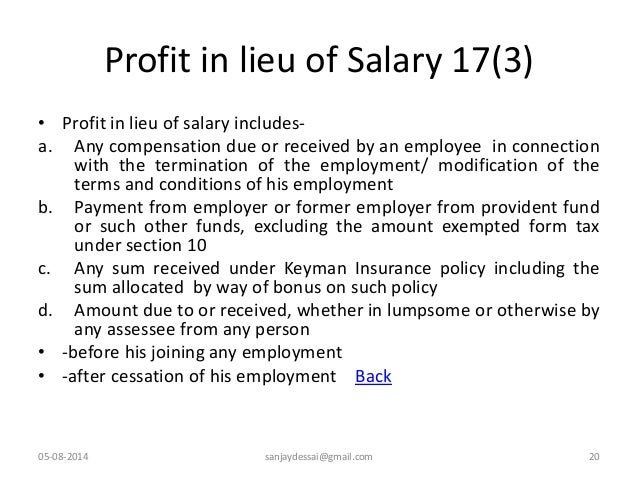

How to make a payment in lieu of notice From slideshare.net

How to make a payment in lieu of notice From slideshare.net

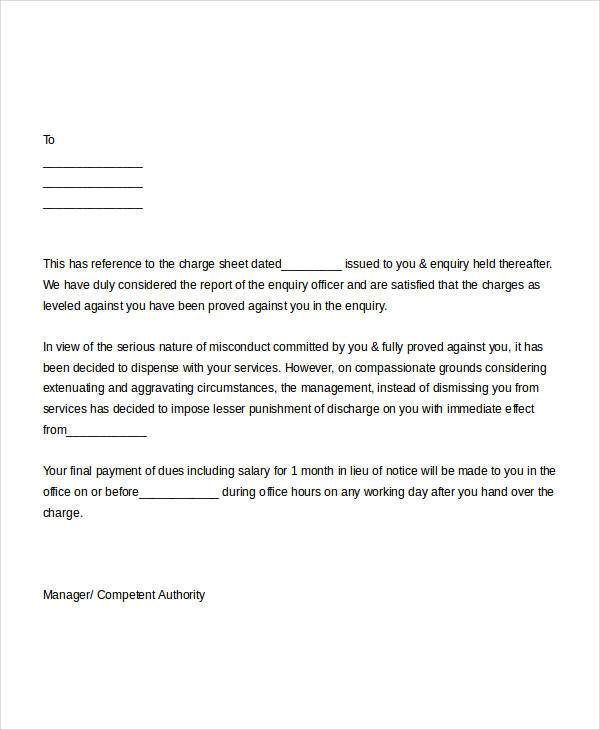

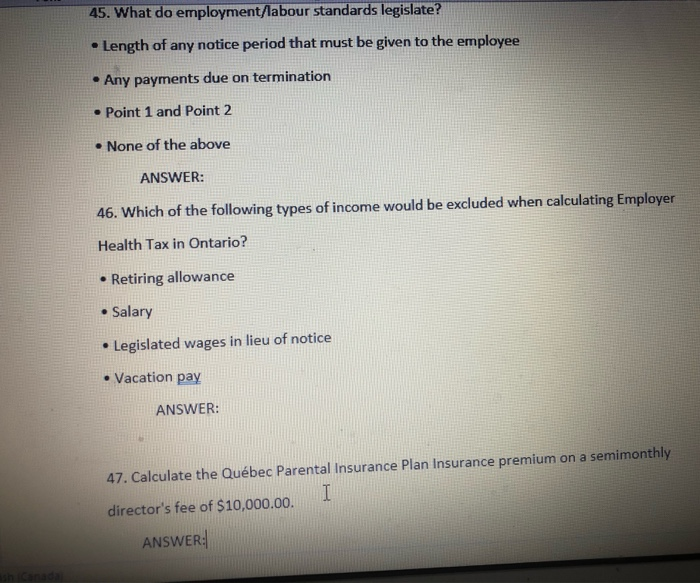

Through “employer payment plans”) in the offering. In lieu of continued employee benefits (other than as statutorily required, such as cobra continuation coverage as required by law ), executive shall receive payments of three thousand dollars ($3,000) per month for twelve months from the date of employment termination in accordance with the payroll schedule applicable to active officers of the. Since you asked about health coverage vs. With the aca, employers are required to comply with the employer shared responsibility code. Ostrower has extensive experience in executive compensation matters and counsels both public and private companies on executive compensation issues, including section 409a and 162(m) of the code. What i found in the research is (1) a congressional committee report on § 125 (it might be a senate report) suggests you are right and (2) several plrs or tams state that a benefit that is eventually taxable (such as a 457 plan contribution) is treated as a taxable benefit, and so a choice between deferred compensation and health benefits makes the health benefits taxable.

You can offer the medical insurance as a benefit, and deduct the cost as a business expense.

This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. You can offer the medical insurance as a benefit, and deduct the cost as a business expense. The department of labor�s office of workers� compensation programs (owcp) administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. What i found in the research is (1) a congressional committee report on § 125 (it might be a senate report) suggests you are right and (2) several plrs or tams state that a benefit that is eventually taxable (such as a 457 plan contribution) is treated as a taxable benefit, and so a choice between deferred compensation and health benefits makes the health benefits taxable.

Source: slideshare.net

Source: slideshare.net

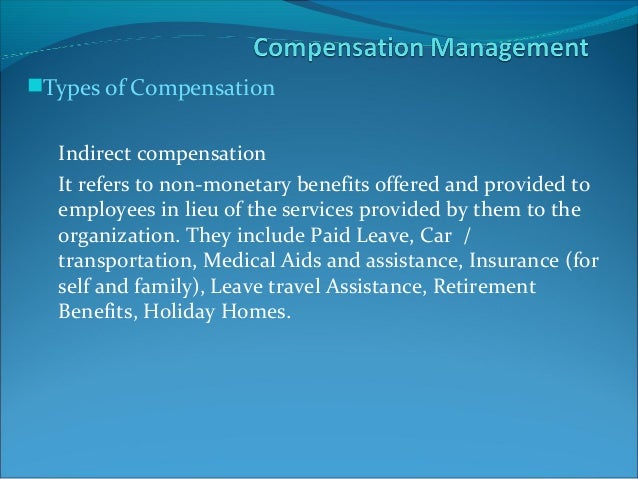

Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or. Compensation is at the heart center of every company! A growing number of employers are offering a “cash in lieu” (cil) or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount if the employee declines coverage under the employer’s group health plan. If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. In lieu of continued employee benefits (other than as statutorily required, such as cobra continuation coverage as required by law ), executive shall receive payments of three thousand dollars ($3,000) per month for twelve months from the date of employment termination in accordance with the payroll schedule applicable to active officers of the.

Source: geklaw.com

Source: geklaw.com

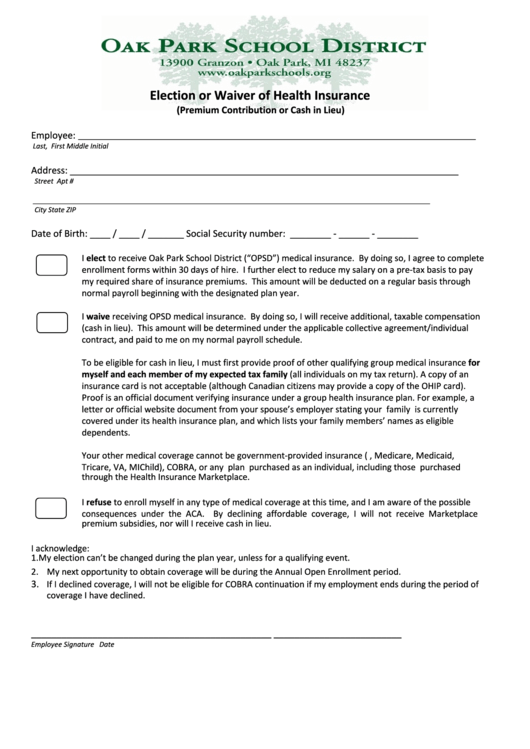

New guidance for employer premium reimbursement. To be eligible, the elected official must obtain health insurance coverage under a separate qualifying group health insurance plan, such as through a spouse’s group plan, medicare, or the veterans administration. Ostrower has extensive experience in executive compensation matters and counsels both public and private companies on executive compensation issues, including section 409a and 162(m) of the code. This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or.

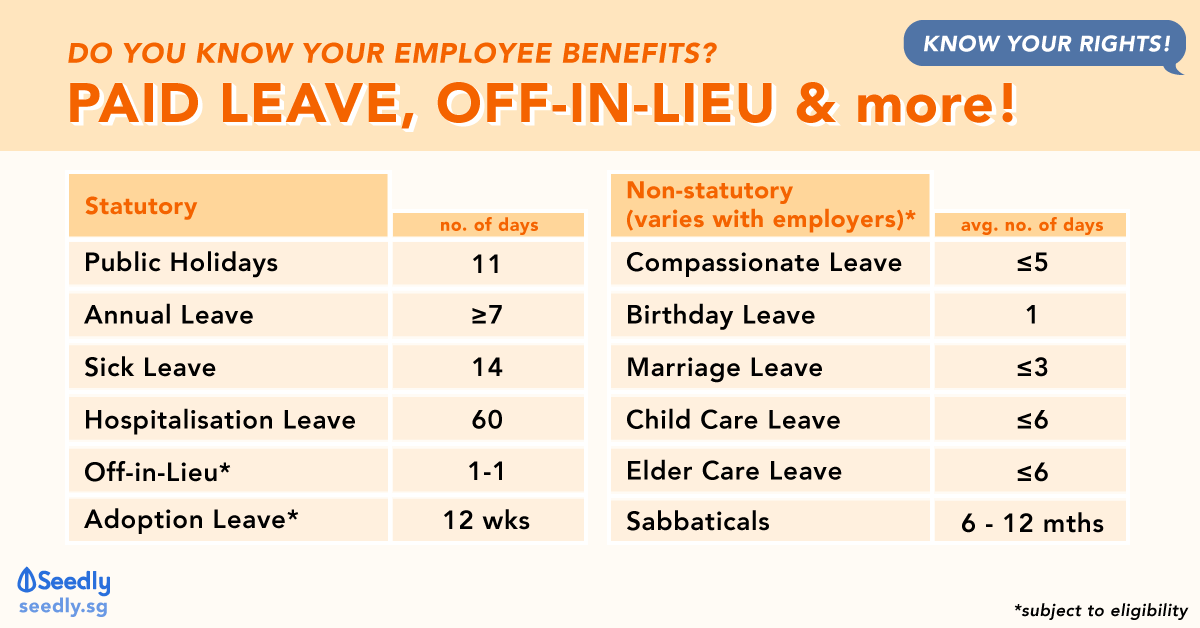

Source: thefinance.sg

Source: thefinance.sg

Employers commonly ask brokers if they can offer a cash payment to an employee in lieu of paying for that employee’s benefits. In lieu of continued employee benefits (other than as statutorily required, such as cobra continuation coverage as required by law ), executive shall receive payments of three thousand dollars ($3,000) per month for twelve months from the date of employment termination in accordance with the payroll schedule applicable to active officers of the. Therefore, the payment is treated as a substitute for the health insurance coverage. New guidance for employer premium reimbursement. Asking employees to show proof of group coverage elsewhere can help employers comply with this law, as it can show that they’re not.

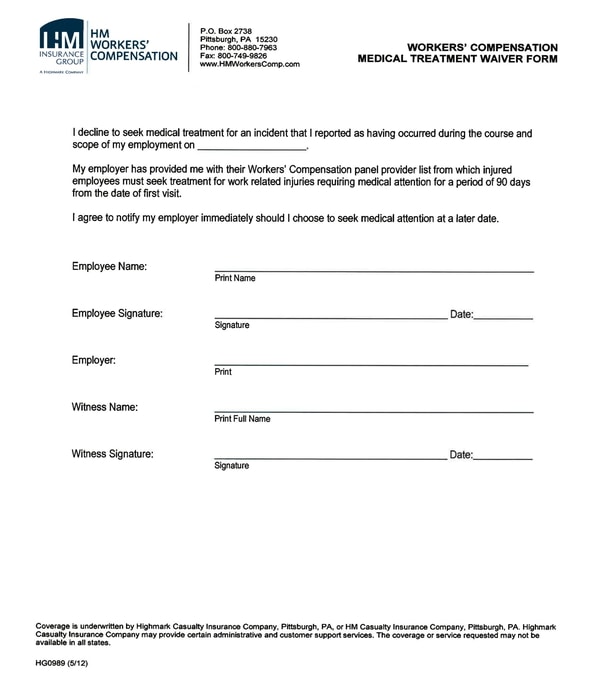

Source: formsbank.com

Source: formsbank.com

You can offer the medical insurance as a benefit, and deduct the cost as a business expense. Ostrower is also a member of the jackson lewis healthcare reform task force and is intimately involved in helping jackson lewis clients ensure. This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. Just don�t call it as in lieu of wages. some larger companies do give their employees money for opting out. The company is offering a benefit option not an entitlement of certain compensation value.

Source: template.net

Source: template.net

The reasoning is that when an employer makes payments to the insurance company where the employee has the option of receiving those amounts as wages, the employee is merely assigning future income (cash compensation) for consideration (health insurance coverage). Since you asked about health coverage vs. Through “employer payment plans”) in the offering. Asking employees to show proof of group coverage elsewhere can help employers comply with this law, as it can show that they’re not. There’s also the fact that you can’t guarantee that your employee will use the “bonuses insurance money” to buy insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

There’s also the fact that you can’t guarantee that your employee will use the “bonuses insurance money” to buy insurance. This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. The company does indeed pay you about $2k a year not to take the health insurance. You can offer the medical insurance as a benefit, and deduct the cost as a business expense. Since you asked about health coverage vs.

Source: chegg.com

Source: chegg.com

This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. Asking employees to show proof of group coverage elsewhere can help employers comply with this law, as it can show that they’re not. February 26, 2015 / in health care reform / by mnj insurance. This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. There are times when an employer wants to make additional compensation available to employees as an alternative to the employer’s share of the premium for health insurance.

Source: howtofinancemoney.com

Source: howtofinancemoney.com

With the aca, employers are required to comply with the employer shared responsibility code. A growing number of employers are offering a “cash in lieu” or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount, if the employee declines coverage under the employer’s group health plan because the employee has coverage under a spouse’s group health plan. A growing number of employers are offering a “cash in lieu” (cil) or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount if the employee declines coverage under the employer’s group health plan. New rules and penalties for cash “in lieu” of benefits. Asking for higher salary in lieu of health insurance won�t work, since companies do not want the added headache and overhead of keeping track of who signed up and who opted out.

Source: blog.seedly.sg

Source: blog.seedly.sg

This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or. With the aca, employers are required to comply with the employer shared responsibility code. If just one of your employees is paid extra wages in lieu of medical insurance, the medical insurance becomes income to everybody. Just don�t call it as in lieu of wages. some larger companies do give their employees money for opting out.

Source: slideshare.net

Source: slideshare.net

Ostrower has extensive experience in executive compensation matters and counsels both public and private companies on executive compensation issues, including section 409a and 162(m) of the code. You can offer the medical insurance as a benefit, and deduct the cost as a business expense. The company is offering a benefit option not an entitlement of certain compensation value. If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. A growing number of employers are offering a “cash in lieu” or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount, if the employee declines coverage under the employer’s group health plan because the employee has coverage under a spouse’s group health plan.

Source: slideshare.net

Source: slideshare.net

Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or. In lieu of continued employee benefits (other than as statutorily required, such as cobra continuation coverage as required by law ), executive shall receive payments of three thousand dollars ($3,000) per month for twelve months from the date of employment termination in accordance with the payroll schedule applicable to active officers of the. This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. The company is offering a benefit option not an entitlement of certain compensation value. The company does indeed pay you about $2k a year not to take the health insurance.

Source: calpublicagencylaboremploymentblog.com

Source: calpublicagencylaboremploymentblog.com

If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or. If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. Since you asked about health coverage vs. Through “employer payment plans”) in the offering.

Source: aalrr.com

Source: aalrr.com

To be eligible, the elected official must obtain health insurance coverage under a separate qualifying group health insurance plan, such as through a spouse’s group plan, medicare, or the veterans administration. What i found in the research is (1) a congressional committee report on § 125 (it might be a senate report) suggests you are right and (2) several plrs or tams state that a benefit that is eventually taxable (such as a 457 plan contribution) is treated as a taxable benefit, and so a choice between deferred compensation and health benefits makes the health benefits taxable. This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. A growing number of employers are offering a “cash in lieu” or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount, if the employee declines coverage under the employer’s group health plan because the employee has coverage under a spouse’s group health plan. Asking for higher salary in lieu of health insurance won�t work, since companies do not want the added headache and overhead of keeping track of who signed up and who opted out.

Source: youtube.com

Source: youtube.com

Compensation is at the heart center of every company! A growing number of employers are offering a “cash in lieu” (cil) or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount if the employee declines coverage under the employer’s group health plan. Asking employees to show proof of group coverage elsewhere can help employers comply with this law, as it can show that they’re not. Ostrower is also a member of the jackson lewis healthcare reform task force and is intimately involved in helping jackson lewis clients ensure. There are times when an employer wants to make additional compensation available to employees as an alternative to the employer’s share of the premium for health insurance.

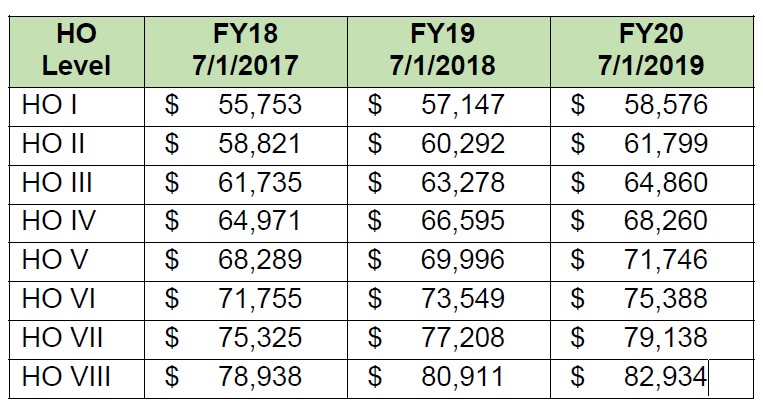

Source: medicine.umich.edu

Source: medicine.umich.edu

If an employer wishes to offer compensation in lieu of group health plan coverage (oftentimes referred to as an “opt out payment” or a “waiver payment”), there are two important compliance issues that must be considered. What i found in the research is (1) a congressional committee report on § 125 (it might be a senate report) suggests you are right and (2) several plrs or tams state that a benefit that is eventually taxable (such as a 457 plan contribution) is treated as a taxable benefit, and so a choice between deferred compensation and health benefits makes the health benefits taxable. This is sometimes possible with some employers, but i would guess that by default, a company would want to administer its health insurance in the most straightforward. If just one of your employees is paid extra wages in lieu of medical insurance, the medical insurance becomes income to everybody. The department of labor�s office of workers� compensation programs (owcp) administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease.

Source: slideshare.net

Source: slideshare.net

Through “employer payment plans”) in the offering. New rules and penalties for cash “in lieu” of benefits. A growing number of employers are offering a “cash in lieu” or “pay in lieu” of benefits option, under which the employer offers an employee a taxable “opt out” amount, if the employee declines coverage under the employer’s group health plan because the employee has coverage under a spouse’s group health plan. Ostrower is also a member of the jackson lewis healthcare reform task force and is intimately involved in helping jackson lewis clients ensure. The reasoning is that when an employer makes payments to the insurance company where the employee has the option of receiving those amounts as wages, the employee is merely assigning future income (cash compensation) for consideration (health insurance coverage).

Source: slideshare.net

Source: slideshare.net

This means that employers must make sure that employees aren’t using the cash to enroll in individual health insurance plans. This option is permitted, and it is referred to as a “cash in lieu of benefits” option (or a “pay in lieu of benefits” option). Through “employer payment plans”) in the offering. Asking employees to show proof of group coverage elsewhere can help employers comply with this law, as it can show that they’re not. Like heartbeat is one of the primary components for human survival, benefits availed via settlement keep employees survive or.

Source: sampleforms.com

Source: sampleforms.com

Employers commonly ask brokers if they can offer a cash payment to an employee in lieu of paying for that employee’s benefits. Compensation plays a significant role in human resource management to boost the overall performance and effectiveness of the employees working in the organization. Since you asked about health coverage vs. The department of labor�s office of workers� compensation programs (owcp) administers four major disability compensation programs that provide wage replacement benefits, medical treatment, vocational rehabilitation and other benefits to federal workers or their dependents who are injured at work or who acquire an occupational disease. In lieu of continued employee benefits (other than as statutorily required, such as cobra continuation coverage as required by law ), executive shall receive payments of three thousand dollars ($3,000) per month for twelve months from the date of employment termination in accordance with the payroll schedule applicable to active officers of the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title compensation in lieu of health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Craft insurance arab al Idea

- Colonial life insurance claims Idea

- Business insurance and benefits information

- Deans and homer insurance Idea

- Crown cost without insurance information

- Delmonico insurance syracuse ny Idea

- Department of insurance and financial services michigan duties information

- Cost of eye exam with insurance Idea

- Cashless hospital list under national insurance company Idea

- Crowel insurance agency information